ALIAKSEI KOVALIOU/iStock via Getty Images

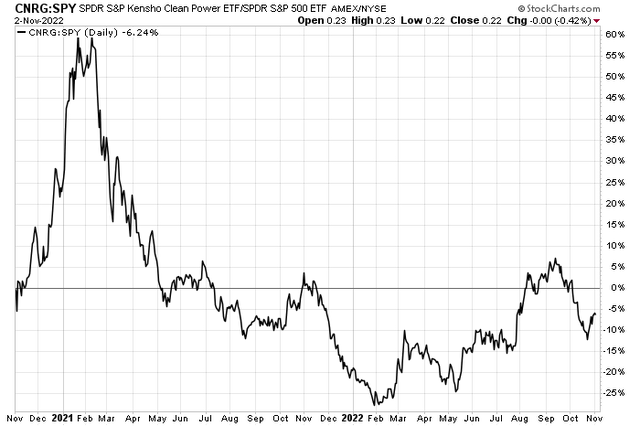

Midterm elections are on the doorstep. Right now, traders see the likelihood of a red wave in Congress. Could that mean less in the way of positive clean energy investment? Perhaps so. The SPDR S&P Kensho Clean Power ETF (CNRG) has endured big relative weakness since mid-September, when the tide started to turn against the Democrats in election prediction markets. One of the fund’s top holdings has a key earnings report next week.

Clean Energy Stocks Down Relative to the S&P 500 Since Mid-September

According to Bank of America Global Research, SunPower Corporation (NASDAQ:SPWR) sells and installs solar panels for residential customers. Total SA, one of the largest integrated oil and gas companies in the world, owns 57% of SunPower. It operates through Residential, Light Commercial; Commercial and Industrial Solutions; and Others segments.

The California-based $3.2 billion market cap Electrical Equipment industry company within the Industrials sector has negative GAAP earnings over the last 12 months and does not pay a dividend, according to The Wall Street Journal. Importantly, ahead of earnings next week, the stock has a high short interest as a percentage of the float with a current reading of 14.3%.

SunPower had some tailwinds earlier this year, signing an impressive deal with IKEA and potentially benefiting from the Inflation Reduction Act (IRA). Headwinds might be mounting, though. California’s net metering 3.0 program could pose problems while macro risk around a steep drop in new home sales likely pressures the firm’s top line in the coming quarters. Back in July and early August, mortgage rates were much lower than today’s 7% levels. This stealth housing market exposure is concerning. Uncertainties in China are another variable.

Still, there’s potential upside from a better pricing environment, and lower input costs which could beef up margins, and lower customer acquisition costs.

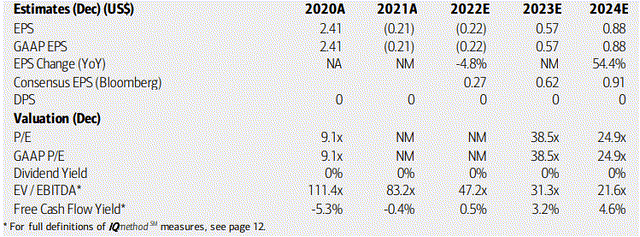

On valuation, analysts at BofA see this year’s earnings per share in the red, about unchanged from 2021’s loss. The Bloomberg consensus forecast is more optimistic for this year and through 2024, though. With recent negative cash flow that will just slowly turn positive, don’t expect a dividend any time soon.

Seeking Alpha rates the stock with a poor D+ valuation rating, but growth prospects are high with an A+ rating. Given that tandem, I like to look at the forward PEG ratio – that metric is high near 4.0, well above the sector median. Overall, the valuation still appears rich to me ahead of Q3 results.

SunPower: Earnings, Valuation, Free Cash Flow Forecasts

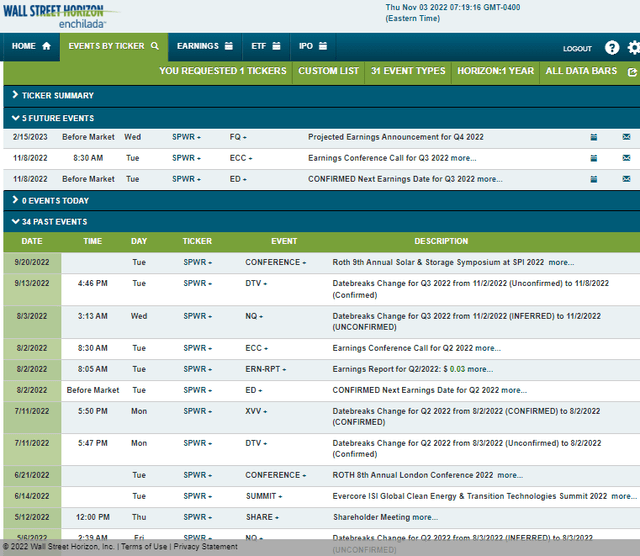

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2022 earnings date of Tuesday, Nov. 8, before the open, with a conference call immediately after results cross the wires. You can listen live here. The calendar is light aside from Tuesday of next week.

Corporate Event Calendar

The Options Angle

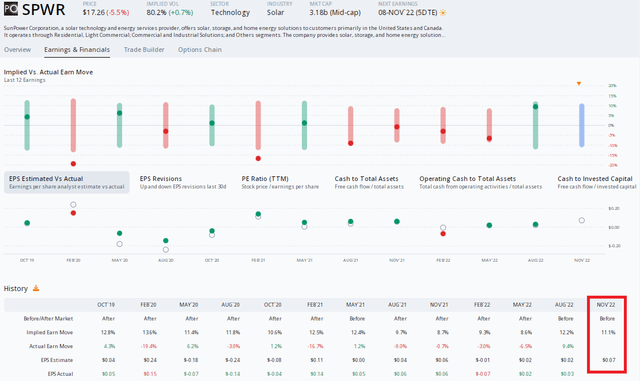

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $0.07. That would be nearly unchanged from $0.06 of per-share profits earned in the same quarter a year ago. SunPower has a strong earnings beat rate history, with the company topping forecasts in nine of the last 10 reports. Unfortunately, for the bulls, shares have traded lower post-earnings after four of the past five earnings releases.

ORATS also shows an expected stock price swing of 11.1% after Tuesday morning using the nearest-expiring at-the-money straddle. While down from the implied swing from last quarter, it’s higher than what was seen earlier this year and since the Q2 2021 report. Interestingly, SPWR does not have a history of major earnings-related stock price changes of late, so selling options could make sense here.

SPWR: Expensive Options Into Earnings

The Technical Take

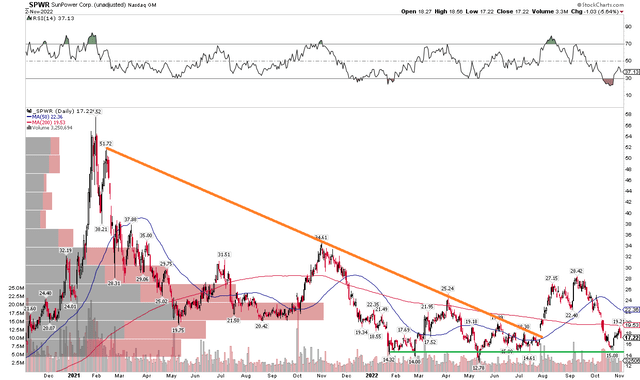

SPWR had broken out above a downtrend resistance line around the IRA news and its Q3 report in late July and early August. I suggested going long on that technical premise then, which worked for a time. The stock rose from nearly $20 to above $28. Gains were capped there, though, as a broad market selloff, ongoing turmoil in the housing market, and fears in China all hurt SPWR. The stock was nearly halved to its recent low near $15.

Notice how there is now significant ‘volume by price’ in the $20 to $23 range, and the stock’s major moving averages are flat to trending lower. Those are bearish signs. On the bullish side, $15 is support followed by the May low just under $13. Being long here could make sense, targeting the low $20s, but I would hold off for now given some of the changes in technicals.

SPWR: A Rally Burns Out

The Bottom Line

SunPower has rising risks compared to a few months ago. Its valuation remains high and technicals have turned more bearish. I would avoid the stock for now after a pop and drop during Q3.

Be the first to comment