Khanchit Khirisutchalual/iStock via Getty Images

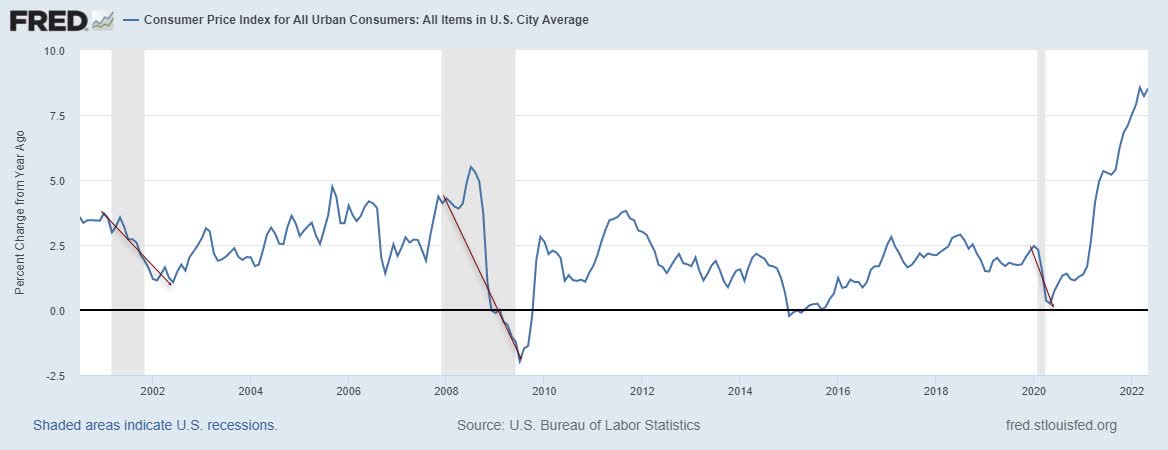

With inflation running at decade highs, many investors are worried that inflation will remain elevated even as the US economy falls into a recession.

It’s worth looking at the history of inflation after recessionary periods to understand how the coming recession will impact the current level of inflation.

In this article, we will explore if recessions historically bring down inflation, what happens after the recession, and what we can expect over the next few quarters.

Let’s answer the question upfront. Do recessions bring down inflation?

Yes.

Since 1948, a recession knocked down the rate of inflation 100% of the time.

Does inflation stay down, however? That is the real question. Let’s explore history…

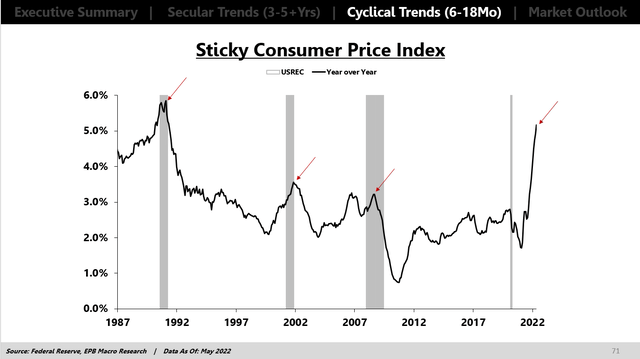

To start, we have to understand that inflation is classified as a LAGGING economic indicator. Especially if we look at the “sticky” part of inflation, it is clear that the rate of inflation peaks during or even AFTER the recession is over!

Federal Reserve, EPB Macro Research

As a side note, this makes the current exercise of hiking interest rates until inflation falls a dangerous game as this method virtually guarantees the Fed will be accelerating rate hikes into the deepest part of the recession.

Since 1980, inflation bottoms an average of 14 quarters after the end of a recession!

