Win McNamee/Getty Images News

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on June 8th.

Real Estate Weekly Outlook

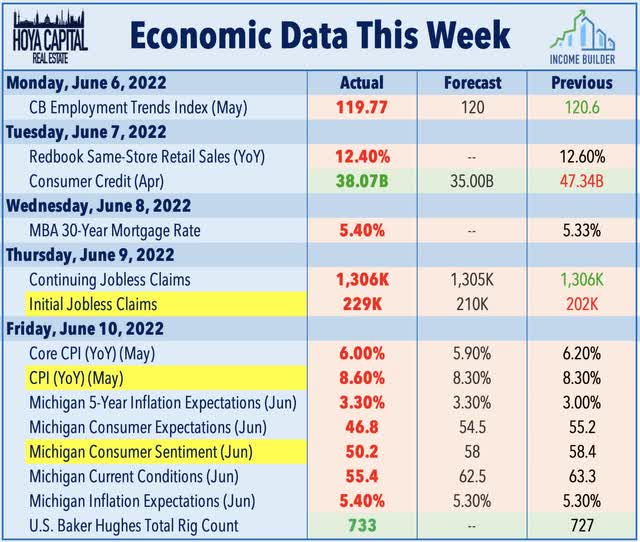

U.S. equity markets were slammed this week after inflation data showed that consumer price pressures remain broad-based and unrelenting despite continued indications of softening demand and declining confidence. Effectively forcing the hand of the Federal Reserve to amplify its efforts to tame inflation through monetary tightening in its FOMC meeting this coming week, red-hot CPI data contained few “silver linings” and coincided with data showing a jump in weekly initial jobless claims and a dive in consumer sentiment to levels below that of any point during the Great Financial Crisis.

