designer491/iStock via Getty Images

The 13F filings for Q1-2022 were completed by May 15, hence we updated the universe of the consensus stocks from 40 large hedge fund. The change in holdings are seen in the trading signals for iM-Top50(of 40 Large Hedge Funds), see below.

Research from Barclays and Novus published in October 2019 found that a copycat stock selection strategy that combines conviction and consensus of fund managers that have longer-term views outperformed the S&P 500 by 3.80% on average annually from Q1 2004 to Q2 2019.

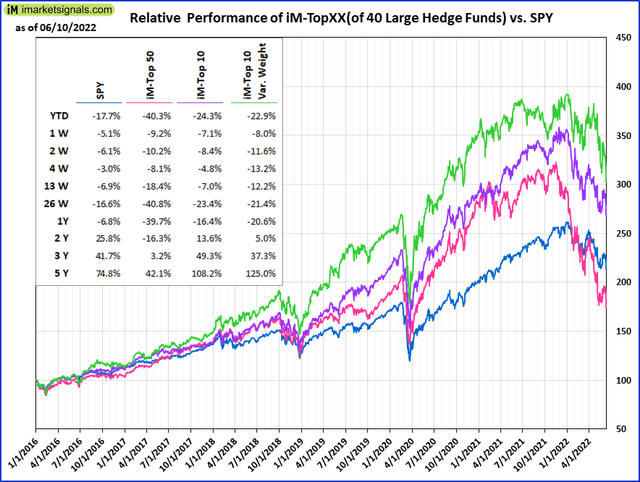

Based on that rational, we previously presented two trading models (in Article-1 and Article-2) that use the top 50 consensus stocks of 40 Large Hedge Funds (listed in Appendix A below), that historically outperformed the S&P 500. The iM-Top50(from 40 Hedge Funds) model holds all 50 stocks equally weighted and has a low turnover. The iM-Top10(from 40 Hedge Funds) model holds a subset of 10 stocks, also equally weighted, but with higher turnover which is rewarded by improved returns.

The performance simulation, and generation of trading signals, for these strategies is done using the platform Portfolio123 and reported below. For more comprehensive description of the 50 stock universe please refer to here.

Note: This update is published on Seeking Alpha, editor permitting, only if the model has generated trading signals.

Model Performance:

Trade Signals for 6/13/2022

| iM-Top10(of 40 Large Hedge Funds) | |||

| Ticker | Action | Shares | Name |

| (MCO) | SELL | 87 | Moody’s Corp. |

| (MSFT) | SELL | 111 | Microsoft Corp. |

| (AAPL) | BUY | 188 | Apple Inc. |

| (DHR) | BUY | 103 | Danaher Corp. |

| iM-Top50(of 40 Large Hedge Funds) | |||

| Ticker | Action | Shares | Name |

| No Trades | |||

The models trade on the first trading day of the week. Trading signals are published on a weekly basis here on Seeking Alpha (subject to model trading and editor’s acceptance) and on iMarketSignals. Next update on Sunday 6/19/2022

Holdings for iM-Top10(of 40 Large Hedge Funds) as of 6/10/2022

| Current Portfolio 5/20/2022 | Cash Flow | ||||||||

| Ticker | Number of Shares | Weight | Value now | Open Date | Open Costs | Rebal Costs | Return | Dividends Received | Gain to date | |

| (BBWI) | 531 | 7.53% | $20,544 | 02/28/22 | ($30,285) | $2,564 | — | ($7,176) | |

| (CHTR) | 65 | 11.41% | $31,137 | 04/18/22 | ($30,231) | ($3,876) | — | ($2,970) | |

| (INCY) | 361 | 9.91% | $27,032 | 02/28/22 | ($30,799) | $7,377 | — | $3,610 | |

| (MA) | 76 | 9.37% | $25,550 | 05/02/22 | ($27,266) | — | — | ($1,716) | |

| (MCO) | 87 | 9.23% | $25,166 | 04/11/22 | ($29,208) | — | $61 | ($3,980) | |

| (MSFT) | 111 | 10.28% | $28,034 | 04/18/22 | ($31,162) | — | $69 | ($3,059) | |

| (NFLX) | 147 | 10.04% | $27,393 | 05/16/22 | ($27,760) | — | — | ($366) | |

| (QCOM) | 218 | 10.52% | $28,689 | 08/02/21 | ($32,635) | $2,794 | $423 | ($729) | |

| (SCHW) | 421 | 9.77% | $26,641 | 05/16/22 | ($27,054) | — | — | ($413) | |

| (V) | 140 | 10.21% | $27,864 | 12/07/20 | ($30,865) | $1,269 | $308 | ($1,424) | |

Holdings for iM-Top50(of 40 Large Hedge Funds) as of 6/10/2022

| Current Portfolio 6/10/2022 | Cash Flow | ||||||||

| Ticker | Number of Shares | Weight | Value now | Open Date | Open Costs | Rebal Costs | Return | Dividends Received | Gain to date | |

