DedMityay/iStock via Getty Images

Investment Thesis

Titan International (NYSE:TWI) is in the off-highway wheel and tire manufacturing business. The company is experiencing rising industrial demand due to the favorable financial condition of farmers and rising government infrastructural investments. The company also has a huge backlog order book to fulfill in the coming years. I believe the company has reached the optimum entry point, and the second quarter result supports my thesis.

About Titan International

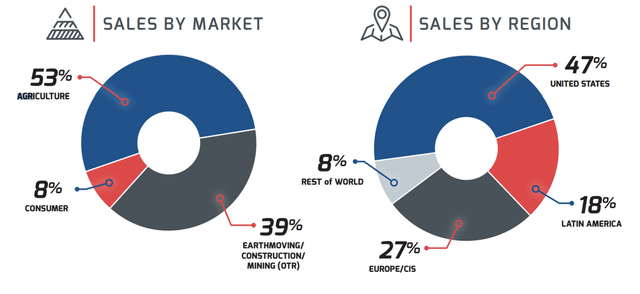

Titan International is a developer and distributor of wheels, industrial undercarriage equipment, and tires. As a pioneer in the off-highway sector, Titan creates a wide variety of goods to satisfy the demands of original equipment manufacturers (OEMs) and aftermarket clients in the earthmoving, construction, consumer, and agricultural markets. The company has a competitive advantage due to its prominent market position in the off-highway wheel, tire, and undercarriage sector and its long-standing core customer connections. I believe the company also has a strong entry barrier because replicating the firm’s production tools, dies, and molds, which are utilized in specialized processes, will require a huge investment. The company reports its revenue under three segments: Agriculture, Consumer, and Earthmoving & Construction Mining. The consumer segment contributes 8%, and Earthmoving & Construction Mining generates 38% of the total revenue. The agriculture segment comprises the most prominent part, which is 53% of the total net sales. Its maximum income comes from the United States, which is 47% of the total revenue. The Latin American market comprises 18%, the European market contributes 27%, and the rest of the global market generates 8% of the total revenue.

Sales by Market and Region (Annual Report of TWI)

Strong Industrial Demand

The company’s OEM and aftermarket divisions both saw strong demand. Farmers have a favorable financial condition because of government aid and high farm commodity prices. Due to this position, low inventory levels, and aging huge equipment, the firm’s demand and earnings have significantly increased. I believe there is still lots of space for growth because large AG machinery is on the older side, and sales are still below 30-year mean trends on the replacement cycle. The combination of these favorable characteristics, unfulfilled retail demand, inventory replenishment, and a robust cycle that extends into 2023 all point to strong product demand for the coming years. The earthmoving and construction division, which does a sizable amount of international undercarriage business, had a successful 2021 and a healthy order book for 2022. After slowing down in 2020, construction activity picked up quickly, and the expansion is expected to be boosted by major government infrastructural development. The benefits of rising demand have already started to impact the company’s financials positively.

Growing Financials

The company has recently reported strong second-quarter results for the period ended June 30, 2022. The company has reported net revenue of $572.9 million, which is a 30.6% growth compared to the $438.6 million in the same quarter of last year. I think the rise in sales was driven by the rising demand in the industry and healthy market conditions. The gross profit margin has expanded by 510 bps and has reached $109.7 million. The significant gross profit expansion was due to the rise in revenue, which caused economies of scale and efficient production. Selling, administrative, research, and development expenses were $36.9 million and have grown marginally by 5.1% compared to the $35.1 million of the prior year’s same quarter. The rise in variable costs drove the increase. The company has reported an operating income of $69.7 million, which is a 194% growth as compared to the second quarter of FY2021.

The company’s net income was $67.17 million or a diluted EPS of $1.06, which is a 2522.32% growth compared to the $2.8 million loss or (0.04) diluted loss per common share. The company’s total cash and cash equivalent has increased by 19% and stands at $116.7 million. Long term debt of the company is $441.1 million. The company believes the full-year sales for FY2022 will reach $2.2 billion and EBITDA at $240-$250 million. The company believes that FY2022 and FY2023 might be the strongest years and end FY2022 with a free cash flow of $90-$100 million. I believe the stated outlook of the company can turn out wrong, and the actual financial results could be significantly higher. According to my analysis, I think the company’s revenue could be 17-20% higher due to the rising industrial demand, and EPS could be $2.19. I believe the strong financials of the second quarter of FY2022 shows that the company is at an optimum entry point, and we can expect strong growth in the coming period.

What is the main risk faced by TWI?

Commodity Price Fluctuations

TWI is greatly affected by the fluctuation in prices of commodities like steel, rubber, and fabric, as these are the main materials required in the production of wheels and tires. The main problem is that the company generally doesn’t enter into long-term contracts and prefers on-spot purchases, resulting in high-risk exposure. TWI isn’t involved in any hedging activities to limit this risk’s exposure. This makes it highly vulnerable to commodity price change. However, there has been no material impact on the company’s performance due to commodity prices in the recent past, but this is a risk that cannot be ignored before taking a position in the stock.

Technical Analysis and Fundamental Valuation

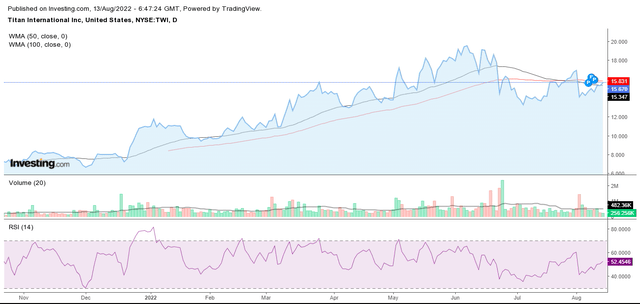

Technical Analysis Chart (Investing.com)

TWI has significant positive technical indicators reflecting a buying opportunity from current price levels. The stock has recently crossed the 50-day weighted moving average (WMA), which generally results in a big upside move. The stock is heading for its 100-day WMA, and once the stock crosses it, we could witness a strong momentum in the stock price. The WMA indicator for TWI is bullish. The stock is currently consolidating in the 40-60 RSI band range; this range is generally considered a buying range for the stocks. The stock could soon head for the 70 RSI band level, and this would result in a huge upside in the stock price. However, there is no significant divergence on the RSI indicator, but the overall technical indicators are bullish for TWI.

TWI has been witnessing strong demand since the last year, which translated into solid quarterly results. I believe the company could continue this growth rate even in future quarters on the basis of sustained strong demand. TWI is trading at a forward P/E multiple of 7.15x with the FY22 EPS estimates of $2.19. This forward P/E multiple of 7.15x is significantly below the sectorial median of 16x. I believe with the strong growth prospects that TWI has; it could trade at a higher P/E multiple of 10x, giving us a target price of $21.9, a 40% upside from the current stock price of $15.67.

Conclusion

TWI has posted strong second quarter 2022 results on the basis of strong demand. The demand is expected to remain solid even in the future quarters of FY2022 and FY2023, which will reflect in the results. The company is trading at a cheap P/E valuation of 7.15x, and it is an attractive investment opportunity for investors looking for a growth stock at a cheap valuation. I assign a buy recommendation for TWI on the basis of these factors.

Be the first to comment