Matheus Obst

Azul S.A. (NYSE:AZUL) is one of the three main players in the Brazilian airline market, with Gol Linhas Aéreas Inteligentes S.A. (GOL) and LATAM Airlines Group S.A. (OTCPK:LTMAQ).

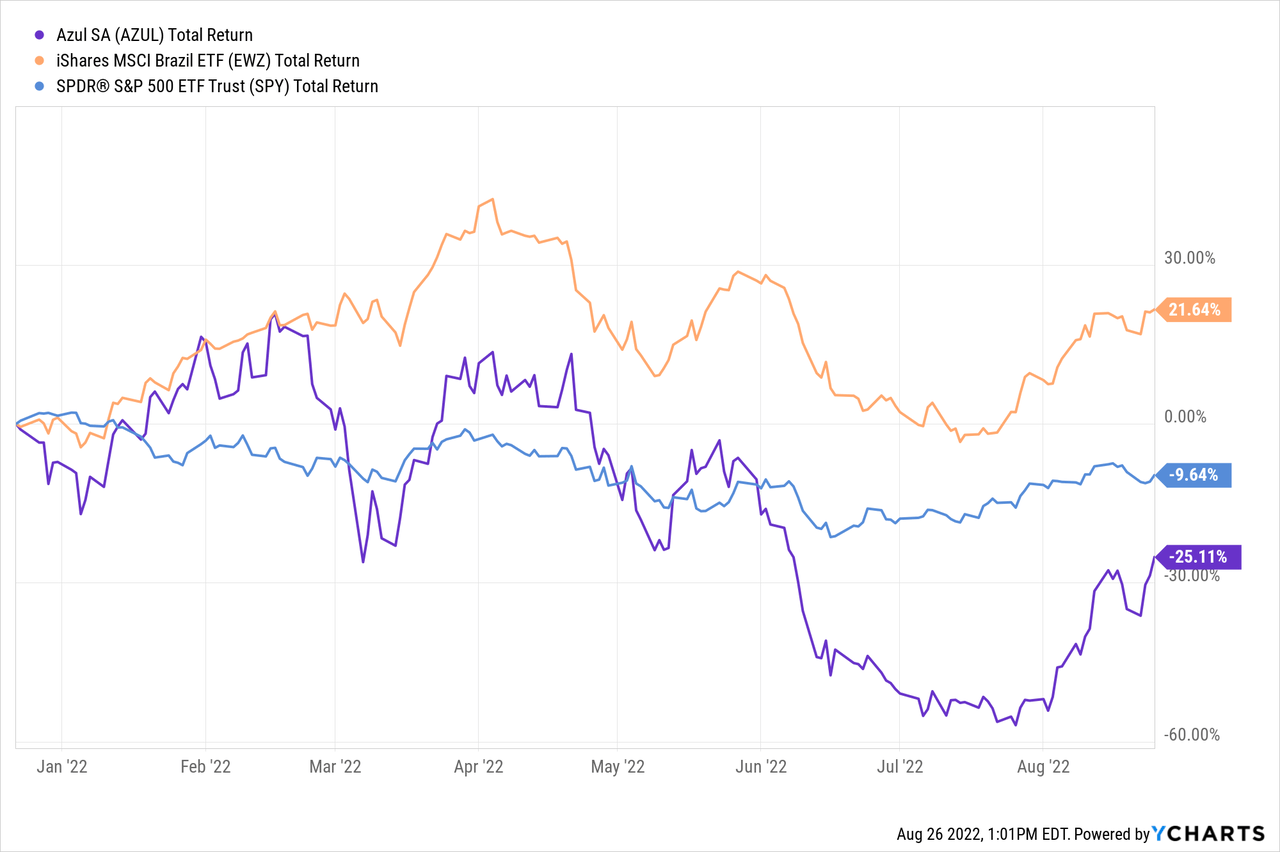

Last year, I wrote an article on the company, with a hold recommendation. Since then, the company has felt more than the S&P (SPY) and more than Brazil’s EWZ ETF (EWZ).

