Dikuch/iStock via Getty Images

Introduction

The Bermuda-based Teekay Tankers Ltd. (NYSE:TNK) released its first-quarter 2022 results on May 12, 2022.

Important note: This article is an update of my article published on April 19, 2022. I have been following TNK on Seeking Alpha since 2021.

1 – 1Q22 Results Snapshot

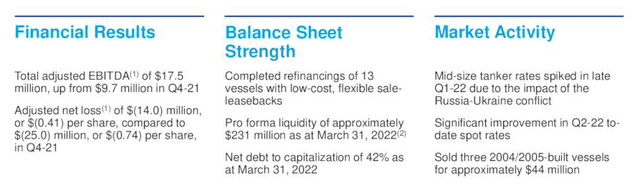

The company posted a quarterly adjusted loss of $0.41 per share compared to a loss of $0.65 per share a year ago. The results were slightly better than expected due to higher spot tanker rates.

Net income is again a loss of $13.94 million compared to $21.37 million a year ago.

TNK 1Q22 highlights Presentation (Teekay Tankers)

CEO Kevin Mackay said in the conference call:

Our results improved quarter-over-quarter were primarily due to higher spot tanker rates. We have maintained a focus on financial strength, supported by our recent attractive refinancings and vessel sales that have taken advantage of its firm asset market

Teekay Tankers is now the last remaining subsidiary of the “Teekay group” after the company sold Teekay LNG to Stonepeak on January 22, 2022.

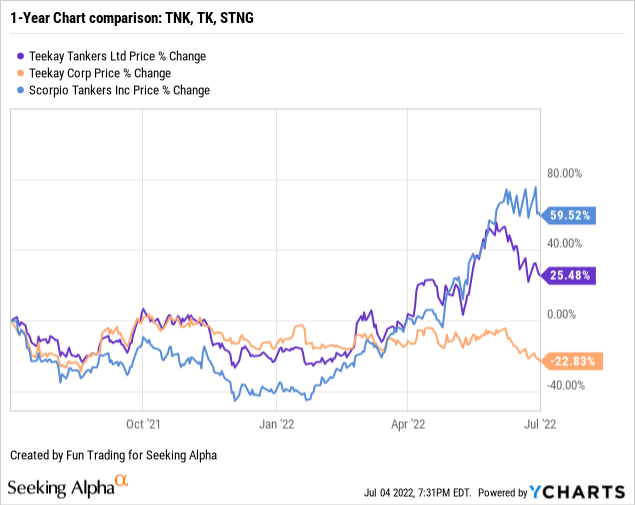

2 – Stock Performance

As we can see below, TNK has done quite well in 2022 but is now retracing from its high in June. TNK is up 25% on a one-year basis.

3 – Investment Thesis

The investment thesis for TNK is always a strenuous exercise due to the inherent extreme volatility of the Tankers industry, and the rest of 2022 will not be different.

However, the sector has turned around and may continue to perform well in 2022.

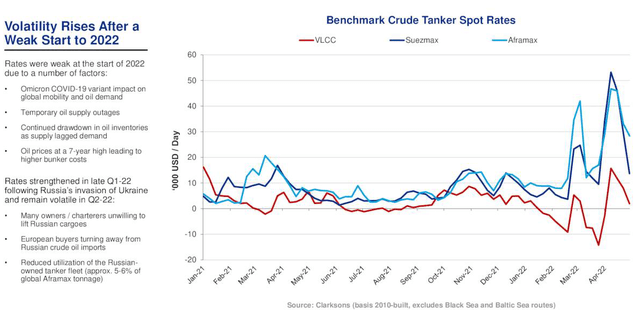

After a slow start in 2022, the tankers industry experienced a notable spike in spot tanker rates late in 1Q22. This increase was driven primarily by the impact of the ongoing Ukraine conflict. The midsize tankers segment benefitted the most due to disruptions in oil trading patterns.

TNK rates (TNK Presentation)

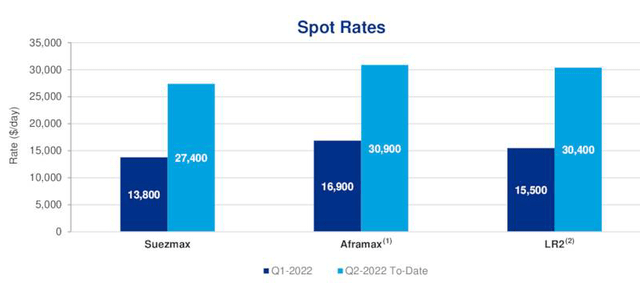

TNK operates mainly in this segment and saw an increase in ton-mile demand, pushing higher rates (see table below).

CEO Kevin Mackay said in the conference call:

However, Russia’s invasion of Ukraine in late February, led to an increase in tanker rates, particularly in the Aframax and Suezmax sectors due to trade disruptions and the rerouting of cargoes.

