SusanneB

This article is part of a series that provides an ongoing analysis of the changes made to Glenn Greenberg’s 13F portfolio on a quarterly basis. It is based on Greenberg’s regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Glenn Greenberg’s Brave Warrior Advisors Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q1 2022.

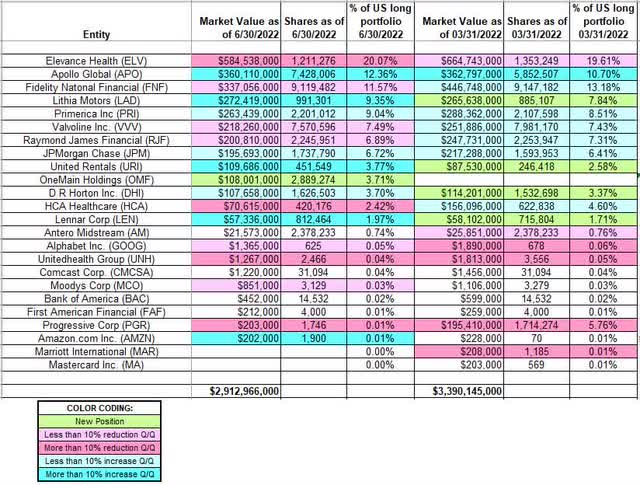

This quarter, Greenberg’s 13F portfolio value decreased ~14% from $3.39B to $2.91B. The top three holdings represent around 44% of the portfolio while the top five are at 62%. The largest position is Elevance Health which is at ~20% of the portfolio.

New Stakes:

OneMain Holdings (OMF): OMF is a 3.71% of the portfolio position purchased this quarter at prices between ~$35 and ~$50 and the stock currently trades near the low end of that range at $35.84.

Stake Disposals:

Mastercard Inc. (MA) and Marriott International (MAR): These minutely small 0.01% stakes were disposed this quarter.

Stake Increases:

Apollo Global (APO): APO is a large (top three) ~12% of the portfolio position purchased in Q3 2021 at prices between ~$56 and ~$80. Last three quarters have seen a ~200% increase at prices between ~$46.75 and ~$80. The stock currently trades at $55.67.

Lithia Motors (LAD), D.R. Horton Inc. (DHI), United Rentals (URI), and Lennar Corp (LEN): These positions purchased last quarter were increased this quarter. LAD is a large (top five) 9.35% of the portfolio position purchased at prices between ~$255 and ~$346 and the stock currently trades at ~$276. The 3.70% of the portfolio DHI stake was purchased at prices between ~$75 and ~$106 and it is now just below the low end of that range at ~$72. There was a minor ~6% increase this quarter. URI is a 3.77% of the portfolio position established at prices between ~$236 and ~$365 and it now goes for ~$301. The ~2% of the portfolio stake in LEN was purchased at prices between ~$81 and ~$113 and the stock currently trades just below that range at ~$80. There was a ~14% increase this quarter.

Primerica, Inc. (PRI): PRI is a large (top five) ~9% of the 13F portfolio position established in Q3 2011 at a cost-basis in the low-20s. H2 2016 saw a two-thirds reduction at prices between $53 and $72.50. The position has wavered. Recent activity follows: Q1 2020 saw a stake doubling at prices between $62 and $137. The four quarters through Q1 2021 had seen a combined ~30% stake increase at prices between ~$81 and ~$153. The stock currently trades at ~$127. Last four quarters have seen minor increases.

JPMorgan Chase & Co. (JPM): JPM is a large 6.72% of the portfolio stake established in Q3 2014 and built over the next two quarters at prices between $54.50 and $63. The position has wavered. Recent activity follows: Q4 2017 & Q1 2018 had seen a combined ~25% selling at prices between $95 and $119 while the next four quarters saw a ~40% increase at around the same price range. There was a one-third selling over the three quarters through Q4 2021 at prices between ~$147 and ~$172. Last two quarters saw a ~17% increase at prices between ~$113 and ~$168. The stock currently trades at ~$114.

Amazon.com (AMZN): The minutely small 0.01% stake in AMZN was increased this quarter.

