Investment Thesis

Visa Inc. (NYSE:V) is doing well to cope with the macroeconomic challenges that have been an obstacle for many companies this year. Consumers remain strong, payment volume is growing, and the international traffic recovery has been a strong support for Visa’s financial results. An attractive upside is already included in the market price, but we maintain HOLD status owing to the likelihood of further declines in the major indices.

Digital payments market and Q3 2022 report

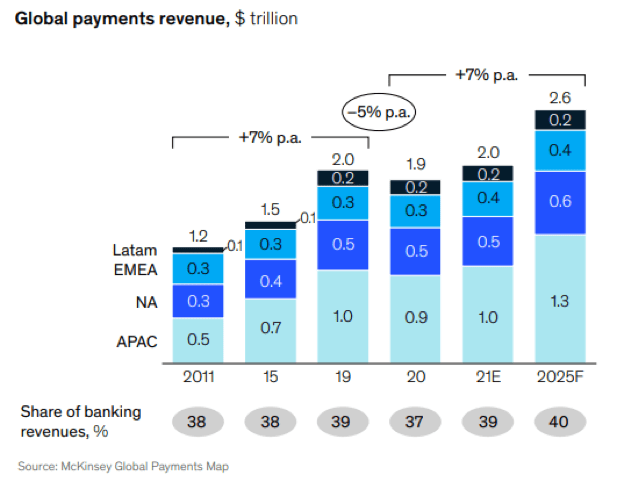

Visa has been showing strong growth in financial results for many years, which is a consequence of the economy digitalization and more frequent use of non-cash modes of payment, according to McKinsey Global Payments Report 2021. While the concentration of cash in developed economies has significantly decreased, there is still room for growth in the digital payments market through developing countries and consistent abandonment of paper money.

FinkAvenue McKinsey

Despite the presence of negative factors in the global economy (high inflation, decline in real income, etc.), Visa’s recent report shows that the company has coped well with macroeconomic conditions, and we expect the financial results of future periods to be stable.

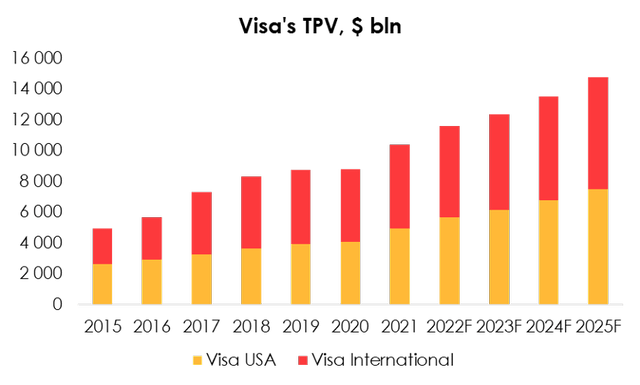

The Services segment is largely the base of other divisions and now it is showing remarkable performance. As of the end of Q3, total payment volume was up by 8.01%, with credit card payments being the main driver. In our previous article, we have discussed that with rising interest rates and declining consumer activity, Visa is likely to face a severe drop in TPV.

Based on Q3 results and retrospective data review, we have concluded that Visa is able to avoid these problems.

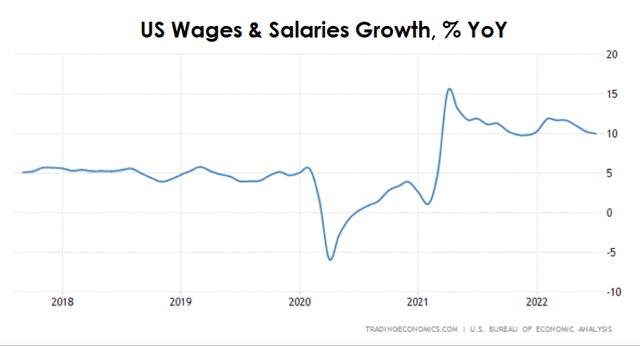

Consumer takes on all the hardship, record wage growth YoY allows, according to Trading Economics, households to maintain basket volume in the face of price hikes for all commodities.

