vzphotos

Nvidia’s (NASDAQ:NVDA) launch of the RTX 4090 graphics card flagship has salvaged what could have been an ugly quarter following the end of Ethereum (ETH-USD) mining. The 4090’s performance proved skeptics wrong, and the card was an instant sell-out. Nvidia’s GPU prowess has translated into adjacencies such as game streaming and the metaverse. Nvidia has thoroughly disproven the myth that its success relied mainly on crypto.

Upgrading my rating of Nvidia from Hold to Buy after the Ethereum merge proves less impactful than expected

In my recent article on the impact of the Ethereum Merge on Nvidia, I was fairly cautious and maintained a Hold rating on the company. The end of Ethereum mining would, I calculated, put roughly 11 million used cards on the market, most of which were high end current generation GPUs from Nvidia and AMD (AMD). This would suppress demand for new cards of the same generation.

It certainly seems to have done that, judging by the drop in prices for new RTX 30 series cards. A new 3090 Ti, which originally cost upwards of $2,000 can be had on eBay for about $1,000.

Then Nvidia did something that no one expected: it launched the RTX 4090 flagship graphics card that turned out to be vastly superior to the previous generation. While the Ethereum Merge has depressed prices for the RTX 30 series, it has had little impact on demand for the new RTX 4090, which sold out of all sources in the US in a matter of minutes.

The Ethereum Merge could have little or no impact on RTX 4090 sales for the simple reason that there were no used graphics cards that could touch it in performance. The 4090 was in a class by itself.

Together with other developments I discuss below, I decided to lift my Hold on Nvidia and informed subscribers on October 17 that I now rated Nvidia a Buy. I resumed buying the stock on October 19.

Reason #1: the successful GeForce RTX 4090 launch

Nvidia’s CEO Jensen Huang launched the RTX 4090 with the claim that it offered a 50% performance uplift for non-ray traced (rasterized) games and as much as 2-4 times improvement in ray traced games compared to the RTX 3090 Ti. Here, gaming performance is measured in frames per second (FPS).

Not surprisingly, there was considerable skepticism about the claims, with some YouTube tech reviewers even going so far as to claim that Nvidia was lying and that the RTX 4090 was just a scam.

In fact, I can’t remember ever seeing so much hostility towards an Nvidia product launch. The messaging was uniformly pro-AMD: Nvidia is lying about the performance gains of the 4090; Nvidia is gouging consumers with a launch price that is a whole $100 (!) over the launch price of the RTX 3090; Nvidia is evil and consumers should wait for AMD to come to their rescue.

That all changed once the review embargo was lifted on October 11. Even reviewers who had been openly hostile had to grudgingly acknowledge that Nvidia had delivered on its 4090 performance claims. A good example is the review by Paul’s Hardware.