| (AAPL) | 31 | 2.45% | $4,251 | 01/04/16 | ($2,109) | $3,910 | $264 | $6,315 | |

| (ADBE) | 10 | 2.27% | $3,938 | 01/04/16 | ($2,118) | $2,765 | — | $4,586 | |

| (AMT) | 18 | 2.60% | $4,518 | 01/04/16 | ($2,033) | $731 | $461 | $3,678 | |

| (AMZN) | 3 | 0.19% | $329 | 01/04/16 | ($1,913) | $6,594 | — | $5,010 | |

| (ANTM) | 13 | 3.61% | $6,277 | 02/28/22 | ($4,503) | ($1,408) | $29 | $395 | |

| (APP) | 164 | 3.41% | $5,922 | 05/30/22 | ($3,147) | ($3,613) | — | ($838) | |

| (BBWI) | 170 | 3.32% | $5,760 | 02/28/22 | ($4,533) | ($3,169) | $17 | ($1,926) | |

| (BRK.B) | 21 | 3.53% | $6,126 | 05/23/22 | ($4,343) | ($2,192) | — | ($409) | |

| (BSX) | 162 | 3.47% | $6,031 | 02/24/20 | ($3,949) | ($2,273) | — | ($190) | |

| (CNI) | 39 | 2.47% | $4,288 | 05/23/22 | ($4,410) | — | $23 | ($99) | |

| (COUP) | 91 | 3.17% | $5,496 | 08/19/19 | ($3,549) | ($5,684) | — | ($3,736) | |

| (CRM) | 35 | 3.60% | $6,246 | 05/22/17 | ($2,315) | ($1,779) | — | $2,151 | |

| (CRWD) | 40 | 3.90% | $6,773 | 05/26/20 | ($4,210) | $2,491 | — | $5,053 | |

| (DASH) | 95 | 3.40% | $5,907 | 05/30/22 | ($3,127) | ($3,845) | — | ($1,065) | |

| (DHR) | 24 | 3.48% | $6,036 | 08/19/19 | ($3,547) | $542 | $50 | $3,081 | |

| (DIS) | 59 | 3.38% | $5,865 | 08/24/20 | ($5,102) | ($1,702) | — | ($940) | |

| (DOCU) | 77 | 2.92% | $5,077 | 08/24/20 | ($5,118) | ($5,436) | — | ($5,477) | |

| (FATE) | 273 | 3.11% | $5,408 | 02/16/21 | ($6,499) | ($6,726) | — | ($7,817) | |

| (FISV) | 44 | 2.39% | $4,151 | 11/18/19 | ($3,209) | ($1,830) | — | ($888) | |

| (FOLD) | 557 | 2.68% | $4,651 | 05/23/22 | ($4,407) | — | — | $244 | |

| (GOOGL) | 2 | 2.56% | $4,446 | 01/04/16 | ($2,281) | $2,292 | — | $4,458 | |

| (INCY) | 87 | 3.53% | $6,125 | 02/28/22 | ($4,566) | ($1,401) | — | $158 | |

| (INTU) | 16 | 3.51% | $6,100 | 02/19/19 | ($3,523) | $60 | $106 | $2,742 | |

| (KMX) | 47 | 2.60% | $4,513 | 05/24/21 | ($5,377) | — | — | ($863) | |

| (MA) | 18 | 3.47% | $6,026 | 01/04/16 | ($2,088) | $334 | $139 | $4,411 | |

| (MCO) | 23 | 3.62% | $6,284 | 01/04/16 | ($2,044) | ($206) | $251 | $4,285 | |

| (META) | 34 | 3.44% | $5,969 | 01/04/16 | ($2,047) | ($2,902) | — | $1,021 | |

| (MSFT) | 16 | 2.33% | $4,048 | 01/04/16 | ($2,085) | $3,882 | $356 | $6,201 | |

| (NFLX) | 22 | 2.32% | $4,025 | 01/04/16 | ($2,092) | ($411) | — | $1,523 | |

| (NOW) | 13 | 3.54% | $6,151 | 11/19/18 | ($2,825) | $721 | — | $4,047 | |

| (NVDA) | 35 | 3.42% | $5,941 | 02/24/20 | ($3,830) | $4,661 | $16 | $6,788 | |

| (QCOM) | 46 | 3.53% | $6,127 | 08/24/20 | ($5,106) | $182 | $220 | $1,424 | |

