Stephen Wair/iStock via Getty Images

Note:

Tidewater (NYSE:TDW) has been covered by me previously, so investors should view this article as an update to my earlier publications on the company.

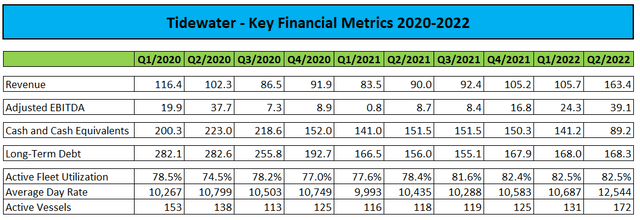

Last month, leading offshore support services provider Tidewater reported much better-than-expected second quarter results and offered a highly constructive industry outlook (emphasis added by author):

We believe the second quarter of 2022 marks the inflection point in the industry that we have long awaited and is now evident in our financial performance. Revenue, gross margin, average day rate and utilization all improved meaningfully during the second quarter as the building momentum in offshore vessel activity reached critical mass. The second quarter results reflect the impact of the Swire Pacific Offshore (SPO) acquisition, necessarily showing a large jump in revenue and vessels worked, but when viewing the quarter on relative metrics, the improvement is clear. The average day rate improved by nearly $1,900 per day sequentially, which is in excess of the improvement we would typically expect to realize over the course of an entire year in a normal market upcycle. Vessel level cash margin improved to 38%, up approximately four percentage points and continuing to meaningfully outperform the 30% target we have discussed in recent quarters. These improvements during the quarter, particularly the move in day rates, speak to continued demand growth as offshore activity continues to increase and as the vessel supply fundamentals continue to work in our favor given the shortage of available vessels on the market today. We expect activity to continue to improve throughout the remainder of 2022 with another likely step-up in 2023.

Even when adjusted for the recent acquisition of Swire Pacific Offshore, the company’s results were well ahead of consensus expectations on both the top and bottom line.

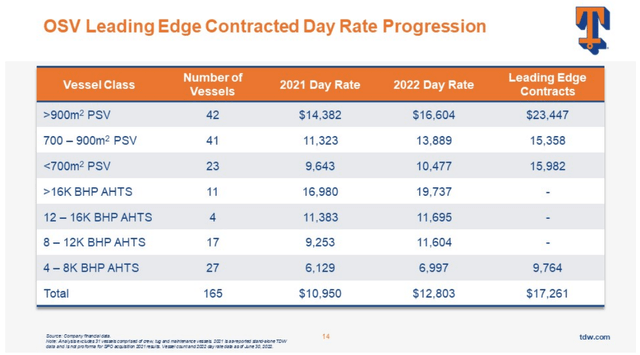

Average day rate jumped by an impressive 17.5% sequentially to new multi-year highs while gross margins improved another 420 basis points to 38.2%. On the conference call, management elaborated further on day rates:

To put the strength of our day rate increase in perspective, during the second quarter, 24 of our vessels entered new contracts of various durations that will ultimately provide a nearly 50% aggregate uplift in day rates as compared to the previous aggregate contracted day rates. This compares to the 16 vessels that entered into new contracts during the first quarter that realized just over 20% of pricing improvement.

While there are some mix issues, it’s worth noting that for our largest class of PSVs, pricing on new contracts entered into during the second quarter was in excess of 80% uplift as compared to their prior contracts. Candidly, the market is moving faster than we anticipated.

Very similar to the offshore drilling industry, cash flows are still pressured by elevated reactivation expenses but Tidewater also experienced higher working capital requirements for a second quarter in a row partially due to temporarily elevated days sales outstanding (“DSO”) and large tax payments related to the legacy Swire Pacific Offshore business.

On the conference call, management expected cash collections to pick up in the current quarter and DSO to normalize by the end of the year.

As a result of reactivations and ongoing efforts to dispose of non-core vessels, Tidewater is targeting 100% fleet utilization by year-end.

Backlog for the second half was stated at $327 million, well above the $281.5 million consensus revenue expectation. The company already secured approximately $400 million in backlog for next year.

During the question-and-answer session of the call, CEO Quintin Keen stated his belief that “businesses are made to build cash and return that cash to shareholders” but refrained from providing a certain time frame for reinstating the dividend.

Asked about day rates going into 2023, management offered some very interesting remarks:

And so what we’ve really seen so far in our demand for vessels has been catching up on deferred maintenance and looking for ways to enhance production. The rigs that are now going back to work as well as the offshore wind farms that are being constructed are adding another layer of demand and we’re going to see that come in ’23.

I will tell you that in prior peak cycles, average day rates for the Tidewater fleet at the time was right about $20,000 a day, okay? The fleet at that time was not as high graded as the fleet is today. (…)

So the fleet today is a much better and higher spec fleet on average than the Tidewater fleet was at the end of the last cycles, right, call it, the 2006, 2008, kind of ’12 to ’14, that time frame, okay? And so I would suspect that we would see day rates in excess of those peak day rates in this coming cycle.

I don’t see anything, to your earlier question, that I believe in the next three years, we’ll add considerable supply to the market. There’s not enough boats to reactivate. There’s not enough people to crew the boats. There’s not enough parts to reactivate the boats. The new build economics still are not there to justify a new build.

So over the next three years, I see this to be a vessel-constrained market which will continue to push up day rates.

With the average day rate around $12,500 in Q2, there’s apparently plenty of upside here.

In Tuesday’s presentation, Tidewater provided more detail on recent day rate developments:

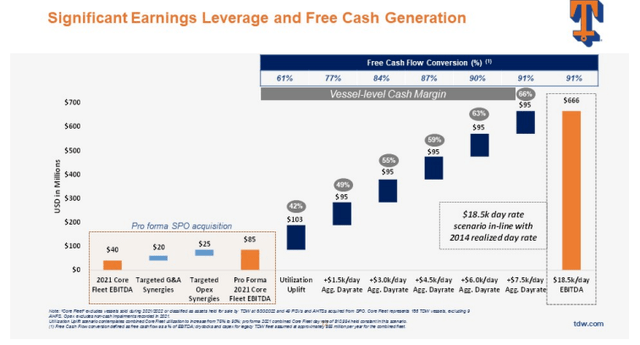

The company also illustrated its earnings leverage and free cash flow generation potential:

Assuming Tidewater achieving the $45 million in outlined merger synergies and average day rates increasing by another 25% until the end of FY2023, the company’s annual EBITDA run rate would increase to almost $480 million with anticipated free cash flow of more than $400 million.

Given the strong Q2 report and even better outlook, some investors appeared to be perplexed by the company subsequently selling new shares in an underwritten offering at just $17.85 for estimated net proceeds of $70 million but the move turned out to be non-dilutive as the company used the funds to repurchase an equal number of Jones Act penny warrants which had been issued as part of the consideration for the purchase of Swire Pacific Offshore.

Personally, I used the initial confusion to increase my position in the company’s common shares substantially.

Bottom Line

While it might still take a couple of quarters for a substantial increase in profitability and cash flow generation, stars are aligning for Tidewater with a recovery in offshore drilling activity and new tailwinds from recent geopolitical events.

Should Tidewater indeed achieve the $480 million annual EBITDA run rate outlined above, I would expect the company to initiate a quarterly dividend of approximately $0.75 per share in early 2024.

Even at multi-year highs, shares are still trading just slightly above 2x my estimated EV/EBITDA run rate at the end of 2023.

Get long Tidewater with a medium-term price target of $50 based on an assumed 5x EV/EBITDA run rate at the end of FY2023.

Be the first to comment