simonkr/E+ via Getty Images

Investment Summary

The June selloff has opened the floodgates for value opportunities within the medical technology (“medtech”) universe. Healthcare/medtech as an equity factor has traditionally provided a defensive overlay to equity portfolios in times of economic downturn. Namely, high predictability of future cash flows, short equity duration and low earnings variability are all characteristic of the sector.

The high-beta/growth trade has also exhausted itself and hence low-beta, high quality strategies continue to offer strategic alpha looking ahead. With an equity beta of ~0.87, medtech provides investors alternatives-like exposure when budgeting risk towards defensives. This brings us to IRadimed Corporation (NASDAQ:IRMD) the developer and manufacturer of magnetic resonance imaging (“MRI”) and MRI compatible devices such as the MRidium IV infusion pump system.

We are bullish on IRMD with the view it has the economic pillars to re-rate to the upside in the forward looking climate. There are numerous factors that stack a bullish tilt into the risk/reward calculus. Here, we will discuss but a few of these. IRMD is a high-sharpe name that exhibits a 27% return objective and seems fairly priced at ~$46 on current earnings. We rate shares a buy, with a price target of $46.

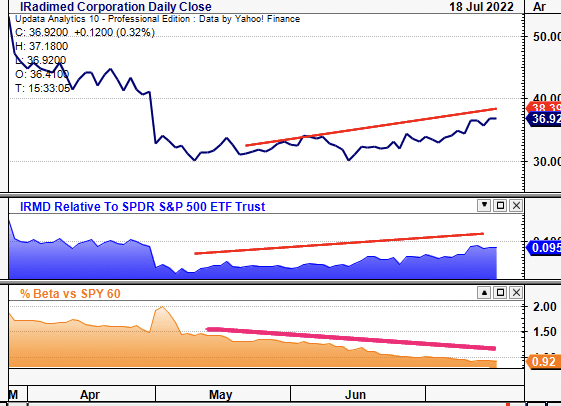

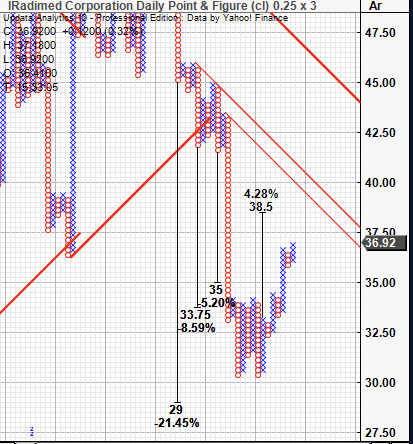

Exhibit 1. IRMD 12-month price action

Data: Updata

Market factors

Duration has been punished in FY22 both on the fixed income and equity side. Long-duration, high-beta stocks have been punished, despite growth stocks catching a bid rolling into H2 FY22. Consequently, low-beta, high quality strategies have outperformed this year and continue to lend investors tactical alpha looking ahead. Investors are therefore paying a premium for these characteristics in FY22.

IRMD presents with these desirable characteristics. The stock has curled up since May whereby its covariance structure began shifting downwards and it gained in strength relative to the benchmark. As seen in Exhibit 2, IRMD has caught a bid lately amid a corresponding wind-down in equity beta. Market pundits are paying a premium for these statistical properties in FY22, as mentioned, and this provides a solid base for IRMD to re-rate to the upside.