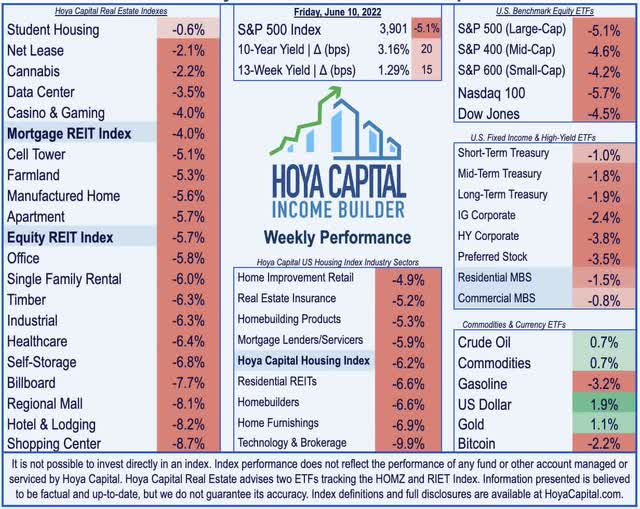

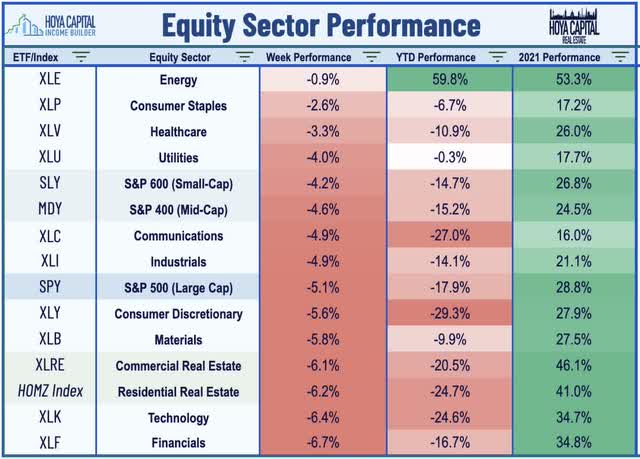

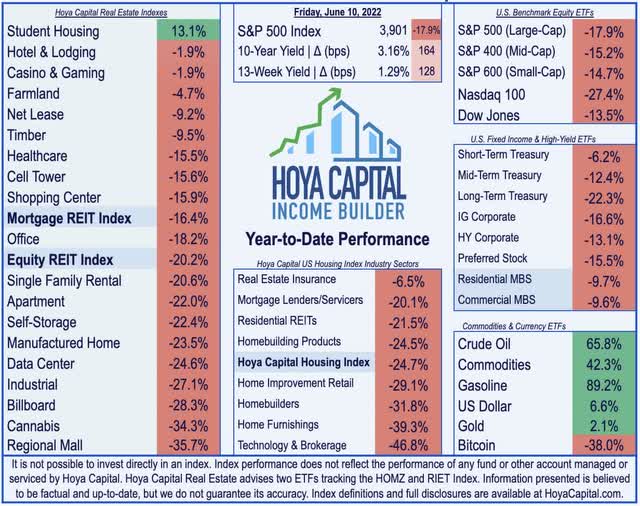

Declining for the ninth week out of the past ten and posting its worst week since January, the S&P 500 retreated 5.1% on the week and is now back on the cusp of “bear market” territory. The tech-heavy Nasdaq 100 plunged 5.7% to push its drawdown to nearly 30%. Real estate equities were under pressure as well despite an upbeat slate of REITweek updates and dividend hikes. Dragged down by a sharp sell-off among retail and hotel REITs, the Equity REIT Index declined 5.7% with all 19 property sectors in negative territory while the Mortgage REIT Index declined by 4.0%.

Hotter-than-expected inflation data sent benchmark interest rates surging across the curve as the 2-Year Treasury Yield surged by 40 basis points on the week to the highest level in 14 years as investors price-in expectations of a more aggressive path of Fed rate hikes. Underscoring the global impact of red-hot inflation, the U.S. Dollar soared nearly 2% on the week – one of its largest-ever weekly gains – to push it to the strongest level in two decades. Despite the market carnage, Crude Oil prices climbed another 1% on the week, sending U.S. consumer gasoline prices to above $5 per gallon for the first time ever while the Bloomberg Commodities Spot Index climbed to fresh record highs. All eleven GICS equity sectors were lower on the week with the Financials (XLF) and Technology (XLK) dragging on the downside.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

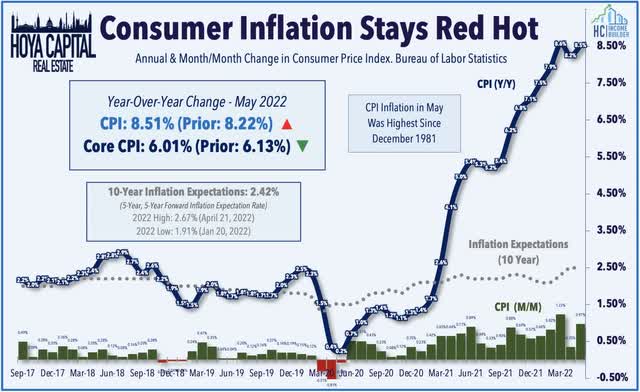

Peak Inflation? Not yet. Consumer prices rose at the fastest pace in more than 40 years in May – and significantly above analysts’ estimates – as cost pressures continue to be far less “transitory” than economics and public officials projected. The annual increase in the Consumer Price Index accelerated to 8.5% in May – above the 8.3% rate expected – the highest annual increase since January 1981. There were few silver linings anywhere in the data as the Core CPI – the metric on which the Fed focuses its attention – recorded its highest month-over-month gain since last June, pushing its annual gain to 6.0% – above expectations for a 5.9% gain. Remarkably, the energy index rose 34.6%, the largest 12-month increase since September 2005. The food index increased 10.1% for the 12 months ending May, the first increase of 10 percent or more since the period ending March 1981.