In that article, I cited the industry’s less than desirable economics, and the company’s complicated financial position. Although Azul has some characteristics that make it a better company than its competitors, price seemed too high.

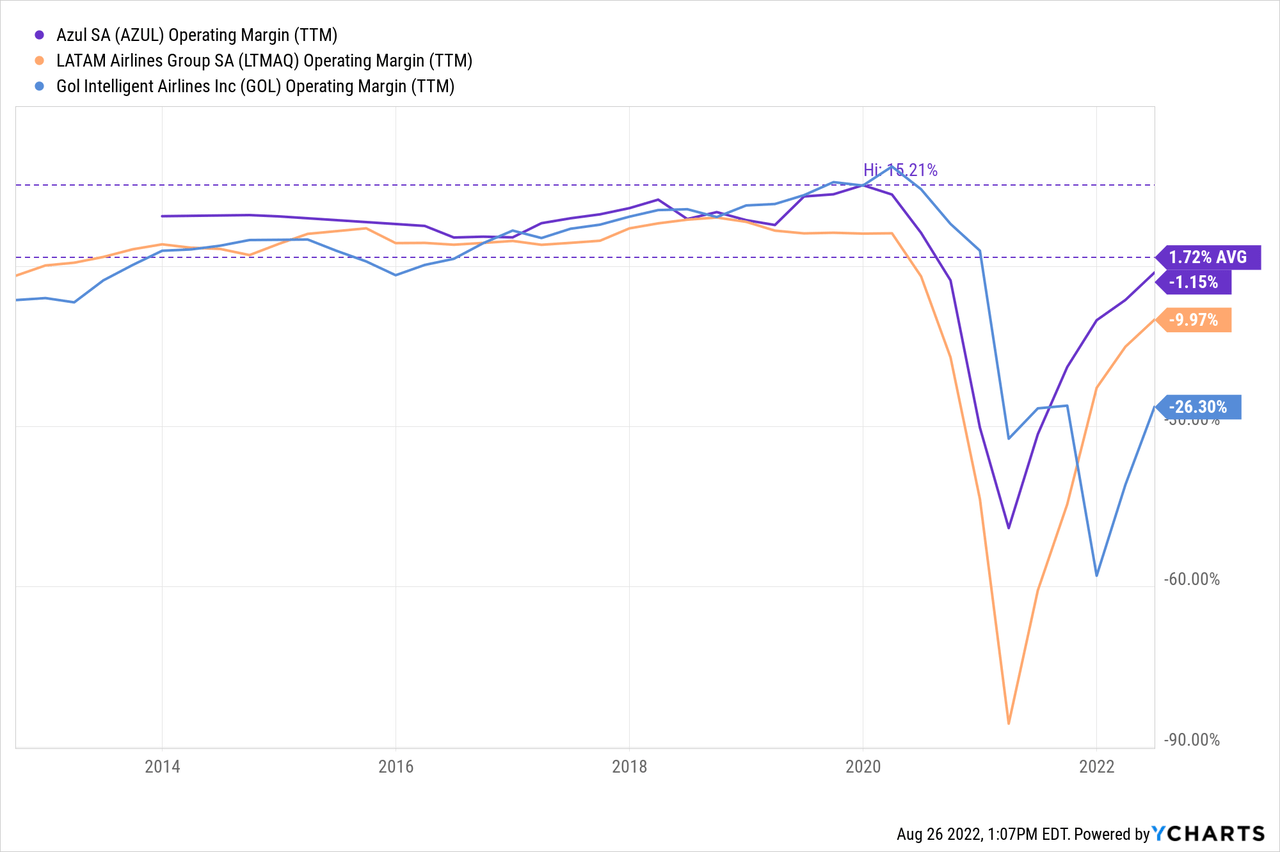

In this review of the situation, I find that Azul has made use of its advantages to recover faster than competitors, returning to operational profitability in the past few quarters. Using its significant operational leverage, it could improve profitability quite fast. Today, the main block ahead is the increase in fuel costs, and how much of that can be translated to customers.