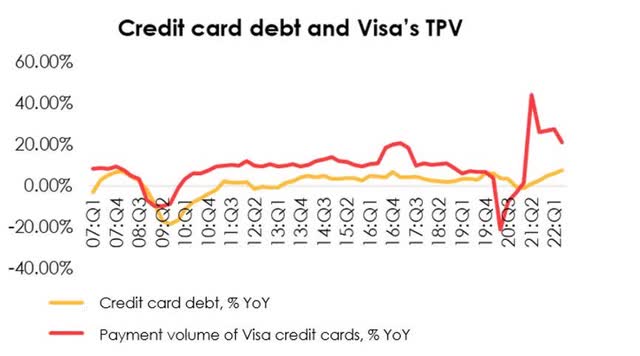

After reviewing retrospective information, we have concluded that credit card debt volume is not a fully predictive indicator of Visa’s payment volume. Visa’s TPV growth has outpaced credit card growth by ~8% over the past 20 years. We attribute this to the fact that many banks do not charge interest if the debt is paid off within a short period.

Credit cards have largely replaced debit cards, which is clearly visible both in the U.S. and abroad. We have revised our TPV and revenue forecast for the Services segment upwards. According to our calculations, Visa’s TPV will grow at an average rate of 8.40% per year over the next 3 years.

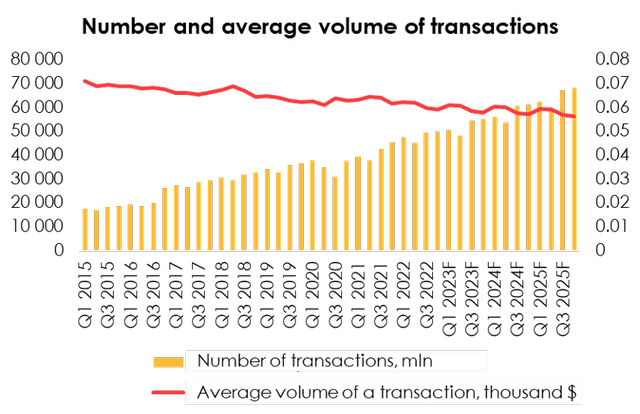

Another important growth driver is the decrease in the average ticket with overall increase in payment volume. Thus, the company processes more transactions and earns from clearing, settlement, network access etc.

Given the steady downward trend in average transaction size due to more frequent daily use of cards, Visa’s future revenue in the Data Processing segment will continue to grow substantially, unless the company changes its monetization system.

Post-COVID recovery is a strong support for Visa

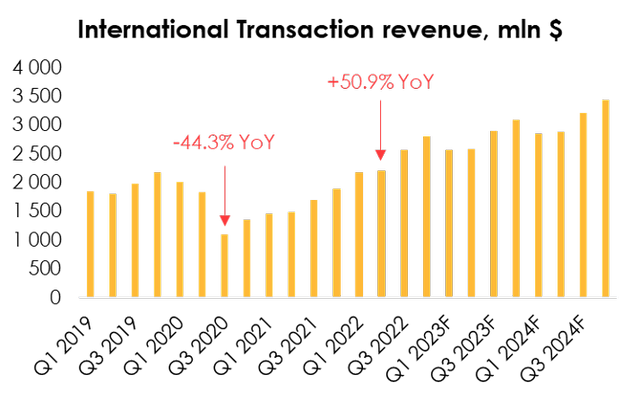

The 2020 pandemic hit many industries hard, including transactional services. The e-commerce industry boomed thanks to incentive payments, loose monetary policy, and limited mobility, but the volume of international payments fell dramatically.

Although the share of such transactions in total volume is small, it is a real goldmine for Visa, as the company can also earn on exchange rate differences and retain higher fees.

The segment’s revenue nearly halved in Q3 2020 (-44.3% YoY) but has been growing steadily since then. In Q3, the revenue increased by 50.9% y/y, even though international passenger and freight traffic did not fully recover to 2019 levels.

According to our calculations, the segment’s revenue growth will reach normal level of 11.24% YoY in 2024. Average 3-year growth will total 11.86% YoY.

Solid margins, high quality free cash flow

When we see massive margin squeeze among manufacturers, Visa is generating stable operating profit without a decline in profitability. In Q3, the operating profit margin was 57.04%, but there was negative effect of one-time litigation expenses (9.85%). As of the end of Q3 fiscal 2022, despite record wage growth, business margin outperforms the previous period. Next quarter will see the effect of the premature salary indexation mentioned by the management, but we do not expect it to significantly impacted on Visa’s profit.

