tortoon/iStock via Getty Images

Pacira BioSciences (NASDAQ:PCRX) has made decent progress over the last few years. Exparel has continued to grow despite the negative impact of the pandemic on surgery volumes and other near-term headwinds, and the company has acquired Flexion Therapeutics to get Zilretta and expand its presence in the chronic pain market.

The valuation is not too demanding, and I believe Pacira has the potential to be a decent compounder in the next few years.

Exparel continues to grow but at a slower pace

Exparel sales continue to be impacted by the COVID-19 pandemic. The impact is nowhere near the levels the company saw in the second quarter of 2020, but the situation has not returned to normal, and the company is seeing additional headwinds such as operating room labor shortages, reduced hospital services, decreased hours at ambulatory surgery centers, and management also mentioned the impact of inflation on certain elective procedures.

The good thing is that Exparel’s growth continues to exceed the elective surgery market recovery as the utilization has expanded across all target sites of care.

The company has several initiatives to improve Exparel’s uptake, from long-acting regional blocks, training center expansion, and the recent pediatric approval to women’s health (C-section) and in the medium- and long-term with the potential approval of lower extremity nerve block and stellate ganglion block in cardiac dysrhythmia where a registration study is expected to start soon.

The company reported positive phase 3 from the first lower extremity nerve block trial and if the second trial is successful (results are expected in the following weeks), the sNDA for this indication will be submitted in the first quarter of 2023. Management believes lower extremity nerve block is an incremental $100 million revenue opportunity for Exparel.

There are also geographic expansion efforts with the launch in Europe, but I do not expect to see a lot of growth outside the United States because I doubt the company will be able to secure attractive reimbursement rates. Management specifically mentioned a five-year plan of getting to $100 million in Exparel sales in Europe and later trimmed that to $70-$80 million (Wedbush presentation in August), but I would be happy if it gets to $50 million.

Overall, I see Exparel as well-positioned to continue growing in the following years, although the growth rates are unlikely to be exceptional. Exparel is more likely to grow revenues in high-single digits and up to 15% if the label is expanded to include the two above-mentioned indications.

Exparel is now more of a decently growing cash machine for Pacira, and the company is working to improve the product’s profitability with the new manufacturing facility which should improve gross margins.

Exparel’s competitive position remains strong. I must admit I expected more from the main competitor Heron Therapeutics (HRTX) given the attractive product attributes of Zynrelef, but so far, Zynrelef’s impact on Exparel is not visible. And that is not surprising since Zynrelef’s annualized net sales run rate is only at approximately $10 million after five quarters on the market. I wrote about Heron last month and said the company has a lot of work to do to create shareholder value and to threaten Exparel’s leadership position in the branded post-operative pain management market.

However, the addressable market is very large and there is certainly room for a second successful product like Zynrelef.

Zilretta sales growth to pick up after discount and rebate program changes and manufacturing problems

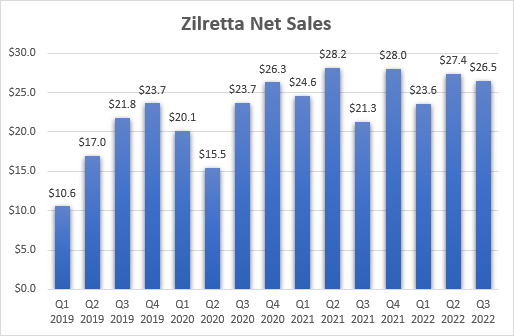

A year has passed since Pacira announced the acquisition of Flexion Therapeutics, and Zilretta’s growth trajectory has not really improved – net sales in the first nine months of 2022 grew only 4.6% to $77.1 million and it is, so far, unable to reach last year’s record quarterly sales of $28.2 million.

Flexion Therapeutics, Pacira BioSciences earnings reports

Management remains happy with the acquisition as they have sought to address some of the issues to get Zilretta back on track. Pacira has ended Flexion’s rebate program and has implemented a simplified tiered discounting program instead. There were also manufacturing problems that led to smaller order sizes and higher product returns. This puts the lack of growth since the acquisition into perspective and the company expects the situation to improve in the following quarters.

Longer-term, label expansion could improve Zilretta’s growth trajectory, but we must wait a few years for that. A phase 3 trial in shoulder osteoarthritis is planned and could add approximately one million procedures to Zilretta’s addressable market. The company is also seeking FDA input on a potential type 2 diabetes study where it should show differentiation to generic triamcinolone (Zilretta is an extended-release version of triamcinolone) with Zilretta not showing blood glucose spikes that are seen with injections of generic triamcinolone.

