SimonSkafar/E+ via Getty Images

Since my last article on Power REIT (NYSE:PW), shares have been cut in half. I’ll be the first to admit that I’m not a market timer or short-term trader, but that is unusual, even for me. Such is the microcap investing world. However, I recently took a position in the company after the recent 10-K, and I think the upside could be significant. There are reasons that I still think the company is a speculative buy compared to larger competitors, but a little bit of Power REIT could go a long way.

Investment Thesis

Power REIT is a microcap REIT with a market cap just over $100M. The company owns an interesting set of assets, from railroads to solar farmland and even greenhouses for cannabis. They recently purchased a greenhouse for produce cultivation, but the transition to focus on greenhouses has kickstarted growth for the company. It is projected to continue to grow at a rapid pace, and the valuation is reasonable today at 14.5x price/FFO. It’s only a matter of time before the company starts paying out a dividend, which will likely grow rapidly as well. There are a couple of things about the company that give me pause, but I think Power REIT is a speculative buy today with significant upside if the bullish thesis plays out.

Business Update

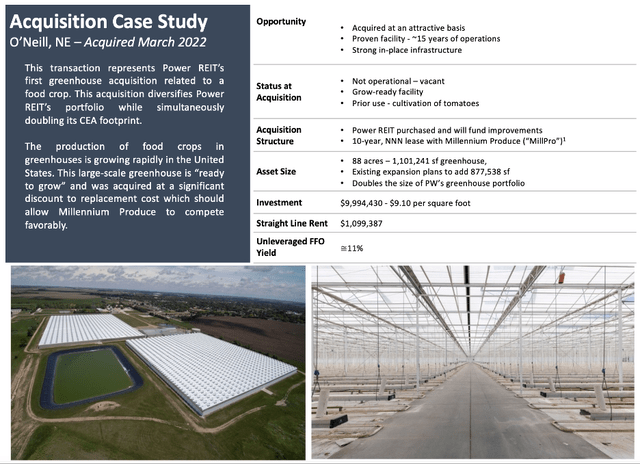

Power REIT has continued to grow its real estate portfolio and recently added another property in April 2022. While the recent focus has been on cannabis cultivation, this property is a greenhouse in Nebraska for producing food crops. The company did record a one-time write off of $0.54 per share for 2021. While the write off isn’t ideal, I’m not too worried about the impact on the long-term future of the company.

Nebraska Greenhouse (Power REIT)

One of the biggest question marks for me are the related party arrangements with several tenants for Power REIT. Several properties are leased to Millennium Sustainable Ventures Corp. (OTCPK:MILC), which has the same CEO as Power REIT. While I think the huge insider ownership mitigates some of that risk and aligns management with shareholders, I still view Power REIT as a speculative position. The valuation has started to get very attractive for investors that understand the situation and are willing to deal with volatility.

Valuation

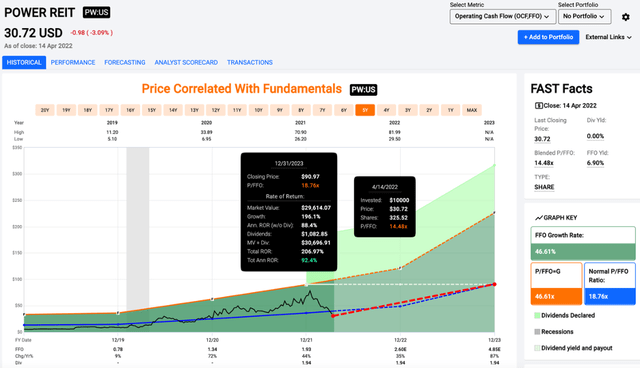

One of the main drivers of the bullish thesis for Power REIT is the valuation relative to the growth potential. Shares currently trade at 14.5x price/FFO, which is below the recent valuation average multiple. The reason I shortened the timeline is that the company started to materially grow FFO/share. The average multiple of 18.7x would still be cheap relative to the expected growth. With FFO/share projected to double in the next couple years, I think shares could be a steal in the $30 range.

While the projected FFO/share growth certainly looks attractive, some investors might be wondering why Power REIT doesn’t pay a dividend. Due to their net operating loss and other properties, they haven’t paid out a dividend since 2013. In my opinion, that is going to change in the next couple of years.

The Dividend?

Power REIT is eventually going to pay out a decent dividend if they continue to grow FFO/share at these rates. I think it will happen at some point in the next couple years, but I’m not going to try to pinpoint the exact timing. The lack of the dividend is part of the reason why I own much larger positions in AFC Gamma, Inc. (AFCG), NewLake Capital Partners, Inc. (OTCQX:NLCP), and Innovative Industrial Properties, Inc. (IIPR). All three pay increasing dividends with large starting yields. When Power REIT’s dividend is initiated, it will likely draw in a new set of investors, and I think the dividend growth could be impressive. It all depends on how patient you are as an investor.

Conclusion

There are several things that raise questions on Power REIT for me. I will be keeping an eye on the company and its tenants, as the related party issues could create issues in the future. While I don’t think the recent write off impacts the long-term bullish thesis, I’m not a huge fan of that, either. That is why it is a small position for now. I am optimistic on the growth potential of the company, and each future acquisition could move the needle in a big way for a company of its size.

The valuation is certainly cheap compared to the projected growth in FFO/share, and I think we could see upside from earnings growth as well as multiple expansion. The dividend will be here in a matter of time and could see significant growth in the future. The share price will likely stay volatile, but I think the risk/reward is skewed to the upside. I bought a small position in the company, and investors that like the occasional speculation might want to do the same. $30 a share could look very cheap in a couple of years.

Be the first to comment