MStudioImages/E+ via Getty Images

~ By Tim Murphy, Marketplace Success Manager

Thank you to all readers of Earnings Preview Roundtable – Part 1 – Tech & Growth. Your comments and engagement were appreciated by all contributors involved.

Today we have insights from seven of our Marketplace contributors on Dividends, REITs, and Income coverage. Once again, we asked the open-ended question – What are you monitoring with your subscribers this earnings season?

Enjoy reading! Links to the author’s profile and service are included. All services have either a two-week free trial or a limited one-month money-back guarantee.

*Note for non-Premium readers: If the author provides a link to an article, we have included a dollar symbol ‘($)’ to indicate it is behind the paywall. Articles from this account, SA Marketplace, are not paywalled.

David Alton Clark of The Winter Warrior Investor: The three major indexes posted sharp gains Friday July 15 after worries the Fed would raise rates by a full point faded. Investors may now shift focus to earnings results rather than rate hikes. I don’t see the Fed raising rates by 100 basis points irrespectively, that would signal they have lost total control, which may actually be true.

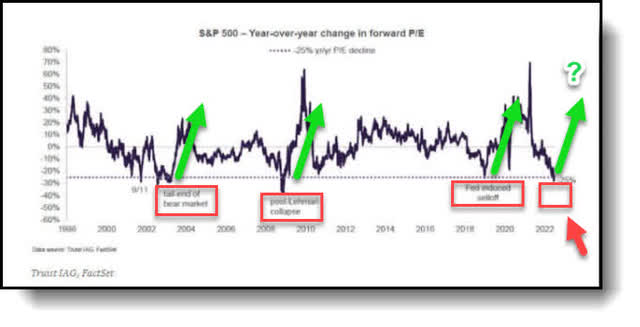

What’s more, the 9.1% CPI number is backward looking. My money is on the next reading showing the inflation fever has broken. The day that happens you will want to be long. Furthermore, multiples have already been significantly compressed. The S&P 500 multiple has dropped 25% to 16 times the current forecasted earnings. This level has marked the bottom in stocks several times since 2000.

Truist IAG (FactSet)

This chart shows the degree of valuation adjustment during past major selloffs. Based on the present set-up compared to similar historical patterns, the probabilities favor positive returns coming for the next couple of years if historic data holds true. The S&P 500 breaking above $4,000 will be the first sign the tide has turned. Nevertheless, another 10% downside may be in the cards if companies chose to “kitchen sink” the quarter, using inflation and recession fears as cover. Notwithstanding, I see any weakness as a buying opportunity in solid income producing and wealth creation securities for my retirement portfolio. My watchlist includes Devon Energy (DVN), Microsoft (MSFT), NVIDIA (NVDA), AT&T (T), and the Pimco Dynamic Income Opportunities Fund (PDO).

Disclosure: Long T and MSFT

ADS Analytics of Systematic Income: This earnings season we will be looking carefully at BDC earnings. First, we expect a significant drop in borrower prepayments which typically forms a significant part of BDC earnings. Two, we will be looking for any weakness in BDC net asset values due to the drop in prices of publicly traded loans. And three, we will be monitoring changes in non-accruals in BDC portfolios.

This year we have tilted to BDCs with higher-quality portfolios and those with greater first-line allocation such as BXSL, GBDC and OCSL and we expect these companies to remain more resilient and outperform this year.

Disclosure: Long BXSL, OCSL, GBDC

Chris Lau of DIY Value Investing: Nearly every company on our dividend income champs model are up solidly since 2020. Still, they pulled back from their highs in 2022, giving long-term investors another chance to capture yield. When they report results, look for a dividend increase, stock buyback, and an update on business conditions.

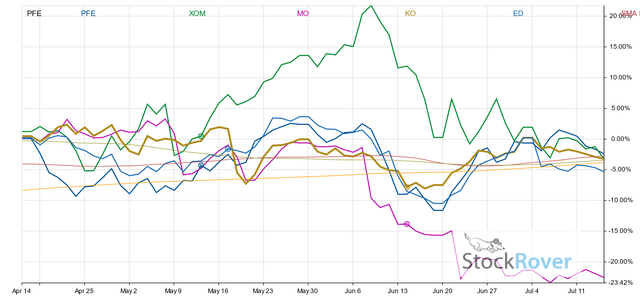

Expect Pfizer (PFE) to raise its outlook when it forecasts paxlovid sales. Markets expect Pfizer to report an EPS of $1.73. Its small acquisitions are of less value compared to a potential mega-deal. In the energy sector, Exxon Mobil (XOM) may exceed the $3.58 EPS estimate. Listen to Exxon’s oil price forecast.

Newell (NWL), whose stock pays a 4.8% yield, should earn 47 cents a share. The company will indicate the health of its household product sales. Controversial as ever, Altria (MO) will reaffirm its confidence in its legal team. It will fight to keep Juul on the market, citing product safety. The stock’s dividend yield is around 8.5%. Expect a $1.25 EPS.

