dulezidar/iStock via Getty Images

The markets have been volatile in 2022, and some say that we are headed into a recession and a bear market. I haven’t done any selling, but I haven’t been doing much buying, either. There are still several stocks that I find attractive at current prices, but there are a couple of these that fall in my highest conviction category. All of them have juicy dividends with a history of dividend growth, low valuations, and businesses that will not suffer (as much), even if we head into a recession. One of these businesses is British American Tobacco p.l.c. (NYSE:BTI).

Investment Thesis

British American Tobacco is an anti-bubble stock with a wide moat. As one of the few mature public businesses in the tobacco industry, BTI has net margins over 25%. This is one of several keys to the bullish thesis. The other keys are the cheap valuation, continued debt repayment, and a large dividend combined with a buyback program. I will be looking for any drops near $40 to add to my position, and I think investors looking for the holy trinity of current income, future dividend growth, and capital appreciation should consider doing the same.

The 5 Keys to Double Digit Returns

I have talked about each of these factors in previous articles, but it is prudent to go over each one again. Many good businesses have a couple of these factors, but it’s rare to find all of them in the same company.

High Margins

The tobacco industry is well known for being a high-margin industry. Combined with the defensive nature of the industry, tobacco stocks have been some of the best performing stocks over long periods of time, especially when they can be bought at attractive valuations. For 2021, BTI earned $34.7B in revenue, with just $6.2B in cost of revenue. That comes out to an 82% gross margin. Once you filter out all the other expenses, BTI had $9.2B in net income for 2021. That’s good for a 26.5% net margin. This level of profitability allows them to pay a generous dividend, buy back shares, and repay some of the debt, all at the same time.

Debt Repayment

BTI’s debt level is the biggest sticking point for me as an investor. I have no issues with companies taking out debt, especially in the current interest rate and inflation environment, but the debt level is higher than I would like. It is the result of an acquisition a couple years ago, and BTI had $47.8B in debt at the end of 2021. That is down from just under $60B at the end of 2017, and I’m hoping the company continues to pay down the debt. More manageable debt levels free up cash for dividends and buybacks.

Buybacks and Dividends

I talked about buybacks and dividends extensively in my previous articles. BTI has started buying back stock on its $2.7B repurchase authorization, and my assumption is that they will be buying back stock for years to come. The dividend yield currently sits at 6.5%, and I think it will continue to grow in the future. It won’t grow in a straight line like dividend king Altria (MO), primarily due to the currency exchange effects, but the dividend should be appealing for investors looking for current income with some dividend growth to go with it.

Valuation

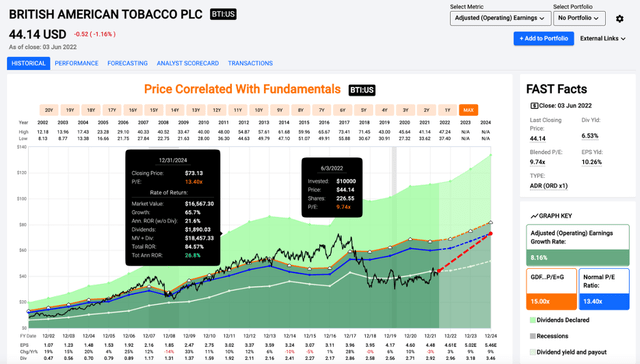

The last, and possibly most important, key to the bullish thesis is the cheap valuation. BTI has basically been stuck in neutral for a couple years with a single digit earnings multiple. Shares currently trade at 9.7x earnings, which is dirt cheap in today’s market. Shares have an average multiple of 13.4x, and investors could see significant total returns if we see some multiple expansion.

Price/Earnings (fastgraphs.com)

I think shares of BTI are a no brainer under $45, but I will be looking to take advantage of any short-term selling if shares dip a little lower to the $40 range. That locks in a 7% yield and limits any further downside in my opinion. When you look at a business like BTI that has high margins, a large dividend and buyback program, and see that it’s trading a single digit multiple while the rest of the market is very expensive, the risk/reward looks very skewed to the upside over the next couple years.

Conclusion

BTI isn’t for every investor. Some investors refuse to invest in the tobacco industry for obvious reasons, and we are all free to make those choices. However, if you don’t have any reservations about investing in tobacco, BTI is a fantastic choice. Investors can buy a piece of a company that is massively undervalued, buying back a bunch of stock, and get paid 6.5% to wait for capital appreciation. The debt levels have been decreasing and should be monitored, but BTI is a high margin cash cow trading at a single digit P/E ratio.

It’s hard for me to imagine a scenario where long-term investors lose money owning BTI if they are buying shares under $45. I will be looking to add to my position in the coming months, especially if shares go below $40.

Be the first to comment