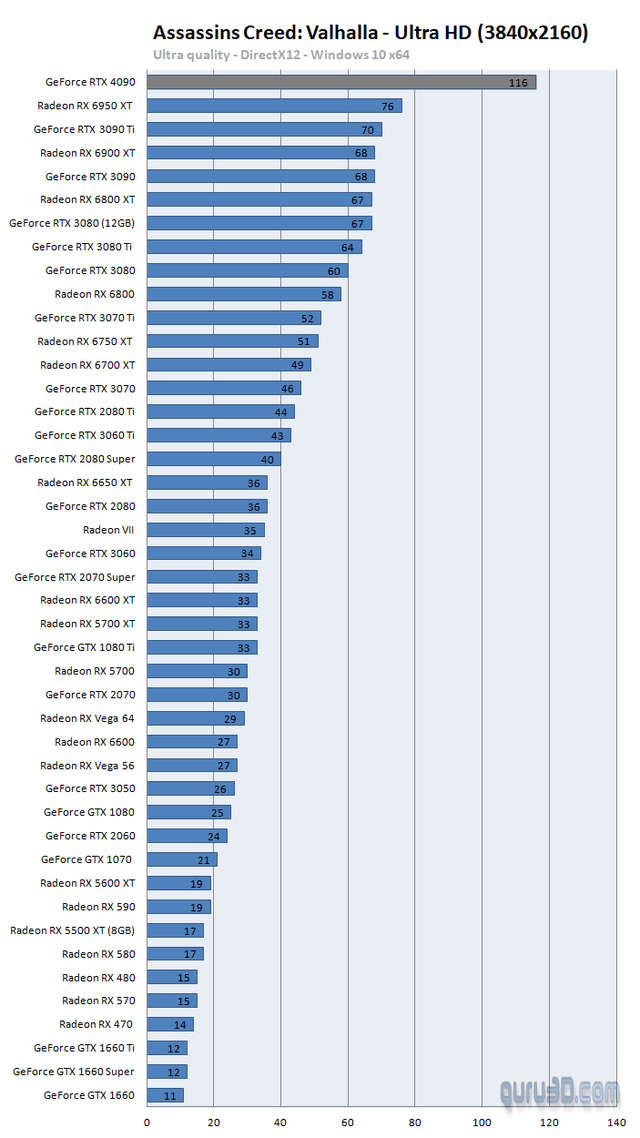

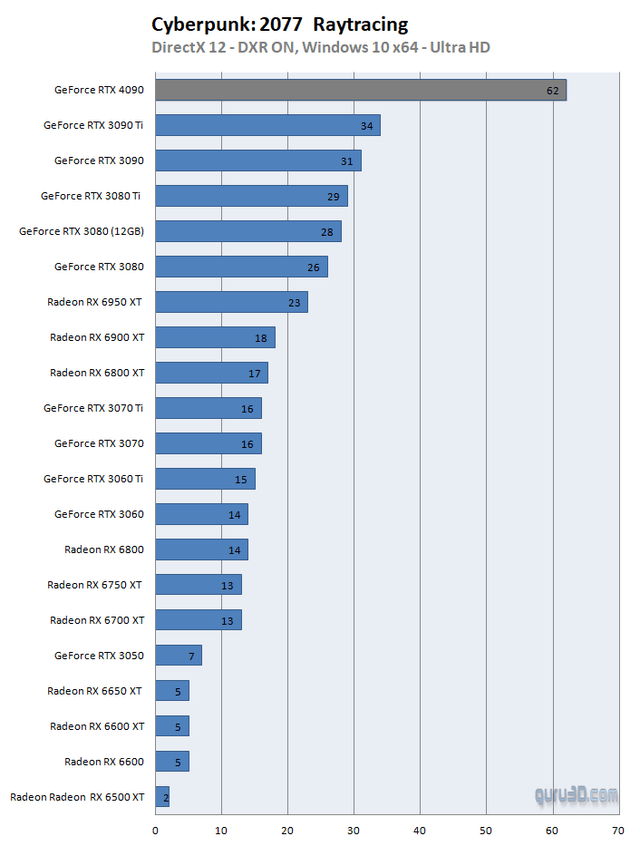

I’ve gone over numerous reviews on YouTube and traditional tech review sites and their conclusions are basically all the same. For display resolutions of 4K UHD and above, FPS performance is limited by the graphics card and not the CPU. In that regime, the 4090 delivers on its performance claims. A couple of examples from one of the best PC reviewers in the business, Guru3d:

Rasterized performance:

Ray tracing performance:

Many reviewers still concluded by questioning whether the card is worth the $1,599 list (for the Nvidia Founders Edition), often imploring their audience to wait until the launch of AMD’s next generation GPUs on November 3.

This is not unreasonable advice, but frankly, I don’t expect AMD’s next generation GPUs to match the performance of the 40 series in ray tracing. AMD has tended to de-emphasize this in favor of rasterization performance.

And the advice has seemed to fall on deaf ears for customers of the 4090. On October 12, the cards sold out within minutes on all venues. Almost certainly, Nvidia was too cautious and underestimated demand.