For the past year, we’ve continued to project persistent near-term pressure on the headline inflation metrics due to the delayed recognition of soaring shelter costs – the single largest weight in the CPI Index – which is just beginning to filter into the data. The cost of shelter increased 0.6% in May – the largest monthly increase since March 2004 – pushing its year-over-year rise to 5.5% – the largest 12-month increase since the period ending February 1991. We believe this still significantly understates the actual rise in shelter costs as private market rent data has shown that national rent inflation has been in the 10-15% range over the past twelve months while home values have risen by 15-20%. The delayed recognition of shelter inflation alone will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

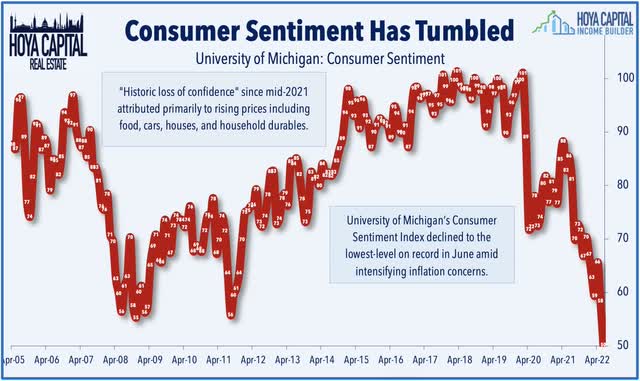

Ongoing concerns over inflation have weighed on consumer confidence since the middle of last year, sending the University of Michigan’s consumer sentiment index plunging to all-time lows in June. The University of Michigan’s preliminary June sentiment index fell to 50.2, from 58.4 in May – substantially weaker than the 58.1 reading expected by economists. Just 13% expect their incomes to rise more than inflation, the lowest share in almost a decade. An index of expected business conditions over the next year fell to the second-lowest on record. Notably, with U.S. midterm elections now months away with just four more inflation reports before Election Day, the report showed that sentiment among political independents dropped to the lowest on record.

Equity REIT Week In Review

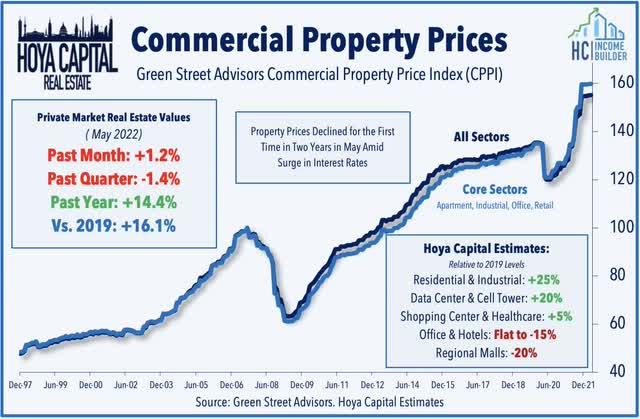

The REIT industry gathered in New York City this past week for its annual REITweek conference. Roughly 100 REITs provided business updates and held public sessions, the tone of which was generally quite upbeat – particularly across the residential and industrial sectors – even as executives acknowledged storm clouds gathering across the broader economy. Commercial real estate valuations were a focus among analysts and investors amid the rise in interest rates as data from Green Street this week showed the first month-over-month decline in property prices in two years in May. Most REITs – especially those with strong balance sheets and “dry powder” to work with – appear well-positioned to take advantage of pockets of softening or mild distress as some over-levered private market players head for the exits.