With a lot of debt and lease payments ahead, the company continues to be financially strained. It is currently not complying with its debt covenants and debtors might push for a default. Although I believe this risk is low if the company continues to improve its finances, it is a significant risk factor.

Given the situation, I currently do not recommend Azul, but I provide with some key operational metrics to be followed in the future. In the event of continued improvement or a much higher price discount, it may become a more reasonable (although always speculative) purchase.

Note: Unless otherwise stated, all information has been obtained from AZUL’s filings with the SEC.

Brazilian airline industry

Airlines are an example of bad business economics because of the competitive characteristics of the industry.

With a lot of fixed investments, competitors are pushed to fill the airplanes at almost any cost, sowing the ground for fierce rivalry among companies. Because of its economic sensitivity, they are not allowed to consolidate on competition grounds. High fixed investments provide airlines with abundant credit and capital that drowns the industry in over capacity. Its employees are usually unionized. Many customers spend significant time comparing air ticket prices. A few companies control the plane and engine supply. I could go on.

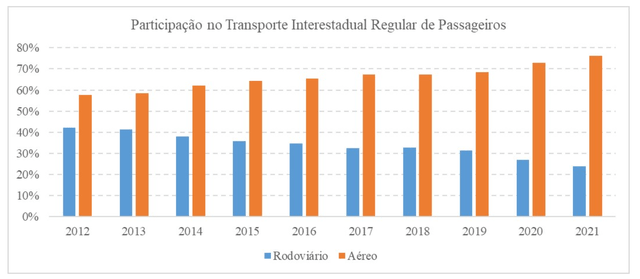

Brazil’s airline industry is not very different, with a few particular characteristics. The country is enormous, and although its more densely populated areas are in the coast, this provides for a higher addressable market. With a growing affluent population, Brazil’s airline market is considered one growing. While the US passenger traffic grew 50% between 2000 and 2019, Brazil’s market grew 300%. Bulls compare that figure with Asia, which grew 1000% in the same period, auguring further growth potential for Brazil. The chart below, from ANAC, the Brazil’s national civil aviation association, shows that air transportation between states is also gaining terrain from road transportation.

Participation in passenger transport, air (orange) and road (blue) (ANAC)

Brazil’s airport infrastructure is somewhat constrained, with many important airports unable to offer more slots. These slots are allocated to companies by ANAC and they can only be lost if they are not used or if the company goes bankrupt. This provides for a significant entry barrier, although it also caps some of the growth potential.

Three companies control 100% of Brazil’s domestic air travel: Gol; Latam; and Azul. Although Latam is somewhat different given that it operates all around Latin America, the three companies show a similar situation: constant low profitability, high debt and negative equity.

Azul in particular

Not every airline is a bad business. Some of them find a niche where they can thrive. Azul has some characteristics that separate it from its competitors, but I have difficulties determining its competitive power.

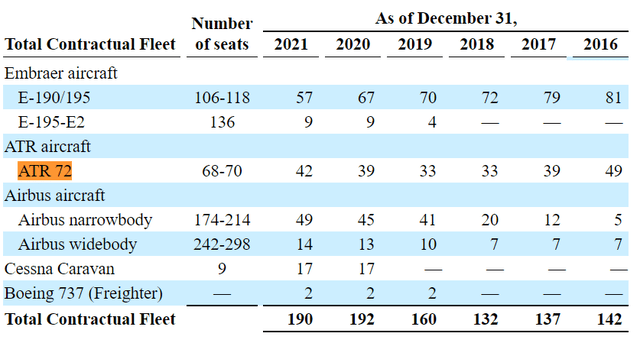

First, Azul operates a range of plane types, from small Cessnas (9 seats), passing through regional turboprop ATR-72s (80 seats), Embraers 195 (120 seats) to narrowbody Airbus (150 to 300 seats).

