lcva2

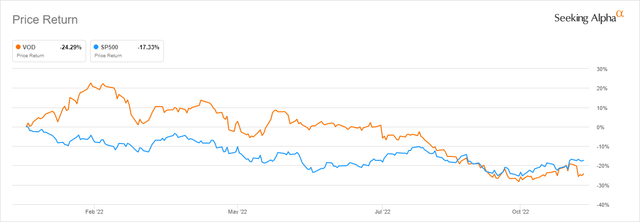

At face value, defensive-oriented stocks such as telecommunication companies that were in a position to offer immediate access to shareholder returns in the form of lucrative dividends should have been able to perform well this year during the market downturn. However, the oligopoly-like market conditions combined with the potent cash flows the companies were generating allowed them to become significantly more levered up than what would usually be considered acceptable. The rising interest rate environment, accompanied by increased capital expenditures dedicated to building up the 5G infrastructure, as well as the fact that the risk-free rates started slowly creeping up to the dividend yields the telecoms were offering started draining equity out of telecoms this year at an alarming pace.

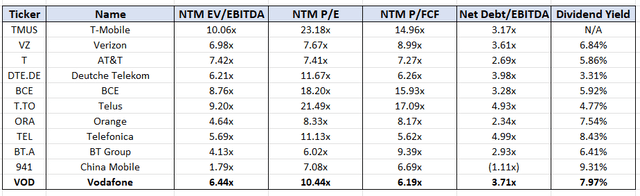

This process hit telecommunication companies across the globe, and Vodafone (NASDAQ:VOD) was no exception, with the British-based telecommunication giant losing more than a quarter of its market capitalization since the offset of the year, once more leading to disappointing results for investors. This has led to an interesting valuation, with the company currently being sold for an NTM EV/EBITDA of 6.44x, NTM P/E of 10.44x, and an NTM P/FCF of 6.44x, while offering an attractive dividend yield of 7.97%. Today, we attempt to analyze the situation and attempt to dissect if we are dealing with a classic value trap or a possibly truly attractive and immersive investment opportunity.

Vodafone vs S&P500 YTD Returns (Seeking Alpha)

Overview of the company

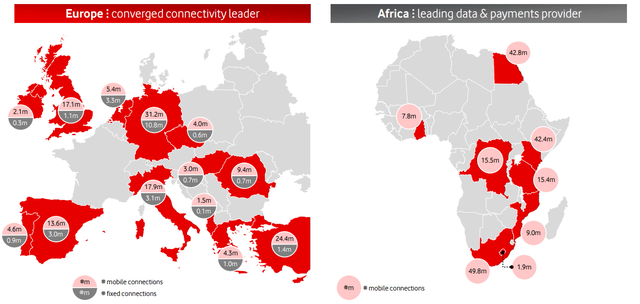

Vodafone Group represents one of the leading telecommunications services providers in Europe, as well as one of the largest communications providers in the world, as measured by both customer base and generated revenues. The group offers its fixed-line and mobile communication services to more than 650 million customers in 21 countries across three continents. Being founded all the way back in 1984 in the United Kingdom, the company has since evolved to become a true Pan-European telecommunications giant. Vodafone ended last year with €45.58 billion in revenues while generating Adj. EBITDA of €15.20 billion, as well as €5.43 in Adj. Free Cash Flow.

The U.K.-based company provides a broad range of traditional services offered through mobile communications, including call, text, and data access, as well as fixed-line services, including broadband, television, and voice. Beyond its traditional portfolio offering, Vodafone also engages ins products such as the Internet of Things, comprising managed IoT connectivity, automotive, and insurance services; cloud and security portfolio comprising public and private cloud services, as well as cloud-based applications and products for securing networks and devices; and international voice, IP transit, and messaging services to support business customers that include small home offices and large multi-national companies.

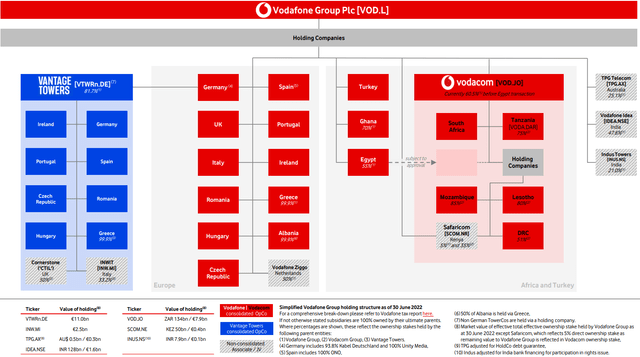

Vodafone Group Holding Structure (Investor Relations Presentation)

The telecom empire Vodafone has managed to build throughout the decades expanded way beyond only premium and high-end markets such as Germany and the United Kingdom, through distressed markets such as Turkey, to major growth markets such as Africa.