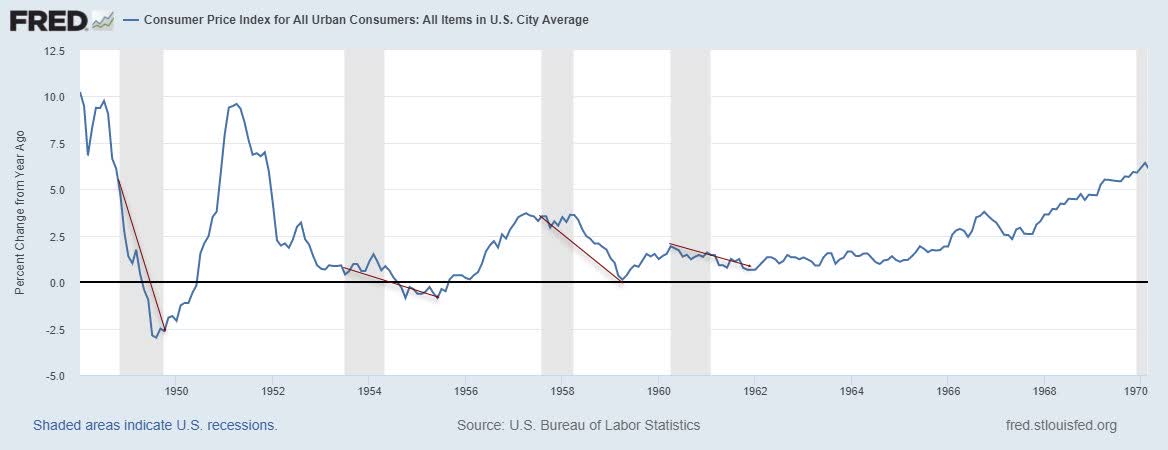

Starting in 1950, we can see that each recessionary period caused a decline in the rate of inflation once we allow for the appropriate lag time.

BLS, FRED

The rate of inflation declined after every recession, even in the 1970s!

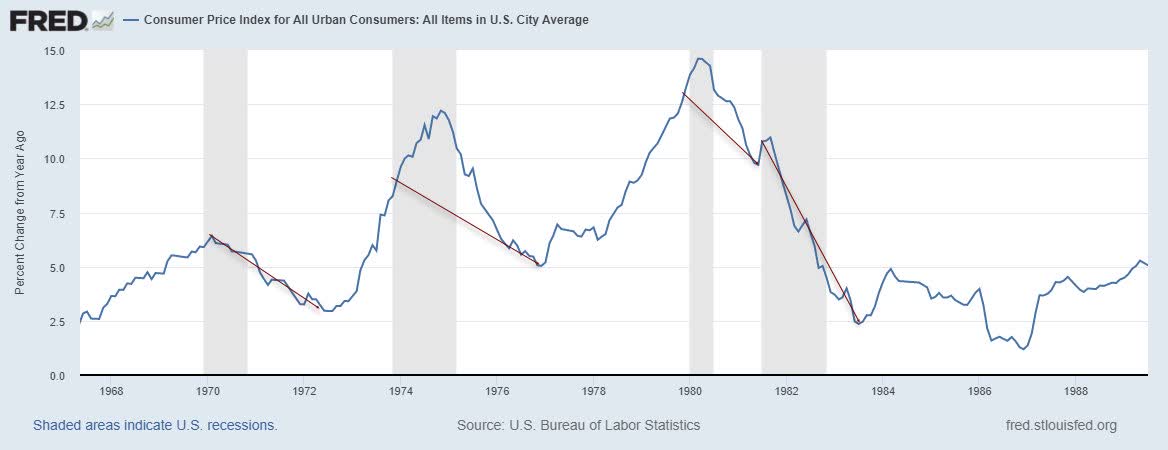

BLS, FRED

Yes, inflation resumed AFTER the recession ended and once the economic expansion got rolling again, but this is something we’ll look at in a moment.

