Charday Penn/E+ via Getty Images

This article is about FOMO – The Fear Of Missing Out. This article isn’t for everyone. This isn’t for you Day Traders – you play by your own rules and don’t take advice from anyone else anyway. This article isn’t about you youngsters – those below 50 that are still in the accumulation phase of your investment cycle – You should be dollar-cost averaging into every dip in the market investing every dollar you can spare into high growth stocks or funds. You have plenty of time to ride out the dips and trends.

This is an article for those of you that have retired or near retirement and are living off your investments. You are in the phase where capital preservation is a higher priority than maximizing your returns.

If you have been preserving your capital you are probably out of the market and sitting on a pile of cash. Every time you turn on the TV some pundit is yelling: “The market has been in a rally for the last 3 hours” or “This week the market is up since the first time since 1/4/22.”

You are worried that if you don’t jump back in you will be left behind with thousands of dollars left on the table – You suffer from FOMO – The Fear of Missing Out.

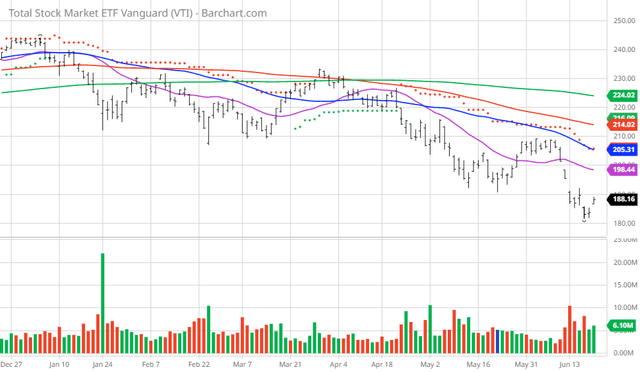

I’d like to use Vanguard’s Total Market ETF (VTI) to illustrate my point. The Fund has over 4,000 stocks in it so it is pretty representative of the US stock market.

The first chart shows the price vs. the Trend Spotter and the 20, 50, 100 and 200 daily moving averages:

You can see that the market is down and not as yet recovered.

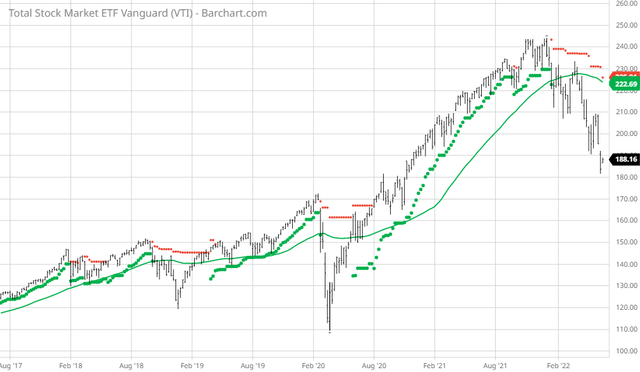

The next chart takes a longer view over the last 5 years and shows the price vs the 50 weekly moving averages:

VTI Vs 50 Weekly Moving Average

I hope you can see you have plenty of time to get back in. Choose the 50, 100 or 200-day moving average as your alert to tell you when to get back in. I think you can agree today is not the day.

Be the first to comment