Regional Footprint (Investor Presentation FY ’22)

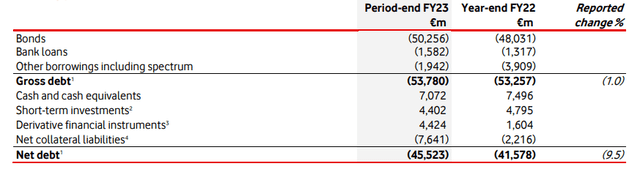

When analyzing telecommunication companies around the world, there usually comes a point where we would have to discuss the debt levels of the company, which are usually quite high, and that remains the case with Vodafone as well. The company struggled with leverage for a long time. As of the half-year results, the company was carrying a significant amount of debt totaling €53.78 billion in gross debt, and €45.52 billion in net debt. The net debt position increased by €3.94 million to €45.52 million when compared to the FY 2022 results. Using its definition of Adjusted EBITDAaL, Vodafone has a net leverage ratio of 3.53x and a gross leverage ratio of 2.99x.

Financial Results (H1 FY ’23 Release)

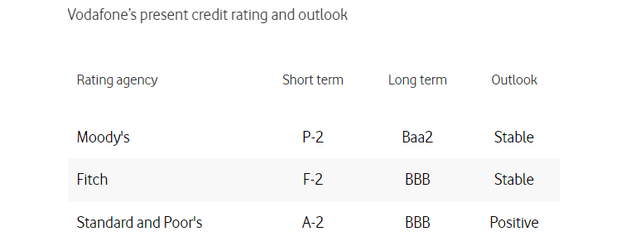

The company holds a borderline respectable credit rating. Currently, it received an investment-grade rating from all three major credit rating agencies. It carries a Baa2, BBB, and BBB credit rating from Standard & Poor’s, Fitch, and Moody’s, respectively.

Credit Ratings (Vodafone Investor Relations)

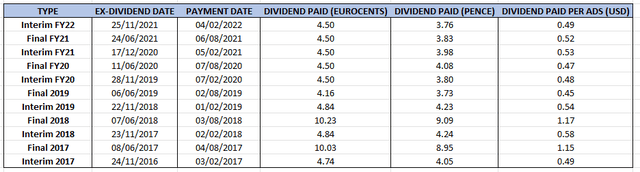

The main form of generating shareholder value for Vodafone was its lucrative dividend program. All things considered, Vodafone Group is operating a very lucrative dividend policy within the current market environment. Between the London-traded shares selling at around £0.99 and the ADR shares selling at around $11.69, the current dividend yield is roughly 7.97%.

Dividend growth has definitely not been a strong point when it comes to Vodafone, as the company was forced to cut its dividends twice over the past decade in order to ensure the stability of its balance sheet. The currently committed dividend distribution is about half of what the distribution was almost a decade ago. Currently, the company is paying out €0.09 on a semi-annual basis, through its equal €0.045 interim and final dividends. That leads us to the question of dividend safety. The company should not in theory be struggling to keep up with its current dividend policy, which costs slightly more than €2.3 billion each year. As a reminder, Vodafone generated €5.43 in Adj. Free Cash Flow last year. Latest developments indicate it’s likely that FCF is going to come under pressure, which led to some analysts even raising the question of a possible dividend cut, but that seems rather unlikely from our point of view.

Dividend Distribution History (Author Spreadsheet – VOD Data)

Management has reaffirmed its commitment to the €0.09/year dividend policy, but their stance on the issue sends a clear message dividend growth is likely out of the question for the short-mid term.

Yes. So maybe just to frame how the Board would think about the dividend, we have a minimum commitment of EUR 0.09. That was part of our midterm ambition. We have been prioritizing deleveraging. We have gone past the peak of 5G spectrum and Liberty integration, so that will support free cash flow. We are doing a number of portfolio actions that will materialize synergy benefits, et cetera, if we complete everything that we want to complete. Clearly, in the near term, we have an energy hit, but we have to look through that. And when we look through it and, let’s say, the exceptional inflation, and we have the balance sheet effectively to absorb that, if we look through it, management still remains on the ambition of the midterm growth. So we see the dividend intrinsically linked to that profile.

