Lukassek

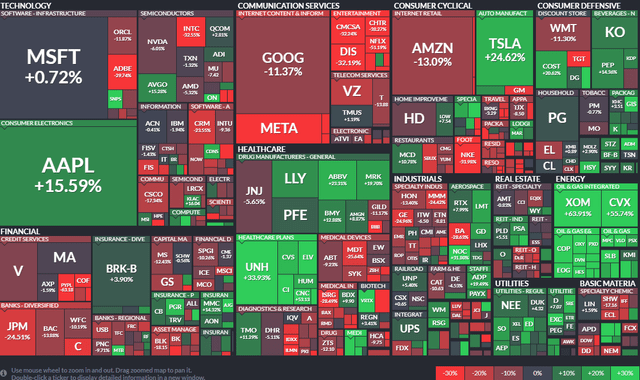

Stocks have staged an impressive rally over the last two months. With the bear market starting in early January this year, it makes one-year returns look not so bad across many sectors. One of the smallest groups in the market is Materials. Chemicals don’t get much press, and there is no industry ETF to play the space. Investors are forced to either buy a broad Materials sector ETF or buy individual Chemicals stocks. The biggest Chemicals industry company in the S&P 500 is actually a foreign firm that sports a positive total return year-over-year.

S&P 500 1-Year Total Return Heat Map

According to Bank of America Global Research, Linde (NYSE:LIN) is the largest industrial gas company in the world, with sales nearing $30 billion following the merger of Praxair and Linde. It produces and distributes atmospheric and process gases, high-performance surface coatings, and engineering solutions. Linde’s products, services, and technologies bring productivity and environmental benefits to a wide variety of industries, including aerospace, chemicals, food and beverage, electronics, energy, healthcare, manufacturing, metals, and others.

The UK-based $152 billion Chemicals industry company in the Materials sector trades at a high 45 P/E ratio using trailing 12-month earnings and features a small dividend yield of 1.5%, according to The Wall Street Journal. The stock trades as an ADR on the NYSE and is listed on the S&P 500.

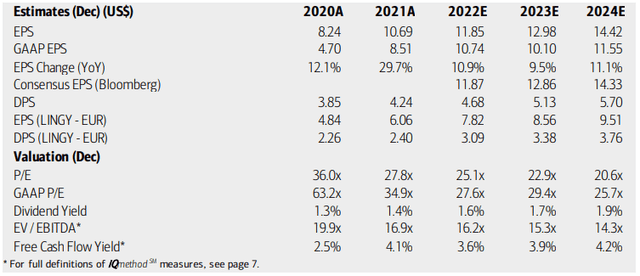

BofA analysts are positive on LIN shares due to the company’s ability to grow earnings through big pricing power and its defensive nature. Moreover, surging energy costs in Europe are a boon for the Chemicals business. Finally, Linde is buying back stock, which is another tailwind. EPS is seen as growing at a healthy 10% through 2024, which helps warrant the high P/E ratio. Still, LIN shares have a high EV/EBITDA multiple and free cash flow is not that impressive. So, the fundamental picture is mixed.

LIN: Earnings, Valuation, Dividend Forecasts

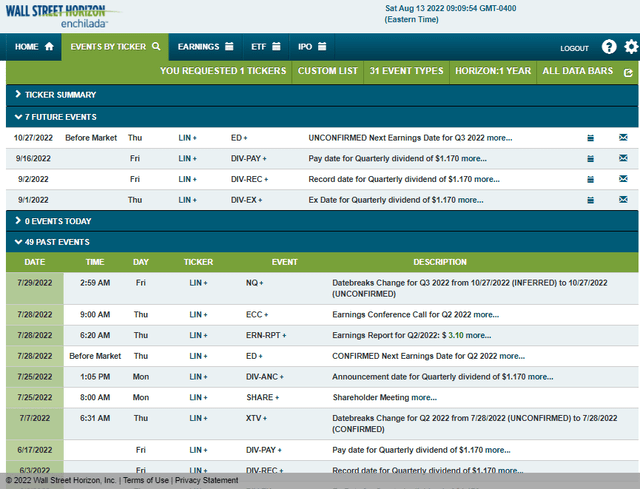

The industrial gas and engineering company reported Q2 profits per share of $3.10 on July 28, beating analyst estimates. Shares rallied to near $300 from $287. Looking ahead, Wall Street Horizon’s corporate event calendar shows a dividend ex-date of Thursday, September 1, before its unconfirmed Q3 earnings date of October 27 BMO.

Linde’s Corporate Event Calendar

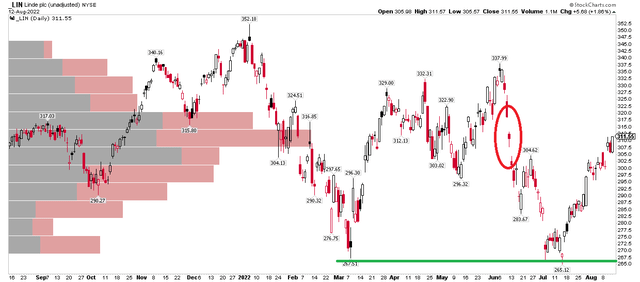

The Technical Take

LIN shares are up 17% from the low just a few weeks ago. That is a monster move for such a big company. I see resistance around current levels based on heavy volume traded in the $307 to $320 range. Moreover, there are two price gaps from June that are now in play. It is a natural spot for investors to book profits. There’s a solid base at $265, so I would be a buyer of the stock on a pullback to about where it began surging around the previous earnings report – near $290. Resistance is in the $337 to $352 range.

LIN: Heavy Volume-By-Price At Current Levels With Gaps As Resistance

The Bottom Line

Linde has a high valuation, but strong earnings growth partially explains that. When looking across several metrics, shares appear somewhat pricey, though. The technical picture is also mixed, but leaning bearish. It’s a good stock to purchase on a pullback – perhaps about 7% lower from Friday’s closing price.

Be the first to comment