| (RIVN) | 214 | 3.49% | $6,069 | 05/30/22 | ($3,131) | ($3,328) | — | ($390) | |

| (SCHW) | 92 | 3.30% | $5,724 | 02/28/22 | ($4,555) | ($2,620) | $11 | ($1,440) | |

| (SGEN) | 33 | 2.65% | $4,600 | 01/04/16 | ($2,099) | $1,661 | — | $4,163 | |

| (SHOP) | 18 | 3.61% | $6,272 | 11/18/19 | ($3,233) | ($1,696) | — | $1,343 | |

| (SNOW) | 50 | 3.52% | $6,121 | 02/16/21 | ($6,487) | ($2,768) | — | ($3,133) | |

| (SPGI) | 13 | 2.49% | $4,326 | 05/23/22 | ($4,544) | — | $11 | ($207) | |

| (TDG) | 10 | 3.35% | $5,811 | 01/04/16 | ($2,071) | $215 | $912 | $4,867 | |

| (TMO) | 8 | 2.43% | $4,215 | 05/23/22 | ($4,446) | — | — | ($231) | |

| (TMUS) | 34 | 2.56% | $4,437 | 05/23/22 | ($4,395) | — | — | $42 | |

| (TSLA) | 6 | 2.41% | $4,180 | 05/26/20 | ($4,098) | $10,984 | — | $11,066 | |

| (TSM) | 69 | 3.52% | $6,119 | 11/22/21 | ($6,768) | ($675) | $44 | ($1,280) | |

| (UBER) | 185 | 2.53% | $4,388 | 05/23/22 | ($4,358) | — | — | $30 | |

| (UNH) | 13 | 3.63% | $6,300 | 05/22/17 | ($2,274) | $991 | $303 | $5,320 | |

| (UNP) | 20 | 2.43% | $4,222 | 05/23/22 | ($4,331) | — | $26 | ($82) | |

| (V) | 30 | 3.45% | $5,985 | 01/04/16 | ($2,046) | ($854) | $164 | $3,249 | |

| (W) | 111 | 3.29% | $5,722 | 11/23/20 | ($5,390) | ($6,918) | — | ($6,586) | |

| (WDAY) | 40 | 3.44% | $5,971 | 05/26/20 | ($4,213) | ($2,074) | — | ($316) | |

Appendix A

Hedge Fund Filers:

- Akre Capital Management LLC

- Alkeon Capital Management LLC

- Altimeter Capital Management, LP

- Aristotle Capital Management, LLC

- Baker Bros. Advisors LP

- Barings LLC

- Calamos Advisors LLC

- Capital International Ltd

- Citadel Advisors LLC

- Coatue Management LLC

- D. E. Shaw & Company, Inc.

- Disciplined Growth Investors Inc

- DSM Capital Partners LLC

- Echo Street Capital Management LLC

- FMR LLC

- Fort Washington Investment Advisors Inc

- GW&K Investment Management, LLC

- Hitchwood Capital Management LP

- Jennison Associates LLC

- King Luther Capital Management Corp

- Kohlberg Kravis Roberts & Company LP

- Lone Pine Capital LLC

- Loomis Sayles & Company LP

- Matrix Capital Management Company, LP

- Meritage Group LP

- Panagora Asset Management Inc

- Perceptive Advisors LLC

- Pinebridge Investments, LP

- Redmile Group, LLC

- Renaissance Technologies LLC

- Riverbridge Partners LLC

- Ruane, Cunniff & Goldfarb LP

- Steadfast Capital Management LP

- TCI Fund Management Ltd

- Tiger Global Management LLC

- Verition Fund Management LLC

- Viking Global Investors LP

- Westfield Capital Management Company LP

- Whale Rock Capital Management LLC

- Winslow Capital Management, LLC

Be the first to comment