Nicholas Read, CEO – Q2 2023 Earnings Call

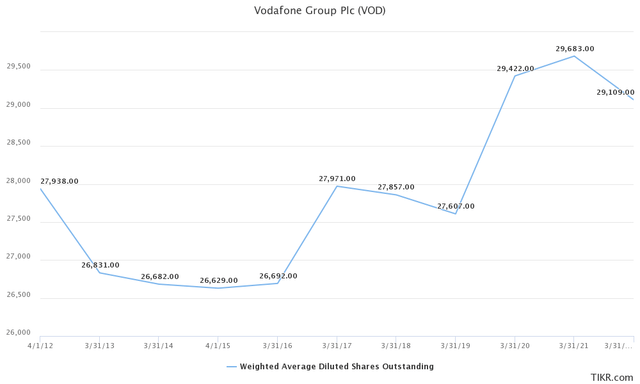

Even though the company has engaged in some significant buy-back programs in the past, the results were mostly aimed at offsetting the share dilution originating from convertible bonds. As a result, the somewhat depressing valuation wasn’t capitalized on by management, whose almost sole focus is still placed on the efforts to deleverage the balance sheet.

Shares Outstanding (TIKR Terminal – IQ Capital Data)

When asked about it during the latest earnings call, management avoided providing a direct answer. Last year alone, the company dedicated €2 billion toward share buy-backs and more than €10 billion over the past decade, but the overall results in this aspect lacked.

On capital allocation, as you mentioned, we have always indicated that our near-term priority would be deleveraging. And I think this is proving the right approach in the current macroeconomic conditions, so you should expect us initially to allocate the proceedings towards further strengthening our balance sheet. But we will form a full view on this once the transaction will have completed, and the final proceedings will be set.

Margherita Della Valle, CFO – Q2 2023 Earnings Call

Valuing the telecom

While it does remain true that Vodafone is trading at relatively attractive multiples that do signal a possible value opportunity, the depressed multiples also serve to embody the level of investor disappointment Vodafone has garnered throughout the years.

In this context, the sheer amount of equity erosion that has taken place is being actively priced into the company stock by investors. Over the past decade, Vodafone generated a negative 32.55% return. For the same time period, the average passive index investor managed to almost triple his principal, even after the stark market (SPY) decline this year. This obviously does not take into account the dividends that were distributed over the period, such as the £1.02 major dividend after the company sold its Verizon (VZ) stake, but does speak toward the sentiment surrounding the company.

Vodafone and S&P500 10-year returns (Seeking Alpha)

With that being said, we are not attempting to value Vodafone back in 2012, but the company that it represents today. As of today, British-based telecom does seem to be positioning itself well to be able to deliver above-market returns over the upcoming period. Currently, the market is valuing the company for an NTM EV/EBITDA of 6.44x, NTM P/E of 10.44x, and an NTM P/FCF of 6.44x, as it offers an attractive dividend yield of 7.97%.

Vodafone and Industry Peers (TIKR Terminal – IQ Capital Data)

Closing thoughts and arguments

Strictly, fundamentally speaking, it is somewhat hard not to conclude that Vodafone represents an attractive investment opportunity from a value investor’s perspective. We can certainly recognize value hidden behind depressed multiples that could unlock along the way, indicating a material upside potential, but in our view, catalysts for such an upside action are too far between. The main issue we encounter with Vodafone’s current valuation is that the company is trading relatively in line with its US-based counterparts such as AT&T (T) and Verizon, which possibly remains somewhat unwarranted in our view. Ultimately, Vodafone does offer a higher dividend yield accompanied by some strong upside potential if one is willing to accept the inherent risks associated with the investment, but we remain unconvinced if the European telecom is a place in which, given the market conditions, one would be willing to take on such risks.

The bottom line is that we fail to recognize why the average income investor would opt to invest in the British-based telecom instead of the already discounted American counterparts. However, for some international income investors, Vodafone could make a lot of sense given the right circumstances. The slightly higher yield combined with the more lenient approach to the question of dividend withholding taxes from His Majesty’s Treasury would make for a compelling argument. Further to the point, we also fail to see a likely scenario where Vodafone’s valuation gets further depressed and opens the floodgates to an even more accelerated erosion of equity, or a noticeable decrease in distributed dividends compared to its foreseeable cash generation potency, making the company far from the worst investment opportunity for international income-oriented investors.

Be the first to comment