In addition to inadequate supply, the launch was also marred by a marketing faux pas. Nvidia had announced two versions of the RTX 4080 set to go on sale in November. The lower priced version used a different GPU chip and less video RAM, and it was obvious that it should have been called the RTX 4070.

Once again, it was evil Nvidia trying to deceive the public. Here, I think Nvidia was not so much evil as just plain stupid from a marketing standpoint. On October 14 Nvidia announced that it was “unlaunching” the lower end 4080, prompting much gloating among Nvidia’s critics.

Reason #2: GeForce Now thrives while Google Stadia dies

At Nvidia’s fiscal 2023 Q2 conference call, CFO Colette Kress noted that Nvidia’s game streaming service, GeForce Now, had surpassed 20 million registered users. GeForce Now offers over 1350 games, some of which are included in the subscription, but most can only be played if the user has bought the game elsewhere, such as through Steam.

As such, GFN deviated from the classic streaming model of all content being available for a monthly fee. The GFN user was paying for the privilege of being able to play Windows PC games on a wide variety of other devices or through a web browser.

The saving grace of GFN was that even though users were required to buy most games, the games were portable to Windows PCs. Users weren’t required to keep their games on GFN and didn’t have to worry about losing them if GFN folded.

Not so Google (GOOG) Stadia. Google wanted users to treat Stadia as a gaming platform comparable to consoles or Windows PCs. Users would buy games for Stadia, and they would reside on Stadia, being available nowhere else. “Free” games were also included in the subscription, but most games had to be purchased outright.

On September 29, Phil Harrison, VP and General Manager of Stadia, announced that Stadia would be shut down. Stadia just became the latest in a long line of projects killed by Google.

There had always been concern among gamers about Google’s tendency to kill projects and questions about Stadia’s long-term viability. Google confirmed many gamers’ fears about the platform but did the right thing by refunding all hardware and game content purchases.

In retrospect, Stadia just had the wrong business model. Ideally, one would like the content of a streaming service to be available for an all-inclusive price. Game streaming just isn’t there yet, which I think is mainly due to the publishers. Unlike much of the software industry, game publishers have not embraced the subscription model.

This is probably due to the fact that no individual publisher has a large enough user base to be able to make the transition from outright purchases to subscriptions. The initial phase of such a transition involves some cash crunch. Adobe (ADBE) and Microsoft (MSFT) could afford to make the transition for key products such as Creative Suite and Office, but that’s the kind of scale that’s required.

Even Sony (SONY) PlayStation Plus, which does offer streaming for an inclusive price, restricts title availability to previous generation games, PS 2, 3, and 4, only. Here, it’s easy to see why the game publishers would go along with this. They’re not selling a lot of the older generation games, so this is just a nice source of residual income.

GeForce Now has turned out to be a savvy adaptation to the financial needs of the game publishers. Not all of them are on board with it. After GFN exited beta, some publishers bailed out and refused to authorize streaming of their games on the service. This was despite the fact that users would have purchased the games they were streaming for the most part, so no loss of revenue to the publisher.

This may have been more about political alignments between GFN and Stadia. Now that Stadia is no more, I expect GFN to continue to grow content and subscribers.

Reason #3: Omniverse grows while Meta’s Metaverse declines

These days, we’re hearing a lot of hype about the “metaverse”. The metaverse will replace today’s internet with an all-encompassing immersive 3D experience. The concept is not new and has been the stuff of science fiction since William Gibson invented it in Neuromancer. He called it, The Matrix. Yes, that’s where the movie title came from, but Gibson’s Matrix was fully consensual and had simply evolved out of the internet.

Under the limits of today’s technology, our ability to create a simulated world falls well short of The Matrix. Virtual reality goggles don’t make you feel like you’ve been inserted into a virtual reality but more like you’ve been inserted into a video game. Kind of like Mark Zuckerberg’s avatar that was recently demonstrated for the Meta Connect 2022 event:

Part of the problem with Meta Platforms’ (META) concept may be that it’s so often cartoonish, not even up to current video game standards. More like console or mobile device games of a decade ago.