The growth of Zilretta in the following years should result in decent operating leverage, but overall, Zilretta does not seem nearly as important a growth driver for Pacira as Exparel.

Other considerations

The other product Pacira has acquired in 2019, iovera, is barely worth a mention. Net sales grew from $8.8 million in 2020 to $16.2 million in 2021 and third quarter net sales reached $4.5 million. Management remains enthusiastic about iovera’s growth prospects due to the introduction of a second-generation device and expects to expand the addressable market to include spine and lower back pain, but considering the lack of traction in the primary osteoarthritis market, I am pessimistic about iovera becoming even a Zilretta type of a product for Pacira.

There are also other pipeline efforts such as dexamethasone pMVL (proprietary multivesicular liposome) for low back pain and high dose Exparel (bupivacaine) with the potential for pain relief lasting five days or longer and an intrathecal low dose Exparel with potential for broad applications. However, these are longer-term efforts with phase 2 trials expected to start in late 2024 for the first two product opportunities, and a phase 2 trial for intrathecal low-dose Exparel expected to start next year.

And lastly, business development remains an important part of Pacira’s long-term growth strategy. However, there is not much capacity to make deals that could contribute in a meaningful way in the medium term. The company had $316 million in cash and equivalents at the end of the second quarter and $775 million in long-term debt, consisting of a $375 million term loan it took out last year to fund the acquisition of Flexion and $400 million in convertible senior notes.

Upside potential and risks

I believe Pacira can be a decent compounder in the following years, thanks to a combination of continued revenue growth and margin expansion which will be driven by both operating leverage and improved gross margins.

If all goes according to plan, I expect to see a compound growth rate in Pacira’s share price of at least 10% at the low end of the range and up to 20% at the high end of the range in the next 3-4 years, under the assumption that the current growth estimates are achievable – and I believe they are. The current 2025 Street revenue consensus is $988 million and the EPS consensus is $5.98.

The main long-term risks are worse-than-expected execution, competition and Exparel going generic.

Regarding competition, Heron’s Zynrelef is so far not anywhere near being the threat I thought it would be, and while that could change, so far there are no indications Zynrelef’s trajectory and uptake will make a dent, and the market is more than large enough for two successful branded drugs even if Zynrelef’s trajectory improves.

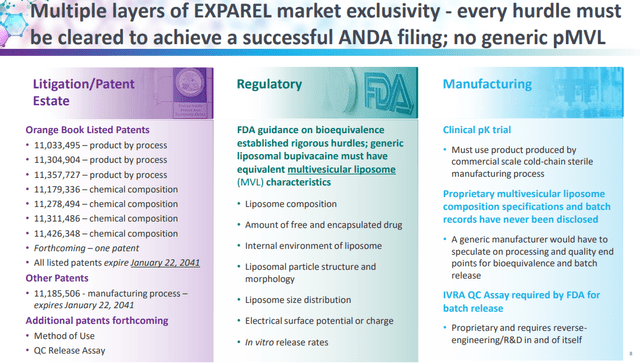

And while there is a generic threat, Exparel is unlikely to go generic anytime soon. In October and December of 2021, eVenus Pharmaceutical Laboratories filed an Abbreviated New Drug Application (‘ANDA’), seeking authorization to sell a generic version of Exparel 266mg/20mL and Exparel 133mg/10mL, respectively. In November 2021, and February 2022, Pacira filed patent infringement suits against eVenus, asserting the ANDA product will infringe the ‘495 and ‘336 patents. The lawsuit triggered a 30-month stay and this litigation will take time to resolve, but Exparel is a difficult product to manufacture at scale and the FDA guidance on bioequivalence established rigorous hurdles for the manufacture of generic liposomal bupivacaine (see presentation slide below). And, in the meantime, several additional patents were added to the FDA’s Orange Book.

Pacira BioSciences investor presentation

Conclusion

Pacira looks well-positioned to deliver shareholder value in the following years despite some of the near-term challenges and headwinds. Exparel remains the company’s key asset and while its growth rates will not be exceptional, it still has a long runway. Zilretta and iovera are additional potential growth drivers, but the company needs to work harder to accelerate the growth of these assets. Business development and earlier-stage pipeline assets are the additional potential long-term drivers.

Be the first to comment