Exhibit 2. Down-shifting covariance structure lends investors strategic and tactical alpha whist reducing equity beta

These are alternative risk premia investors are paying a premium for in FY22

Data: Updata

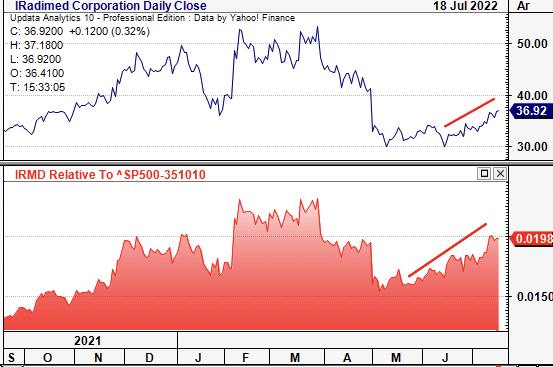

Moreover, IRMD has gained in relative strength to the US medical devices and health care equipment sector. As investors look to step up in quality and resiliency, IRMD looks to be bifurcating away from the sector to the upside as shown in Exhibit 3. At this rate, long-biased investors could look to this as early confirmation of a reversal and newly-formed uptrend. It’s not that medical devices as a basket have weakened, either. We firmly believe the combination of IRMD’s narrowing covariance structure and strengthening bottom-line fundamentals (discussed below) are seeing it re-rate against the wider sector.

Exhibit 3. Bifurcating away from medtech universe implying further upside

Data: Updata

Fundamental Factors

Investors have shied away from rewarding top-line growth in FY22 and shifted onto bottom-line fundamentals instead. In that vein, IRMD came in with solid earnings last quarter. It reported turnover of ~$12 million, up ~33% YoY, underlined by a ~37% YoY gain in domestic sales. In Q1 domestic revenue contributed ~81% to the top, up ~300bps YoY. Segmentally, IRMD recognized a ~100% YoY gain in monitor sales, driven by higher adoption rates and new wins throughout the quarter.

Importantly, IRMD successfully recognised ~330bps in pricing elasticity to its MRI compatible IV infusion system. Average selling price was $33,800 compared to $32,700 the year prior. More successfully, it saw ~22% pricing elasticity to the upside in its vital signs monitoring system ($46,800 from $38,000 in Q1 FY21). As a result, disposables turnover gained 26% YoY to $3.3 million

Despite the pass-through of costs, gross margin contracted ~40bps YoY to 76.2% due to higher labor costs and larger overhead for the quarter. GMs are slightly behind historical averages, providing headroom to lift higher. Moving down the P&L, trends were more favorable. IRMD recognized a ~50% gross operating margin, up from ~43% the year prior. On this, it printed a loss on FCF of ~$16 million.

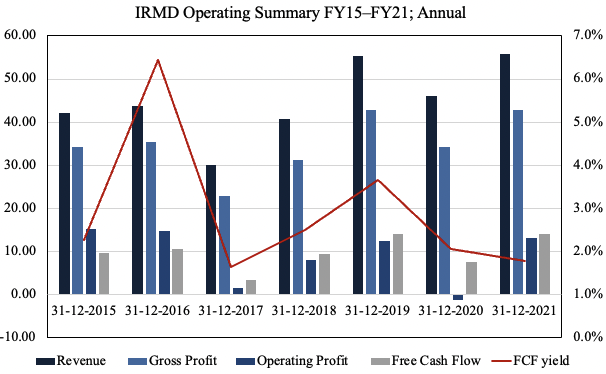

Exhibit 4. Steady cash conversion and operating cash flow 5-years to date

Data: HB Insights, Refinitiv

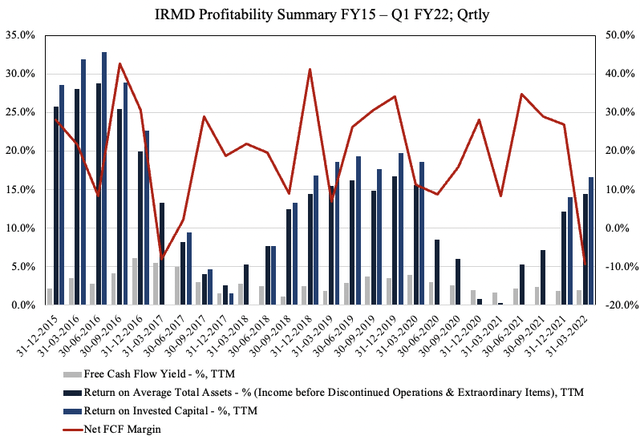

As seen in Exhibit 5., IRMD’s profitability has been strengthening since the onset of Covid-19 and is now back at pre-pandemic highs. The recovery to the upside illustrates the strength in IRMD’s business model and demonstrates a reasonable level of value for shareholders to bite into, by estimate. FCF margins have also remained steady, on average, for the past 6 years to date. Moreover, ROIC and ROA have both pushed back towards longer-term averages as seen below. The confluence and growth of these factors bring a high degree of fundamental momentum to the investment debate.

