Scharfsinn86

This article first appeared in Trend Investing on July 4, 2022, but has been updated for this article.

For a background on our past articles on autonomous vehicles (“AV”), you can read:

The autonomous vehicle sector has the potential to disrupt the taxi and fleet transport industries; however, there are still several obstacles to be achieved before that happens.

Wikipedia gives a good history of the autonomous vehicles evolution and first companies to market. They also summarize the various levels quoting:

The SAE levels can be roughly understood as Level 0 – no automation; Level 1 – hands on/shared control; Level 2 – hands off; Level 3 – eyes off; Level 4 – mind off; and Level 5 – steering wheel optional.

Latest industry forecasts

- ResearchAndMarkets – “Global autonomous vehicle market is expected to reach $327.19 billion by 2030, representing a revised 2020-2030 CAGR of 22.6%. The annual shipment of autonomous vehicle will grow to 12.21 million units in 2030 with a 2020-2030 CAGR of 24.9%.”

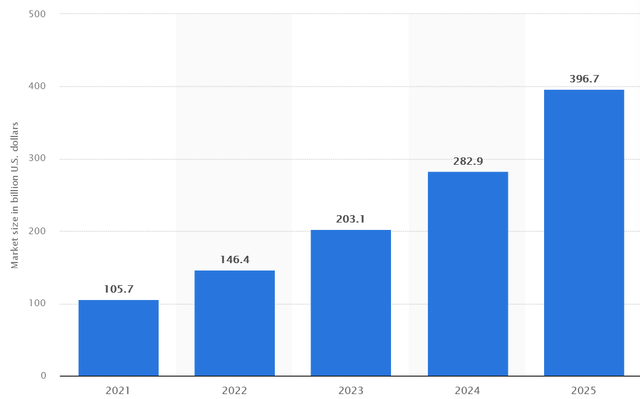

Statista (KPMG) projected autonomous vehicle market size worldwide between 2021 and 2025 (in billion U.S. dollars)

Note: The above chart and data include revenues from the various levels of autonomous driving (level 1 (driver assistance) to level 5 (full automation)).

An update on the leading global autonomous vehicle companies

(Order is in terms of commercial advancement in driverless taxi sales, not technical advancement.)

Waymo (Alphabet (GOOG) (GOOGL))

Waymo launched its commercial autonomous vehicles in 2018 and opened the first U.S. driverless taxi service to the public in 2020 in Phoenix. Then in March 2022, Waymo expanded to San Francisco starting initially with driverless rides for Waymo employees.

On March 30, 2022, Reuters reported:

Waymo offers driverless rides to San Francisco employees, expands in Phoenix…..Waymo needs to receive at least two more permits from the California Department of Motor Vehicles (DMV) and the California Public Utilities Commission (CPUC) to start charging passengers for driverless rides in San Francisco…..Cruise already is giving fully driverless rides to employees and members of the public free of charge in San Francisco. The company is seeking CPUC approval for commercial driverless service, with a goal to get permitted this year.

The longer term vision for Waymo is to open in more U.S. cities and to expand internationally.

Waymo is one of the leaders in terms of commercializing driverless vehicles as a taxi service

GM Cruise (General Motors (GM))

In 2022, GM expanded their stake in autonomous driving technology company Cruise to 80%. The other remaining owners of Cruise are Honda [TYO:7267] (HMC) (OTCPK:HNDAF), Microsoft (MSFT) and Walmart (WMT).

On June 13, Reuters reported:

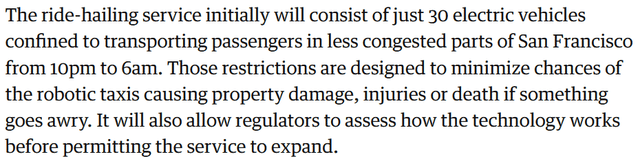

GM’s Cruise wins first California permit to carry paying riders in driverless cars……Cruise on Thursday became the first company to secure a permit to charge for self-driving car rides in San Francisco, after it overcame objections by city officials……Cruise said it would launch paid services within the next couple of weeks using up to 30 driverless Chevrolet Bolt electric vehicles……Cars will be limited to a maximum speed of 30 miles per hour (48 km per hour), a geographic area that avoids downtown and the hours of 10 p.m. to 6 a.m. They will not be allowed on highways or at times of heavy fog, precipitation or smoke.

