Teka77

Background

Vonovia SE (OTCPK:VONOY, OTCPK:VNNVF) is Germany’s leading residential real estate company. Vonovia currently owns and manages ~550k residential units, mostly in Germany, but with some apartments also in Austria and Sweden.

Whilst rental income from holding residential apartments is its main business, Vonovia also has additional segments that include:

1) Property development segment

2) Recurring sales (disposal of non-core apartments)

3) Value-add services (e.g., craftsmen, media, etc.)

Valuation

The stock is currently trading at ~0.33 of net asset value (“NAV”) and with a forward dividend of 8.5%. Note, for foreign investors, that the last dividend payment was structured as a return of capital and, therefore, no German dividend withholding tax was deducted from the dividend payment.

I also recommend buying the stock in the primary listing in the German stock market as opposed to an ADR due to various issues with collecting dividends as well as liquidity. Also, investors should consider whether they prefer to hedge their euro exposure, this is something I typically do when investing in European stocks.

The current distressed valuation factors in a projected decline in the German property market of ~35% to 40%. So, on the face of it, the decline in the stock seems materially overdone.

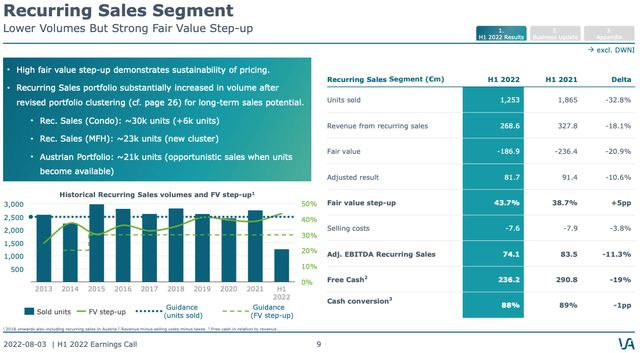

It is important to note that the carrying value of Vonovia’s properties appears conservative. There are several data points that clearly point to that. Firstly, Vonovia manages to consistently sell (albeit at an average pace of ~3000 units a year) at 30% to 40% above its book value. This can be seen from the below slide from the 1H Earnings Release:

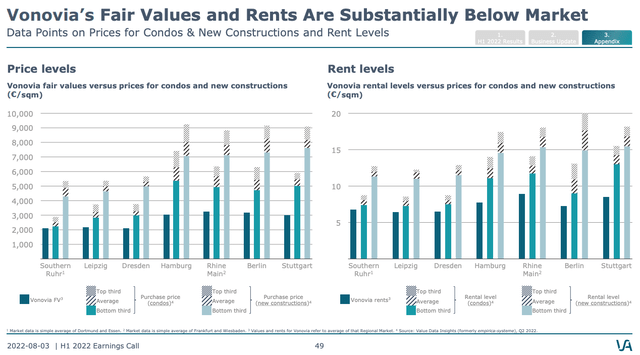

Secondly, Vonovia’s apartments are located in high-demand urban areas suffering from chronic supply shortages. Rents and prices of apartments are also well below market rate and book value as highlighted in the below slide:

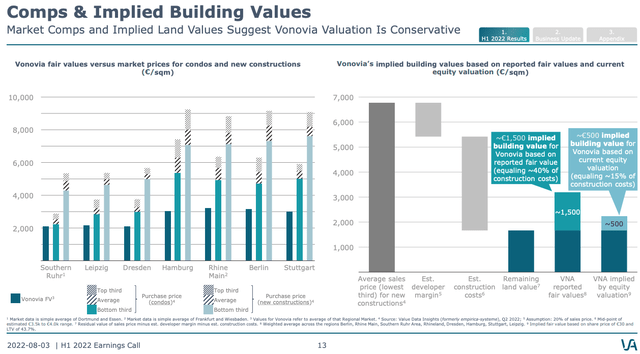

Importantly, the implied value of building values is estimated at ~40% of current construction cost (based on book value) and ~10% based on current equity value. This is shown in the below slide:

So, all in all, it does appear, based on the above data points, that the assets in Vonovia’s book are absolutely conservatively valued.

The bearish view, of course, is that the German property market is set to decline, at least on a nominal price basis, in the next 12 to 18 months driven by the energy crisis and ensuing Eurozone recession. However, it appears that the consensus currently is a price decline of up to 10 percent (based on rating agency assessment but more on that later).

In my view, given that the equity market is factoring in a price decline of up to 40% of assets, there seems to be a very wide margin of safety.

The Stock Is Trading Like A Bond Proxy

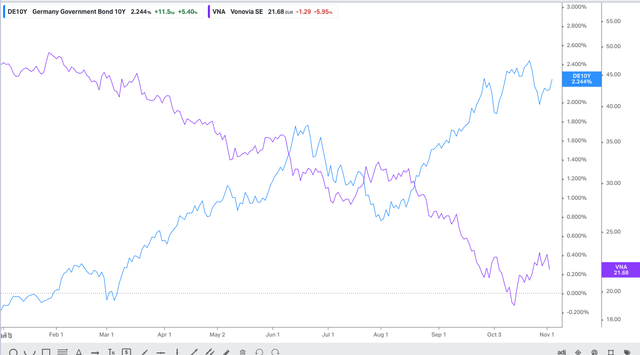

The inverse correlation to the yield of the 10-year Bond is uncanny.

So why does Vonovia trade like a leveraged Bond exchange-traded fund (“ETF”)?

There are a few reasons:

- German residential real estate investment Trusts (“REITs”) are long-duration assets, and thus NPV of future cashflow is computed with a higher discount rate.

- Vonovia accesses the capital market for debt to raise fresh funds or refinance bond maturities

- Rising interest rates are a negative for real estate prices as they impact a buyer’s affordability

The most important reason is that Vonovia’s cost of capital has now increased substantially. In fact, the main reason for the share price collapse is the increased cost of capital due to higher rates in the Eurozone. Currently, Vonovia’s cost of debt is 1.2% with an effective maturity of 7.7 years. To refinance the debt currently, Vonovia’s cost of debt is likely to be in the range of 4% to 5+%. As such, this renders its previous business model of debt-funded inorganic M&A not tenable any longer. It is also no longer economical for Vonovia to refinance its debt at such costs, and it is effectively forced to deleverage.

The deleveraging is planned to be achieved mostly by selling units, and a sale portfolio of EUR13 billion has been earmarked for sale over time. The market is skeptical that, in the current market conditions, Vonovia will be able to sell enough properties without conducting a fire sale and selling well below net assets value. On its part, Vonovia has developed a JV structure to sell sizeable chunks of that portfolio to institutional investors that deliver both a tax benefit, alternative capital sources, and an additional income stream.

All in all, this is what the uncertainty boils down to. The market wants to see actual deleveraging and not just a promise to deleverage, and the quicker, the better.

The Key Catalysts

The key positive potential catalysts are:

1) Vonovia is able to demonstrate deleveraging through increased sales or ideally through a JV structure at prices near, at, or above book value.

2) Reduce LTV to ~40% and start buying back shares.

3) Demonstrate cost efficiency through M&A synergies (EUR115 million per annum from 2023) and lower maintenance costs (EUR 60 -100 million per annum).

4) Longer term, demonstrate that it delivers rental income growth through modernization and the regulated German rules known as Meitaspiegel that operate with a multi-year lag.

Final thoughts

Vonovia stock has been caught in a near-perfect downward spiral and a vicious cycle triggered by rapidly rising interest rates. The bad news is already completely factored into the valuation and then some. If interest rates decline, then Vonovia stock should certainly rally.

In the medium term, the stock will be fine in any event and likely to trace back closer to its book value even with higher rates. As an investor, I remain patient, as the underlying value backed by real brick and mortar remains solid. The cashflow from rental income is also exceptionally safe, with low vacancy rates and supply shortages.

At the same time, Vonovia is a coiled spring if any of the abovementioned catalysts were to play out, the stock should catapult higher very quickly.

Admittedly, I was early on this opportunity, buying in the mid to high 20s. Still, I am content to add to my position opportunistically and euro-cost-average and get paid to wait with a near 9% yield in the process.

Be the first to comment