Shahid Jamil

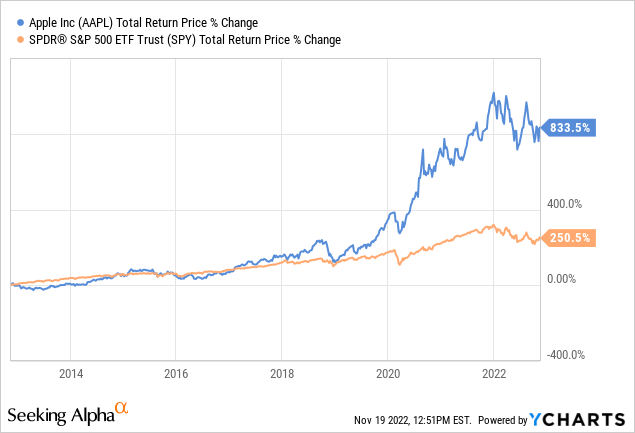

While we believe Apple (NASDAQ:AAPL) will continue to be a very solid business for a long time, we are increasingly seeing signs that it will struggle to outperform the market going forward. There is no question that Apple shareholders did great this past decade, more than tripling the S&P 500 (SPY) returns, however we believe that it is unlikely that the company will outperform the S&P 500 by a meaningful amount in the coming ten years.

Already the company stopped disclosing the number of units for devices such as iPhones, Macs, etc. a few years ago. Our interpretation is that it meant growth would increasingly depend on raising prices versus selling more devices. While both strategies can deliver significant revenue growth, we believe raising prices results in less sustainable growth, given that at a certain point it starts having a meaningful impact on the number of units sold. In other words, consumers will only pay so much before switching to another brand.

A big source of growth the last few years has been the Services business, which reached $19.2 billion in revenue and more than 900 million paid subscriptions in the September quarter. In the most recent earnings call management even called out how it is already the size of a Fortune 50 business on its own, and has nearly doubled during the last four years. Its growth, however, is decelerating, with the business growing only about 5% from the previous year. There was a roughly 600 basis points of negative impact from foreign exchange, so it can be argued that constant currency growth is closer to 11%, but even this growth rate is not that impressive.

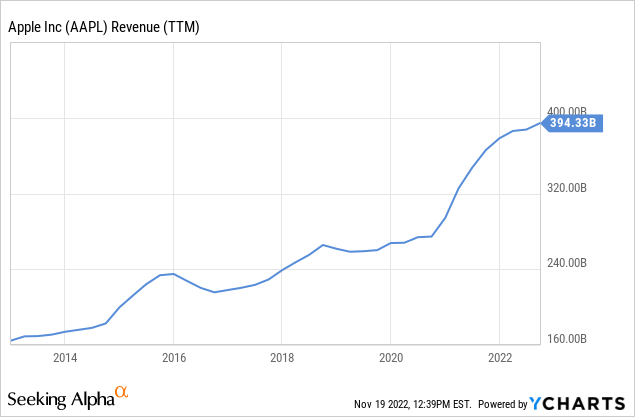

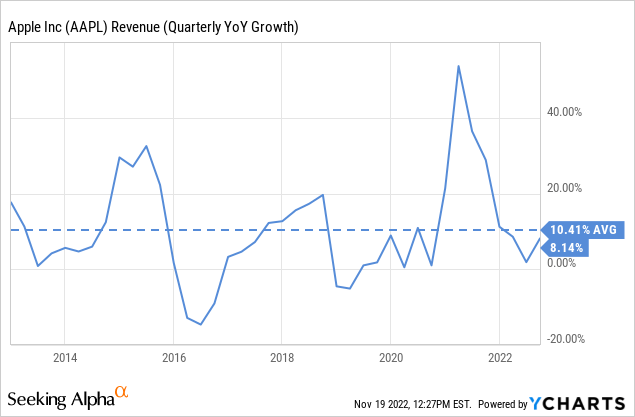

Meanwhile, the previously hyper growth segment of Wearables, Home and Accessories saw revenue grow only about 10% year over year; the iPad saw a 13% year over year decline. Overall, Apple achieved revenue of $394 billion in fiscal year 2022, which corresponds to ~8% annual growth, and its diluted earnings per share grew only slightly faster at ~9%. In addition to relatively disappointing growth, the company decided not to provide revenue guidance for next quarter, other than to say that total company y/y revenue performance will decelerate during the December quarter as compared to the September quarter.

As growth decelerates for the company, and with a rich valuation which we’ll consider in the analysis below, we believe that unless the company manages to find a new disruptive innovation that can move the needle, it will very likely underperform the market in the coming ten years.

