ilbusca/iStock Unreleased via Getty Images

Published on the Value Lab 5/8/22

We are market opportunists, and while we like Warren Buffett we aren’t usually comfortable sitting still with his long horizons necessary to benefit despite paying a quality premium. Nintendo (OTCPK:NTDOY) is a stock that could satisfy the both of us. It has that opportunistic value while also a buy and hold forever profile constituted of some of the most recognisable brands in the world. It is even recession resistant, and will fare much better than average as the economy works through its current issues. Even with management being passive, a larger multiple could be deserved, and the Switch console still needs to mature with more generation of games to come.

A Look At Q1

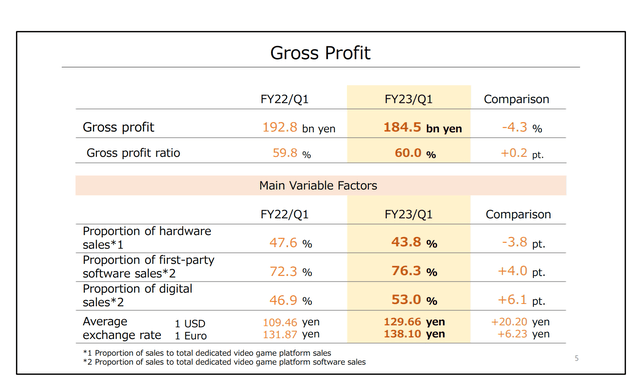

Let’s start with the headline figures. Topline declined by -4.7% while operating profit declined by -15%. The Yen’s depreciation cut both ways, but was more of a positive than negative, with the topline effect likely being around 15 billion Yen, and the SG&A effect possibly being around 3 billion Yen. The release of the new OLED Switch model also helped with sales thanks to the higher ticket price but lower margin as those economies scale up. The impact of the new Switch model limited the benefits of mix effects from first-party software sales growing in the mix, therefore limiting gross profit expansion, and causing gross profit to decline in line with sales.

Gross Profit (Q1 2023 Pres)

SG&A expansion was what really hit the quarter this year and was responsible for almost all of the operating profit declines. It was partially due to the depreciation of the yen, but ultimately that is offset by yen depreciation benefits on sales. The increase in SG&A came from higher logistic costs and higher costs in procuring scarce semiconductor inputs. With declines in software sales from a strong 2021 also limiting mix effects, GM improvements couldn’t offset these declines.

Ordinary profit grew thanks to FX gains and not due to operating factors.

Forecasts have not changed with expected decline in hardware sales at -8% and software at -10%. Software declines can be explained almost fully by strong 2021 comps, while hardware sales are being limited by semiconductor shortages. Higher average selling price of the new OLED model is mitigating some of these declines, but it doesn’t improve contribution, so while topline declines are less evident on account of volume declines, profits will shrink for the FY in line with what we’re seeing this quarter, hopefully better as procurement conditions are expected to improve.

Thoughts

Where is Nintendo going from here? Operating profit is falling on account of higher SG&A, limited contribution from new higher ticket models, and topline unit troubles on account of strong 2021 comps for software, and semiconductor shortages for hardware. Forecasts say they will see a 15% decline in operating profit.

The key increments we are seeing are the following: digital sales are growing YoY by quite a lot, and this is offsetting declines in physical sales of software. Nintendo Switch Online sales are still growing YoY, which is a testament to the growth in recurring revenue streams for the business. Physical sales in both hardware and software (packaged games) are responsible for all the declines. Sell-through sales in software are growing thanks to digital, and this is a help to margins as retailers don’t get a cut, likely having allowed for a tiny bit of GM expansion. This software sell-through impulse is coming from Nintendo Switch Sports and a new Fire Emblem game as well as Mario Strikers. Hardware sales, regardless of channel, are falling and this can be safely attributed to the semiconductor shortages.

Seeing any resilience in software sales, even within only one channel, is welcome. They are higher margin, and they are resilient in the higher margin channels. Moreover, the recurring revenue generators (Nintendo Switch Online) are also seeing growth YoY despite tough comps and same consumers upgrading hardware and obviously not duplicating subscriptions. Now it’s in the hands of Nintendo to release popular games and keep that first-party software success going.

There is nothing that can be done about the semiconductor shortage, but keeping the current base engaged as new platforms are sold will grow the most robust components of Nintendo’s revenue. New mainline Pokémon games are coming out at the end of the year and that will surely give Nintendo another boost as it consolidates its profile and matures. The Switch will likely stay the main platform for another several years, and we feel that Nintendo has the scope within that time to make itself into a more intensely platform-based developer over the next couple of years, which should all improve its margin profile. The company trades at a 9.36 EV/EBITDA multiple, which is low for a recession resistant company with an increasing cash flow quality profile. Remember Activision Blizzard (ATVI), a widely reviled company by gamers, sold for 17x. With a company like Nintendo having one of the easiest times leveraging IPs to release blockbusters, we see them as a pretty clear buy.

Be the first to comment