AVTG

Investment thesis

Stock markets have fallen from their highs, and we as investors have to put our focus on cash flows instead of long-term fantasies. While some indices are still highly valued, I believe that some companies already trade at an unjustified discount and are now superb pickups. Now, focusing on high quality and profitability is more important than ever. Rising interest rates and a cooling down economy create tough times for an unprofitable, disruptive premier growth company that depends on debt capital.

Smurfit Kappa (OTCPK:SMFTF, OTCPK:SMFKY) (SKG) is a profitable niche market leader that has generated sustainable free cash flows for years ongoing since its IPO in 2007. Above-average EBITDA and dividend growth make this stock a buy for any income-oriented investors.

Business model

Smurfit Kappa creates innovative and sustainable packaging solutions. All products are paper-based and can therefore mostly be recycled. SKG divides its operations geographically in “Europe” and “The Americas”. The “Europe” segment has operations in 22 countries (after completing the exit of the Russian market).

These include 23 mills (of which 18 produce containerboard), 186 converting plants, and 27 other production facilities. Additionally, 20 recovered fiber collection facilities and two wood procurement operations provide the raw material for paper production. The Americas Segment is also highly integrated and comprises 12 paper mills, 25 recovered fiber facilities, and 41 corrugated plants.

SKG not only produces the final products like corrugated cardboard or paper but also owns 68.000 hectares of forest. The forests comprise pine and eucalyptus trees, which are excellent for corrugated cardboard and paper production. Those forests mainly cover the resources necessary to keep the paper mills running, allowing SKG to operate party autarkic and have a lower dependence on suppliers. Besides timber, recyclable paper is an extremely important resource. In 2021 alone, around 7.4 million tons of recyclable paper were used across the globe. This makes the margins somehow dependent on the market prices of recyclable paper.

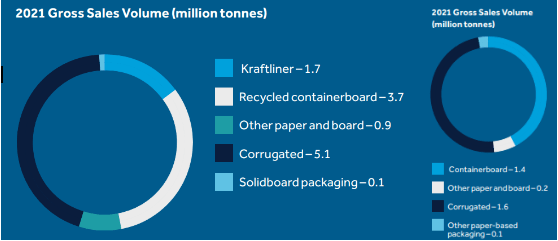

Sales Volume in 2021 (Smurfit Kappa annual report 2021)

Fundamentals

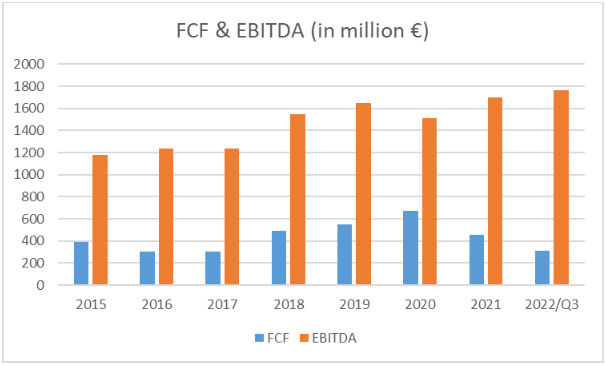

Most of the revenue is earned in the “Europe” segment. In the first half of 2022, it generated €4.939 million (+35.4% YoY) compared to €1.446 million in “The Americas” (+40.4% YoY). The EBITDA margin grew slightly to around 18.4% (+1.7% YoY). These Year-on-Year growth rates seem staggering at first sight, particularly compared to the current market situation and also the development of the stock price. Excluding the last two years, SKG has managed to keep up EBITDA (5.0%) and FCF (11.7%) growth rates since 2015. While the EBITDA also increased in 2021 and 2022 the FCF dropped significantly.

FCF & EBITDA in million € (Graphic made by the author using data from Smurfit Kappa’s financial reports)

This has two main reasons. In 2021 the company had an unusually high outflow of capital expenditures, which offset the depreciation by 124% compared to 104% in 2020. Additionally, a buildup in inventories caused an increase in working capital of €501 million. All this causes the free cash flow to be negative, showing a cash outflow.

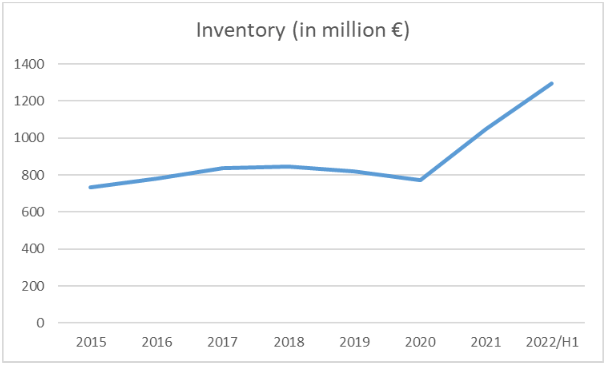

Inventory in million € (Graphic made by the author using data from Smurfit Kappa’s financial reports)

While the inventory remained at a solid level between 2015 and 2022 it grew significantly in 2021 and continued to do so in H1/2022. This buildup in inventories (€1.296 million) is concerning and might indicate a stumble in demand. The latest disclosed data (2021 report) on stored raw materials shows a rise of 69.1% compared to 2020. This increase does not bother me because it shows how the management tries to smooth out the difficult situation by building up a stockpile and becoming less affected by short-term price spikes.

2021 was characterized by significant and unprecedented cost inflation. These costs, particularly in energy, recovered fiber and other categories of raw materials, remain at elevated levels at the beginning of 2022.

As mentioned above, the buildup of “finished goods” is what worries me. An increase of 35.7% is likely caused by a plunged demand. I recommend checking this metric in the upcoming annual report of 2022, considering the fact that the macro-economic situation has definitely worsened in the last nine months.

While a lot of other European companies had to cut costs by laying off employees to avoid unprofitability, SKG has been able to at least to some extent use the situation to its advantage and increased prices for many of their products. The company has a moat because it is laborious for, in particular, large customers to switch the cardboard/paper supplier in this oligopolistic market for two reasons. First, the corrugated market is a localized market and paper mills should not be further away than 300 km (186.4 miles) to be economical. This also increases the entrance barriers for competitors, as they have to build an enormous infrastructure to compete on a large scale. Besides that, large customers mostly have custom-tailored cardboard packaging, which is precisely produced for their needs.

Smurfit Kappa’s balance sheet has also seen improvement, with net debt only being up to currently €3,309 million from €3,048 million in 2015. An increase of only 8.6% in seven years. In the same time period, the EBITDA increased by 113% (H1, 2015: €551 million). I think SKG is poised to profit in this rising interest rate environment. The Group has gradually reduced its bank debt and shifted towards offering bonds: In 2015 corporate bank debt was at €767 million. Currently, it is only at €103 million. SKG plays a huge role in sustainable packaging and has therefore easy access to debt capital by offering those bonds at low rates. Just recently two so-called “green bonds” got offered, yielding 0.5% (due 2029) and 1.0% (due 2033) with a volume of €500 million each. Refinancing this way has allowed SKG to keep the average interest rate down at 2.86%.

Dividend

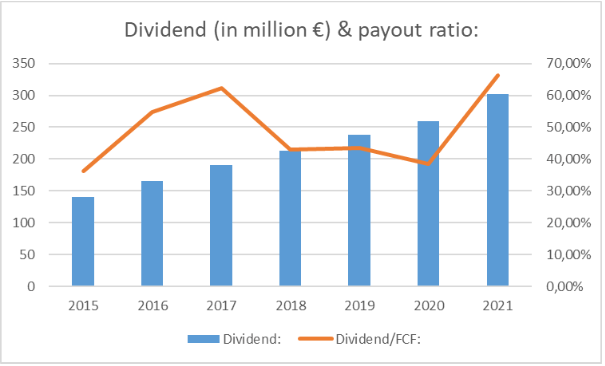

At current levels, SKG offers an attractive dividend yield of almost 4%. Based on free cash flow, the payout ratio has fluctuated, but was always on a safe, sustainable level:

They distributed the first dividend in 2008, followed by three years without one. Since 2012 they have increased the dividend with a CAGR of impressive 22.1%:

Dividend & payout ratio (Graphic made by the author using data from Smurfit Kappa’s financial reports)

Valuation

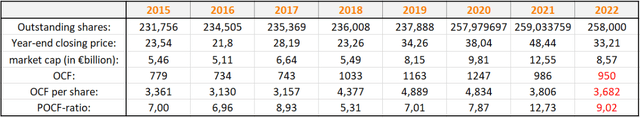

With a share count of around 258 million and a current valuation of €33.2 per share, the market cap is just below €8.6 billion. In order to pin down whether this valuation is cheap, look at the historical EBITDA and cash flow multiples:

Historic valuation based on operating cash flow (Graphic made by the author using data from Smurfit Kappa’s financial reports)

The red numbers include the first three quarters and my expectations for the rest of the year.

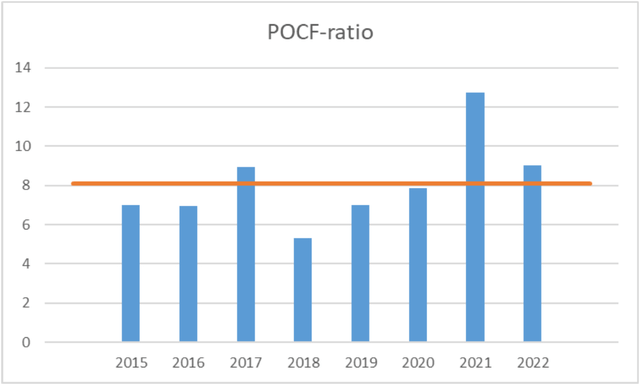

POCF-ratio (Orange line is the average POCF-ratio) (Graphic made by the author using data from Smurfit Kappa’s financial reports)

Even including my optimistic expectations for the Q4 of 2022 SKG seems only at a fair value compared to historical multiples.