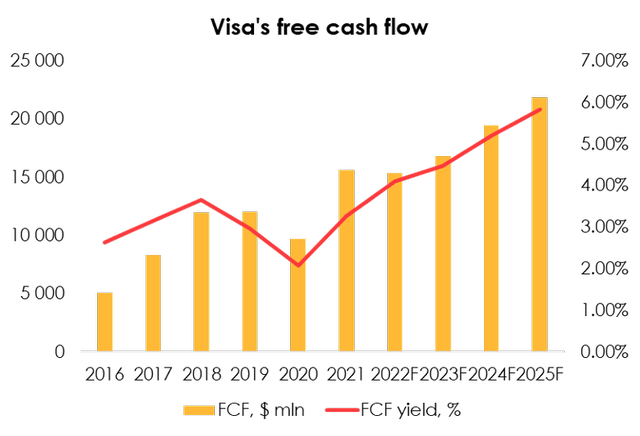

The conversion rate of EBITDA to FCF during the last 5 years averaged 71%, allowing Visa to conduct active share buyback and maintain stable dividend policy.

According to our estimates, FCF will total $15 369 mln in 2022 and increase to $16 794 mln in fiscal year 2023.

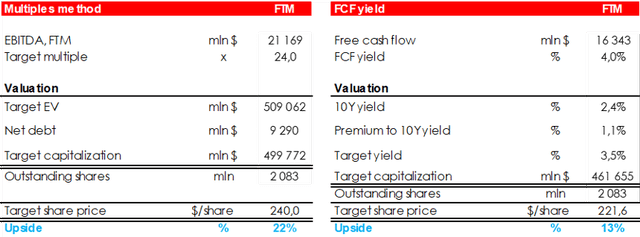

Valuation

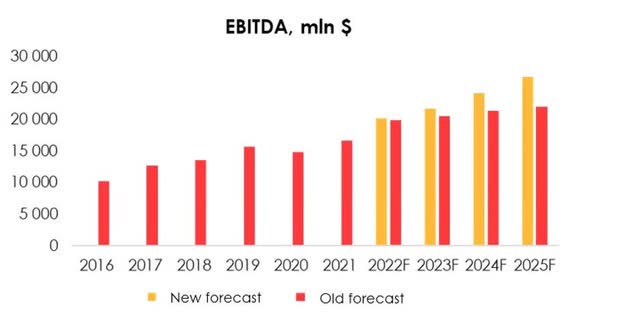

We are raising the EBITDA forecast from $19 892 mln (+20% y/y) to $20 175 mln (+21% y/y) for 2022 and from $20 509 mln (+3% y/y) to $21 676 mln (+7% y/y) for 2023 due to:

- A change of Visa’s revenue model: We now reflect performance of all segments of the business in the revenue forecast.

- An increase of the revenue forecast due to a smaller decline of consumption and a sustainable trend among the population toward a transition to digital payments.

We are raising the target price for the shares from $203.1 to $230.8 due to:

- The increased EBITDA forecast for 2022-2023.

- The shift in the FTM valuation (we earlier included the period from 3Q 2022 through 2Q 2023 into the forward 12 months EBITDA forecast, while now the forecast period runs from 4Q 2022 to 3Q 2023).

Based on the new assumptions, we are maintaining the rating for the shares at HOLD. The upside is28%.

Visa seems to have an excellent outlook, and significant upside is already included in prices. Nevertheless, due to high volatility on the stock market, we do not take the investment idea yet, as we set the BUY status at upside of 30% or higher. Visa is already very close to it, but we prefer to wait a bit.

Conclusion

From a fundamental perspective, Visa is doing very well. We see that the current macroeconomic conditions are not a large obstacle for the company. There is still strong demand for Visa’s services, and the management is doing a great job of managing costs.

We maintain HOLD status on the company for now, but we are very close to upgrading it to BUY. We believe that investors should wait a bit due to the current turbulence on the market. However, since the stock already has significant upside, it is reasonable to start taking the position in small increments right now.

To manage the position, we recommend keeping an eye on the financial statements of Visa, the company’s events for investors, industry surveys (e.g. Capgemini) and key macroeconomic indicators.

Be the first to comment