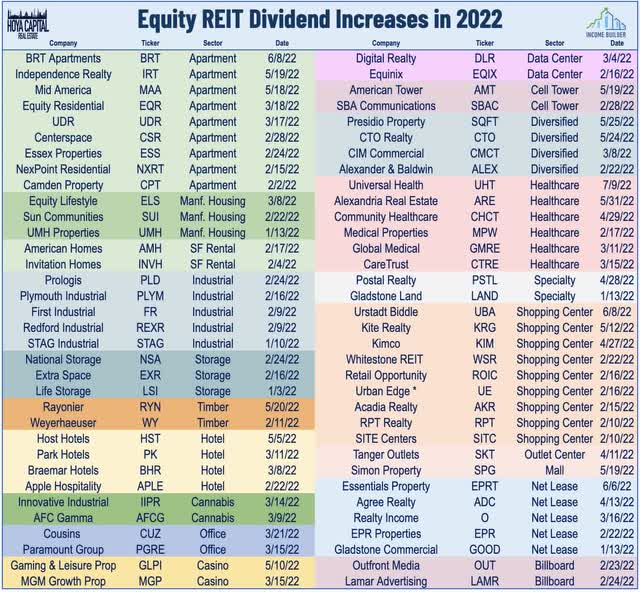

Another week, another handful of REIT dividend hikes. Universal Health Realty (UHT) was among the leaders this week after hiking its quarterly dividend by 1% to $0.71/share. Small-cap apartment REIT BRT Apartments (BRT) raised its quarterly dividend by 9% to $0.25/share. Net lease REIT Essential Properties (EPRT) lagged despite hiking its quarterly dividend by 4% to $0.27/share. We’ve now seen 69th equity REITs raise their dividend this year along with another half-dozen mortgage REITs. In our State of the REIT Nation report, we noted that FFO growth has significantly outpaced dividend growth over the past several quarters, driving the dividend payout ratios to just 68.8%, so REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021.

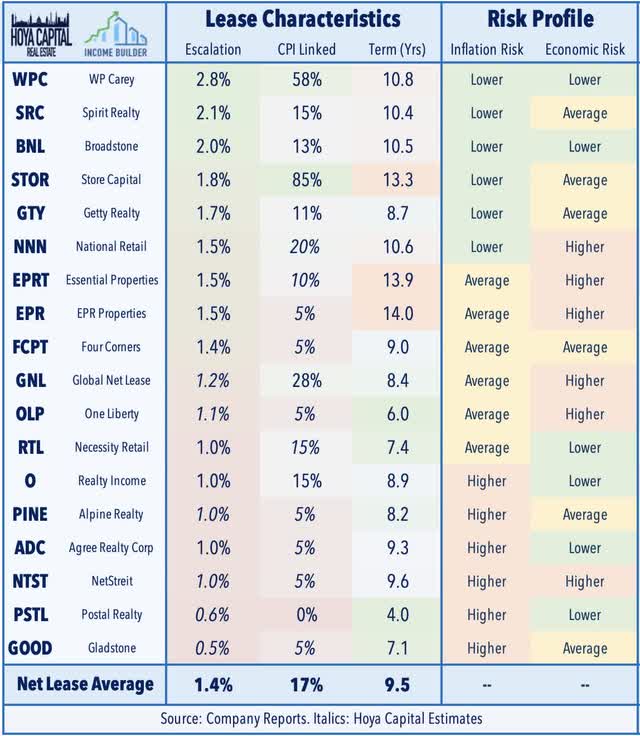

Net Lease: One of the few places to hide this past week, net lease REITs were the best-performing property sectors following several encouraging REITweek updates showing that net lease REITs are playing “offense” on the acquisition-front. W.P. Carey (WPC) was roughly flat amid the broader sell-off after announcing that it has acquired $400M in assets since the end of Q1. As discussed in Net Lease REITs: Surviving Inflation, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust accretive external growth has more than offset the drag from muted property-level growth. Within the sector, inflation risk isn’t uniform nor is it always efficiently priced, however, and we took a deep-dive into the inflation risk of each individual net lease REIT.