– (Stock Rover)

Coca-Cola (KO) has exceptionally strong branding power and a product mix. Like PepsiCo (PEP), it may beat expectations. Analysts expect a 67-cent EPS. Investors may “panic sell” Consolidated Edison (ED), citing higher interest rates. This is a mistake. The firm will post a 57-cent EPS. The stock has a dividend yield of 3.4%, which is solid as ever.

Disclosure: None

Steven Bavaria of Inside the Income Factory: Market downturns and periods of volatility are dangerous times for all investors, but especially for retirees and others living off their income. Typical growth stocks yield only 1 or 2% and count on earnings and dividend growth for an extra 7 or 8% to add up to the 8-10% average equity total return of the past century.

But average returns are just… averages. In down markets, investors who need 4, 5, or 6% to live on are left with the unhappy choice of cutting expenditures, or selling stocks at depressed prices. A high-yielding Income Factory strategy avoids this. We still strive to earn 8%-10% per annum, but use asset classes that pay high enough yields that earn all or most of our 8%-10% target return in cash.

– (Seeking Alpha)

This provides us the 4%, 5% or 6% we need to live on without touching our capital, which is also depressed in price, just like stocks, but still pumping out its 8%-10% “river of cash.” The untouched portion of which we reinvest and compound at bargain prices and yields. The key to doing this successfully is to execute our strategy only with funds whose distributions are well-covered by their OWN cash flows, and DO NOT use capital to make up any shortfalls. As discussed in detail here ($).

These will not be equity funds, but largely credit funds, like Ares Dynamic Credit (ARDC), KKR Income (KIO), XAI Octagon (XFLT), Pimco Dynamic Income (PDO), or New America High Income (HYB).

Disclosure: Long ARDC, KIO, PDO, XFLT

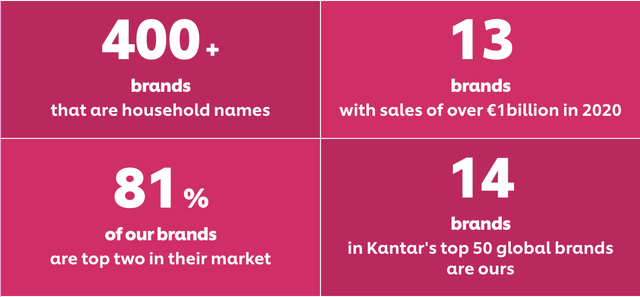

Tariq Dennison of Big Picture Growth & Income: The main earnings release we’re watching this month is that of Unilever Plc (UL), which reports half-yearly results on 26 July. Unilever probably has the best global picture on inflation and the movement of physical goods across most markets, and is a likely beneficiary of the weakening Euro. Dollar-based dividend investors may not like that the dollar value of the EUR 0.4268 quarterly dividend has been falling with the Euro, but overall, I see inflation as a net strength for the long-term dividend growth of this name. The image summarizes well how their brand portfolio makes this name a bellwether of the world economy and for world-class dividend growth investors.

– (Unilever Website)

Disclosure: Long UL, and also long through options and via the shares listed in London and Amsterdam

Dane Bowler of Portfolio Income Solutions: The million-dollar question hovering over the market is whether or not we’re in a recession. 2Q22 earnings and the guidance that comes with it will be a key source of information in answering that question. At Portfolio Income Solutions we have built out a spreadsheet with earnings estimates for every equity REIT such that we can quickly compare the quarterly numbers and the guidance against estimates. As of right now, REITs on average are expected to grow FFO/share by about 7% year over year making the sector far stronger than the S&P which is expected to have negative earnings growth if energy is netted out.

In the coming weeks, we will find out if REITs are actually doing as well as they are expected to. My hunch is that it will be quite variable by property type and by individual company. We’re putting out analytics on company specific fundamentals to try to discern which companies are strong and which are weak.

Location is always a big deal particularly as it relates to supply of new developments. Certain submarkets are experiencing job and population growth without a corresponding increase in real estate supply which bodes well for existing properties. I particularly like sunbelt apartments, class B industrial with highway or rail access, manufactured housing, hospitals and medical office.

2Q22 earnings will be a huge influx of fresh fundamental data. I look forward to staying nimble and repositioning to the opportunity.

Disclosure: None

Fredrik Arnold of The Dividend Dog Catcher: Dividend stocks with historically long annual dividend increases five years running or more. Keeping fit with dividends from $1K invested exceeding the price of a single share. As the present market shows rapidly descending stock prices, more strong companies show dividends within that sweet spot. These include Dow Inc. (DOW), Intel (INTC), Leggett & Platt (LEG), and Amcor (AMCR).

Disclosure: Long INTC

Be the first to comment