Financials

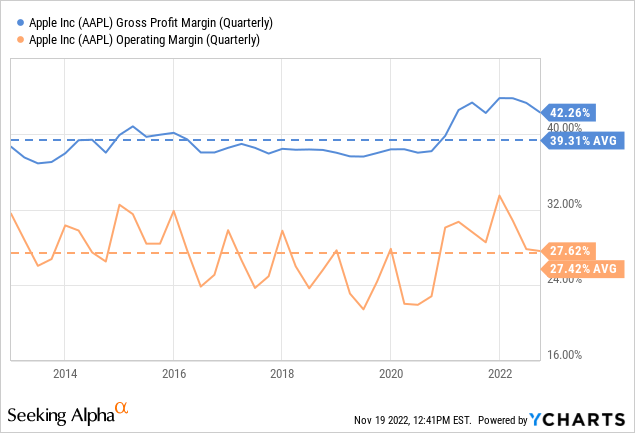

We don’t think there is much room for margin improvement for Apple. The company was even showing a declining operating margin trend prior to the Covid crisis.

Apple ultimately benefited from Covid given that travel, restaurants, and other recreational activities were off the table, and many people decided to spend their discretionary income on a new device, such as a new iPhone. This increase in revenue resulted in operating leverage, which is the main reason why we saw profit margins improve.

While there might be some operating leverage in the future, it could be countered by increasing component costs and other inflationary impacts.

Growth

The Covid impact can be seen quite clearly in the revenue graph below, and it is also clear that growth has started to moderate significantly. Regarding the main product, iPhone growth decelerated to only 10% in the most recent quarter, compared to an overall growth of 39% in fiscal year 2021.

Growth has cooled off significantly for the entire company, with revenue growth of ~8% for 2022 below the ten-year average for the company. It can be argued that Apple has seen periods of weak growth before, only to see growth be reignited. What has changed is that now the revenue base is massive, so any one product or service will have an incredibly hard time moving the needle. With respect to inorganic growth, the company is already doing plenty of acquisitions, averaging about one per month during fiscal year 2022.

There also does not seem to be any disruptive innovation in the pipeline, other than perhaps the Apple Car, which admittedly could be important enough to really contribute to growth in a meaningful way.

The Apple Car or “Project Titan”

Our impression of Apple is that of a company incredibly talented at delivering incremental innovation. It of course has a history of disruptive innovation too, with the iPhone probably being the prime example. Still, it’s been a long time since the company introduced a brand-new revolutionary device. The last few years Apple seemed to be playing it safe by making incremental improvements to its existing product lines.

One potential disruptive innovation which has made a lot of noise is the Apple Car, otherwise known as “Project Titan”. If successful, we believe this is the type of innovation that could actually enable Apple to re-ignite growth, and outperform the market. It does not seem, however, that it will happen any time soon.

Analyst Ming-Chi Kuo, who has a reputation of accurately revealing Apple’s product launch plans says that he wouldn’t be surprised if the Apple car doesn’t launch until 2028 or later, and that it might not even be a competitive product. It is becoming clear that Apple has so far relatively little to show for this effort.

Balance Sheet

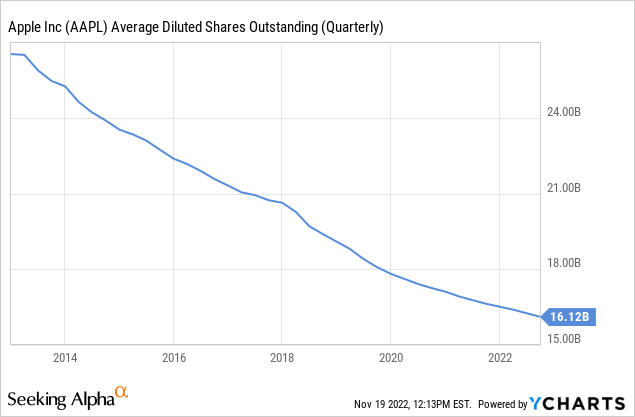

At least Apple has a rock-solid balance sheet that can provide the necessary flexibility to pursue interesting acquisitions or heavily invest in R&D. This is despite massive amounts of capital returned to shareholders via share buybacks.

Apple ended the quarter with $169 billion in cash and marketable securities, and total debt of $120 billion. As a result, net cash was $49 billion at the end of the quarter as the company continues to make progress towards its goal of becoming net cash neutral over time.

