SL_Photography/iStock via Getty Images

Introduction

I would just like to start off by saying that this is the first article that I have written as a partner in the Conservative Income Portfolio. This series of articles is intended to be educational for those interested in improving their fixed-income investing (preferred stocks and baby bonds). It lays out many strategies for generating high returns while also focusing on safety. These are the strategies that we will also be using at Conservative Income Portfolio. I hope you find this article interesting and useful.

This article was shown to Conservative Income Portfolio members on Sept. 19.

Finding Undervalued/Mispriced Investments

By focusing on relatively undervalued/mispriced preferred stocks and baby bonds, you not only achieve higher yields but you also have significantly more capital gains potential – thus higher total returns. The market will generally correct mispricings over time, so when the price of your investment moves closer to fair value you can look to swap this investment for a different one that is more undervalued/mispriced. This swapping strategy can really boost your returns and I will talk more about this in Part 2 of this article series.

Mispricings Within A Sector

Strong Buy on OXLCN (Oxford Lane Capital Term Preferred Due 6/30/2029)

One place to locate mispriced preferred stocks or baby bonds is to look within a particular sector at similar securities. One example might be to look for a mispricing within the hotel REIT preferred space.

One sector that I like to peruse regularly is the CLO CEF (closed end fund) sector. The term preferred stocks of OXLC, ECC, OCCI and PRIF have virtually the exact same risk so screening them as a sector works great. They’re all bound by the same legal leverage limit of 50% making them quite a safe sector, and they all hold the same types of investments (CLO equity tranches). Also, they all tend to carry about the same level of leverage.

Term preferred stocks are preferred stocks that have a maturity date. This makes them much less sensitive to interest rates because you can expect to get back $25.00 par on the maturity date. In this case, all of the term preferreds listed below will achieve capital gains upon maturity or a call.

I have created my own spreadsheet that helps me identify mispriced preferred stocks and baby bonds, but the following tools is good for showing these mispricings.

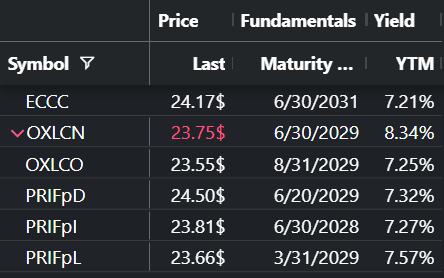

Author – Using 9/15/2022 Intraday Prices

In the above screen, I screened all the CLO CEF term preferred stocks with maturity dates from 2028 to 2031. As you can see, currently OXLCN smashes the competition with a very high YTM (yield-to-maturity). I think OXLCN is one of the great buys in the market currently. To get that kind of YTM on a CEF preferred stock is outstanding. No CEF preferred stock has ever gone bad.

And if you own one of the others, you have a great swap opportunity to upgrade your portfolio’s yield while taking no additional risk. Repeatedly making these types of swaps can really boost your portfolio’s total return.

Mispricings Within A Particular Credit Rating

One way to find mispricings is to look at all preferred stocks or bonds within a particular credit rating to find the one with the best yield, and you can also consider which one has the best capital gains potential. Of course, when you do this, you want to make sure you’re comparing apples to apples. So, for example, you might screen for all fixed-rate preferred stocks with “qualified dividends.” To try and compare fixed-rate preferred stocks to floating rate stocks can make life difficult and comparing yields for stocks that have tax advantages versus ones that don’t also adds complexity.

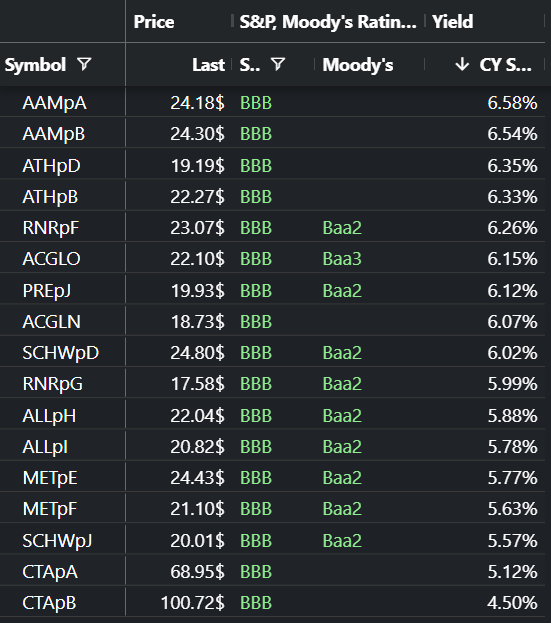

Here’s the same tool, but this time it’s quite useful for screening and not just for displaying mispricings. In the example below, I have screened for all fixed-income preferred stocks that have a qualified dividend and a “BBB” rating from S&P and the equivalent Moody’s rating of Baa2 (or no Moody’s rating).

Author – Using 9/15/2022 Closing Prices

If you are looking for a very high quality investment grade preferred stock with a “qualified dividend,” Apollo Global Preferred “A” (AAM.PA) is the highest yielder relative to other preferred stocks with the same credit risk. If you own MetLife Preferred “E” (MET.PE), you might want to swap and boost your 5.77% yield to 6.58%, a 14% higher yield. You also might consider looking a bit further down at Athene Preferred “D” (ATH.PD). At a price $19.40, you give up a little yield vs. AAM.PA but get a shot at a huge capital gain if long term interest rates move lower. I always like to try to get a large capital gain prospect with my purchases if possible.

Screening For Mispricings Within The Same Company

Strong Buy On SCCE (Sachem Capital Notes Due 3/30/2027)

These are the easiest to spot because all preferred stocks or baby bonds from the same company have the same exact credit risk and interest rate risk. Looking at the above chart, ATH.PD and ATH.PB are identical in risk as they are from the same company and they trade at nearly the same yield. But ATH.PD trades at $5.81 below par while ATH.PB trades at $2.73 below par. This is a mispricing as ATH.PD has much higher total return potential than ATH.PB. So again, if you own ATH.PB, it is a no-brainer to swap to ATH.PD.

One company that I really like for mispricings is Sachem Capital (SACH). They have seven baby bonds within the same company and the volatility and illiquidity of these baby bonds offers up many opportunities to find mispricings and opportunities to swap and improve your portfolio.

In this case, my spreadsheet helped me find this mispricing opportunity and here is our display tool that demonstrates this mispricing.

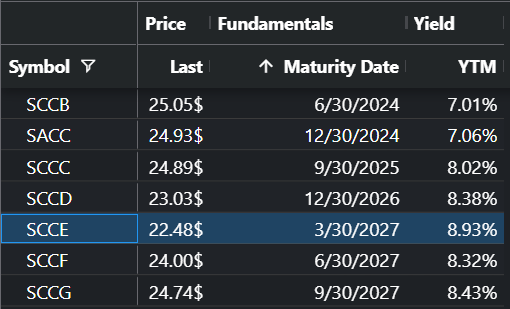

SACH Baby Bonds (Author – Using 9/15 Closing Prices)

As you can see from the above chart, SCCE is clearly the SACH bond that is relatively mispriced. This is an example where volatility and illiquidity worked to my advantage. I owned SCCD a few days ago, but when SCCE sold off for no reason, I had the opportunity to swap SCCD for SCCE and in so doing I pocketed 50 cents per share and boosted my yield quite a bit.

The way I view this is that fair value of SCCE is 15 cents below SCCD, but I bought it at 50 cents below pocketing a gain of 35 cents on the swap. Getting a 35 cent gain in 1 day is a gain of almost 1.5%. The annualized yield on this trade is off the chart – like 500%. And if I can make these kinds of swaps repeatedly, I can generate very high total returns. And in this market, these opportunities occur fairly frequently.

Buying Pinned to Par Preferred Stocks

Strong Buy On CMRE.PE (Costamare Preferred “E” Stock)

“Pinned to par” (P2P) preferred stocks are those stocks that trade way below fair value because of a risk that they might be called. For example, a preferred stock that might normally trade at $28.50, if it didn’t have call risk, can be purchased at $25.50. This not only provides you outsized yields but also great protection against a drop in the stock price. The fair value of this preferred stock would have to drop $3.50 for this $25.50 priced preferred stock to drop to a price of $25.00. So these are great core portfolio holdings that are superb investments, especially in a bear market. They will hold up much better than other preferred stocks.

My favorite P2P preferred stock now is CMRE.PE. It currently has a stripped “qualified” yield of 8.87%. Because of the tax benefit of being a “qualified” preferred stock, the after-tax yield is equivalent to a 9.75% bond for those in the 24% tax bracket and a 10.65% bond for those in the 33% tax bracket.

To show how undervalued CMRE.PE is, let’s compare it to CMRE.PB, which has a much lower dividend and thus has no call risk. CMRE.PB has a $1.91 annual dividend, and at a price of $25.30 has a current yield of 7.63%. So it would seem that 7.63% is the fair value yield of a CMRE preferred stock without call risk. So the 8.87% yield on CMRE.PE is 16% higher than fair value and thus CMRE.PE should trade at a price 16% higher than CMRE.PB if there was no call risk. This would put a fair value price on CMRE.PE of $29.25. Thus, if CMRE.PB dropped 16% or $4.00 per share, CMRE.PE should only take a slight drop to $25.30.

And the crazy thing about CMRE.PE is that it is not even callable yet and has an 8.4% yield-to-call (YTC). Even the YTC is much better than the yield on CMRE.PB yet CMRE.PE has massively better downside price protection.

On top of this, it’s unlikely that CMRE.PE will be called on its call date. CMRE management just does not call their preferred stocks. CMRE.PD also has a very high yield and it has been callable for a long time but no call has occurred. Even when rates were much lower, CMRE had no interest in calling CMRE.PD, so why would they call one of their preferred stocks now that rates are higher? CMRE has a large family ownership and management actually owns positions in CMRE preferred stocks. Most managements only hold common stock in their companies, so CMRE management has a financial interest in not calling their excellent preferred stocks.

“Don’t Fight The Fed” is probably the best investment advice there is. In November, when the Fed decided to start raising interest rates, I went to a defensive position on the fixed-income market. CMRE.PE was one of my top defensive picks and it has not disappointed. While a large number of preferred stocks have dropped $6.00 or more below par, CMRE.PE has never broken $25.25 to the downside. This is the idea of a P2P preferred stock.

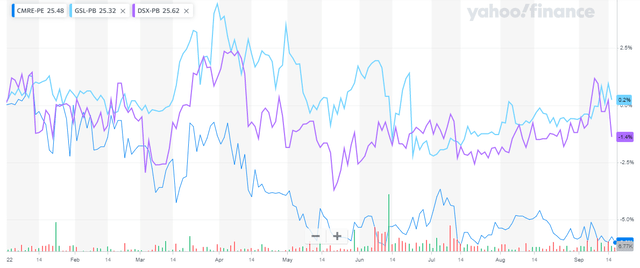

And here is why CMRE.PE is my favorite now. There are three excellent P2P preferred stocks in shipping, CMRE.PE, GSL.PB and DSX.PB. They generally have traded at around the same price, and actually while GSL.PB and DSX.PB are callable now, CMRE.PE is not yet callable. But as you can see from the following chart, CMRE.PE has disconnected and is now providing a bargain price.

Year To Date Price Chart

And about CMRE, they are a diversified shipper. They were a containership leasing company but have more recently moved into the dry bulk sector as well. This diversification helps stabilize the company long term, although dry bulk has been weak of late.

Importantly, CMRE is expected to earn $3.74 per share this year and $3.93 next year and they have locked in a number of very profitable long term contracts which helps give them some visibility into future profits as well as ensuring that the company will have some very profitable contracts into the out years.

So CMRE looks safe, at least in the near term and intermediate term. Unless we see CMRE.PB start crashing, we have little to worry about with CMRE.PE which has a fair value that is $4.00 higher than CMRE.PB.

Conclusion

In part 1 I have laid out some of the investment strategies that I use for my own personal investing and that we will be implementing at Conservative Income Portfolio. These include:

- Screening for mispriced stocks within a sector, individual company or credit rating.

- Doing stock swaps that improve your portfolio’s yield, lower your cost basis, let you lock in profits, and/or improve your capital gains potential.

- Implementing “pinned to par” strategies.

In part 2 (and probably part 3), I plan to discuss:

- High yield parking places for cash

- Taking advantage of mutual fund rebalancing which cause sharp price spikes in preferred stocks and baby bonds

- Taking advantage of intraday price spikes

- Buying undervalued IPOs

- Building a baby bond ladder

- Buying laggards

- Scaling in and out of positions/swing trading

Additionally, we have strong buys on 1) CMRE.PE, as our top undervalued pinned-to-par holding, 2) OXLCN, which is clearly vastly undervalued versus other CLO CEF term preferred stocks, and 3) SCCE, which is quite undervalued relative to the other SACH baby bonds.

Some of the shorter term strategies, that I will discuss in Part 2, generate very high annualized total returns in the 20% to 50% range. Although these investment strategies are highly effective, some of these strategies require time consuming research as well as tools that are not generally available. At Conservative Income Portfolio, we will be identifying these opportunities for our members. For those who wish to get notifications for part 2/3 of this article and further articles from me, you can become a real time follower of mine.

Be the first to comment