Stake Decreases:

Elevance Health (ELV), previously Anthem: ELV is currently the largest 13F position at ~20% of the portfolio. It was established in Q3 2019 at prices between $238 and $311. Q1 2020 saw a ~40% stake increase at prices between $175 and $306. That was followed with a ~50% increase in Q1 2021 at prices between ~$288 and ~$371. Q3 2021 saw another ~20% stake increase at prices between ~$358 and ~$398. The stock currently trades at ~$489. Last three quarters saw ~12% trimming.

Fidelity National Financial (FNF): FNF is a large (top three) ~12% of the portfolio position established in Q2 2021 at prices between ~$40.50 and ~$47. There was a ~40% stake increase next quarter at prices between ~$42 and ~$49. The stock is now at $39.79. Last three quarters have seen only minor adjustments.

Valvoline Inc. (VVV): VVV is a large 7.49% of the portfolio stake established in Q1 2021 at prices between ~$22.75 and ~$26.75 and the stock currently trades at $29.66. There was a minor ~7% stake increase last quarter and similar reduction this quarter.

Raymond James Financial (RJF): RJF is a large 6.89% portfolio stake established in Q3 2018 at prices between $88 and $97. It was increased by ~20% over the next two quarters at prices between $69 and $94. Q2 2021 saw a ~20% reduction at prices between ~$123 and ~$137 while next quarter there was a ~40% stake increase at prices between ~$83 and ~$95. The stock currently trades at ~$106. Last three quarters have seen only minor adjustments.

HCA Healthcare (HCA): HCA is a 2.42% of the portfolio position established in Q1 2020 at prices between $68 and $151 and increased by ~20% next quarter at prices between $82 and $118. There was a ~60% reduction over the three quarters through Q3 2021 at prices between ~$157 and ~$262. That was followed with a one-third selling this quarter at prices between ~$168 and ~$275. The stock currently trades at ~$204.

Alphabet Inc. (GOOG): The original 4.32% of the portfolio stake in GOOG was purchased in Q4 2017 at prices between ~$48 and ~$54. Q4 2019 saw a ~20% selling at prices between ~$59 and ~$68. Next quarter saw another ~25% selling at prices between ~$53 and ~$76. That was followed with a ~60% reduction in H2 2020 at prices between ~$71 and ~$91. Q1 2021 saw the position reduced to a minutely small stake at prices between ~$86 and ~$107. Last few quarters have also seen further trimming. The stock currently trades at ~$110.

Note: the prices quoted above are adjusted for the 20-for-1 stock split last Month.

UnitedHealth Group (UNH): The UNH position was purchased in Q4 2019 at prices between $215 and $296 and increased by roughly two-thirds next quarter at prices between $195 and $305. There was a ~40% reduction in Q2 2020 at prices between $230 and $312. Q1 2021 saw a ~50% stake increase at prices between ~$324 and ~$379. Last quarter saw the position almost sold out at prices between ~$456 and ~$521. This quarter saw further selling. The stock is now at ~$530.

Progressive Corp. (PGR): PGR was a large 5.76% of the portfolio stake established in Q4 2019 at prices between $68.50 and $77. Q1 2021 saw a ~45% stake increase at prices between ~$85 and ~$99. There was a ~25% reduction last quarter at prices between ~$102 and ~$117. The stake was reduced to a minutely small 0.01% of the portfolio position this quarter at prices between ~$107 and ~$121. The stock currently trades at ~$125.

Moody’s Corp (MCO): MCO is a minutely small 0.03% position that saw a ~5% reduction this quarter.

Kept Steady:

Antero Midstream (AM): A small stake in AM was built in Q1 2019 at prices between $11 and $14.50. There was a ~30% selling in Q3 2019 at prices between $6.65 and $12.10. The position was increased substantially to a ~2% portfolio stake over the four quarters through Q3 2020 at prices between $2 and $7.60. The five quarters through Q4 2021 saw a ~70% selling at prices between ~$5.30 and ~$11.50. The stock is now at $10.55.

Bank of America (BAC), Comcast Corporation (CMCSA), and First American Financial (FAF): These minutely small (less than 0.1% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Greenberg’s 13F stock holdings in Q2 2022:

Glenn Greenberg – Brave Warrior Advisors’ Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment