Editor’s note: Seeking Alpha is proud to welcome Chris Shann as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

stock_colors/E+ via Getty Images

Investment Thesis

Rent the Runway’s (NASDAQ:RENT) share price has now dropped 80% since the first day of its IPO in October 2021, presenting an ideal buying opportunity. In fact, the prospects of the company are better now than when they listed – revenue and active subscriber numbers are edging back to pre-Covid levels when, according to Pitchbook, RTR raised $20m in 2018 valuing the company at $770m.

IPO vs Current

Rent the Runway had their IPO on 27 October 2021 and at the final close, the company had a valuation of $1.2bn; the current market cap is $247m. I’m not suggesting that I think the IPO valuation was sensible; it was overpriced – but not only have the key performance indicators improved since October 2021, management’s guidance for future performance is relatively upbeat and I expect to see RTR’s active subscriber base, revenue and product acquisition costs surpass the levels seen pre-Covid. The market is not reflecting this improved outlook.

The backdrop at IPO was:

- Rent the Runway had been heavily impacted during the Covid pandemic and they had to make 15% of staff redundant and furlough another 30%

- Revenue was down – $157.5m was reported for 2020 and $80.2m of revenue had been earned in the six months to 31 July 2021. This compares to $256.9m in 2019

- Long-term debt had skyrocketed from $171.1m in January 2020 to $381.8m in July 2021

- 98k of active subscribers in July 2021; down from a January 2020 high of 134k

The most recent RTR earnings presentation shows:

- $203.3m of revenue for FY 2021

- Long-term debt of $312.8m

- 115k of active subscribers

- The guidance for 2022 is upbeat: $295 – $305m of revenue for FY 2022 and a growing active subscriber base

In this research article, I delve into how achievable RTR’s projections are for three key components where the company needs to succeed to become profitable: the active subscriber base, revenue, and product acquisition costs.

Active subscribers

In their “Q421 Earnings Presentation” Rent the Runway stated that they’re expecting their active subscriber base to increase from 115k in Q4’21 to 130-132k during Q1’22, representing an increase of c.15-17k (13-15%). Given that their Q3’21 active subscriber base was 116.8k, there are doubts over whether this target is achievable.

Can they achieve it?

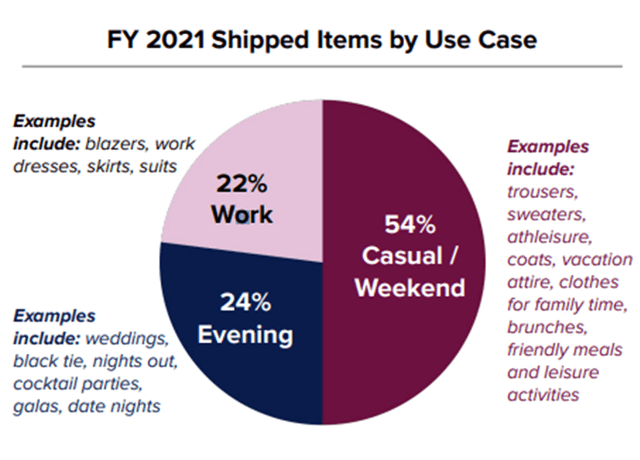

Here’s a breakdown showing what people have been ordering from RTR in FY 2021:

What Customers Have Been Ordering in 2021 (Rent the Runway, Investor Relations, Company Overview)

For RTR to grow their active subscriber base, we need to see an increase in appetite from the American public to socialise, attend events, and return to work.

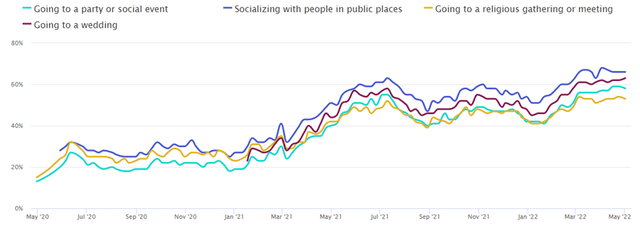

Are they socialising?

Yes, just take a look at this tracker from Morning Consult:

Tracking the Return to Normal: Socializing (Morning Consult)

What about attending events?

According to Allied Market Research, the U.S. Events Market generated $94.8bn in 2020 and is projected to reach $538.6bn by 2030, with a CAGR of 13.0% from 2021 to 2030 (U.S. Events Market Size, Share & Growth | Industry Forecast, 2030).

Heading back to the office?

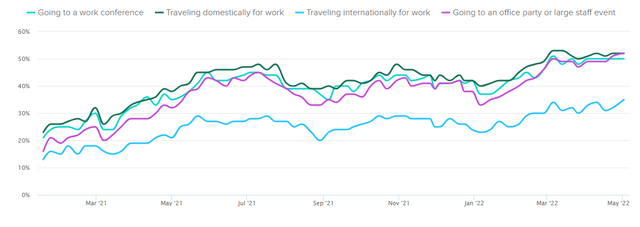

Tracking the Return to Normal: Work & Offices (Morning Consult)

A recent Morning Consult survey indicated that half of Americans feel comfortable going to a work conference, travelling domestically for work, or going to an office party – up from 2021 levels.

We can see that Americans feel more comfortable now than they did in 2021 for all three. Society is returning to pre-Covid levels of interaction and RTR’s active subscriber projections are reflecting this backdrop.

All stats are pointing in the right direction for RTR.

A satisfied customer base leads to more customers

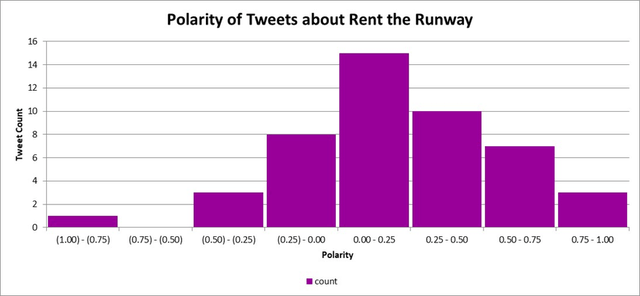

We know that social media has a huge influence on people’s buying behaviour, so I ran a sentiment analysis on what people were posting online.

The following sentiment polarity scoring has been applied to all posts on Twitter containing the words “Rent the Runway” over the past nine days:

Sentiment Polarity Scoring for Tweets about Rent the Runway (Image created by author using data from Twitter)

The above suggests that across the board, the tone of the Tweets have a neutral to slightly positive skew which provides me with confidence that RTR should be well positioned to not only retain many of its existing customers but to also expand its active subscriber base through word of mouth and positive online reviews.

Revenue

RTR have three pricing plans for subscription customers with monthly prices ranging from $69 in the most basic plan up to $235 in the most advanced plan.

Q1’22 guidance is for total revenue of $63.5 – $64.5m; they reported $64.1m for Q4’21. For the guidance to be achieved, I have modelled one possible scenario where:

- RTR will lose 12k of existing customers (~10% churn)

- They expect to gain 29k new ones

- Those new customers will pay an average of $114 per month throughout the quarter (the active subscriber base increases by a net 16.8k (115.2k to 132k) equally over the three months in the quarter and equally in to the three pricing plans)

Other input assumptions include:

- The average existing customer pays $170 per month ($58.8m of subscription fee revenue in Q4’21, divide by active subscribers of 115.2k, divide by 3 for the monthly amount)

- ‘Other Revenue’ remains static to Q4’21 at $5.3m

On the face of things, acquiring 29k new customers in a quarter and losing 12k of the existing active subscriber base seems very unlikely. However, RTR had total subscribers of 159.5k in Q4’21 which means a dormant customer base of 44.3k who have previously been customers of RTR but who have paused their plans. These are consumers who have engaged with the brand before, who understand the product and who – presumably because they have paused their subscriptions rather than cancelled entirely – intend on returning.

I therefore expect a significant amount of the 29k new active subscribers to come from the dormant subscriber base.

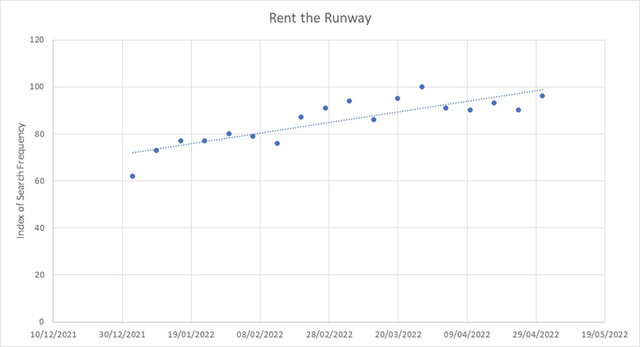

As for the newly acquired subscribers – the societal backdrop suggests that there could be a rise in demand for Rent the Runway’s services during FY22, and by analysing Google Trends for the year to date, we can see an upward trend for searches of the company name.

Google Search Frequency of Rent the Runway (Image created by author using data from Google Trends)

This heightened interest in the brand will be the missing piece required for RTR to achieve their net gain of 16.8k new active subscribers and thus, achieve their revenue guidance of $63.5 – $64.5m for Q1’22.

Product acquisition

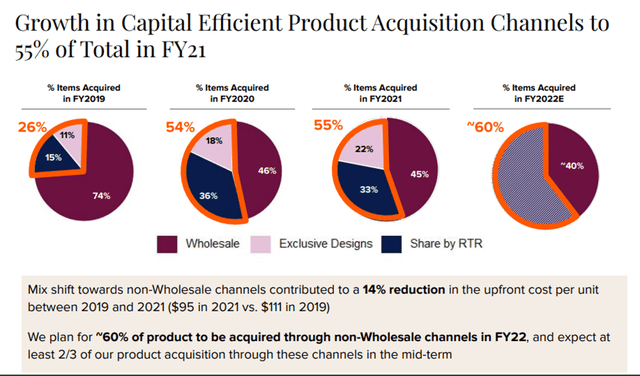

Rent the Runway acquire products through three primary channels: Wholesale; Share by RTR; and Exclusive Designs.

The portion of RTR’s products that are sourced through Share by RTR and Exclusive Designs – the more capital-efficient sources – has grown from 26% in fiscal year 2019 to 55% in fiscal year 2021. The company stated in their “Q421 Earnings Presentation” that they are targeting 60% of products to be acquired through non-wholesale channels in FY22.

Change in Product Acquisition Channel Mix (Rent the Runway, Investor Relations, Q421 Earnings Presentation)

This has helped to estimate that if RTR achieves its FY22 target of having 60% of its products acquired through non-Wholesale channels, then they should be able to achieve an average upfront cost per unit of $92 – a 3% reduction to FY21 levels.

|

Wholesale |

Share by RTR |

Exclusive Designs |

Upfront cost per unit ($) |

|

|

2019 |

74% |

15% |

11% |

111 |

|

2021 |

45% |

33% |

22% |

95 |

|

2022 |

40% |

37% |

23% |

92 |

This is a significant cost improvement and bodes well for the future of the business; being able to establish stronger relationships with brand partners and pivot to the two more capital-light acquisition channels will benefit the company in the long run and allow it to expand its margins.

One point of concern is the cash spent on the purchases of rental product – in 2019, RTR spent $117.7m on new products but in 2021, that was reduced to $30.8m. By applying the average upfront cost per unit provided by the company ($111 per unit in 2019 and $95 per unit in 2021), we can calculate that roughly 1.06m of new products were acquired in 2019 compared with only 325k in 2021.

There could be a variety of reasons for this – perhaps, due to the pandemic, the company is holding elevated levels of high-quality stock and there isn’t a need to replenish it at the same rate; or perhaps – slightly more cynically – in the pursuit of an improved free cash flow and better profitability, the company has adopted a very short-term view by delaying the expenditure which will only cause a problem in a few months’ time.

The stock price has been pummelled since their IPO and I doubt that senior management would want to undo their work of repairing the company’s reputation in the eyes of investors. I suspect the reduction in cash spent on purchases of rental product is because RTR holds elevated levels of stock that are in a good condition and they are choosing to be more selective on the apparel and accessory lines being offered to customers going forward.

Incidentally, RTR has forecast acquisition of new product spend of $60m for FY 2022 which equates to ~650k of new stock – double the number of 2021 but 60% of 2019 levels.

Valuation

For FY 2019, RTR generated revenue of $256.9m and had a valuation of $770m (according to Pitchbook, RTR raised $20m in 2018 valuing the company at $770m), giving them a P/S ratio of 3.0. For FY 2021, RTR had revenue of $203.3m, yet its current valuation is $247m. The P/S ratio is 1.2. Applying a P/S ratio of 3.0 to the most recent full year revenue, we get a target valuation of $609m, or $10.91 per share. As the current price is $4.42, I think there is significant upside to this stock.

Risks

The main risk that I foresee for investors is that the active subscriber base targets are not achieved, directly impacting the revenue earned and compounding the company’s losses. RTR is loss making and left unchecked, could end up with negative equity. The company had net losses of $(39.3)m in Q4’21 and with current equity at just $71.1m, a marked improvement is urgently required. I believe that RTR will achieve its targets and although the company won’t be profitable in the immediate future, I think they will turn things around.

Summarising recommendation

Summarising the analysis above, I would conclude that the IPO valuation of $1.2bn was overstated, but the current market cap of $247m is too low – particularly because the company is returning to 2019 performance levels when the company was valued at $770m. The general sentiment from customers about the company and its services is skewed towards the positive side of neutral which is reason for optimism about the stock. Achieving the Q1’22 active subscriber base of 130 – 132k and revenue guidance of $63.5 – $64.5m will be a challenge, but I am expecting to see the company going some way towards that in the near term. If RTR can sufficiently grow its active subscriber base, it will eventually have more leverage to negotiate better product acquisition contracts with its brand partners and thus lower its cost base in the medium to long term.

Taking a step back from the analysis above, I ask myself the question: does this business make sense to me and is it conceivable that the business will perform better than the market currently prices it to? In short, I think it will. More companies are encouraging their employees to return to the office and there is pent-up demand for social events that have been delayed or cancelled over the past two years (i.e., weddings). I am no fashionista, but people will want to dress well for this and subscribing to a service like Rent the Runway makes sense – particularly with the backdrop of a rise in inflation where people may not have the money to purchase multiple new outfits. I don’t think it’s for everyone but, on balance, I think there is demand there and I expect their active subscriber base to increase over the course of 2022, which in turn will grow revenue and reduce the company’s losses.

My recommendation for Rent the Runway is, therefore, a buy.

Be the first to comment