vejaa/iStock via Getty Images

Introduction

In the last 6 months, PLAYSTUDIOS, Inc. (NASDAQ:MYPS) has declined 11.3% as a result of the economy worsening and changing behavioral trends. However, the company still has very solid fundamentals and its valuation remains due for a massive upside.

Company Overview

Playstudios is a free-to-play casual online video game company, which before focused mainly on casino mobile games. More recently, however, they are known for having obtained exclusive rights to Tetris last November. The company makes nearly all its revenue from in-game store purchases along with advertisements. According to Straits Research, the Video Game market was worth $119 billion in 2021, with an attractive 12.3% 8-year CAGR.

Rough Earnings

Playstudios’ Q2 earnings were not pretty. Revenue was $68.4 million, a decline of 3.4% YoY and missing expectations by $3.25 million. The company expects its 2022 revenue to be in the range of $270 to $285 million, which would mean between a 7% to a 1.3% decline compared to 2021. However, this is to be expected. Gaming activity as a whole has slowed down, and it’s hard to beat the records that were set in atypical market conditions. However, they did report EPS of $0.04, which beat expectations by $0.05

Sound Fundamentals

With Playstudios’ revenue stemming from in-game purchases, seeing high daily and monthly active users is vital to understanding the health of the company. Although gaming at large has seen a decline, management reported that in Q2 2022, DAU saw an increase of 17.2% YoY and MAU saw an increase of 54.4% YoY. Playstudios can likely base its success in such a tumultuous time on its loyal player base. Its enduring franchises will secure the confidence of investors even in a depressive economy. With user activity numbers, it becomes clear that Playstudios saw its revenue decline because of reduced amounts of consumer discretionary spending (vs players disliking their games). This means that Playstudios revenue could quickly pick up again as the economy recovers.

In addition, investors might be overly bearish on the growth prospects of Playstudios by comparing it to other triple-A publishers. Playstudios’ catalog largely contains casual games, which a lot of the time are played in the outside world (on subways, waiting in lines, etc.) Therefore, any headwinds to its business will be less felt compared to the rest of the gaming industry.

Valuation

As a gaming company with plenty of growth ahead, a 1.76 P/S ratio by itself is incredibly low. However, I’ll still be using it in my valuation model just to be conservative. Assuming Playstudios grows its revenue at an 8-year CAGR of 12.3% (along with the rest of the market) that puts its revenue at $717.8 million in 8 years. Applying its current 1.76x P/S ratio, which gives us a market cap of $1.263 billion. Discounting this figure back to today (with a discount rate of 10.5%) gives us a price target of $5.04, still a 21.1% upside despite using such a conservative P/S ratio. Not to mention, its valuation remains a perfect take-over candidate.

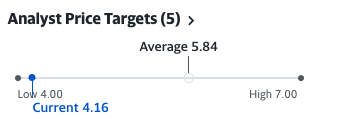

Yahoo Finance

My price target is closely supported by other analysts tracked by Yahoo Finance. With a range between $4 and $7, and an average of $5.84 (a 40.3% upside).

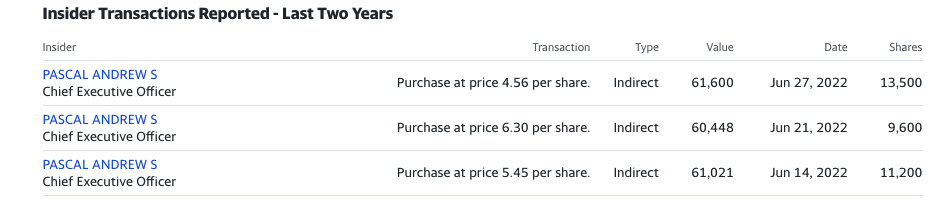

Insider Buying

The CEO of Playstudios, Andrew Pascal, bought the stock three times in June of 2022 totaling over 30,000 shares. Even when the stock fell from $6.3 to $4.56, the CEO continued buying, showing his conviction.

These insider transactions support the bullish sentiments surrounding the stock, serving as a vote of confidence for Playstudios’ growth potential and indicating that the stock is undervalued.

Yahoo Finance

Recommendation

Although Playstudios has been affected by behavioral trends as well as the worsened economy, its company fundamentals are resilient and remain poised for growth. Finally, its valuation is extremely attractive and gives a considerable margin of safety even through a conservative lens. Although the stock might continue to fluctuate in the short term, I’m confident in its long-term growth.

Be the first to comment