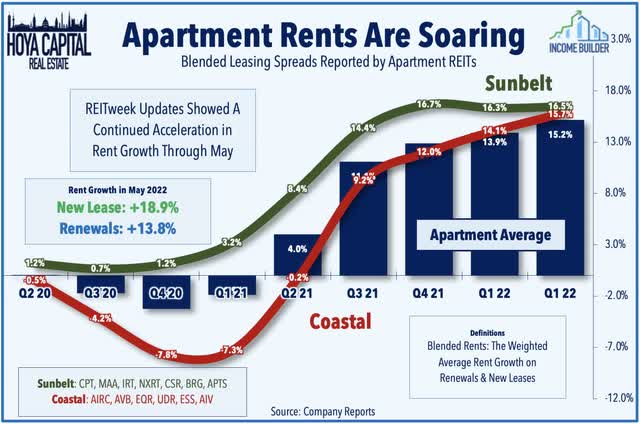

Apartments: REITweek updates from residential REITs showed a continued acceleration in rent growth across essentially all major markets and property types. Rent growth remains strongest in the Sunbelt as Camden (CPT) recorded historically strong blended leasing spreads of 14.6% and 15.9% in April and May, respectively, while commenting that its business is “the best it’s ever been” while updates from Mid-America (MAA) were even stronger with blended leasing spreads topping 17% so far in the second quarter. Coastal markets are also seeing robust demand as Essex (ESS) boosted its full-year FFO outlook to 13.4% – up 170 basis points from its update last month – while raising its NOI growth outlook by 140 basis points to 12.1%. UDR (UDR) reported the strongest blended spreads of any multifamily REIT with renewal spreads of 15% and new lease spreads of 20.6%.

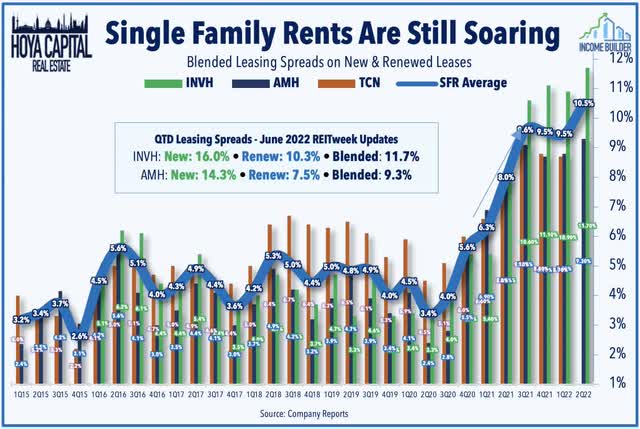

Single-Family Rental: Updates across the SFR space were similarly strong as American Homes (AMH) reported blended lease growth of 9.3% so far in Q2, an acceleration from the 8.8% rate in Q1 while Invitation Homes (INVH) that blended rents accelerated to 11.7% in Q2, up from 10.9% in Q1. American Homes also announced a partnership with Värde Partners – a global alternative investment firm – to acquire and develop new land opportunities as part of American Homes 4 Rent’s internal development platform. The facility will provide AMH with $500 million in initial capacity to acquire and develop new land opportunities. As discussed in Renting The American Dream, rapid home price appreciation and stiff competition in the “traditional” acquisition channel have forced SFR REITs to get creative with external growth plans. “If you can’t buy it, build it” has been the recent mantra as SFR REITs have effectively become strategic homebuilders through internal development and partnerships with existing builders.

Shopping Center: Urstadt Biddle (UBP) – which we own in the REIT Focused Income Portfolio – was the best-performing retail REIT on the week after reporting solid earnings results for its quarter ending April 30. Consistent with the broader shopping center REIT sector, UBP reported sequential gains in occupancy rates and an acceleration in rent growth on new and renewed leases. UBP commented that it believes that “the increasing demand for space will continue, particularly as supply becomes more constrained.” In Shopping Center REITs: Winning The Last Mile, we discussed why shopping center fundamentals are now strong – if not stronger than before the pandemic. The versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks.