And perhaps that’s why people seem to be losing interest, according to the Wall Street Journal:

While Mr. Zuckerberg has said the transition to a more immersive online experience will take years, the company’s flagship metaverse offering for consumers, Horizon Worlds, is falling short of internal performance expectations.

Meta initially set a goal of reaching 500,000 monthly active users for Horizon Worlds by the end of this year, but in recent weeks revised that figure to 280,000. The current tally is less than 200,000, the documents show.

Most visitors to Horizon generally don’t return to the app after the first month, and the user base has steadily declined since the spring, according to the documents, which include internal memos from employees.

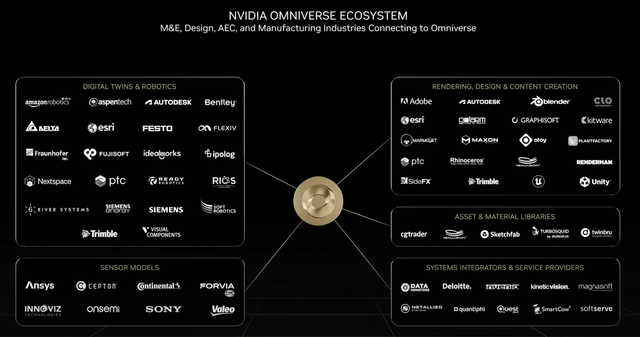

Nvidia’s Omniverse has a different focus. Instead of trying to replace the internet, Omniverse is intended mainly as a tool for workplace collaboration. This collaboration can take many forms, including architectural design, mechanical engineering, robotics simulation and game creation.

Always there is an emphasis on ray-traced realism and real-time simulation. At the RTX 40 series launch event, Nvidia also demonstrated the power of Omniverse as a game creation tool. A small team of 30 developers were able to create the Racer X demo shown below in just 3 months. Racer X is fully ray traced and physics simulated with no pre-baked visuals, and runs in real time on an RTX 4090.

With Omniverse, we see the convergence of a number of Nvidia technologies, including GPU hosted ray tracing, game streaming from the cloud, and AI. All of it knitted carefully together with very extensive software development.

Although Omniverse doesn’t have the aspirations of the Metaverse, it could well become it. Omniverse has already attracted numerous partners:

Investor takeaways: Nvidia has proven that it isn’t just about crypto

I still occasionally come across comments to the effect that Nvidia is totally dependent on crypto. This is despite the fact that Data Center revenue exceeded Gaming revenue in fiscal Q1, when Gaming revenue was $3.6 billion and presumably still augmented by crypto.

Even as Gaming segment revenue declined in fiscal Q2 to $2.042 billion, Data Center revenue continued to grow to $3.806 billion, far greater than AMD’s Data Center revenue for Q2 of $1.4866 billion. While many have tended to focus on the battle for data center CPU market share between Intel (INTC) and AMD, Nvidia has been the stealth disrupter of the data center market.

Nvidia has created a virtuous cycle of innovation in which continued performance improvements in its GPUs are funneled into its data center business. Advances in the data center are then folded back into the consumer space through cloud services such as GeForce Now and Omniverse.

If Nvidia can move quickly to meet demand for the RTX 40 series, it will emerge relatively unscathed from the end of Ethereum mining and resume growth in the Gaming segment. Fortunately, Nvidia has a much better manufacturing partner for the 40 series in TSMC (TSM) than it had in Samsung (OTCPK:SSNLF) for the 30 series. TSMC has the scale to meet the demand for the 40 series.

I still expect it to take a few quarters to work through the GPU inventory glut, but in the meantime Nvidia will be able to sell every 4090 and 4080 card it and its board partners can make. That should take the sting out of the lost crypto revenue and lay to rest once and for all the myth of Nvidia’s crypto dependence. I remain long Nvidia and rate it a Buy.

Be the first to comment