Pushpa Hegde/iStock via Getty Images

The fun thing about the market is that it can be incredibly volatile. This is true both broadly speaking and when it comes to individual companies. Although this can be stressful when the volatility works against you, it can be exciting and rewarding when it works in your favor. One company that has recently experienced a tremendous amount of upside, despite some continued pressures regarding profitability, is The Vita Coco Company (NASDAQ:COCO). Although the company, which focuses on products like coconut water, was not terribly priced before, shares certainly didn’t deserve to soar higher as they have. Now, the stock does look truly overpriced in the current environment. And because of this, I’ve decided to downgrade the company from a ‘hold’ to a ‘buy’, reflecting my sentiment that it is likely to underperform the market moving forward.

Vito Coco stock has skyrocketed

Back in March of this year, I wrote an article about Vita Coco wherein I acknowledged that it was an excellent company but one that was trading at a lofty price. The company had been doing extraordinarily well growing its top line in recent years, even though margins had been impacted by issues outside of the company’s control. This led me to conclude that shares were probably more or less fairly valued, essentially balancing out the quality of the operation from its fundamental weaknesses. As a result, I rated the business, at that time, as a ‘hold’. So far, the performance of the company has blown away my expectations. While the S&P 500 is down by 1.5% since I wrote about the company, its shares have generated a return for investors of 51%.

This is an astronomical move higher in such a short timeframe. Normally, it would be reserved for a buyout or merger or something of that nature. Instead, it seems to have been driven by a couple of factors. Analysts, for instance, are becoming more bullish about the company’s prospects. Most recently, Bank of America (BAC) citing decreased transportation costs coming around the corner, said that shares of the company were well positioned to outperform even in the event of a recession thanks to the company’s decision earlier this year to still appeal to price-conscious consumers during these difficult and high-priced times. The company achieved this by increasing costs only marginally so far. The analyst of the firm ultimately increased their target on the company from $10 per share to $12. Another interesting development for the company came in early July when it and Diageo (DEO) announced a collaboration to launch a line of premium canned cocktails crafted with a blend of Captain Morgan rum and Vita Coco coconut water. This further increases the company’s exposure to the ready-to-drink category all across the U.S. market.

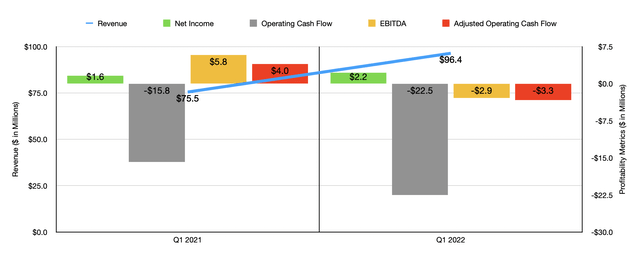

Meanwhile, fundamentals for the company have been somewhat mixed. Revenue has done nicely, with sales in the first quarter of the year totaling $96.4 million. This represents an increase of 27.7% over the $75.5 million the company reported the same quarter one year earlier. Growth for the company was particularly strong in the Vita Coco Coconut Water category of its Americas segment, with sales skyrocketing 39.5% year over year. This was driven by a 35.1% rise in shipment volume, but the company it did take some pricing actions to help offset costs. For the business as a whole, total volume grew by 27.1%. This echoes Bank of America’s assessment that more consumers have gravitated toward Vita Coco’s offerings as pricing actions have been minimal and as consumers still want coconut water and other related products.

Profitability, meanwhile, has been somewhat mixed. In the first quarter of the year, net income came in at $2.2 million. That was higher than the $1.6 million reported one year earlier. At the same time, operating cash flow fell from negative $15.8 million to negative $22.5 million. Even if we adjust for changes in working capital, it would have fallen from $4 million to negative $3.3 million. And over that same window of time, EBITDA went from a positive $5.8 million to a negative $2.9 million. Higher transportation costs and input costs associated with its products made an impact here.

When it comes to the 2022 fiscal year as a whole, management does expect sales to come in between $440 million and $455 million. That would represent a year-over-year increase of between 16% and 20%. At the same time, however, EBITDA should come in at between $27 million and $32 million. This compares unfavorably to the $36.9 million generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that they will change at the same rate that EBITDA should, then we should anticipate net income of around $15.2 million and adjusted operating cash flow of roughly $16.8 million.

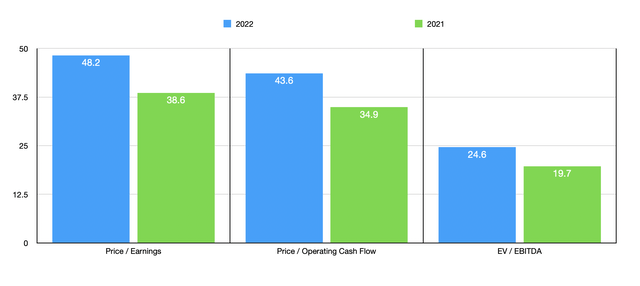

Taking this data, we can see that shares of the company are very pricey at this moment. The forward price to earnings multiple comes in at 48.2. This compares to the 38.6 reading that we get using 2021 results. The price to adjusted operating cash flow multiple should rise from 34.9 using 2021 results to 43.6 using our forward estimates. Meanwhile, the EV to EBITDA multiple should increase from 19.7 to 24.6. From a valuation perspective, the company is aided by the fact that it has cash in excess of debt in the amount of $5.9 million. That does reduce the risk of adverse credit events. But I wouldn’t say that it warrants the kind of multiples that the company is trading for.

As part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, four of the five companies had positive results, with their multiples ranging between 15.2 and 677. Only one of the four companies was cheaper than Vita Coco. Using the price to operating cash flow approach, the range was between 12 and 860.9. In this case, three of the four companies that had positive results were cheaper than our target. Meanwhile, using the EV to EBITDA approach, the range was between 12 and 63.4. In this case, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The Vita Coco Company | 48.2 | 43.6 | 24.6 |

| SunOpta (STKL) | 300.3 | 860.9 | 24.6 |

| Vital Farms (VITL) | 677.0 | 21.3 | 35.0 |

| Calavo Growers (CVGW) | 91.1 | 29.9 | 63.4 |

| Whole Earth Brands (FREE) | 15.2 | 12.0 | 12.0 |

| Landec Corporation (LNDC) | N/A | N/A | 15.8 |

Takeaway

Although sales at Vita Coco are slated to grow nicely this year, and transportation costs may be declining, the company looks rather pricey at this moment. While it is true that tremendous growth could warrant this kind of pricing, it’s difficult to see that kind of trend taking place, especially at a time when inflation is still rather painful. What I fear is a scenario where management continues to let margin suffer so that it can capture additional upside for revenue. But eventually, that can create some pretty nasty circumstances. Due to my concerns, I have decided to change my rating on the company from ‘hold’ to ‘sell’ until such time that we can see further clarity on future profitability.

Be the first to comment