Fritz Jorgensen

Introduction

Whenever the market rallies hard, we encounter situations where certain stocks that already trade at or above fair value start to rally, as the rising tide often lifts all boats. During bear markets, there’s another saying that applies:

Don’t throw the baby out with the bathwater.

As investors have been rather risk-averse, we’re seeing suffering across the board. Especially stocks related to the “new economy” and tech (in general) are in a tough spot as investors don’t want growth stocks but investments that do well when rates and inflation are on the rise. That’s why GXO Logistics (NYSE:GXO) is suffering.

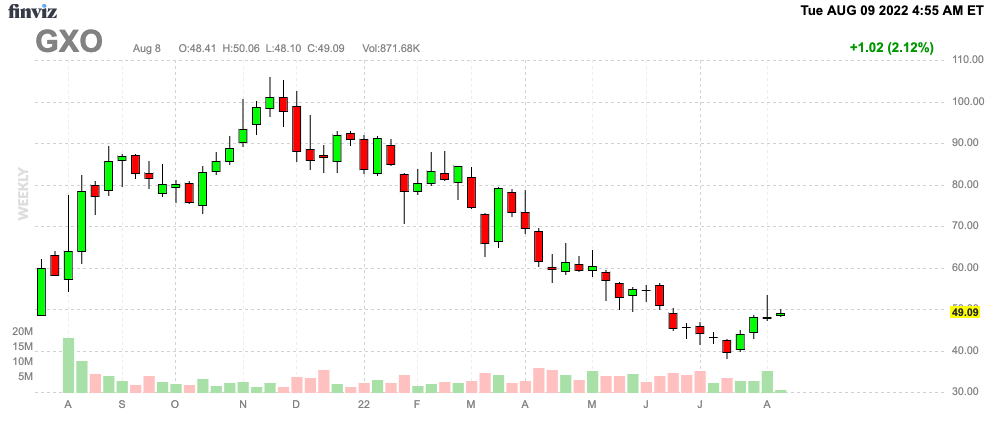

GXO is down 47% year to date, which makes the company way too cheap. While I am down on both of my bullish calls this year, I’m not giving up on the company. On the contrary, the bull case for a long-term investment became even stronger as companies make strategic inventory-related investments to reduce costs. The company’s recent earnings confirm this and make the company a bargain with a forward EV/EBITDA multiple below 10.0. The problem is that the market isn’t letting this company rally.

In this article, I will give you the details and explain when I expect the company to do very well on a long-term basis.

I Was Early

It’s important to admit mistakes, and being bullish too early is a mistake.

I turned bullish shortly after the company’s spin-off from XPO Logistics (XPO) in 2021. While the call worked out nicely in the months that followed, the stock is now down more than 40% since then. While the company’s own business improved during this period – above expectations – I underestimated how much selling pressure would hit the stock as investors dropped everything related to growth.

However, while GXO is a growth stock, it’s also a stock that brings value to the table through already strong earnings and a business model that makes money now, instead of 5-10 years from now.

In other words, while I was early, I’ve only started to like GXO more. And for what it’s worth, even at 2021 prices the company is undervalued.

Now, let’s look at the details.

The Market Environment

There are many reasons why the S&P 500 is down roughly 13% since December 31, 2021. Most of them are related and form a toxic environment for investors’ risk appetite.

Two problems are slowing economic growth and an aggressive Federal Reserve, which is determined to hike rates to combat inflation. Unlike usual economic downturns, investors do not (and should not) expect the Fed to start lowering rates anytime soon.

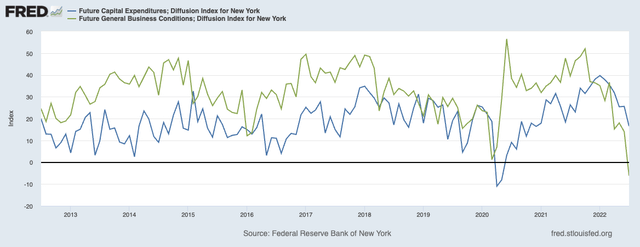

While investors are debating if the US economy is in a recession, there is no debate that growth expectations are falling. The chart below, for example, shows expected business conditions in the New York Fed’s district.

The same goes for expected future capital expenditures, which started a downtrend earlier this year.

That’s bad news for a wide variety of industries that are tied to business investments. Including GXO.

But wait, there’s more.

It’s actually not that bad for GXO as it benefits from secular tailwinds in a cyclical downtrend. In other words, while it hurts the valuation, its business gets stronger.

The other day, I read an article in the Wall Street Journal, which highlighted capital expenditures, especially certain trends that are worth noting.

On the one hand, we see that some companies are boosting capital spending to deal with a challenging business environment, which includes supply chain and related inventory issues:

Companies from Google parent Alphabet Inc. to General Motors Co. to PepsiCo Inc. are among those that have increased spending on big-ticket items, such as real estate, equipment or technology, to fuel growth. The investments are generally intended to expand the companies’ fast-growing operations or even optimize their inventory in the midst of a challenging business environment, according to executives.

This trend is fueled by the need to adapt as well as the fact that a lot of companies built a large cash position during the pandemic years, which can now be put to work.

On the other hand, (other) companies are cutting CapEx and building a war chest as a recession is likely. This explains why companies like GXO do well as I will tell you in this article while indicators like the NY Fed Future CapEx barometer are falling:

Some companies are tightening their belts as they brace for a potential recession. Intel Corp., for example, last week cut its capital spending forecast for the year. The chip maker reported a surprise quarterly loss and its biggest revenue decline in more than a decade, blaming a slump in personal-computer purchases and product delays.

So, here’s what that means for GXO.

Why GXO Logistics Makes So Much Sense

First, let me take a step back and explain what GXO is all about. I believe the company is an Industry 4.0 player, which helps tremendously when it comes to secular growth trends.

As I wrote in my last article:

One of the most important things that investors will have to take into account is Industry 4.0. Basically, Industry 4.0 is a broad definition of the new wave of technological advancements that provide us with a well-connected supply chain. It technically applies to industrial practices but can be used in a broader context. This includes a wide variety of breakthrough technologies like cloud computing to handle data, artificial intelligence, big data, the internet of things, and automation. This new industrial revolution was ‘invented’ in Germany. The country, which is known for its automotive industry, has implemented it by more or less focusing on streamlining the automotive supply chain. This includes keeping inventories low by only ordering what is needed and completely relying on automated processes.

Spectral Engines (Nynomic Group)

I also wrote that GXO is a great way to benefit from this trend without having to buy small startups or big players that also have a lot of exposure in slow-growing areas.

Thanks to XPO spinning off GXO in 2021, we now have a smart-warehousing player.

Since this spin-off, the company is the largest pure-play contract logistics provider in the world. The company provides customers with high-value add warehousing and distribution, order fulfillment, e-commerce, reverse logistics, and other supply chain services differentiated by its technology-enabled solutions.

According to the company:

Our revenue is diversified among hundreds of customers, including many multinational corporations, across numerous verticals. Our customers rely on us to move their goods with high efficiency through their supply chains – from the moment inbound goods arrive at our logistics sites, through fulfillment and distribution, and the management of returned products. Our customer base includes many blue-chip leaders in sectors that demonstrate high growth and/or durable demand, with significant growth potential through customer outsourcing of logistics services.

Now, more than ever, smart warehousing is what gives companies an edge as it allows for efficient inventory levels that protect companies against holding too much in stock or not being prepared in case demand grows.

GXO works with predictive analytics, which helps to stock the right amount of products in e-commerce and omnichannel retail. This also includes dealing with seasonality and statistics like consumers who return products.

I am convinced this area will see even more advanced technologies in the years ahead, which makes it very hard for companies who do not have access to smart warehousing to keep up. Also, as technologies advance, it makes way more sense for companies to work with GXO instead of building their own operations.

Hence, I believe that the more advanced this industry becomes, the bigger the need for third-party logistics like GXO.

A Closer Look At GXO’s Numbers

The company’s recently-released 2Q22 numbers are the perfect evidence of its progress. The company did $2.16 billion in revenue, beating estimates by $70 million. Moreover, revenue growth was 14.9%.

Note that revenue growth was negatively impacted by currency headwinds. A strong dollar is (almost) always bad for GXO as it generates just a third of its revenue inside of the US.

The good news is that organic revenue growth was 20.0%, which is a number that’s way more important than the 14.9% as it shows what GXO is capable of ignoring currency fluctuations.

Moreover, the company raised its organic revenue growth outlook to 12%-16%, which is up from 11%-15%. It now expects full-year adjusted EBITDA to come in between $715 and $750 million. That’s up from $707 to $642 million.

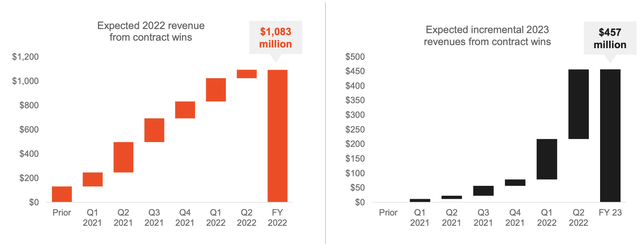

The company won new customers in 2Q22 that are expected to add $475 million in annualized revenue. Next year, these customers are expected to add $500 million in revenue.

What’s interesting is that almost all of its (expected) 2022 revenue comes from deals closed after 1Q21, which shows how strong the growth trend is.

Not only that, but the company won a wide range of high-value contracts including from PepsiCo (PEP), which was mentioned in the Wall Street Journal article I used in this article. The company was also named supplier of the year for another company that relies on efficient inventories: Boeing (BA).

GXO was one of only nine business partners of the aerospace giant out of nearly 11,000 total suppliers to receive this award.

Customers often give out these rewards to strengthen the relationship with key suppliers, which I believe makes sense as especially aerospace companies depend on smooth inventories in a time of volatile demand (uncertainty), supply chain issues, and uncertainty regarding regulations (in the case of Boeing, it’s the 737 MAX program).

Moreover, the company benefits from something called “reverse logistics”, which means reselling products.

E-commerce is growing rapidly for GXO as more big global brands continue to put more of their products online to catch up with consumer behavior. E-commerce generates higher product returns and managing these returns is a problem for most customers. That is why they come to GXO. With GXO involved, our customers get product back into the market faster with up to 96% of products resold to consumers. This is significantly better than the industry as a whole, where 25% of the return products are never resold.

40% of customer wins in 2Q22 included reverse logistics, which – I believe – underlines my statement that higher-tech standards in the industry make the case for third-party logistics even stronger.

Adding to that, the company mentioned that retail inventory levels in the US are 26% above pre-pandemic levels. That’s an issue given that consumer sentiment has fallen off a cliff. Managing inventory is what makes or breaks one’s quarter going forward in consumer sectors. Hence, why not let third-party companies like GXO do it?

And that’s still not everything. 60% of contract wins were for highly automated sites. In other words, customers who wanted the whole package.

So, what about the valuation?

GXO Stock Valuation

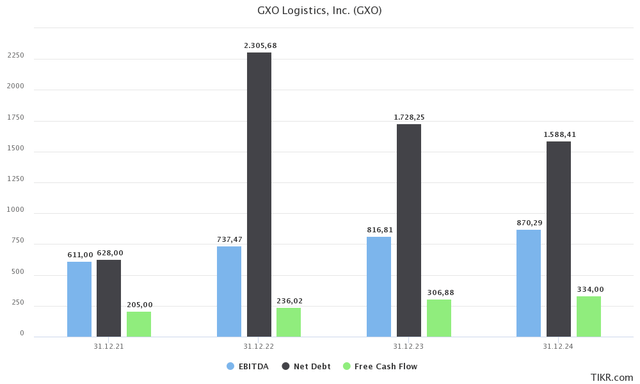

As I said before, GXO is a growth stock, but it’s also a company that already generates value. This year, the company is expected to generate close to $240 million in free cash flow, implying a 4.1% FCF yield. This year, EBITDA growth is expected to be 20.7% followed by 10.8% and 6.5% growth in 2023 and 2024, respectively. I think the company will beat all three numbers.

Moreover, the company is trading at less than 10x expected 2023 EBITDA.

Using its $5.9 billion market cap, $1.73 billion in expected 2023 net debt, and $817 million in expected EBITDA give the company an expected enterprise value of $7.63 billion, which is 9.3x expected EBITDA.

In this case, allow me to quote my last article (when the valuation multiple was 10x):

[…] paying 10x 2023 EBITDA is not a valuation that makes sense, as it’s too cheap. Even if economic growth deteriorates further, I don’t see a scenario where things get so bad that investments in supply chains are canceled. Delayed maybe, but not canceled. Also, as I already said, an implied free cash flow yield of 4.4% is a great deal. It’s similar to the free cash flow of some of the dividend growth stocks that I own.

Based on this valuation, I’m convinced that GXO should not trade below its all-time high.

FINVIZ

Takeaway

GXO Logistics is one of the stocks that just cannot catch a break. The stock market is volatile and down year to date as a result of slower economic growth expectations, high inflation, an aggressive Federal Reserve, and geopolitical issues.

It’s a tough environment and only a few (often large) companies are investing in CapEx.

However, while GXO is highly dependent on business investments, it’s doing fantastic. Now more than “ever”, investments in next-generation warehousing solutions are key. This is resulting in accelerating new business and customers, higher penetration of full-service solutions, and a better than expected full-year outlook despite economic headwinds.

As a result, GXO continues to trade well-below prices that make sense, which is simply a result of investors’ unwillingness to take risks in this market.

While it’s hard to call for a rebound, I believe the Fed will pivot in 2023 when economic growth has dragged down inflation enough to warrant as least the communication of less aggressive hikes.

In other words, given GXO’s cheap valuation but market uncertainty, investors should start small and add on weakness. Also, do not expect a sudden rally in this environment. Prepare to make this a long-term environment, which I think is the best way to play this anyway.

I have little doubt that GXO will grow into a warehousing staple with a market cap much larger than the current one.

(Dis)agree? Let me know in the comments!

Be the first to comment