Exhibit 5. Profitability shifting upward since FY20

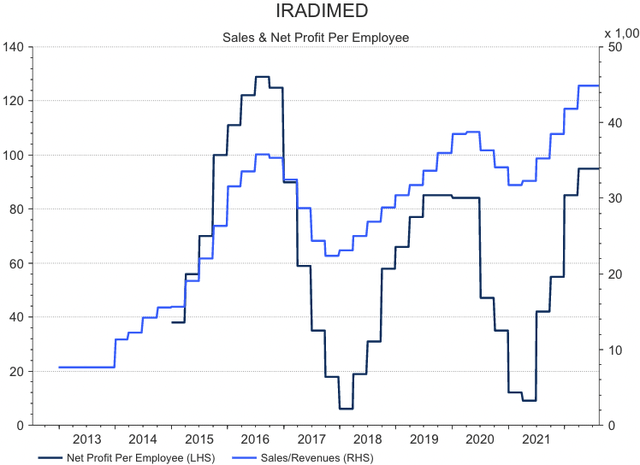

IRMD also elicits idiosyncratic risk premia that we feel will exhibit upside capture in the coming periods. Sine FY17, IRMD has grown net income per employee substantially, now at its highest levels. This is an efficiency and productivity measure that illustrates management’s effectiveness in driving sales. We feel it is these kinds of company-specific premia that is separating IRMD from peers within the medtech universe.

Exhibit 6.

Valuation

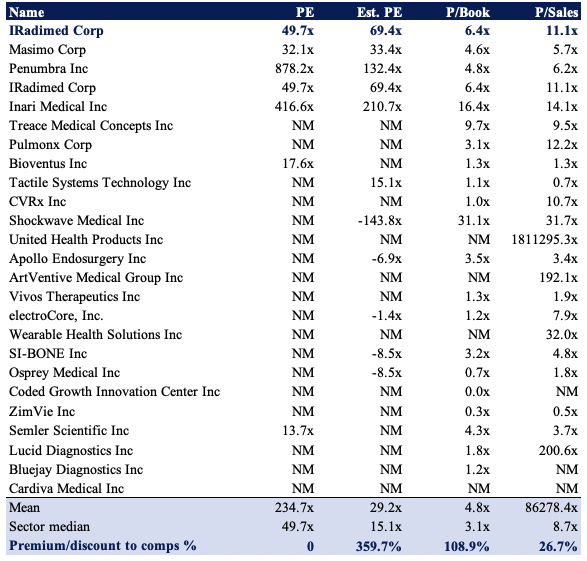

Shares are trading at ~69x FY23 P/E, a ~40% premium to its current P/E. It also trades at ~11x sales whilst investors enjoy $0.24 in annualized FCF/share. Shares are also priced at 6.4x book value, demonstrating outstanding value management has created for shareholders above the peer group, by estimate. IRMD trades at a substantial 124% premium to names used within comps for this report. The question is, if the stock deserves this kind of subscription? The market data provides clarity. The fact investors are paying a premium for the stock and it is bifurcating away from the sector indicates to us it possesses the forward-looking characteristics that justify its current valuation.

Exhibit 7. Multiples & Comps

Data: HB Insights

On the daily point and figure chart, price action has shown a reversal after bottoming at ~$31. As shown in the chart below, there is upside targets towards $38.50 and the stock is pushing towards the 2 inner resistance lines shown. Movement above this neckline is more than confirmation of a bullish trend, in estimate. Nonetheless, this chart is bullish to us.

Exhibit 8. Upside targets pushing to inner resistance lines

Data: Updata

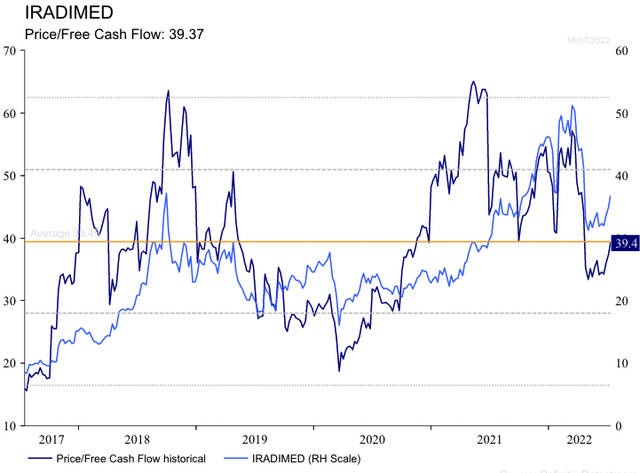

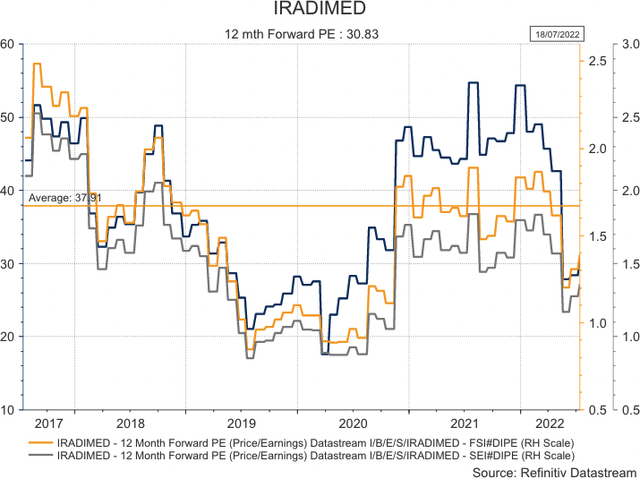

We’re scrutinizing bottom-line fundamentals in the search for long-term cash compounders with the potential to re-rate to the upside. In that vein, IRMD exhibited an uptick in cash-based multiples this year. It now trades in line with FY20 (FY18 pre-pandemic) FCF multiples, having consolidated in mid-late FY21. IRMD’s curling up of P/FCF to ~39x puts it roughly in-line with 7-year historical averages, and is well of frothy periods in FY18 and FY21.

Moreover, the stock trades below the entire health care equipment sector forward P/E. As seen below, the sector’s forward P/E (deep blue) has caught a bid lately and IRMD’s trading at a discount, offering some upside capture from this value gap. On 70x FY22 EPS estimates of $0.91 this values IRMD at $63. Meanwhile, at 39x FY22 FCF estimates we’ve priced IRMD at $39. Blending the three inputs gives us a price objective of $46, around 27% upside potential – our sweet spot in medtech at the moment.

In short

IRMD has strengthened against key benchmarks in recent weeks. The stock has caught a bid amid a bedrock of bottom-line growth and an upturn in FCF multiples. Investors are paying a premium for profitability-like characteristics in FY22 and IRMD fits the bill on this front.

Moreover, statistically speaking, its covariance structure is shifting downward, meaning investors can step up in quality and reduce equity beta in this name, two desirable portfolio characteristics looking ahead. We’ve priced the stock at $46, seeking a return objective of ~27%. This is integral for us as we’re seeking names with a margin of safety of minimum 20% to absorb another 20% shock to US earnings.

With this kind of quality offering in a defensible sector, we advocate that investors consider IRMD for further investigation as inclusion into a long-bias equity portfolio. Rate buy.

Be the first to comment