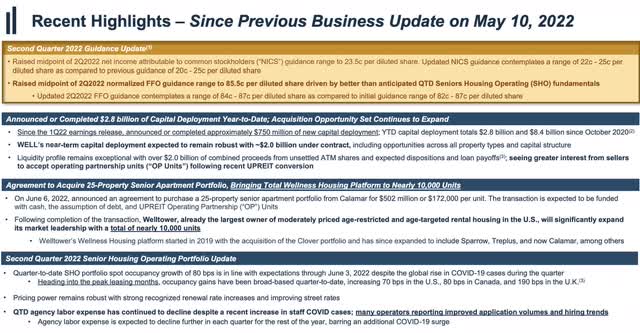

Healthcare: Large-cap healthcare REITs were under-pressure this week despite fairly encouraging REITweek commentary. Welltower (WELL) provided a REITweek business update which included a guidance increase and acquisition announcement. WELL boosted the midpoint of its Q2 adjusted FFO to $0.855 – up from $0.845 – citing improving senior housing occupancy and “robust” pricing power. Welltower – which has been among the most active acquirers of any REIT in recent quarters – also announced a major $502M acquisition of a 25-property senior apartment portfolio from Calamar. Upon completion of the deal, Welltower will own nearly 10,000 age-restricted rental housing units under its Wellness Housing platform and will fund the deal, in part, with OP UPREIT units. Wellness Housing properties operate with low-to-no staffing and an average length of stay of approximately 5 years, resulting in operating margins and capex budgets closer to the multifamily sector.

Mortgage REIT Week in Review

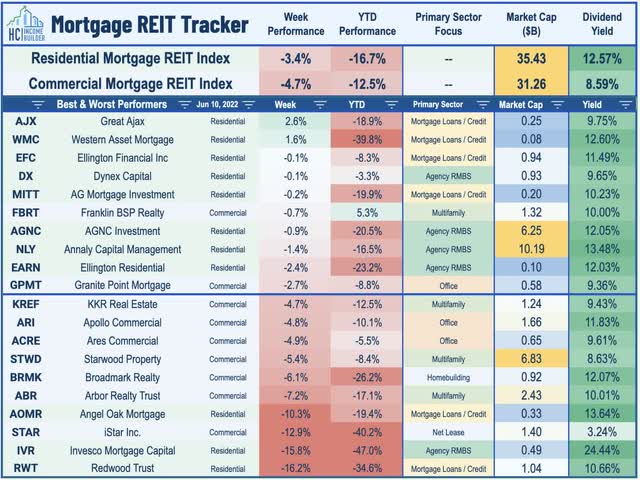

Mortgage REITs were relative outperformers once again this week despite the surge in rates across the maturity curve as mortgage-backed bonds – represented by the iShares MBS ETF (MBB) – were a source of relative strength in the fixed income market. Upside standouts included Annaly Capital (NLY) and AGNC Investment (AGNC) – both of which held their dividends steady this week – as did Ellington Financial (EFC) and Ellington Residential (EARN). On the downside this week, Redwood Trust (RWT) dipped more than 16% after launching a $200M convertible note of 7.75% convertible senior notes due 2027. Holders can convert beginning on March 15, 2027 at a rate of 95.6823 shares of common stock per $1,000 principal amount of notes, equivalent to a conversion price of roughly $10.45 per share.

