Big Dividend REITs pawel.gaul

When it comes to big-dividend REITs, W. P. Carey (NYSE:WPC) is a stalwart favorite. Having increased its annual dividend (paid quarterly) for over ten years straight, and now trading down nearly 20% in the last month, investors are wondering if they should initiate a position (or even buy more shares). In this report, we review the business and then consider the current valuation versus two big risk factors. We conclude with our strong opinion on investing in W. P. Carey.

Overview: A Well-Diversified Portfolio

W. P. Carey is a diversified, large cap, net lease REIT, specializing in the acquisition of operationally critical, single-tenant properties in North America and Europe. Having completed its merger with CPA:18 on August 1, 2022, W. P Carey’s portfolio includes 1,390 net lease properties covering approximately 170 million square feet and a portfolio of 84 self-storage operating properties.

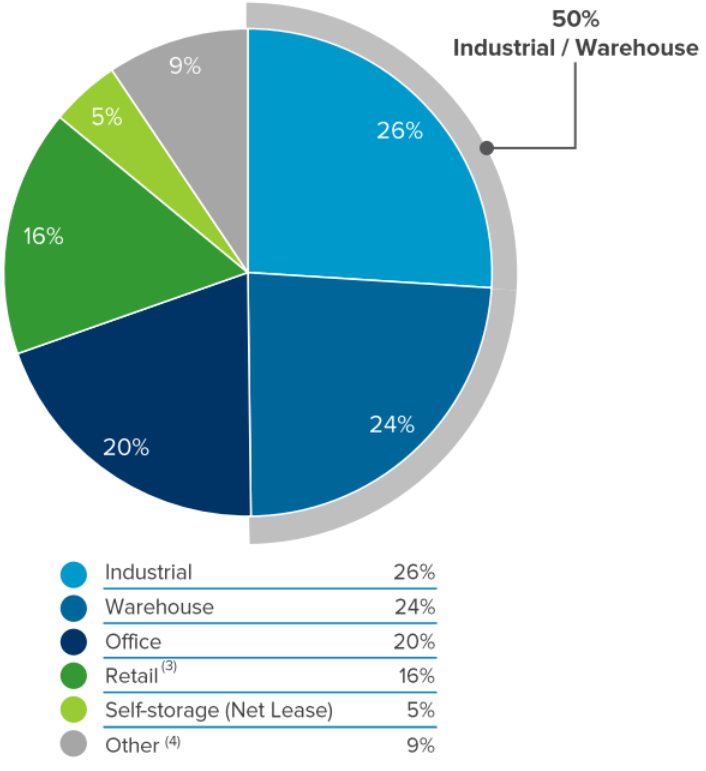

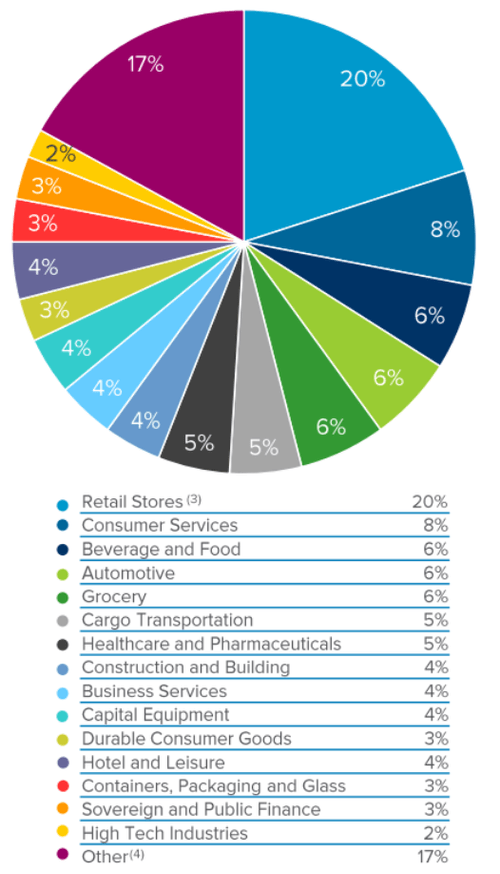

Its portfolio is located primarily in the U.S. (64% of ABR) and Northern and Western Europe (33% of ABR), and it is well-diversified by tenant, property type, geographic location and tenant industry (as you can see in the graphics below).