Valuation

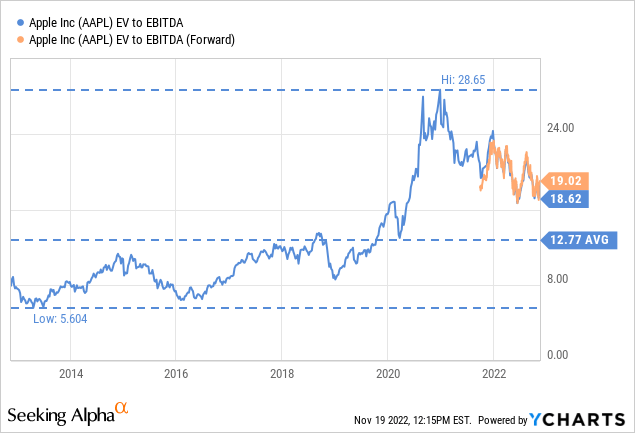

If the starting valuation was low enough, maybe Apple shares would have a good chance of outperforming the market, even if the company delivers relatively little growth. Unfortunately, the current valuation is relatively expensive, with an EV/EBITDA of ~19x, significantly higher than its ten-year average of ~12.7x.

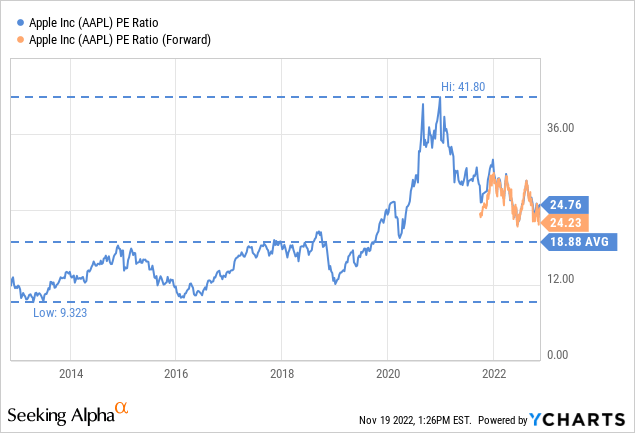

The price/earnings ratio tells the same story, currently around 24x, much more expensive than the ten-year average of ~18.8x. For comparison, ten years ago shares could be bought at roughly half the p/e ratio. Between the multiple expansion and the growth the company delivered, shareholders have greatly benefited.

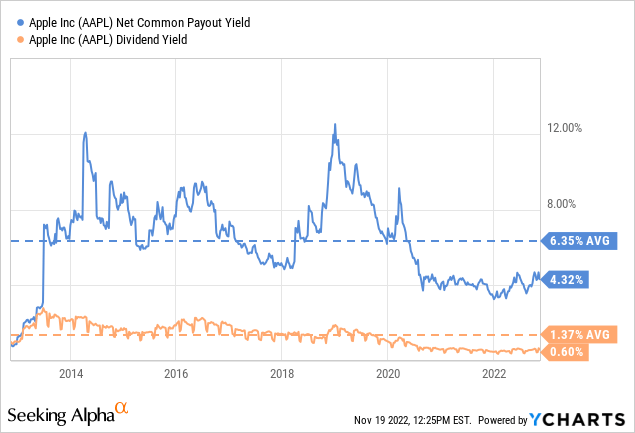

Other signs that the valuation is much more demanding now include a dividend yield that is less than half the ten-year average, and a net common payout yield (which includes dividend yield and buyback yield) that is about 2% below the ten-year average.

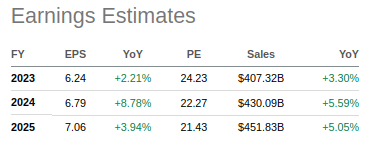

If earnings growth was expected to accelerate, the high valuation could maybe be justified. Analysts, however, have very low expectations for earnings growth for the next couple of years, as can be seen in the table below.

Seeking Alpha

Risks

We believe Apple is a very solid company, and it certainly has an impressive balance sheet and very good profit margins that mitigate risks. We believe the most important risk for Apple shareholders is that of underperforming the market as a result of a high starting valuation, and decelerating growth.

It also has important competition that should not be entirely dismissed, and which could take away market share from the company. In particular we believe investors should keep an eye on Samsung Electronics (OTCPK:SSNLF), and Xiaomi (OTCPK:XIACY).

Conclusion

We are seeing signs that growth is decelerating at Apple, and that it will need new disruptive innovations to re-ignite high growth and have a good chance of outperforming the market in the coming decade. The Apple Car could be one such product, but so far it seems the company does not have much to show for the effort. In terms of valuation, shares are trading at valuation multiples that are higher than the average for the past decade, and will also contribute to making it hard for the company’s shares to meaningfully outperform the market in the coming decade.

Be the first to comment