Pgiam/iStock via Getty Images

While Apollo (NYSE:APO) shares have been pummeled thus far in 2022, the company’s earnings profile has been largely transformed over the past couple years via its acquisition of Athene. While investors may think of Apollo as a volatile business dependent on successful IPOs, the reality is that the vast majority of Apollo’s earnings are derived from stable fees on committed capital and spread related earnings. Taking only these stable sources of earnings into account, Apollo trades for just 10.5x 2022 estimated EPS. This is far too cheap for a business with a stable, fast growing earnings stream. Assuming 15% annual growth for its recurring earnings business I believe Apollo shares can double (or better) over the next four years.

Breaking down Earnings

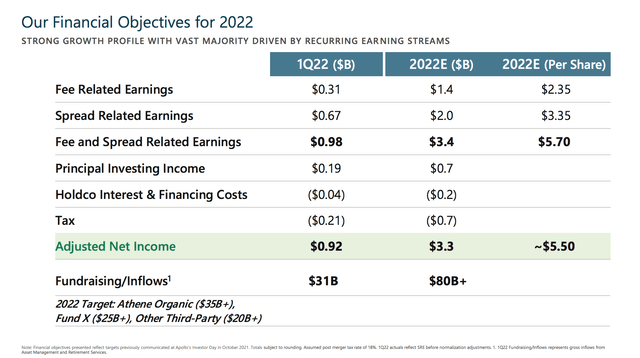

Below is a picture of management earnings expectations for Apollo. On a pre-tax basis, Apollo expects to generate $5.70 per share ($4.56 after taxing at 20%) from its fee related business and spread business. The fee related business consists of Apollo’s private markets business (private equity, debt, real estate and infrastructure) – fees here are earned as a percentage of long-term committed capital. Capital is generally locked up for 7+ years and fees are earned on committed capital (not subject to mark-to-market or mark-to-model). As such this represents a source of stable, recurring income for Apollo shareholders.

Similarly, spread related earnings are derived mainly from Apollo’s insurance business (former Athene) whereby the Apollo sources low cost liabilities through selling fixed annuities and invests the proceeds into higher return fixed income assets and earns a spread on the difference between the rate paid to annuity holders and the rate it earns on assets. Importantly the assets in which Apollo invests are largely first lien assets (relatively low-risk senior debt) which should be resilient even in a tough economic environment.

Apollo 2022 Earnings Expectations (Apollo Investor Presentation)

In addition to the durable sources of earnings outlined above, Apollo earns Principal Investing income which consists of performance fees in its private markets business. These fees are much more volatile in nature than fee related or spread related earnings. These fees are dependent on investment performance which is linked to capital market conditions, i.e. successful investment exits via IPOs or sales to private buyers. These fees will suffer in the current environment as financing conditions are strained and IPO activity is pretty much non-existent. Fortunately for shareholders, the Principal Investing segment represents a very small percentage of earnings, so small that it will be ignored for the purposes of this analysis.

Growth Outlook

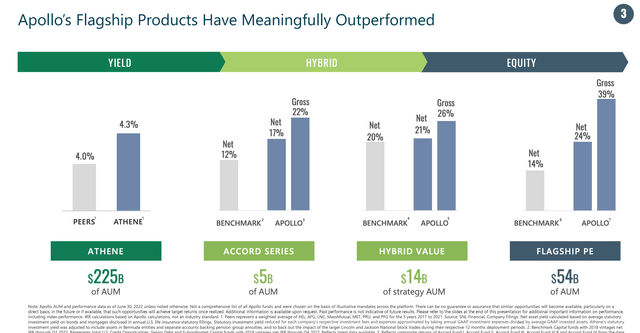

Apollo has several levers which should contribute to long term structural growth in its fee-related earnings business. Over the past 30 years private equity has continued to attract tremendous fund flows as investors shun actively managed public equities and instead allocate capital to top tier private equity firms like Apollo, KKR (KKR), and Blackstone (BX) which have generated industry leading returns for decades (see below).

APO LT outperformance (APO Investor Presentation)

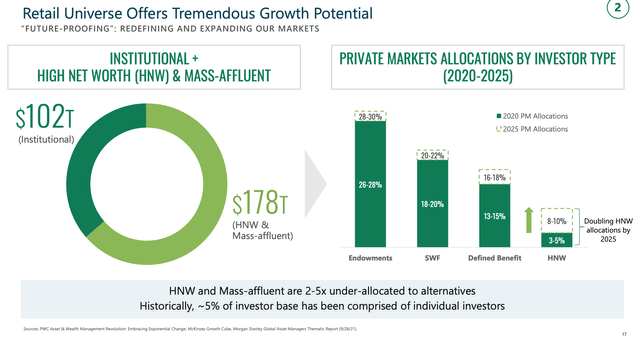

Over the medium and long term, I expect the trend of increasing allocation to private equity strategies to continue. This will benefit Apollo as it raises capital for new funds in new markets. The company is in the midst of raising funds for Private Equity X, a $25 billion private equity fund. In addition, the company has several other funds including real estate and private debt which will raise new fee-earning capital and grow the earnings stream of this segment. In addition, Apollo and other private equity leaders are increasingly targeting retail investors with new products. This could prove a tremendous opportunity given that this segment is largely under-penetrated (retail investors are mainly invested in public markets).

Apollo Retail Opportunity (Apollo Investor Presentation)

In addition to opportunities to grow its fee related earnings, Apollo’s spread related business is perfectly positioned to generate higher earnings going forward. Apollo’s fixed annuity business (Athene) has been a long term market share gainer. The rise in interest rates tilts in Apollo’s favor as the repricing in earning assets exceeds the higher rates paid on annuity liabilities. Furthermore, with many financial institutions pulling back in a tighter economic environment, the yields earned on assets is increasingly resulting in higher spreads and earnings for Apollo’s spread related business.

Conclusion: Putting it all together – nearly $8 in 2026 EPS

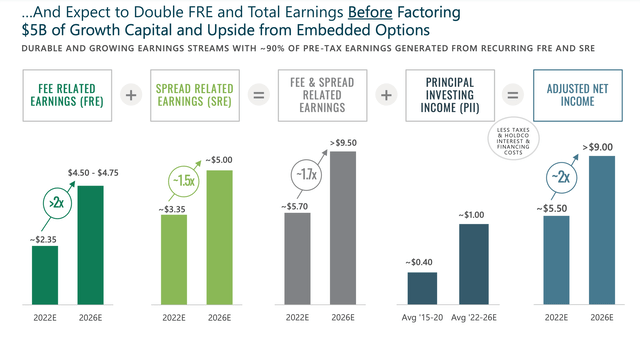

Here is a summary of management expectations for its business in 2026:

2026 Earnings Estimates (Apollo Investor Presentation)

Giving no credit to Apollo’s more volatile Principal Investing segment, management expects after-tax earnings of nearly $8/share in 2026. This implies that today Apollo trades at just 6x 2026 EPS which is far too low for a stable growing business. Further Apollo management has suggested that the company may use some of its ample cash flow to repurchase shares (outlook above does not give credit for any reduction in share count) which could push recurring EPS closer to $9/share.

I believe that a high quality, fast growing business like Apollo should trade somewhere between 12-16x recurring EPS which suggests that the stock could trade between $95 and $125 per share looking out four years implying over 100% upside to patient investors. Meanwhile investors will clip a 3% dividend while they wait.

Risks

1/ Shares of alternative asset managers have been volatile despite their increasingly stable earnings profile

2/ Institutional allocators may be slow their allocation to private markets due to rising interest rates and increased economic uncertainty

Be the first to comment