Jetlinerimages/E+ via Getty Images

Yesterday, the German company Lufthansa presented its results to the investor community and we are commenting on its Q4 and FY numbers.

Q4 and FY Results

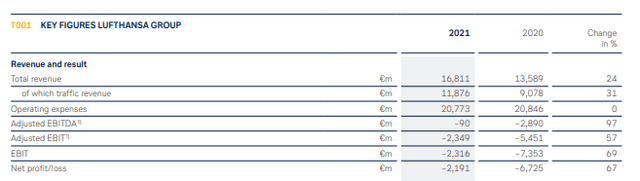

Lufthansa (OTCQX:DLAKF, DLAKY) improved its accounts in 2021 after the blow suffered in 2020 due to the impact from the pandemic. The German airline recorded revenues of €16.81 billion (+24% compared to 2020), of which €11.88 billion (+31%) came directly from air traffic. The adjusted EBITDA figure was still negative, but we note a sharp recovery to -€90 million from -€2.89 billion in 2020 (+97%). EBIT also up +69% from -€7.35 billion to -€2.31 billion, while the net loss was €2.19 billion against a loss of €6.73 billion in 2020. Furthermore, the operating cash flow returned positive going from -€2.33 billion to +€618 million. Among other data, we saw a 29% increase in the number of passengers (47 million in total) and 18% in the number of flights (460 thousand).

“The Lufthansa group made significant progress in overcoming the consequences of the coronavirus crisis” said the company’s CEO, Carsten Spohr. “We have begun to implement profound changes in the company, to adapt to the structural evolution of our markets. The goal remains to improve our competitive positioning and emerge stronger from this crisis. We are very confident that air traffic will undergo a strong recovery. Our strategy of expanding the private travel segment has proved successful and is paying off. People want to travel: they seek and need personal contact, especially after two years of pandemic and related social restrictions“.

Accounts in 2021 show a positive improvement for the German operator with results in line with expectations and with consensus.

What’s Next?

It is very hard to predict 2022 due to geopolitical uncertainty. The German group expects average capacity in 2022 to exceed 70% of 2019 levels, with bookings for the upcoming Easter and summer holidays already nearly reaching pre-pandemic levels. The company warned, however, of the current uncertainties “regarding the dramatic developments in Ukraine and the economic and geopolitical consequences of the conflict, as well as the remaining uncertainties about the progress of the pandemic” that would prevent it from providing detailed guidance for the year ahead. “Our ambition is clear” commented the CFO Remco Steenbergen “we want to return to positive results as soon as possible. We have already laid the foundations for this goal, especially by implementing our cost reduction program”.

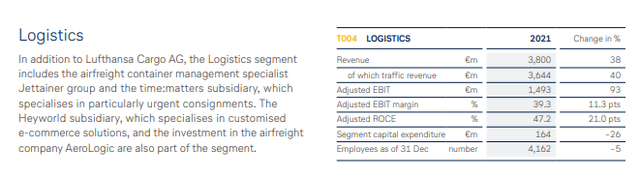

We positively welcome Lufthansa’s accounts and we forecast an increased capacity to 85% of 2019 levels. For short and medium-haul flights, the figure rises to 95%. The company expects an improvement in adjusted EBIT and cash flow for 2022. Our internal team believes that the positive momentum in earnings trends in the logistics segment will continue. Strong demand for freight capacities thanks to scarce supply, especially in shipping, will ensure that Cargo will benefit and earnings will continue to rise. On a positive note, in the 2021 year-end results, we saw that the Lufthansa Cargo division experienced the best results in its history almost doubling its adjusted operating profit.

Lufthansa Logistics (Annual Report)

Looking for M&A

The leader in shipping MSC announced an interest in buying an equity stake in the Italian national airline born from the ashes of Alitalia now called ITA Airways, with Lufthansa on board as an industrial partner. We do not believe that Lufthansa is likely to invest in ITA, but the CEO said:

“Creating a partnership with ITA is our strategic goal and we are looking at the details” and also “Italy is our most important international market in Europe, it is the second-largest in the world after the USA, it is of strategic importance for us and we believe that Lufthansa Group’s Air Dolomiti is the right partner for ITA. MSC, as a partner involved. We will decide between the investment options whether to sign a commercial alliance or acquire a minority stake”.

Conclusion and Risks

We value the German airline company with a 10-year DCF to simulate potential flight recovery and cash flow generation. We ended up with a price of €4 per share versus the current market price of €6 at the time of writing. The main variables in our model were: long-term operating profit was set at 7.5%, WACC at 9% and a terminal growth rate of 2%. This leads us to affix an underperform rating at this stage, other risks that might impact the company’s performance are:

- Jet fuels and energy crisis;

- COVID-19 wave;

- Potential war impact;

- Travel demand.

Be the first to comment