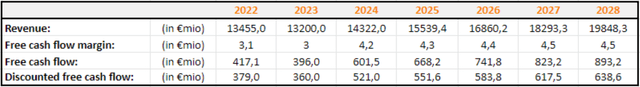

Subsequently, I will perform a discounted cash flow model to justify the current valuation:

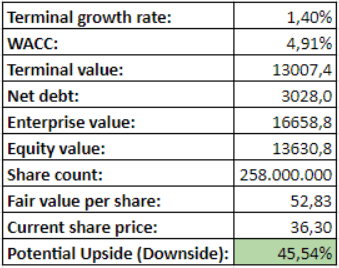

Using the CAPM, I calculated the cost of equity of 9.07%. The current cost of debt for SKG is 2.86%. Using these two, I get a WACC of 4.91% (I used an average tax rate of 25.6% in my calculation).

In order to forecast the cash flows for the following years, I took the average revenue and FCF margins since 2015 and incorporated it with the weakened forecast for Europe’s economy. With long-term tailwinds from growth businesses like eCommerce and a drive towards more sustainable packaging I expect another slightly weaker year in 2023 and then a continuing high single-digit growth rate of around 8.5% annually. The FCF margin should also remain solid for 2023 and then have a slight increase in the following years caused by lower energy and raw material prices and declining inflation.

The FCF for the first 9 months of 2022 has been lower than in the previous years (except 2021). This decrease was caused by a buildup in inventories and an increase in CapEx.

DCF (Graphic made by the author using data from Smurfit Kappa’s financial reports)

DCF (Graphic made by the author using data from Smurfit Kappa’s financial reports)

After deducting the net debt of the enterprise value I get an equity value of around €14.6 billion. Dividing it by the current share count the fair value per share is €52.83. At the current share price of €34.30, the stock seems quite undervalued.

Competition

Stora Enso (OTCPK:SEOJF) and Mayr-Melnhof Karton (OTCPK:MNHFF) are two European companies active in a similar field as SKG. Stora Enso is a Finish-Swedish company, which produces wood-based products for packaging, and building but also pellets or lignin for the chemical industry. The traditional company is more diversified than SKG, which only focuses on packaging solutions.

Mayr-Melnhof Karton AG is an Austrian cardboard producer and a direct competitor to SKG.

Following, I will compare the valuation based on cash flows and past growth to see whether one of the three seems too cheap:

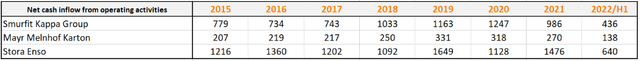

Comparison of cash flows (Graphic made by the author using the company-specific financial data)

Based on the most recent H1 data and the current market cap, the POCF-ratio of Stora Enso is the cheapest at 8.81. Smurfit Kappa is in between at 10.73 and Mayr Melnhof looks expensive at 11.33. Altogether, those small differences should not be any concern and out of the three I prefer Smurfit Kappa as it is much larger than Mayr Melnhof Karton (market cap: €3.1 billion), and Stora Enso is not a stock I like to invest in as it is not focused in one field, but rather comprises several small operating branches. Those have a complex internal structure and often have trouble operating as efficiently as market leaders focused on their core business.

Risks

SKG has to be “physically” present in every country it wants to sell its product in. The war in Ukraine made the company stop its operations in Russia.

Another example of the danger of owning plants and subsidiaries in a lot of different countries is this recent incident in Venezuela. The socialist government seized all plants of the subsidiary “Smurfit Kappa Carton de Venezuela”. Smurfit Kappa’s expansion in the emerging market allows the company to keep growing but is also risky.

The cyclical nature of the packaging industry could cause overcapacity and threaten the group’s pricing structure. According to SKG’s risk management, this risk is minor and the low-cost mill structure allows it to profitably operate even with a noteworthy price drawdown.

Conclusion

Smurfit Kappa is a well-managed, profitable operating company that participates in the long-term trend away from unsustainable packaging (i.e. polymers like polystyrene and polythene) to a better and more environmentally friendly alternative. I am certain quality companies like this are always a good pickup. I give Smurfit Kappa a “Buy” rating, but think that the current upside is limited. The stock is a perfect pick for income investors looking for a company they can buy and forget about.

Be the first to comment