The company says that having a range of planes allows it to cover many regional routes at better costs than Gol, who concentrates on single narrowbody models like the 737. However, an evaluation of the company’s fleet shows that it has been abandoning smaller planes like the ATR 72 or the E-195 in favor of bigger narrowbody planes.

Azul’s airplanes fleet (Azul’s 20-F annual report 2021)

The company also cites that it is the single provider of service in 81% of its routes. Combined with the plane sizes one would tend to think that the company has a significant competitive advantage.

I doubt that figure because Azul usually operates from far away from downtown airports, and does not disclose city to city shares, but airport to airport shares. For example, it has an almost exclusive monopoly on the Viracopos airport, 100 km. from Sao Paulo, but it has low participation in the centric Guarulhos, and Conghonas airports of the same city. The same is true for Belo Horizonte (Confins airport) and Rio de Janeiro.

The Viracopos airport is so far away that Azul has to offer free shuttle busses from Sao Paulo to the airport. The company does not disclose the weight of this specific cost but it could be substantial. Even if it was not, would you ride 100 km. in a van just to take a plane when you can take another one at comparable prices much closer to where you live?

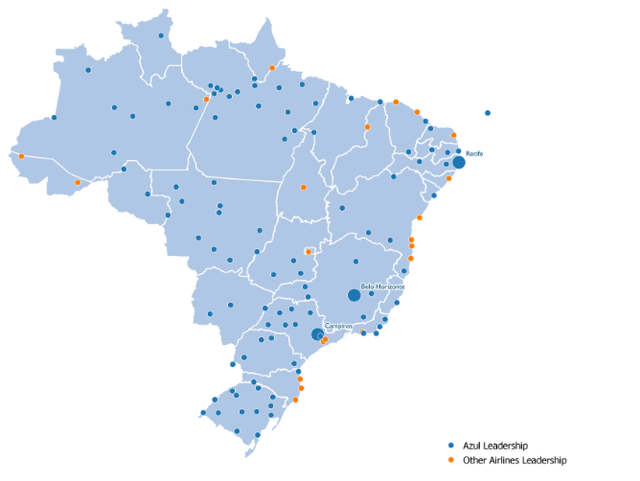

Even with these considerations, Azul shows a primacy in departures in many cities, as the graphic below shows, from the company’s latest 20-F report.

Air departure leader by Brazilian city (Azu’s 20-F report for 2021)

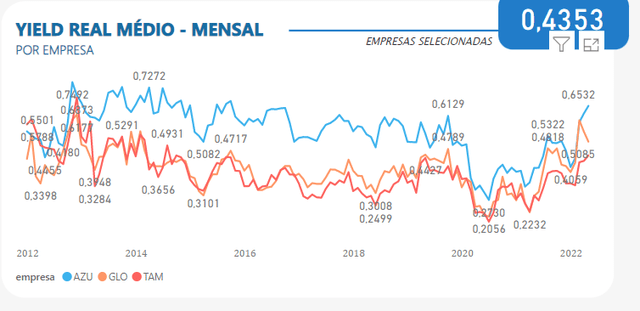

Another contradictory datapoint is that Azul usually shows the highest yield compared to its competitors, as disclosed by ANAC. Yield is a measure of the price paid by a passenger for each kilometer travelled, here in Brazilian reais.

Brazilian airlines’ yield per month (ANAC, Brazil’s national civil aviation association)

Azul’s financials

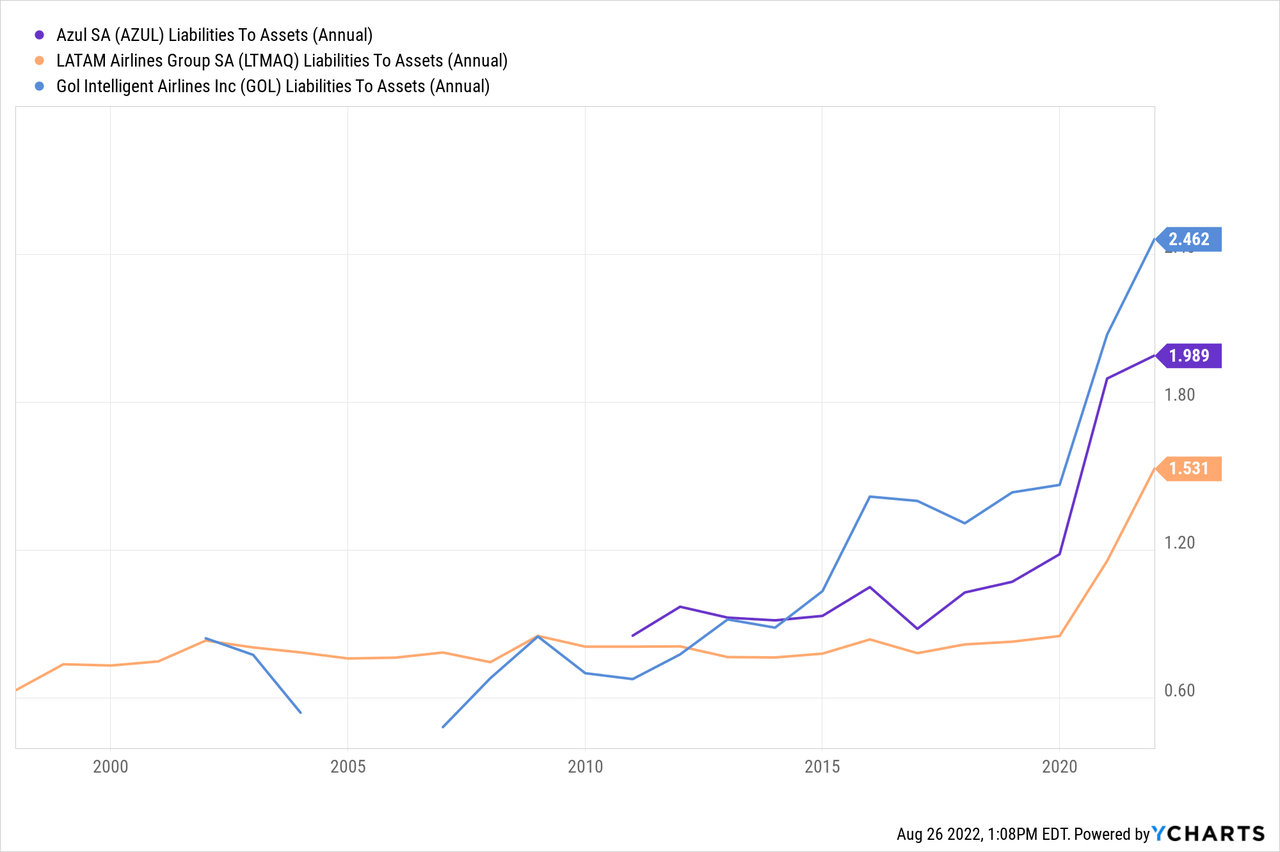

Like its competitors, Azul is drowned in debts, particularly lease debts.

As of 2Q22, the company has about $1.5 billion in financial debts, mostly dollar denominated, paying an average of 7% fixed interest. Those debts are mostly bullet, with maturities concentrated in 2024, 2025 and 2026. These do not represent a significant risk, for the time being.

However, Azul is not complying with its debts covenants. Particularly, it should have a 1.2 obligation coverage ratio (EBIT over debt and lease payments), but it currently has an 0.2 coverage ratio as of 2Q22. It should also show a 5.5 net debt to EBITDA ratio, but it currently shows a 6.2 ratio. Technically, its debt holders could trigger a default event because of covenant non compliance. I do not think this will happen, as long as Azul is still increasing revenues and operating profits, because debt holders and lessors benefit from the company improving its payment capacity, not from savaging whatever is left from a bankruptcy procedure, especially with the company having negative equity. However, if the company’s financials deteriorate, some debt holders or lessors might worry, and considering their own seniority, try to trigger a default and save whatever they can.