The company said that this trend is continuing in the second quarter, and according to the Fearnleys Weekly Report end of June, the Tankers market is still doing reasonably well. In the presentation, the company indicated the 2Q22 to-date spot. TNK secured strong second quarter-to-date spot tanker rates of $27,400 per day for the Suezmax fleet, $30,900 per day for the Aframax fleet, and $30,400 per day for the LR2 fleet.

TNK 2Q22 spot rates (Teekay Tankers)

Because most of the company’s vessels are trading in the spot market, TNK is well-positioned to generate strong cash flow in 2022.

CEO Kevin Mackay said in the conference call:

As shown by the chart on the right of the slide, crude oil exports from the US Gulf to Europe at the end of April were the highest since March 2020 with the vast majority being moved on Aframaxes and Suezmaxes. Due to the nature of the lot of regions involved and the need for greater flexibility and discharge options, midsized tankers have benefited more significantly from these changing trade patterns compared to VLCCs, where rates have remained relatively weak. The net impact of these changes has been a lengthening in average voyage distances and therefore higher ton-mile demand.

| Total fleet: Type | 1Q21 | 1Q22 |

| Suezmax | 12,294 | 13,786 |

| Aframax | 15,679 | 18,037 |

| LR2 | 12,223 | 15,491 |

Source: TNK release.

In 1Q22, TNK completed the sale of three vessels built in 2004 and 2005 for approximately $44 million. It includes one 2005-built Aframax sold for roughly $15 million and two other vessels that were previously announced.

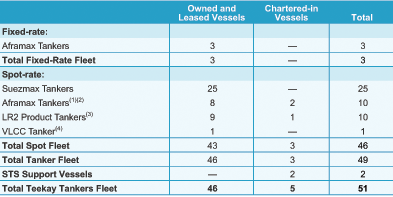

TNK fleet is specialized in crude oil and refined petroleum products tankers. Below is the fleet status as of May 1, 2022.

TNK Fleet status as of May 1, 2022 (Teekay Tankers)

| Segment | Number of vessels |

| Owned and leased vessels | 46 |

| Chartered-in vessels | 5 |

|

Total |

51 |

However, as we can see above, TNK is highly specialized, which increases stock volatility.

Thus, I continue to recommend short-term trading LIFO and taking advantage of the market’s wild swings.

The best way to profit here is to trade about 65%-80% of your position short term and keep a small long-term holding for a much higher price target. The lack of dividends is also a deterrent.

TNK – The Raw Numbers: First Quarter Of 2022 And Financials History

| Teekay Tankers | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues in $ Million | 142.75 | 123.42 | 115.89 | 160.31 | 174.02 |

| Net Income in $ Million | -21.37 | -129.14 | -52.06 | -39.81 | -13.94 |

| EBITDA $ Million | 15.96 | -95.07 | -18.31 | -5.77 | 18.48 |

| EPS diluted in $/share | -0.63 | -3.83 | -1.54 | -1.17 | -0.41 |

| Operating cash flow in $ Million | -27.45 | -18.26 | -38.40 | -23.21 | -14.67 |

| CapEx in $ Million | 0.91 | 6.32 | 7.93 | 6.28 | 4.07 |

| Free Cash Flow in $ Million | -28.36 | -24.58 | -46.33 | -29.48 | -18.74 |

| Total Cash $ Million | 87.60 | 60.50 | 60.72 | 50.57 | 18.37 |

| Total Debt (including current) In $ Million | 599.7 | 596.4 | 631.3 | 634.4 | 607.20 |

| Shares Outstanding (Diluted) in Million | 33.74 | 33.76 | 33.90 | 33.90 | 33.91 |

Source: Teekay Tankers release

Note: More data are available to subscribers only.

Analysis: Revenues, Earnings Details, Free Cash Flow

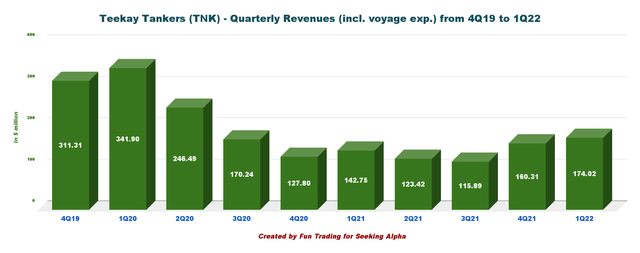

1 – Operating revenues were $174.02 million in 1Q22

TNK Quarterly Revenues history (Fun Trading)

Teekay Tankers announced a total adjusted net loss of $14.00 million, or $0.41 per share, during the first quarter, decreasing from a loss of $22.00 million, or $0.65 per share, in the first quarter of 2021. Revenues were $174.02 million in 1Q22, up from $142.75 million in 1Q21.

The better quarterly results were primarily due to higher average spot tanker rates in the first quarter of 2022. In the press release:

Although the near-term outlook is highly uncertain, the longer-term outlook appears positive due to a small tanker orderbook, very low levels of tanker ordering, and an aging global tanker fleet, which together should lead to an extended period of very low tanker fleet growth.

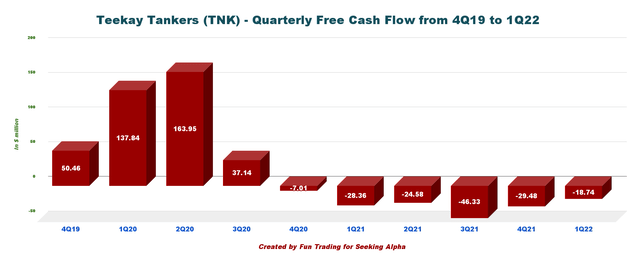

2 – Free cash flow was a loss of $18.74 million in 1Q22

TNK Quarterly Free cash flow history (Fun Trading)

Note: Free cash flow is cash from operations minus CapEx.

Trailing 12-month free cash flow was a loss of $119.13 million with a quarterly free cash flow loss of $18.74 million in 1Q22.

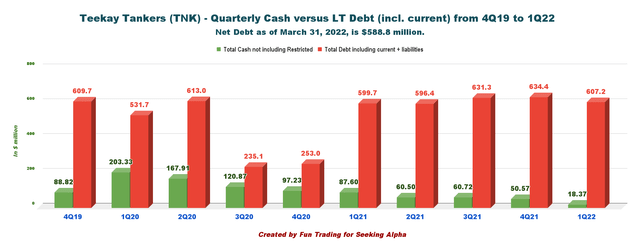

3 – Debt Analysis

3.1 – Debt Analysis

TNK Quarterly Cash versus Debt history (Fun Trading)

Net debt is $130.95 million in 1Q22 (or $588.80 million, including current and long-term obligations related to finance leases). As of March 31, 2022, the company had total pro forma liquidity of $230.9 million. The net debt to total capitalization is 41% in 1Q22. In the press release:

In March and April 2022, completed the previously announced refinancings of 13 vessels with new, low-cost sale-leaseback financings. Including these refinancings and the two vessel sales completed in April 2022, Teekay Tankers’ pro forma liquidity was approximately $230.9 million as of March 31, 2022.

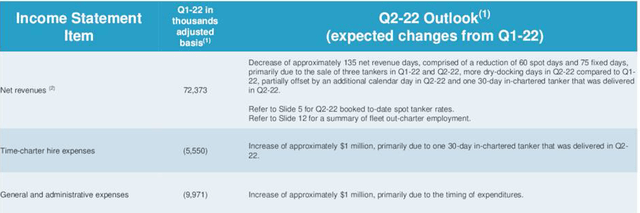

4 – Second Quarter Of 2022 Outlook

The company expects a decrease in revenues of 135 net revenue days due partly to the sale of three tankers in 1Q22, partially offset by an additional calendar day.

TNK 2Q22 outlook (Teekay Tankers)

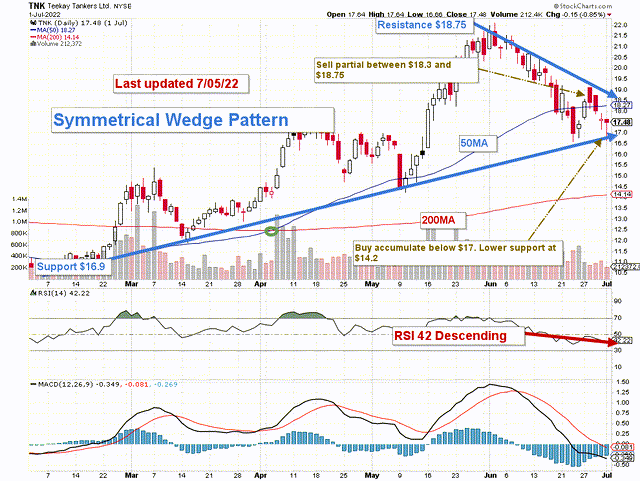

Technical Analysis And Commentary

TNK TA Chart short-term (Fun Trading)

TNK forms a symmetrical wedge pattern with resistance at $18.75 and support at $16.9.

The strategy has not changed since my preceding article, and it is what I promote in my marketplace, “The Gold and Oil corner.”

The basic strategy is to take profits between $18.3 and $18.75 and start to accumulate again below $17 with potential lower support at $14.15.

The short-term trading strategy is to trade LIFO about 65%-80% of your position and keep a small core long-term amount for a much higher payday that could be a range between $22 and $24. What can help a bullish scenario is that the new build prices are rising (currently the highest since 2009), and a lack of shipyard capacity continues to limit new tanker orders.

However, the industry could quickly turn bearish again if the threat of recession materializes and demand of oil drops. In this case, TNK could break down and retest $13.50-$14. It is still not conceivable, but the risk of recession by the end of 2022 gives a non-negligible probability of this event.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States to generally accepted accounting principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment