jetcityimage/iStock Editorial via Getty Images

Fedex’s (NYSE:FDX) quarter doesn’t end for a month but current consensus – as it stands right now per the IBES by Refinitiv data – is expecting $6.84 per share on $24.55 billion in revenue for expected y.y growth of 37% and 9% respectively.

In the last article on FDX, which made the case for a compelling valuation on the stock (written in mid-March ’22), notes that the topsy-turvy world of the pandemic drive a HUGE surge in ecommerce volume at FedEx in mid-2020, only to slow down with the end of Covid towards the end of 2021 and now – finally FedEx is entering a more normal world, except for the fact that there are much higher fuel costs and it’s far more difficult to find workers for FedEx Ground than it was two year ago.

How has FedEx performed the last 20 years?

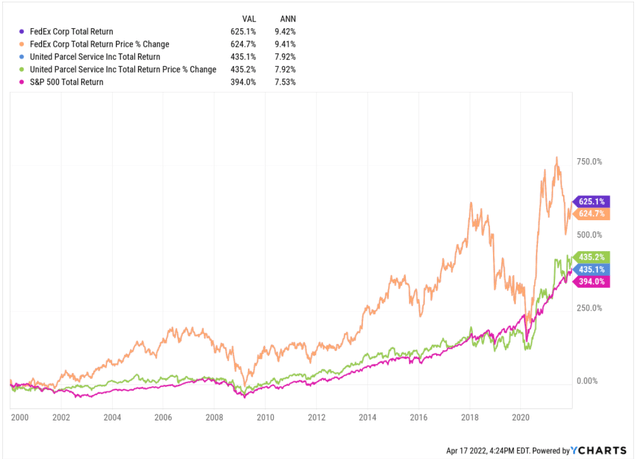

FedEx vs UPS vs SP 500 since 1/1/2000 (Ycharts)

Readers can see that through 12/31/21, FedEx outperformed both UPS and the SP 500 since January 1, 2000, by about 200 bp’s per year.

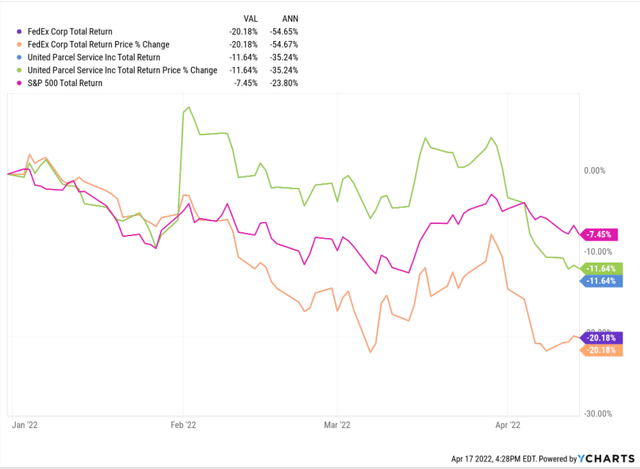

FedEx performance in 2022 YTD as 4/15/22:

FedEx performance YTD ’22 (Ycharts )

Readers can quickly see how FedEx is trailing both UPS and the SP 500’s total return in 2022 as of 4/15/22.

There have likely been many periods over the last 22 years where FedEx has trailed it’s competition and the benchmark for intermediate time frames, but readers can see with the first chart, that the stock typically makes up the difference over time.

Trends in EPS and revenue estimates:

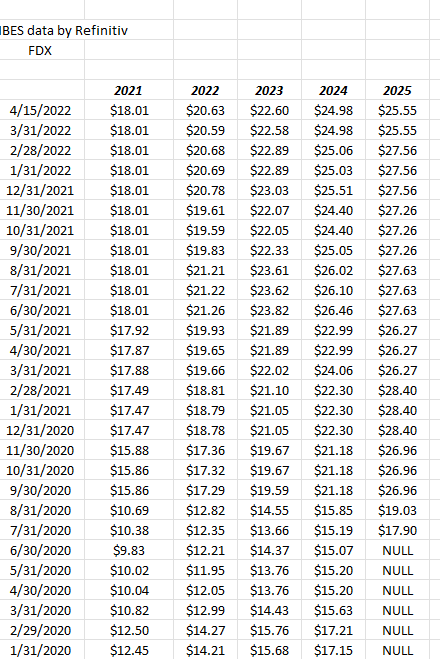

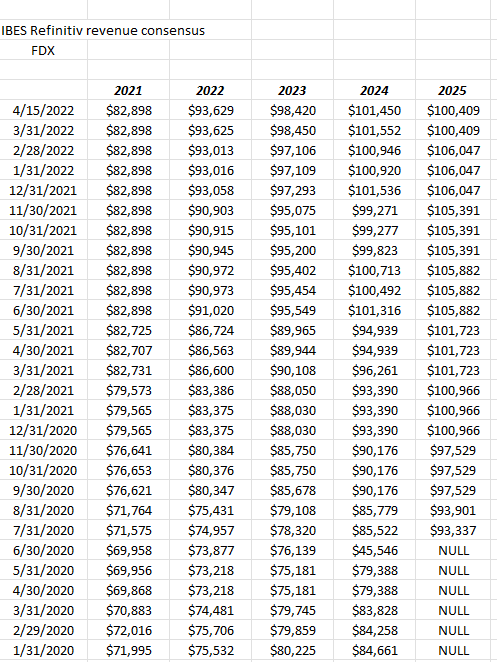

FDX EPS estimate revisions since pandemic (IBES data by Refinitiv ) FedEx revenue revisions (IBRES data by Refinitiv )

The real reason for posting the EPS and revenue revisions on FDX and what happened during the pandemic is to show readers how a little change in revenue for the freight giant, (look at the summer of 2020 revenue revisions and then EPS revisions) can generate a substantial change in EPS.

In business school they teach you that’s called “operating leverage” and it’s inherent within high fixed-cost businesses such as FedEx and UPS and old industrial America.

The point is that we are now exiting the pandemic roller-coaster and even with Ukraine, FedEx should return to more stable and consistent revenue and EPS growth over the next 12 – 24 months.

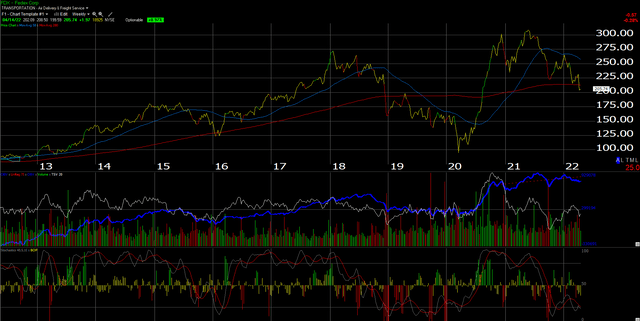

Technical analysis: the weekly chart is now oversold

FedEx Weekly Chart (Worden 2000 Gold )

Like the fundamentals, the weekly chart of FedEx is showing the stock oversold and at a compelling point for longer-term investors.

Summary/Conclusion:

Revenue revisions for FDX have been more positive than EPS revisions as the freight giant struggles with labor issues and costs at FedEx Ground, but the valuation is compelling for the stock at these prices and metrics, particularly the price-to-revenue metric. Historically buying FDX at it’s current 0.6x price-to-revenue and then selling at 1x price-to-revenue, has netted the investor a solid return.

Investors do have recession risk to worry about. Businesses with high operating leverage typically do not fare well as the US economy slides into recession, although once that rate cycle reverses, FDX typically fares well over a strong business cycle.

There was a bullish article in Barron’s this weekend in FedEx, citing many of the factors that were covered in the earnings preview prior to FDX’s March ’22 earnings report. The stock shot higher after earnings and has now fallen back to it’s early March ’22 lows near $200 per share.

Clients have been long the stock for a while and more was bought during the ecommerce volume surge during the summer of 2020, but I didn’t anticipate the ecommerce volume slowdown or the labor shortages, both of which are slowly improving.

The ascension of Fred Smith to executive Chairman is not a worry. The founder of the company and a former Marine Corps. chopper pilot who fought in Vietnam isn’t going anywhere. You truly have to admire a man with that kind of grit and intelligence.

FedEx is currently a 1% position client accounts, which will likely be added to before the May ’22 earnings in late June.

A stronger economy and falling fuel costs (if that should materialize) is a good combination for EPS leverage for FDX.

Be the first to comment