Following, the most important financial risk for Azul are its lease obligations, that is why in the chart above I showed liabilities to assets and not financial debts to assets alone. Leases are an obligation just like debt, and they can trigger a default event.

Azul has lease commitments for R$28 billion in the next 7 years, although it discounts them to show only R$14 billion on its balance sheet. These come to about R$4 billion each year, divided between R$1.7 billion operational, shown in operating expenses as depreciation, and R$2.5 billion financial, shown in financial expenses. Lease commitments are mostly dollar denominated.

In fact, lease payments shows that the real financial cost of Azul, without considering its fixed assets (the planes) is very high. As mentioned, Azul pays R$2.5 billion a year in the financial portion of lease costs, for an asset base that is valued at R$14 billion at cost (undepreciated). That comes to an 18% interest rate, denominated and payable in dollars.

The company has not generated the cash necessary to pay for those leases for the past few years, but it has avoided default because it renegotiated lease payments. As an example, in 2021 it should have paid R$4 billion for leases but it paid about R$2 billion alone. The remaining payments where pushed towards 2024 and 2025, when total maturities rise to R$8 billion a year.

My conclusion is that Azul will be fine as long as its financials continue improving, providing its creditors with the assurance that the company is generating funds to pay back. If the financial deteriorate, because of any reason, debtors may run to the door.

Profit perspectives

Azul has been relatively fast in recovering its markets. Although passenger traffic in Brazil was still at 70% in 2021 compared with 2019, Azul showed higher revenues in 4Q21, 1Q22 and 2Q22 compared with 4Q19, 1Q19 and 2Q19 respectively.

Ideally, this situation should have shown a similar recovery in operating profitability, given that most of Azul’s costs are fixed (planes, employees, airport services, hangars, maintenance).

However, the increase in fuel prices ate most of the new profitability. As the chart below shows, the price of jet fuel has more than doubled from the previous decade’s highs in reais, although the USDBRL exchange rate also almost doubled.

Jet fuel cost in Brazil, in Brazilian reais (ANAC)

Azul has not been able to translate this cost completely to customers. While fuel costs represented 27% of 2019’s revenues, they represent 37% of 2021 revenues and 40% of 1H22 revenues.

With that as a major headwind, the company was able to post positive operating profits in the first half of 2022 for R$200 million. The same period of 2019 showed operating profits in the range of R$400 million, with a stronger BRL. These are still well below what is needed to cover financial costs of R$4 billion per year.

How much is needed to justify the current market cap of $1.2 billion for the company? Considering a very generous 10% return, $120 million in net income, which using Brazil’s 35% tax rate translates to $184 million. Add back almost $800 million in yearly interest payments to find almost $1 billion in operating profits. The company has never posted operating profits not even close to $500 million.

Even considering that the company can translate fuel prices to customers, and reach a 10% operating margin, it would need to (hear this) quintuple its revenues, to R$50 billion, before being able to sustain a 10 PE to current prices.

Conclusions

In order to obtain a 10% earnings return on the current share price, Azul should triple its operating margin and quintuple its revenues. That seems improbable. Even if it was possible, that would only provide for the same return many other companies provide today, with much higher certainty.

On the downside the company could easily go bankrupt if it cannot translate fuel costs to ticket prices, or if the effect of ticket increases reduces demand, which is quite possible.

In my opinion, that is not a good return risk profile. In the future, Azul might deleverage, and substantially increase its margins. However, even in that scenario, the main problem the company faces is that its cost of financing planes (the financing cost of leases over the book cost of the planes) is much higher than any operational margin conceivable. As long as that is the situation, only deleveraging and actual negative growth might benefit the company.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment