piranka

Thesis

The Vanguard Ultra-Short Bond ETF (BATS:VUSB) is a short-dated bond fund. The vehicle stated objective is to “provide current income while maintaining limited price volatility.” The fund aims to achieve this goal via a portfolio of investment-grade fixed-income securities. The vehicle targets a holdings weighted average maturity of 0 to 2 years. As per the fund’s literature:

The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities. Although short-term bond funds tend to have a higher yield than money market funds, their share price fluctuates. Because the Ultra-Short Bond ETF will subject investors to principal risk, the fund shouldn’t be viewed as a substitute for a money market fund. Additionally, increases in interest rates can cause the prices of the bonds in the portfolio, and thus the fund’s share price, to decrease.

VUSB currently offers a 30-day SEC yield of 2.98% with a 10 bps expense ratio and the associated interest rate risk and credit risk. While the credit risk is fairly minimal due to the short fund duration and investment grade collateral composition, interest rates were responsible for the fund’s -1.29% year-to-date performance.

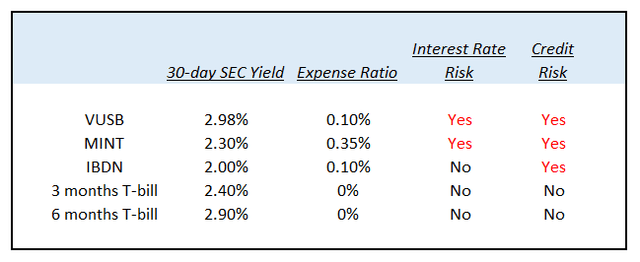

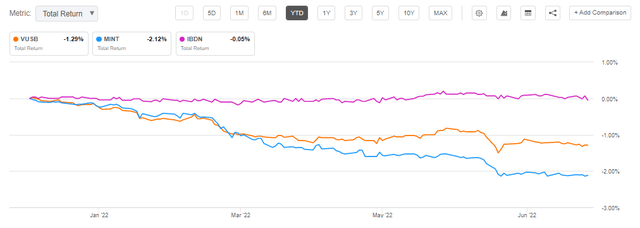

An investor looking to park cash during the current volatile stock market environment (we at BTA believe we are in the midst of a bear market rally and thus favor higher cash allocations) has several alternatives such as (MINT) and (IBDN):

Opportunities to park cash (Author)

We have segregated the vehicles that do not have any interest rate or credit risk due to their composition/holding periods. For example, a 6-month T-bill does have interest rate risk if an investor does not hold the security for the full 6 months, but in the above table, we have considered a hold-to-maturity stance.

We notice from the above table that while VUSB does indeed have the highest 30-day SEC yield, it exposes an investor to interest rate and credit risk. That has translated into a negative performance in 2022 on the back of rising rates. We do not believe short-dated rates are going to rise another 200 bps in 2022, but the cost of opportunity is currently high – 3 and 6 months T-bills currently have very attractive yields and held to maturity have no interest rate or credit risks. We thus feel currently there are better alternatives in the market to VUSB.

Dividend Yield Vs 30-day SEC Yield

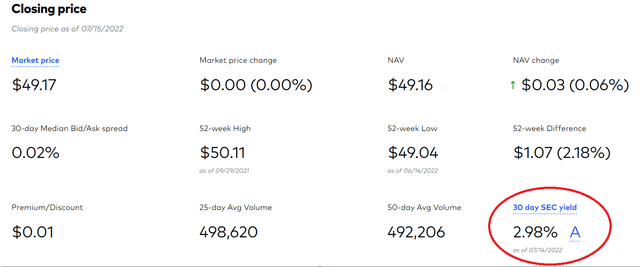

VUSB currently has a 30-day SEC yield of 2.98% while its dividend yield is only 0.56%. A retail investor needs to focus on the larger 30-day SEC yield and understand the difference between the two metrics.

Dividend Yield

Usually, financial websites show a trailing 12-months dividend yield when reporting this metric. For example, if you look at VUSB on Seeking Alpha, you will notice that the dividend box shows a 0.56% ratio – when looking into the details of how this is calculated (go to the Dividends tab – Dividend History). You will notice that this metric is actually calculating by adding the dividends paid out in the past 12 months and then annualizing that figure as compared to the current fund market price. In a stable interest rate environment, this metric is suitable, but in an increasing/decreasing interest rate environment, looking at this analytic would be very misleading (as rates go up, the dividend yield would be understating what you are getting, for example).

30-Day SEC Yield

This is the best metric when analyzing a short-duration bond fund, given the current interest rate environment and the propensity for some funds to have a roll effect in their bond holdings, where the discount to par is being absorbed by the maturity pull and higher-yielding bonds are bought. This creates an effect of having a much higher 30-day SEC yield when compared to a trailing 12 months dividend yield. The 30-day SEC yield is the best metric to look at when considering short-duration bond funds because it gives you an accurate snapshot of what cash you are actually going to receive based on where the portfolio currently is, and where the market price clears

30-day SEC Yield (Fund Website)

VUSB Holdings

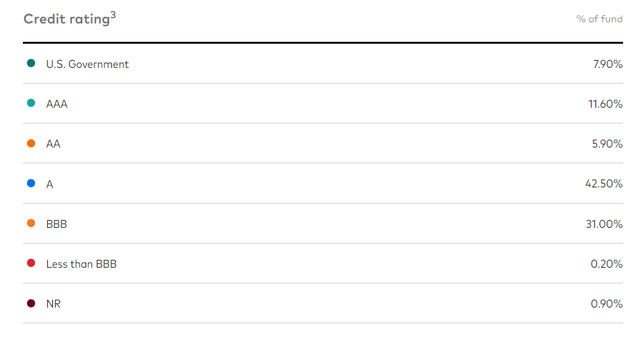

The fund holds almost exclusively investment grade bonds:

Holdings Credit Rating (Fund Fact Sheet)

We can see from the above table that the majority of the holdings fall in the “A” and “BBB” rating bands, with a very small proportion of junk and unrated bonds. We presume these are “fallen angels,” i.e., securities that were downgraded while in the fund. Short-term bond funds need to hold investment-grade securities in order to mitigate credit risk concerns. As per the fund’s investment objective, which is to provide current income, credit risk needs to be minimal. This is achieved via highly rated holdings and a short duration profile.

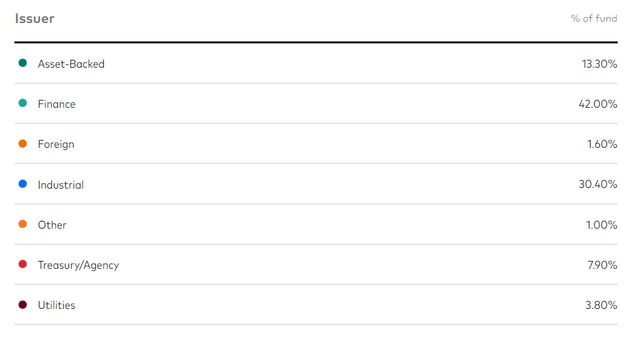

The fund holds a significant amount of ABS securities:

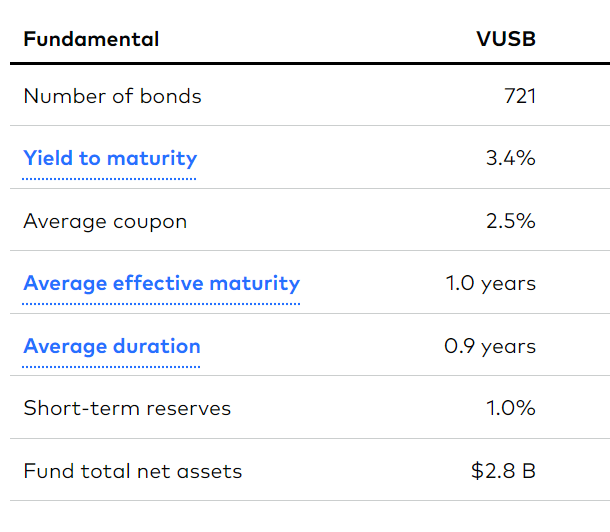

The fund sectors are fairly concentrated among ABS securities, Finance bonds and Industrials. There are 721 bonds in the portfolio:

Characteristics (Fund Fact Sheet)

The fund maintains a very short duration of sub 1 year. This means that roughly every 12 months, the fund securities should experience a full “pull to par” price action. For example, if 1-year rates rise significantly and the price of a 1-year bond in the portfolio decreases, an investor should expect for that decrease to be fully recuperated within a 1-year time frame as the bond approaches its maturity date.

Performance

The fund is down -1.29% this year due to interest rates:

YTD Performance (Seeking Alpha)

Even a short-dated bond fund with a very short duration profile can have a negative performance when rates move up significantly in a short period of time. This is the case here with the fund’s “pull to par” not yet being able to negate the duration impact.

Conclusion

VUSB is a short-dated bond fund. The vehicle aims to attract investor capital that is looking for a high yield for short-dated periods of time with minimal interest and credit risks. The fund is currently sporting a high 30-day SEC yield, but its performance in 2022 has been negatively affected by the rising rates environment. We do not think rates are going to rise another 200 bps in 2022, but the cost of opportunity is currently high – 3 and 6 months T-bills currently have very attractive yields and held to maturity have no interest rate or credit risks. We thus feel currently there are better alternatives in the market to VUSB.

Be the first to comment