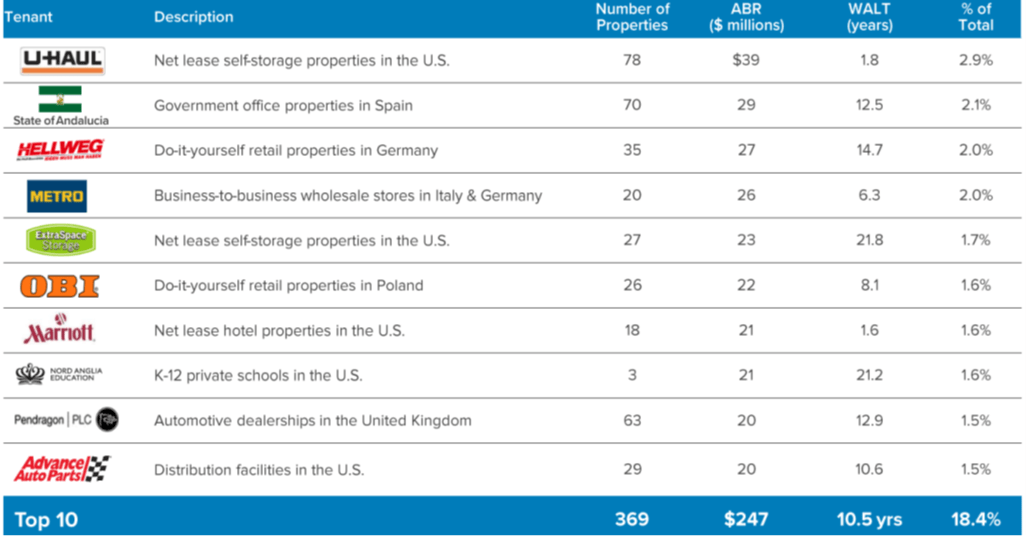

W. P. Carey Investor Presentation W. P. Carey Investor Presentation W. P. Carey Investor Presentation

This strong diversification helps W. P. Carey reduce the risks associated with any one industry, property type and tenant.

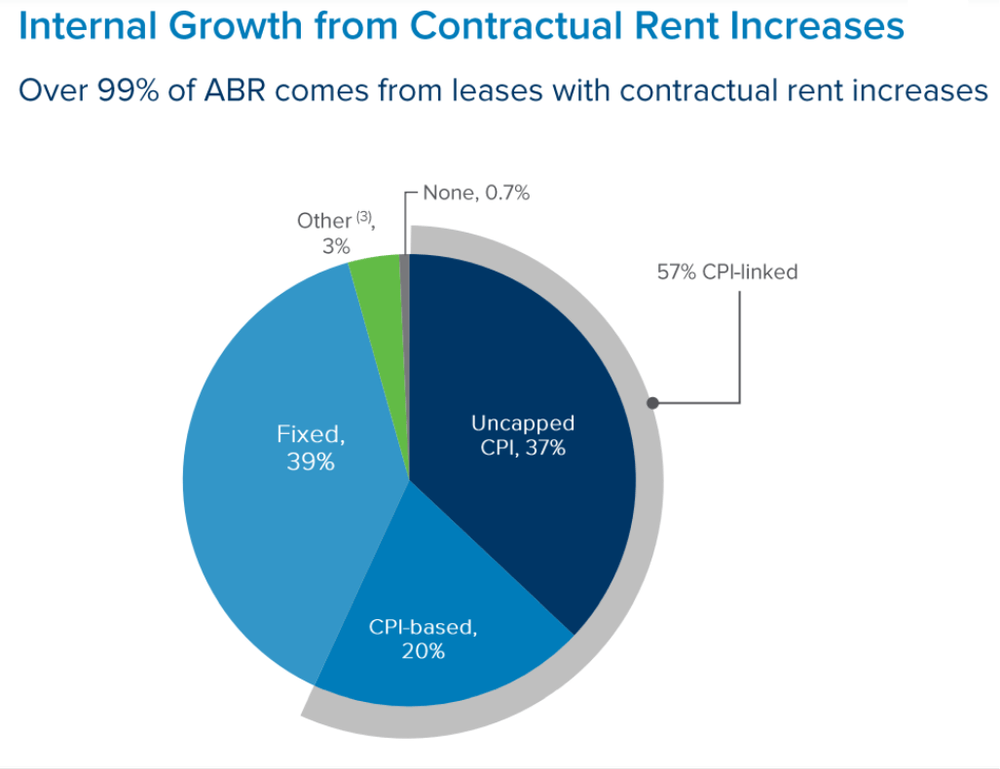

And for a little more background, for nearly five decades, W. P. Carey has invested in high-quality single-tenant commercial properties subject to long-term net leases with built-in rent escalators. If you don’t know, a net lease is a contractual agreement where the lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for the property. And built in escalators means the rent automatically increases (as you can see in the graphic below).

W. P. Carey Investor Presentation

Also important, the occupancy of W. P. Carey properties remains above 99% (a very good thing).

Strong Financial Position

In addition to the attractiveness of W. P. Carey’s property portfolio, its strong financial position is also attractive. For example, W. P. Carey announced just a few weeks ago that its investment grade credit rating had been upgraded by Moody’s to Baa1 with a stable outlook. And this comes following W. P. Carey’s recent offering of 350 million Euro of senior unsecured notes, which helps strengthen its financial position further (i.e. more cash to continue to operate effectively). Also worth mentioning, W. P. Carey wisely issued equity during the second quarter totaling $39 million (at a price of $82 per share) right before the recent 20% share price decline, thereby providing more capital for operations.

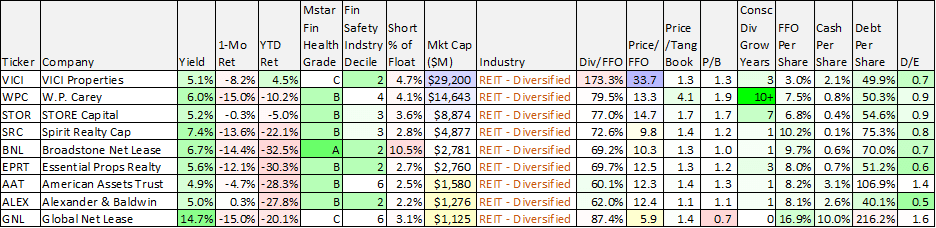

Further still, here is a look at a variety of additional W. P. Carey financial metrics versus peers.

Stock Rover

As you can see, W. P. Carey is in a relatively strong financial position with regards to its debt to equity, debt per share, and Morningstar Financial Health Grade (to get a high grade in this area, a company should have low financial leverage (assets/equity), high cash-flow coverage (total cash flow/long-term debt), and a high cash position (cash/assets). Also, companies with improving financial health are rewarded, while those with deteriorating health are punished).

And according to CEO Jason Fox during the most recently quarterly call:

“we currently have enough equity capital available to fund over $1 billion of investments on a leverage-neutral basis.”

Also important, the recent CPA:18 merger streamlines the financials and helps W. P. Carey operate more effectively and efficiently. According to CEO Jason Fox,

“This acquisition adds about $2 billion of high-quality real estate to our portfolio at a cap rate in the mid-6s after planned asset sales, the vast majority of which have now been completed.”

“…In addition to being well aligned with our existing portfolio with no integration risk and minimal balance sheet impact, the transaction concludes our exit from the non-traded REIT business, incrementally simplifying our company and enhancing the quality of our cash flows.”

This is a good thing. And overall, WPC remains is a relatively very strong financial position.

Healthy Dividend

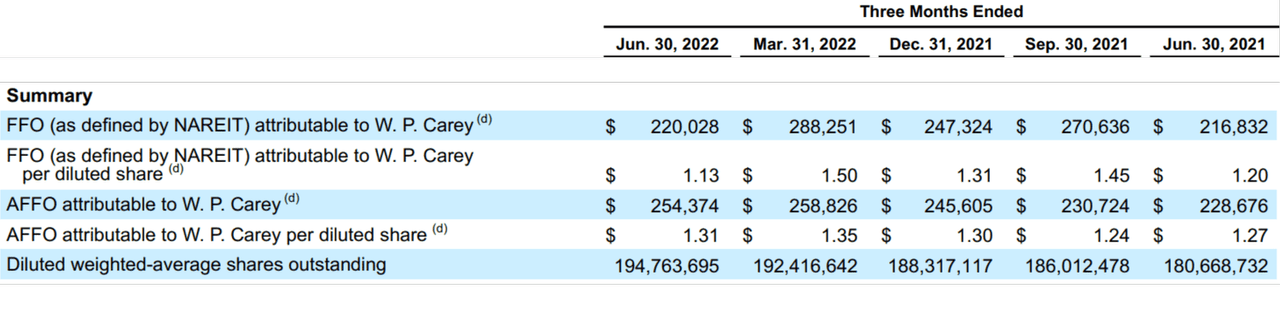

Also important, W. P. Carey stands out for its strong dividend. For example, the annual dividend amount (paid quarterly) has increased for more than 10 years in a row. And as you can see in our earlier table (and in the table below), the $1.06 quarterly dividend is well covered by Funds from Operations (“FFO”).

