Kameleon007

I spoke to an investor last week and was surprised to hear the following characterization of my column:

“I always thought you were a fixed-income guy. All you keep talking about is interest rates.”

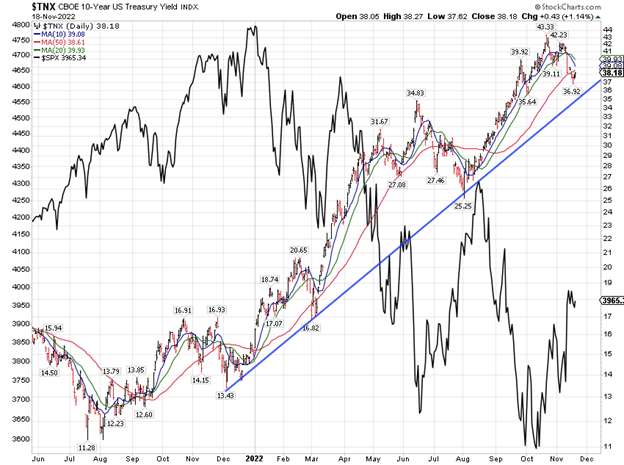

While I am not limited to one type of market, I have been talking a lot about interest rates over the past year, as that’s what has been moving the market. If Fed Chair Jerome Powell were not over-tightening and the 10-year rate did not hit 4.32% in October, I think the stock market would have been a lot higher.

CBOE 10-Year US Treasury Yield (StockCharts.com)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This stock market rally depends on the Fed pivot and perhaps on a Ukraine truce, which was proposed by Russia last week and rejected by the Ukrainians. Ukraine feels they have the upper hand, although it may not seem that way in the middle of winter with a relentless Russian attack on energy infrastructure.

As to the Fed pivot, a lot of institutional money is betting that we have seen the top in Treasury yields. If that is indeed the case, I think the stock market will rally at the end of the year. Last week, Treasury yields didn’t do much and ended the week exactly where they ended the previous week, at 3.82%.

If the Fed is indeed going to raise the Fed funds rate to 5%, I think we are due for one more push above 4 on the 10-year Treasury, as that benchmark rate rarely declines more than one percent below the Fed funds rate in a Fed tightening cycle. It did that when Paul Volcker was tightening, and that was truly a horrific Fed policy. While Powell’s current cycle is the most aggressive tightening cycle since Paul Volcker in 1979-82, I doubt he can go that far because of sheer financial leverage in the system.

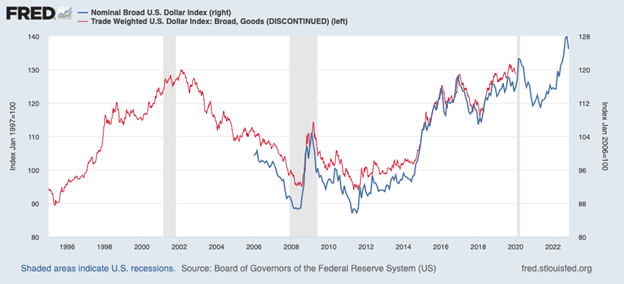

Nominal Broad US Dollar Index; Trade-Weighted US Dollar Index (St. Louis Fed)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The pause and end of Powell monetary tightening will likely result in a top in the Nominal Broad Dollar index, which just came off an all-time high. That will be bullish for the stock market, although it is far from certain as yet. The euro will benefit from more ECB rate hikes or any wind-down of the Ukrainian conflict, which is also not yet certain.

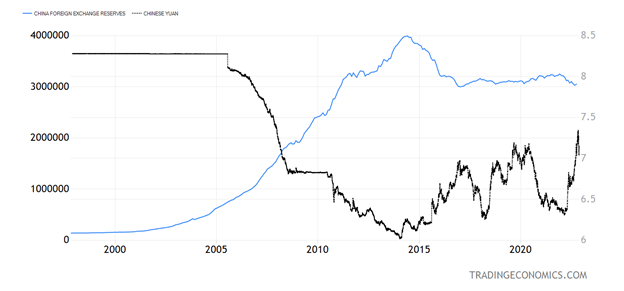

China Foreign Exchange Reserves; Chinese Yuan (Trading Economics)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Also, the Chinese yuan has been weakening notably of late, guided lower by the People’s Bank of China (PBOC). If the Chinese yuan were to weaken further and a flight of capital accelerates out of China, I think the U.S. dollar may appreciate further.

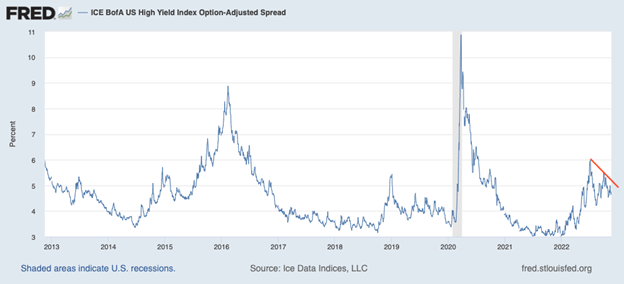

Junk Bond Spreads Will Signal the Lagged Effect of Tightening

While the Fed monetary tightening has long and variable lags, it does reach the real economy at some point. It has had a relatively modest effect in 2022, and the real effects are likely to come in 2023.

One way to see it clearly is when Treasury yields begin to trend lower while spreads to junk bonds begin to expand. Any rise in the credit spread in 2022 has come with rising Treasury yields.

St. Louis Fed

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

At 475 basis points, the high-yield index is well-behaved and almost half of where it was in early 2016, which was a spike that came without a recession due to a slowdown in the Chinese economy. I think U.S. credit spreads can double from here, and I think that most likely will happen by the middle of 2023.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment