Scott Olson/Getty Images News

The retail industry is somewhat notorious for being a low margin business, ranging from grocers like Kroger (KR) to the discount retail giant, Walmart (WMT). On the other end of the spectrum, those retailers who focus on premium goods tend to enjoy higher margins and are therefore better positioned in an inflationary environment due to their pricing power.

This article focuses on one such retailer, Foot Locker (NYSE:FL), and explores what makes the recent price weakness a potentially good entry point, so let’s get started.

FL: Bag A 5.3% Yield

Foot Locker has been in business since 1974 and is a retailer of athletic footwear and apparel. The company operates over 3,000 stores in 27 countries, with the vast majority (~85%) located in the United States. Foot Locker generates the vast majority of its revenue and profits from footwear sales. Apparel sales account for a much smaller portion of total revenue, but have been a growing part of the business in recent years.

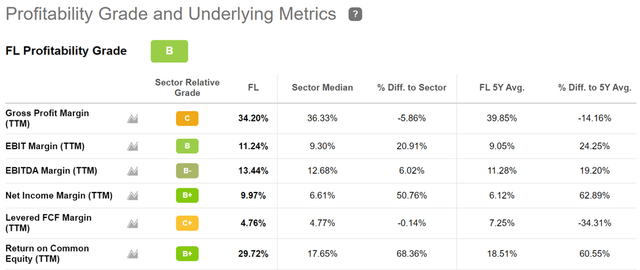

Foot Locker maintains healthy margins, as reflected by its 10% net income margin, sitting well ahead of the 6.6% sector median. This has helped it to earn a B grade for profitability, as shown below.

FL Profitability (Seeking Alpha)

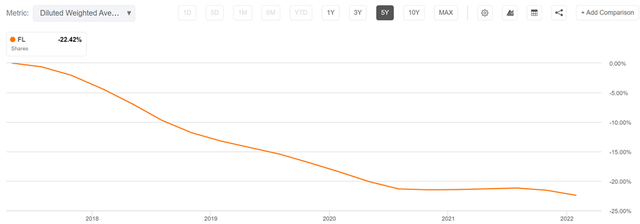

Moreover, management appears to be rather shareholder friendly with share buybacks. This makes sense, as FL’s operating model is tried and true, and doesn’t require heaving reinvestments back into the business. This is supported by management’s recent announcing of a new $1.2 billion share repurchase program. As shown below, FL has retired an impressive 22.4% of its share count over the past 5 years alone.

FL Share Count (Seeking Alpha)

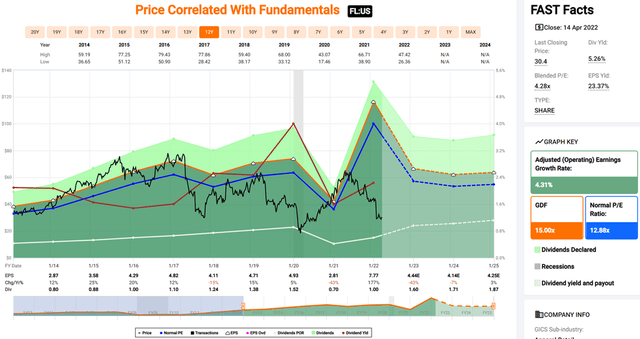

FL’s share price has traded rather weakly since February, when news came out that Nike (NKE) is planning a direct-to-consumer model, which seeks to rely less on retailers such as Foot Locker. As shown below, FL’s share price of $30.40 now sits below its 200 and 50 day moving averages of $45 and $33.60, respectively.

FL Stock Technicals (StockCharts)

Nike represented 70% of Foot Locker’s sales in 2021, and the market obviously fears that such a move by Nike would be detrimental to FL’s sales. Meanwhile, FL has a plan to offset this headwind through product diversification, as it stated that no single vendor will comprise more than 55% of total supplier spending as part of its long-term strategic shift.

Moreover, FL’s business is performing well, with revenue growing by 6.9% during Q4 and nearly 19% in the recently ended fiscal year, the highest in Foot Locker’s history. This was driven by a strong product mix, with strong 30% growth in apparel, and non-Nike comp growth of greater than 30%. This includes momentum FL is seeing around brands such as adidas (OTCQX:ADDYY), PUMA (OTCPK:PMMAF), New Balance, Timberland, UGG, and Crocs (CROX).

Looking forward, management is also addressing concerns around its exposure to U.S. malls with moves to off-mall formats, as highlighted during the recent conference call:

Another area is our shift to bigger box off-mall formats in our rollout of key growth banners, both of which we are accelerating in 2022. Based on the success of our first 50 global community and power stores, we will be growing these formats to approximately 300 locations over the next 3 years. Our community and power stores enhance both our off-mall presence as well as our connection with communities by bringing life to a wider and richer, more locally relevant product assortment.

These stores help us build authentic relationships with our customer at the hyperlocal level by incorporating local elements into the physical designs, partnering with local businesses and organizations and engaging local artists, athletes and influencers. Product from local designers has given special activation, and stores are staffed with local personnel to deepen the ties to the community.

One area I’d like to see some improvement to is the balance sheet, which carries a BB+ credit rating and is one notch below investment grade. FL’s long-term debt currently sits at $394M, sitting above its pre-pandemic range of $125-$130M. This is likely due to its recent acquisitions, and I’d like to see deleveraging over time.

Meanwhile, the dividend was recently raised by $0.10 to $0.40, sitting above the pre-pandemic quarterly rate of $0.38 per share. The dividend appears to be well protected with low 13% payout ratio.

FL stock appears to be cheap at the current price of $30.40 with a forward PE of 6.8. This bakes in an EPS decline that analysts expect this year, but as seen below, still sits well below FL’s normal PE of 12.9 over the past decade. Sell side analysts have an average price target of $33.32, implying a potential one-year 15% total return including dividends.

Investor Takeaway

Foot Locker is a shareholder friendly company that should be able to navigate the challenges it faces, with a clear plan to do so. While Nike’s decision to go direct-to-consumer may weigh on FL’s top-line in the near term, long term I believe the company is positioned for success as it further diversifies its product mix. The recent pullback in the share price appears to have created a buying opportunity for income and growth in a well-diversified portfolio.

Be the first to comment