Note: The service is allowed to operate with no back-up human driver present.

A quote from another source

GM’s Cruise wins first California permit to carry paying riders in driverless cars

An August 8 report from GM Authority stated:

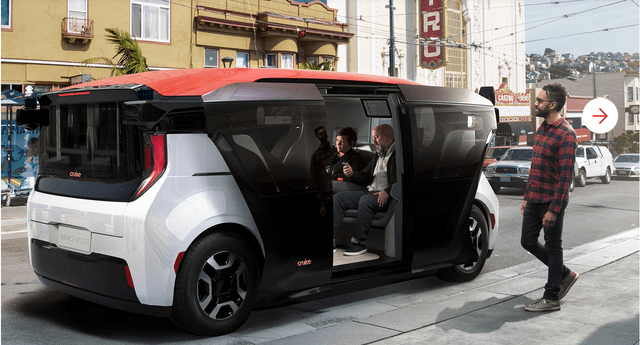

After giving thousands of driverless rides in San Francisco, the company says it has completed over a quarter of a million driverless miles as of August 1st, 2022 and is now setting its sights on unleashing the purpose-built Cruise Origin AV.

The GM Cruise Origin autonomous all-electric shuttle planned for 2023 production

Baidu (BIDU)

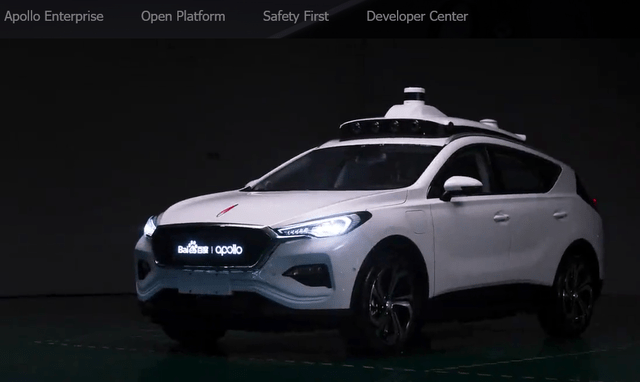

Baidu’s self-driving platform is called “Apollo”. Baidu has an existing fleet provided by Baidu’s autonomous ride-hailing service called “Apollo Go”, in China.

On April 28, Bloomberg reported:

Baidu leads years-long race for first driverless taxis in China. Baidu nabs first-of-its kind robotaxi license in China. It eyes a fully driverless ride-hailing service in 2023. Baidu Inc.’s ride-hailing service will deploy cars without humans behind the wheel on Chinese roads for the first time, a symbolic victory in a years-long quest to carve out businesses beyond internet advertising……..(Baidu) runs a ride-hailing platform powered by a fleet of robotaxis in nine cities including Guangzhou and Beijing. Its electric vehicle spinoff raised $400 million from external investors, and plans to start mass production in 2023.

Baidu’s autonomous car runs on Baidu’s Apollo autonomous vehicle platform

Baidu Apollo RTS with detachable steering wheel

Tesla Inc. (TSLA)

Tesla has not yet started a robotaxi service and some people may see Tesla lagging behind. However, Tesla is the most advanced technically and has a huge fleet collecting data (beta testing).

A key point of difference with Tesla is that most other autonomous taxis only operate on pre-mapped streets in set geographies; whereas Tesla full self driving (“FSD”) drivers can go anywhere provided the cars cameras can see (just like humans). This means that if Tesla succeeds, it should potentially have the greatest ability to expand globally.

On April 8, 2022, at the Tesla Giga Texas Cyber Rodeo Elon Musk mentioned Tesla now plans a ‘dedicated robotaxi’ which would most likely be in addition to the FSD software used on existing Tesla cars. The dedicated robotaxi would have no steering wheel or pedals and look very futuristic and go into production in 2024. Will it be a shuttle similar to GM Cruise?

Meanwhile, Musk also said he hopes to expand the FSD beta testing fleet from 100,000 to 1 million in 2022. On May 17, The Driven reported:

Elon Musk sets new target for self-driving EVs by end 2022……Talking in an interview at the All-In Conference in Florida on Monday (US time), Musk said Tesla will probably be “expanding FSD (Full Self-Driving) Beta to 1 million users by end of the year.”…….Currently, Tesla has about 100,000 drivers on the Tesla FSD beta program. Most of these drivers are in the US and there are a small number in Canada.

At the August 4, 2022 Tesla AGM, CEO Musk stated that FSD beta should become available to anyone who requests it in North America by the end of this year. He also said that Tesla’s FSD system has over 40 million miles driven.

Tesla is currently testing FSD with 100,000 drivers – plans for a dedicated robotaxi to follow. Will it be a shuttle similar to GM Cruise?

Others to consider (in alphabetical order)

- Hyundai (OTCPK:HYMTF) – “Hyundai to run robotaxi pilot in Seoul.” Via (private) – Feb. 2022 – “Motional and Via launch robotaxi service in Las Vegas.” Motional is a JV between Hyundai and Aptiv (APTV).

- Intel (INTC)/Mobileye

- Mercedes-Benz (OTCPK:DDAIF) (DDAIY)

- Nvidia (NVDA)

- Pony.ai (private) – April 2022 – “Pony.ai first to be awarded taxi license in China.”

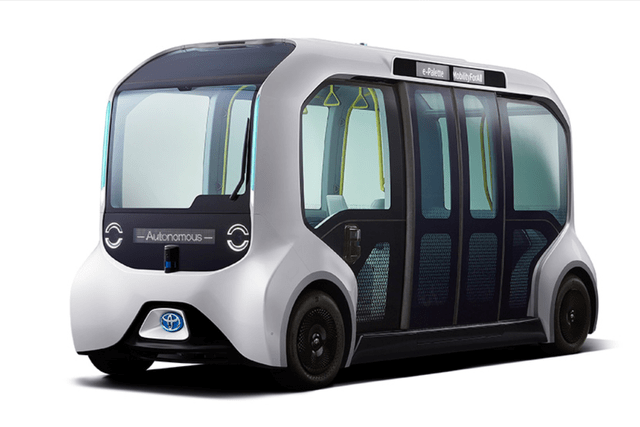

- Toyota Motor (TM)

- Uber Technologies (UBER)

- Via (private) – Feb. 2022 – “Motional and Via launch robotaxi service in Las Vegas.“

- Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)

- XPeng (XPEV) [HK:9868] – “China’s XPeng Sets Up a New Autonomous Driving Company for Robotaxis……During XPeng’s Q3 financial report conference in Nov 2021, XPeng chairman and CEO He Xiaopeng, said the company plans to launch its own robotaxi service in the second half of 2022. The service will launch in Guangzhou.”

Risks

- Technology risk in developing and maintaining autonomous vehicles and a robotaxi network.

- Regulation risk – Governments are still gradually opening up areas for autonomous driving.

- Litigation risk – The risk of AV companies being sued for accidents, etc. Insurance companies will have a say in this also. Some plan to self-insure.

- Public acceptance issues around AVs. I think the huge drop in taxi costs per mile will rapidly bring customer acceptance provided accidents are low.

- Access to electric vehicles. Not all AV groups will be able to rapidly scale up a robotaxi network due to a shortage of EVs. Large EV makers such as Tesla have an early stage advantage.

- Company risks – Debt, liquidity, management etc.

- The usual stock market risks – Liquidity, sentiment.

Further Reading

Fully-electric autonomous shuttles are coming – Toyota showed of their e-palette at the 2020 Tokyo Olympic games

A non-official Tesla shuttle concept shown entering a tunnel that appeared in a tweet regarding the Boring company tunnel

Conclusion

The autonomous vehicle and robotaxi race continues with several companies now operating driverless taxi services in both USA and China. These include Waymo (Alphabet), GM Cruise, and Baidu, as well as some smaller private companies. Others are still testing but many consider to have more advanced software such as Tesla.

It looks like the next development will be all-electric dedicated autonomous vehicles, probably shuttles, similar to what Baidu has and GM Cruise plans.

For investors interested in the sector it would make sense to position in some of the above-mentioned companies or consider an ETF such as the Global X Autonomous & Electric Vehicles ETF (DRIV), the KraneShares Electric Vehicles and Future Mobility ETF (KARS), or the iShares Self-Driving EV and Tech ETF (IDRV). Some other similar ETFs are Ideanomics NextGen Vehicles & Technology ETF (EKAR) and SmartETFs Smart Transportation & Technology ETF (MOTO).

Risks revolve around the technology succeeding, gaining regulatory approval, and litigation risk if things go wrong such as many accidents. Please read the risks section.

As usual, all comments are welcome.

Be the first to comment