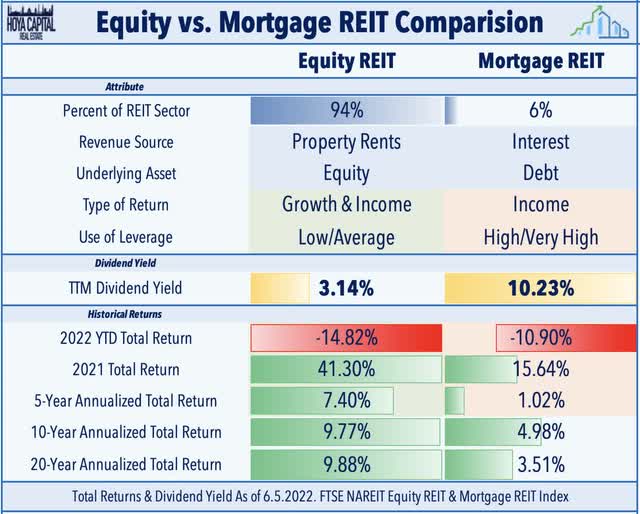

This week, we published Mortgage REITs: Risk And Reward In Ultra-High Yield. Mortgage REITs have stabilized over the past month and are now outperforming their equity REIT peers as valuations of mortgage-backed bonds have firmed following a rough start to 2022. Earnings results confirmed that the challenging macro environment – marked by a “double-whammy” of rising rates and widening MBS spreads – wasn’t the catastrophe to mREITs book values that some expected. Mortgage REIT dividend yields now average over 10%, a hearty premium to the 3.1% average for equity REITs. While some mREITs are pushing the upper limits of their payout capacity, we’ve seen twice as many dividend increases as decreases this year and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio.

2022 Performance Check-Up

Through twenty-three weeks of 2022, Equity REITs are now lower by 20.2% on a price return basis while Mortgage REITs have slipped 16.4%. This compares with the 17.9% decline on the S&P 500 and the 15.2% decline on the S&P Mid-Cap 400. With the exception of the student housing sector, every REIT sector is now in positive territory this year while nine property sectors are lower by 20% or more. At 3.16%, the 10-Year Treasury Yield has climbed 164 basis points since the start of the year, and is knocking on the door of the post-GFC-high rate of 3.25% reached in 2018. The 2-Year Treasury Yield has climbed from 0.73% to 3.07%.

Economic Calendar In The Week Ahead

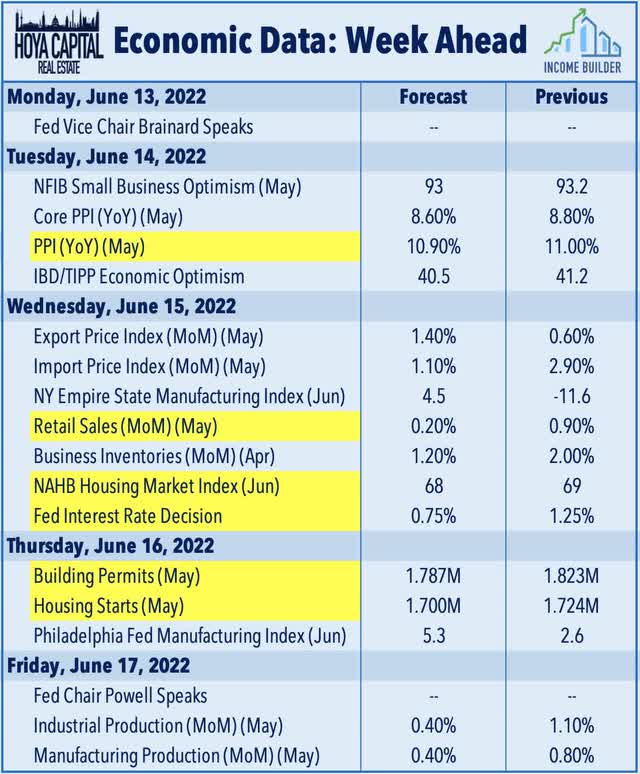

We’ll see a jam-packed week of economic data and monetary policy decisions in the week ahead. On Tuesday, we’ll see inflation data with the Producer Price Index for May, which investors are hoping will signs of cooling from its record-high increases seen in March and April. On Wednesday, we’ll see Retail Sales data – which is expected to show the lowest month-over-month increase of 2022 – while Homebuilder Sentiment is expected to show a moderation to 68 which would be the lowest level since early in the pandemic. All eyes will be on the Federal Reserve on Wednesday afternoon for the FOMC Interest Rate Decision. The Fed is expected to raise policy rates by 50 basis points but guide to a more path of hikes for the balance of 2022. Finally, on Thursday, we’ll see Housing Starts and Building Permits which is expected to show a continued moderation in the pace of new home construction.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment