Galeanu Mihai

MPLX LP (NYSE:MPLX) reported its earnings on November 1st. Our several articles discussing the size of and possibilities for special distributions continues with a twist. The company significantly raised its basic distributions by 7 cents to $0.775 per quarter, leaving open future possible specials. Being special offers, investors extra incentives. Being special means generating a lot of excess cash. Since special offerings must be accompanied by special levels of cash, evaluating cash balances for both the quarter and year-to-date are necessary. Let’s pull the covers back and gauge how special MPLX remains.

The Quarter and Year-to-Date Calculations

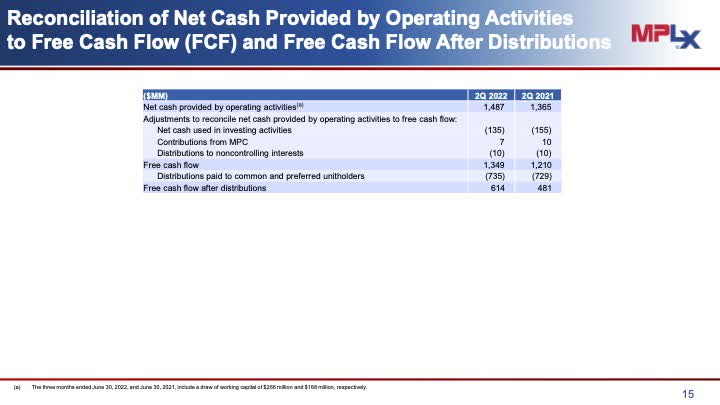

Beginning with slides from the last quarter report, a look at the company’s cash position begins. A few slides from that quarter follow. The first reconciles EBITDA and distributable cash flows comparing the September year-over-year.

Adjusted EBITDA increased nicely year-over-year. But continuing with the next slide, it shows a significant drop in cash after distribution.

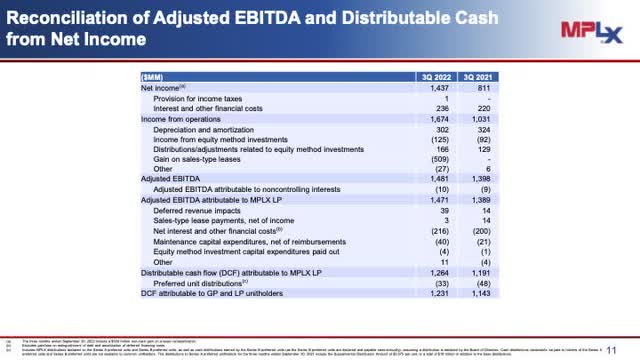

The company warned investors last quarter that $285 million in working capital recovered during that quarter would reappear. The actual amount was stated in note A in the above slide which states:

“The three months ended September 30, 2022, and September 30, 2021, include a working capital build of $208 million and a working capital draw of $12 million, respectively.”

From the article, MPLX: A Special Investment – Part 4:

“A note at the bottom of the 2nd quarter FCF slide notifies investors that approximately $265 million in lower working capital aided the very positive cash results. During the call, management noted that most of the working capital savings will disappear in the 3rd quarter. The 3rd quarter cash flows might equal $614 – 2*$265 or $85 million.”

This estimate was reasonably close when compared to the above slide at $22 million excess cash for September.

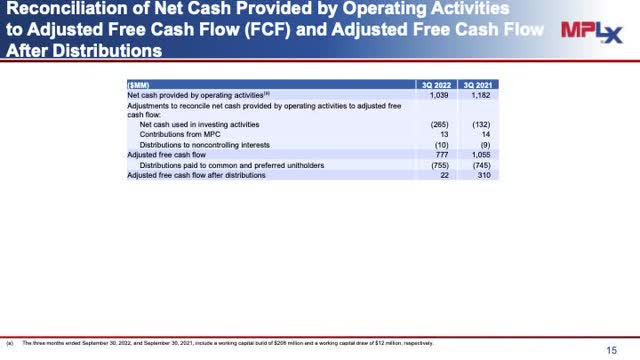

Next comes a slide reconciliation for Free Cash Flow in June.

MPLX June Quarter

The above slide from June’s presentation highlights a difference.

The Cash Balance

Again from the article, MPLX: A Special Investment – Part 4, this summarizes minus unit repurchases through June.

| Cash Flows | 4th Q | 1st Q | 2nd Q | Total |

| Excess Cash | $341 M | $92 M | $614 M | $1050 M |

| Repurchases | $165 M | $100 M | $35 M | $200 M |

| Differences | $174 M | -$8 M | $579 | $745 M |

As noted above, surplus cash for September equaled essentially zero ($22 million). The increase in net cash used in investing activities of $130 plus million quarter over quarter plus the working capital changed played the major role in the much lower extra cash quarter over quarter.

The company also spent $180 million to repurchase units leaving $565 million in extra for the last 4 quarters.

Going forward, the company chose to increase its basic distribution by 10%. On average, MPLX spends approximately $750 million per quarter on distributions, which now increases by $300 million a year, a significant part of the excess cash generated. This leaves about $400 million left over. When asked about special or supplementals from Brian Reynolds of UBS, John Quaid, CFO, danced about highlighting several means to return capital, units repurchases, capital expenses for maintaining the infrastructure and at the end, special or supplements. His last comment dealt clearly with the supplemental (emphasis added):

And just since you asked about it, the special, we’re actually now calling the supplemental, but look, while not a tool we’re going to use this year, that is something that remains available to us as we go forward. So lots of levers, and we’re trying to work around that to optimize that return of capital.”

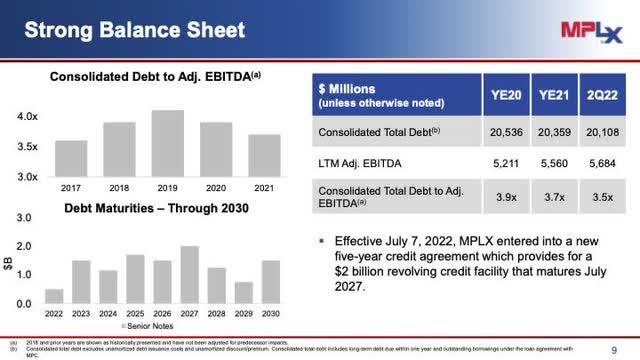

The increase in basic distribution illustrates management’s confidence in the long-term health of the business. But, it must also deal with bonds coming due between now and 2030. The next slide summarizes MPLX’s debt.

The company must refinance or pay off approximately $1-$2 billion each year through 2030. Yes, it could refinance or pay off a choice yet to be determined.

Summary & Risk

MPLX generates more cash than is necessary for capital and distributions. Management’s options include repurchases or debt extinguishing. We sense that special distributions aren’t that high on the list at this point. For example, with a distribution of $3.1 per year instead of $2.7, the unit price defining cheap just increased by $3-$4 per unit.

Investing involves risk. World health issues still exist in some countries including China that could have major effects on energy consumption. Although the government just elected in the United States will experience change with a possibility for improved relations with fossil energy sources, the White House is still governed with a philosophy strongly targeting this source of energy. Even with MPLX not being quite so special, the $3.10 distribution at prices under $33 creates a compelling investment for cash seekers. We have a buy on MPLX LP units. A year from now, the MPLX LP special might appear once again.

Be the first to comment