W. P. Carey Quarterly Supplement

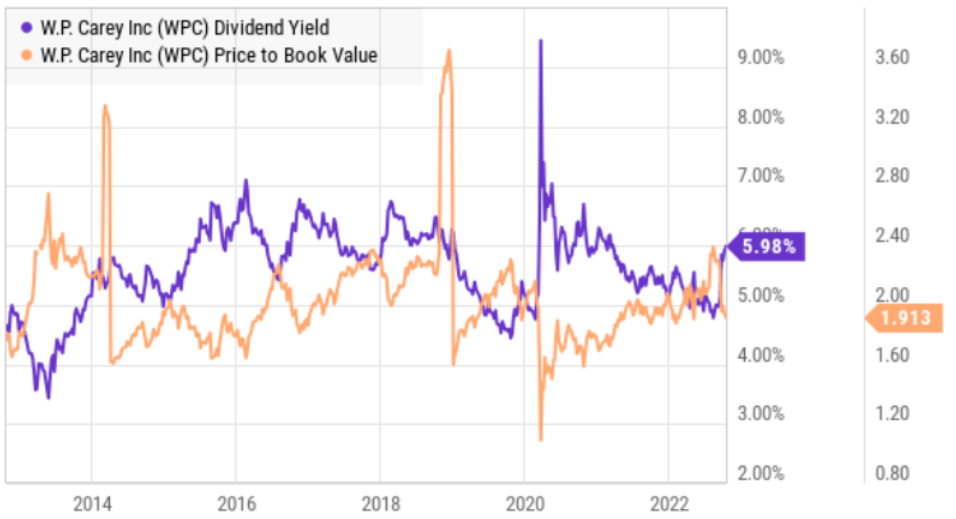

Also important to note, as the share price of W. P. Carey has declined significantly over the last 1-month, the dividend yield has mathematically risen, and now sits near the higher end of its historical range (also arguably a good thing, as we will discuss later in the valuation section of this report).

The Big Risks

Considering the attractive qualities described above, it’s also important to consider the risks, and we see two big ones for W. P. Carey.

1. The Macroeconomic Environment is a big risk for W. P. Carey, and the market in general right now. Specifically, as central bankers around the world raise rates to combat high inflation they are slowing the economy, and W. P. Carey is not excluded from these negative consequences. For example, according to CEO Jason Fox:

“Our ability to execute on our 2022 investment volume will therefore largely be driven by what happens in the broader economy and net lease transaction markets, particularly cap rates rather than our ability to access the capital markets.”

“In addition to higher internal growth, we expect to continue finding interesting new investment opportunities at increasingly wider cap rates, armed with ample liquidity and an advantaged cost of equity. We also continue to believe we’re better positioned than any other net lease REIT for inflation protection. We have one of the safest REIT portfolios with proven stability in our cash flows.”

Nonetheless, the threat of a deep recession can create significant challenges to cap rates and to business in general.

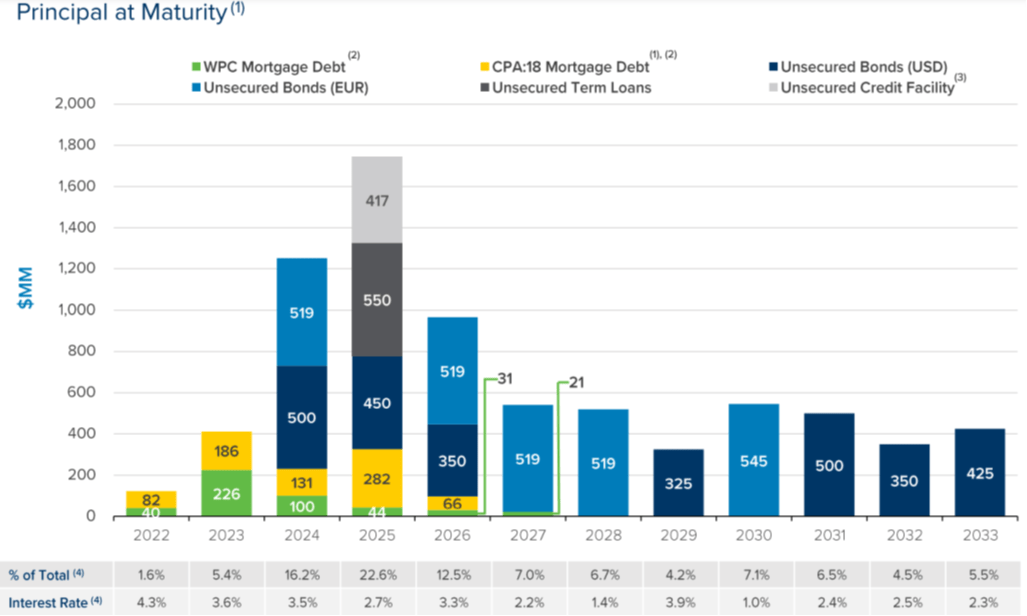

2. Challenging Capital Markets is another big risk. Even though CEO Jason Fox said capital markets will not impact WPC’s “ability to execute,” it’s still a big risk factor. For example, it is now more expensive for W. P. Carey to raise new growth capital whether it be through debt (higher interest rates) or equity issuance (a lower share price). Also, W.P. has a significant amount of debt maturities coming in 2023-2026-a time when interest rates (i.e. the cost to refinance the debt) will likely be even higher as central banks keep raising rates.

W. P. Carey Investor Presentation

Valuation

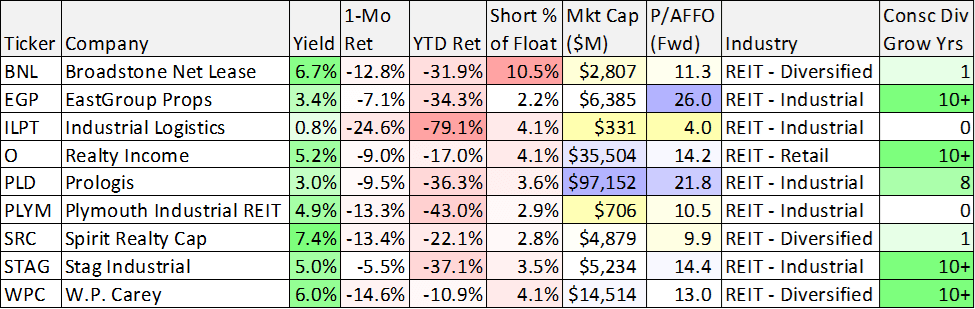

Considering the attractive qualities and the risk factors, let’s take a closer look at W. P. Carey’s current valuation. As you can see in the following table, WPC shares currently trade at around 13 times forward AFFO. This is lower than REIT industry bellwethers like Prologis (PLD) and Realty Income (O), but higher than certain smaller market cap names like Plymouth (PLYM) and Industrial Logistics (ILPT). It’s also a low multiple for WPC by historical standards (for example, the ratio was around 16x just last month).

Stock Rover, Seeking Alpha

WPC’s dividend yield is also high by historical standards, perhaps an indication from management that they believe the share price should be higher.

YCharts

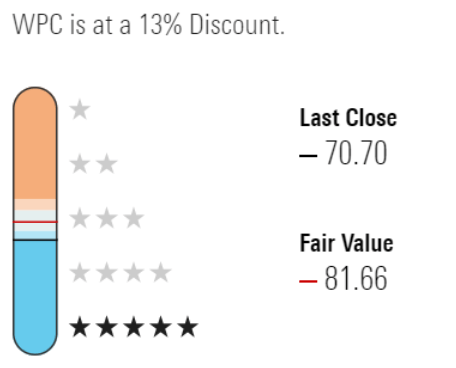

And for a little more perspective, according to Morningstar’s quantitative valuation model, the shares are currently underpriced and have 13% upside.

Morningstar

Conclusion

Current market conditions are challenging. And the shares of W. P. Carey can still go lower. However, given the strength of the portfolio and the strong financial position, we believe W. P. Carey will survive, the dividend is safe, and the share price (and the dividend) will eventually go higher. For these reasons, we have included W. P. Carey as an “honorable mention” in our new report: The 7 Healthiest Big-Dividend REITs. If you are a long-term income-focused investor, W. P. Carey is absolutely worth considering for a spot in your portfolio.

Be the first to comment