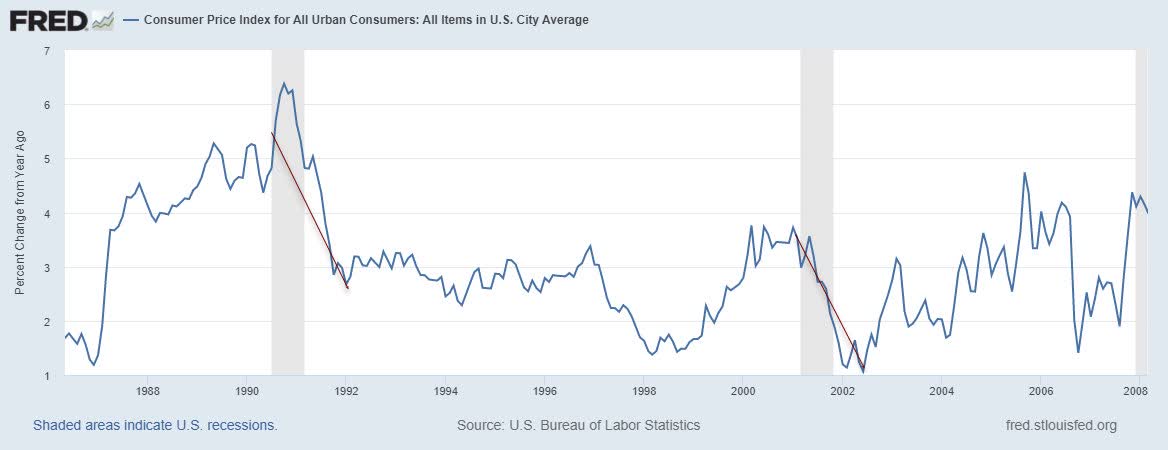

As noted above, it is very common for inflation to peak in the middle or at the end of a recession, like the 1991 recession.

BLS, FRED

So with many examples throughout history, at least 13 out of the last 13 recessions, it is fair to say that, yes, a recession will bring down the rate of inflation.

BLS, FRED

But what about supply problems? If they persist, won’t inflation continue to accelerate into, through, and after the recession?

The 1970s example tells us, “no,” but let’s understand why.

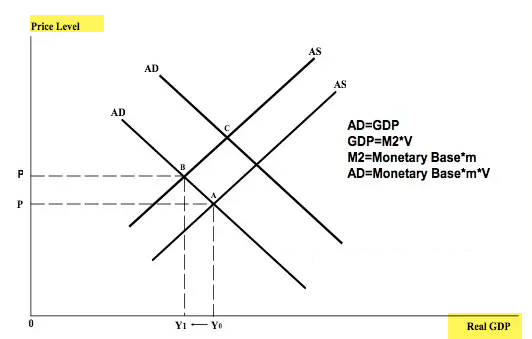

Inflation is determined by the intersection of aggregate demand “AD” and aggregate supply “AS.”

A recession undoubtedly shifts the AD curve inward.

If the AD curve shifts inward (less demand) and AS stays constant, the price level will fall.

Hoisington Investment Management Company

During the initial lockdown of COVID, the AD curve shifted massively inward (less demand), and so did the AS curve (less supply).

AD was so severely damaged that the price level fell. Then, massive stimulus *temporarily* shifted the AD curve outward before AS could respond, and the price level spiked.

Right now, AD is falling as the economy enters a recession, so, with the appropriate lag, given that inflation is a lagging indicator, the inflation rate will come down. The question is, does the recession *knock out inflation* or does it return like in the 1970s?

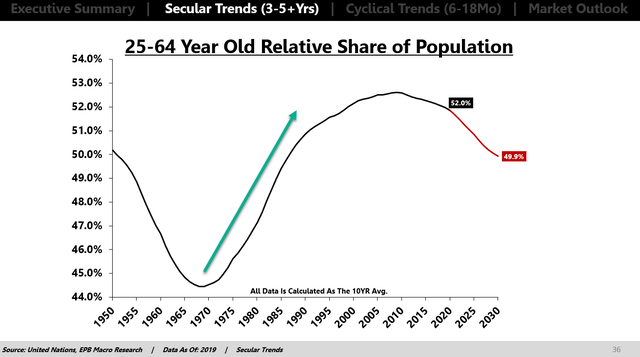

This depends on the policy response, the secular conditions, and the extent of the supply shocks. In the 1970s, there were hugely favorable demographics, so organic demand (outward shift of AD) returned immediately after each recession. Supply issues lingered, so inflation resumed.

Furthermore, on top of the positive demographic demand, there was stimulative monetary policy after each recession in the 70s.

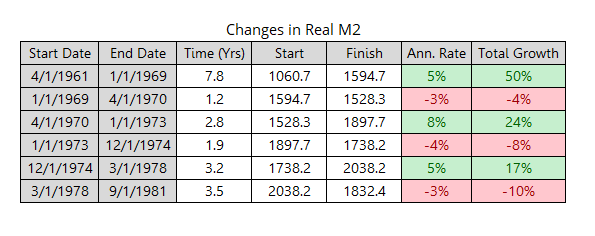

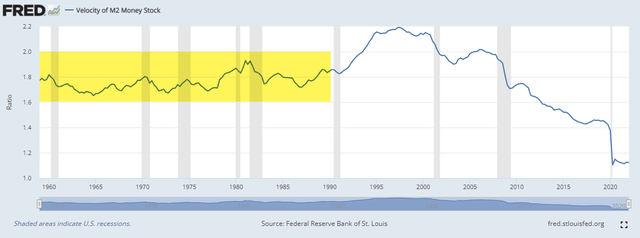

Over the last 60 yrs, real M2 increased at a 3% annualized rate. Remember, in the 1960s and 70s, velocity was stable, so changes in M2 drove changes in nGDP.

With stable velocity in the 1960s, inflation was initiated by an increase in real M2 of 5% per annum for almost eight years!

As the recession began in 1969, real M2 contracted and knocked down inflation.

THEN, however, real M2 increased at nearly triple the long-term average at 8% for another three years. The combination of continued supply problems, stimulative monetary policy, and massively positive demographics caused a resurgence of inflation.

Federal Reserve, EPB Macro Research

The recession of 1973 came with contractionary monetary policy and a decline in the rate of inflation. From 1974 through 1978, real M2 increased at a 5% annualized rate for another three years and, coupled with the demographic demand and continued supply bottlenecks, more inflation.

Finally, in the late 1970s and early 1980s, monetary policy stayed contractionary for over three years, which knocked out inflation.

Today, the velocity of money IS NOT stable like it was in the 1960s and 1970s, so it won’t take Volker-like policy actions to kill inflation, nor can we simply use M2 as a guide for inflation or growth given the instability of velocity.

In other words, the 1970s had persistent inflation because supply problems persisted, yes, but the AD curve was continuously shifting outward into that damaged supply from both demographics and from stimulative policy.

United Nations, EPB Macro Research

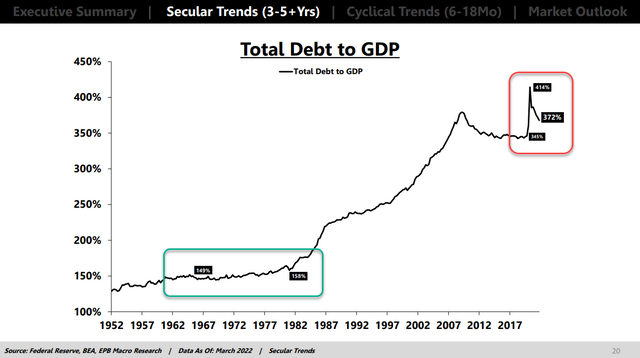

So as the economy slips into recession, with a lag, the rate of inflation will fall. If inflation returns will depend on policy choices given that we don’t have positive demographics nor low debt levels to propel organic demand.

Federal Reserve, EPB Macro Research

If supply bottlenecks persist for several more years AND the policy choice for the coming recession is a “COVID Part-II” stimulus effort with MBS QE and direct fiscal handouts, then we will have an AD curve that shifts outward (more demand) into less supply and inflation WILL come back.

If policymakers don’t lose their minds, having learned the negative effects of the last stimulus package, then the recession will knock down inflation, and the poor demographics and high debt levels will restrain demand, preventing a resurgence of inflation.

History tells us there’s no nuance as to whether a recession will bring down inflation. The nuance is what happens after the recession, which is a cocktail of demographics, debt levels, policy response, and the persistence of supply problems.

Be the first to comment