24K-Production

Thesis

The Vanguard Total Stock Market ETF (NYSEARCA:VTI) is a highly-diversified market ETF benchmarked against the CRSP US Total Market Index. Coupled with a low annualized expense ratio of 0.03%, it offers investors exposure to a value/growth blend of large-cap companies.

Given its growth exposure, its top sector is tech, with a weighting of 25.8%, followed by consumer discretionary (14.8%). As a result, investors should not be surprised by its relatively poor performance in 2022, as it posted a YTD total return of -21.5%. Moreover, it’s well below its 5Y and 10Y total return CAGR of 9.71% and 11.67%, respectively.

It has also been impacted by an increasingly hawkish Fed, which is committed to its goal of crushing record inflation quickly, driving significant volatility in the market recently.

We believe that the market is attempting to decide whether the battering to form its medium-term bottom in June is sufficient to weather the Fed’s hawkish push, which is likely to trigger a recession. As a result, the ongoing price discovery is expected to cause further volatility in VTI.

The VTI is also at a critical juncture as it moves closer to potentially re-test its June lows, supported above its long-term moving averages. Notwithstanding, its medium-term bias remains bearish, corroborated by the market’s rejection of its recent August highs. But, investors need to note that bottoms are often formed at points of maximum pain, not maximum delight. Therefore, unless June’s lows get decisively taken out, we postulate that the market’s long-term bullish bias remains intact.

Therefore, we urge investors not to panic as the market sets up another bottoming process by driving fear and pessimism into investors, forcing them to give up their shares before potentially recovering.

We rate VTI as a Buy and urge investors to use the deep pullback from its August highs to add exposure.

The Fed’s Hawkish Push Drove Fear Into The Market

Fed Chair Powell’s commitment to continue his “unusually large” rate hikes to bring down inflation with more urgency has led to the market pricing in another 75 bps hike in November. As a result, the market has priced in a 73.7% probability of a 75 bps hike, which implies a forward target rate of 3.75% to 4% by November.

However, investors should also consider the Fed’s current median terminal rate of 4.6% has been raised markedly from June’s 3.8% estimates. Therefore, the elevated pace of its rate hikes has likely driven recent market volatility, as participants attempted to price in November’s 75 bps hike.

But, investors need to look forward. If the Fed expects its median terminal rate to be 4.6%, then the December hike should be less, with the Fed repositioning its tools to potentially pause/cut rates moving forward.

Therefore, we believe the critical question facing investors now is not whether inflation will get worse, as we think it has likely peaked in June, with the CPI print posting a 9.1% YoY uptick.

As such, we postulate that the market is focusing on the extent of the economic damage caused by the Fed’s more urgent push to combat inflation. In short, the market is likely trying to price in how deep this potential recession could be.

We don’t think there’s an easy answer to that. Even JPMorgan (JPM) CEO Jamie Dimon highlighted this in his recent congressional testimony. He accentuated:

The US economy today is a classic tale of two cities. There are headwinds and tailwinds, making it challenging to predict the future. While these storm clouds build on the horizon, even the best and brightest economists are split as to whether these could evolve into a major economic storm or something much less severe. – Yahoo Finance

So, if you are in the optimistic camp (like us), you can consider the views of Edward Yardeni, who believes that we could be falling into a “rolling recession” or “growth recession.” In his September 20 briefing, he argued that the US economy could see different industries experiencing their downturn at different times and therefore “avoids shrinking the overall economy.” Stifel also highlighted that it considers the current pullback consistent with its views of a “bottoming process” before a robust rally toward Q1’23.

Otherwise, you can consider joining the bearish camp with the Goldman Sachs strategists. It cut its target on the S&P 500 to 3,600 (SPX) for 2022, seeing more downside risks as “the rate complex has shifted dramatically.”

Therefore, as Dimon accentuated, strategists and economists are split on how they see the market direction unfold, which makes it even more challenging for investors to assess the opportunities.

Is VTI A Buy, Sell, Or Hold?

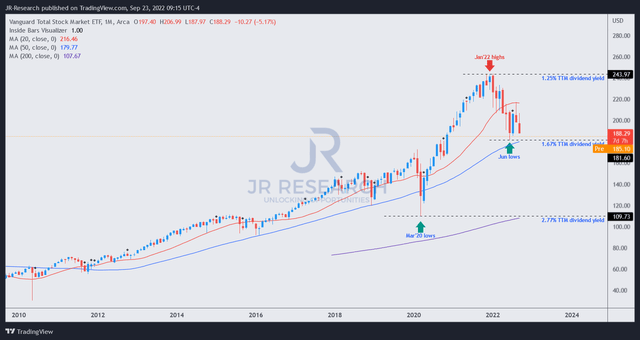

VTI price chart (monthly) (TradingView)

Given the confusion and ambiguities caused by the Fed’s rhetoric and recent actions, we suggest investors consider the power of price action analysis.

It’s easy to glean that the VTI has a long-term uptrend that has survived whatever the market threw at it over the past ten years. So, if you were optimistic at its January 2022 highs, you should be even more confident at its recent September lows. Note that the odds are on your side that whenever the index pulled back to its 50-month moving average (blue line), the buyers returned to stanch further decline.

That includes the bear trap (indicating the market denied further selling downside decisively) in March 2020, as it forced weak hands to capitulate.

We believe investors who buy the VTI have a long-term perspective. And you probably couldn’t ask for a better buying opportunity as it has pulled back closer to its June lows.

As such, we rate the VTI as a Buy for long-term investors.

Be the first to comment