Hispanolistic/E+ via Getty Images

Networking solutions and connectivity services are unbelievably important in the modern era. In a world that is run by all things digital and where data reigns supreme, it’s necessary for there to exist companies that make all of this modern world run. One such player is a company called Belden (NYSE:BDC). With an emphasis on providing network infrastructure and broadband solutions, cabling and connectivity solutions for audio and video clients, and networking and machine connectivity products like field bus infrastructure components and on-machine connectivity systems, Belden performs some incredibly valuable work for a large and growing industry. Over the past few months, shares of the company have roared higher, driven by robust financial performance and the market’s realization that shares are trading on the cheap. Even after seeing some nice appreciation though, the stock still does look to be attractively priced. So despite the easy money having certainly been made by now, I do think the company still warrants the ‘buy’ rating that I had on it previously.

A connectivity win

In early May of this year, I wrote my first article wherein I discussed the investment worthiness of Belden. At that time, I acknowledged that, at first glance, the business looked tremendously undervalued. Having said that, I also believed that some of the discount that shares were trading at was justified given the fact that financial performance in prior years had been disappointing. Overall though, shares looked attractive enough to me to warrant a ‘buy’, reflecting my belief at the time that the stock should outperform the broader market for the foreseeable future. Fast forward to today, and I cannot believe how much shares have appreciated. While the S&P 500 is down by 0.7%, shares of Belden have skyrocketed higher to the tune of 46.5%.

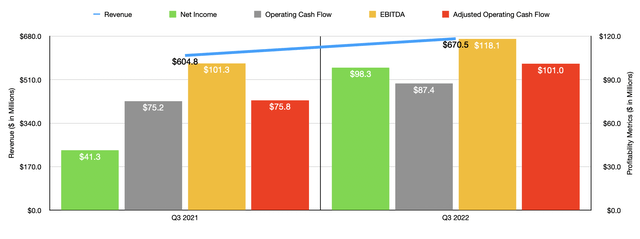

Author – SEC EDGAR Data

To understand why returns have been so strong, we should touch on how the company has fared in the quarters since I last wrote about it. At present, we have data covering two additional quarters of data compared to what we had previously. For the latest quarter alone, the third quarter of the 2022 fiscal year, revenue came in strong at $670.5 million. That’s 10.9% higher than the $604.8 million reported the same time last year. According to management, higher sales volume and favorable pricing for some of its offerings, particularly when it comes to industrial automation, smart buildings, and 5G/broadband applications, all helped to push revenue for the company up by $91.4 million year over year. There were, of course, other factors at play here. Acquisitions added $9 million to the company’s top line while the pass-through of changes in copper pricing impacted the company negatively by $12.7 million. And finally, foreign currency translation hit the company to the tune of $22 million during the quarter. Had it not been for the items that had a negative impact on the company, sales would have grown an even more impressive 16.6%.

On the bottom line, the picture was quite robust. Net income jumped from $41.3 million in the third quarter of 2021 to $98.3 million the same time this year. The company benefited it on this front from an improvement in its gross profit margin, which rose thanks to the same aforementioned issues that impacted revenue. Other profitability metrics followed suit. Operating cash flow rose from $75.2 million to $87.4 million. If we adjust for changes in working capital, it would have risen from $75.8 million to $101 million. And over that same window of time, even EBITDA increased, rising from $101.3 million to $118.1 million.

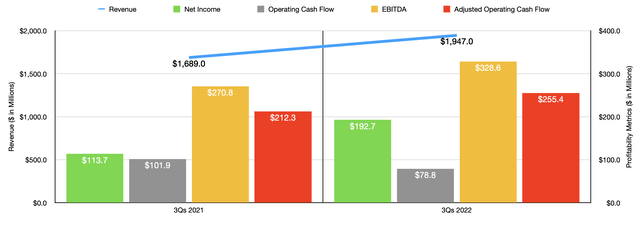

Author – SEC EDGAR Data

These robust results in the third quarter were helpful in pushing up total results for the first nine months of the company’s 2022 fiscal year. Revenue during this time came in strong at $1.95 billion. This is 15.3% higher than the $1.69 billion generated the same time one year earlier. And as was the case in the latest quarter, profitability for the company also followed suit. Net income grew from $113.7 million to $192.7 million. Operating cash flow actually fell, dropping from $101.9 million to $78.8 million. But if we adjust for changes in working capital, it would have risen from $212.3 million to $255.4 million. And over that same window of time, we also saw an improvement in EBITDA, with that metric growing from $270.8 million to $328.6 million.

For the 2022 fiscal year in its entirety, management expects organic revenue to rise by between 15% and 16%. This compares favorably to the prior expected range of between 12% and 13%. As a result, revenue for this year should come in at between $2.583 billion and $2.598 billion. Earnings per share, meanwhile, should come in at between $5.89 and $5.99. The prior expected range there was $4.67 to $4.87. Based on a review of certain adjustments management is forecasting, I ended up lowering the earnings per share figure to $5.61, which would imply net income for the year of $247.2 million. However, as I made clear in my prior article on the enterprise, I don’t view earnings as particularly reliable when it comes to this enterprise. Instead, I prefer cash flow figures. Based on my estimates, adjusted operating cash flow should come in at around $327.3 million while EBITDA should total around $453.1 million.

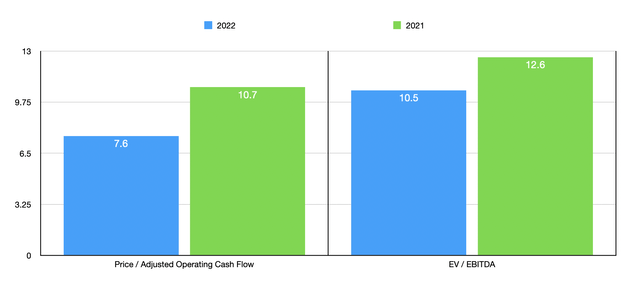

Author – SEC EDGAR Data

Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 7.6 and at a forward EV to EBITDA multiple of 10.5. Using the data from 2021 instead, these multiples would be 10.7 and 12.6, respectively. As part of my analysis, I did also compare the company to five similar businesses. On a price to operating cash flow basis, these companies ranged from a low of 7.1 to a high of 25.6. In this case, only one of the five was cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range is between 3.7 and 17.4, with two of the five companies being cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Belden | 10.5 | 8.7 |

| Vishay Intertechnology (VSH) | 7.1 | 3.7 |

| Knowles (KN) | 13.1 | 8.8 |

| Bel Fuse Inc. (BELFA) | 14.6 | 6.8 |

| Littelfuse, Inc. (LFUS) | 13.7 | 12.3 |

| Amphenol Corp. (APH) | 25.6 | 17.4 |

Takeaway

Based on all the data we have in front of us, I think that things are going particularly well for Belden at this time. The company is posting attractive growth in both its top and bottom lines and shares of the enterprise are trading on the cheap, both on an absolute basis and relative to similar firms. I recognize the current economic conditions could prove problematic for shareholders. But given how strong demand for the company’s offerings has been, even seeing financial results weaken some would still make it difficult for the stock to be overvalued. Certainly, the easy money has been made by this point. So I don’t think that this is a particularly robust prospect. But I do think it offers enough money on the table still to warrant the ‘buy’ rating I gave it previously.

Be the first to comment