FilippoBacci/iStock via Getty Images

Industry Consolidation And Oligopoly

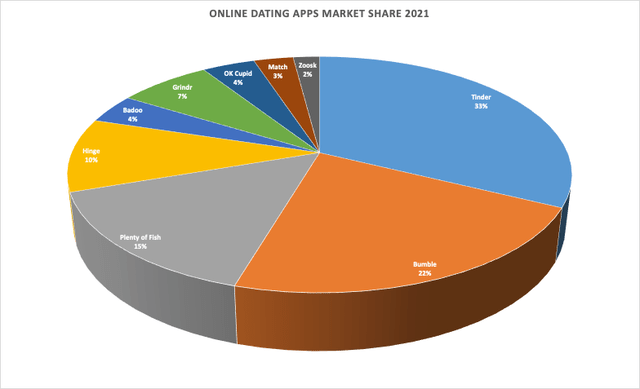

The biggest reason for me to believe in Match (NASDAQ:NASDAQ:MTCH) and the dating app industry is consolidation; this industry is becoming an oligopoly with 3-4 leading global players. In 2021, the Match owned platforms, Tinder, Plenty of Fish, Hinge, OKCupid and Match, took more than 65% of North American revenues.

Online Dating Apps Market Share (Business of Apps, Infogram)

The online dating platform industry is somewhat similar to online food delivery, which has become an oligopoly between Doordash, Uber Eats (NYSE:UBER) and Grubhub, who delivered 90% of meal deliveries in May 2022.

The North American online dating market is dominated by two players – Match with over 65% market share and Bumble (NASDAQ:BMBL) with 22%. Clearly, to succeed you need to be in every segment; Casual -Tinder, GenZ – Fruitz, Mature – Match, Relationships – Hinge, Feminist or Women First -Bumble.

The advantages of investing in a consolidating industry are many

- It creates significant barriers to entry and scale.

- Pricing Power.

- Entrants have to struggle with cash burn and losses for several years.

- New entrants spring up in smaller niche categories and provide growth for consolidated players as they get folded in to the big tent, giving the bigger company even more leverage and scale.

I don’t believe the market is big enough or growing fast enough to entice very large players from outside the dating industry. According to grandviewresearch.com, the global online dating market is about $7.5Bn in revenues and expected to grow at only 5% from 2022 to 2030. The biggest growth is coming from niche players or those who are creating new segments, Feminist (Bumble) or ethnic – (Coffee and Bagel). Market leader, Tinder also created the casual segment ten years back. Niche players are not a major threat because of their size and struggle to get to profitability — they eventually get bought out for a good price and fold into the big tent.

Bumble is another large player – it was backed by Andrey Andreev, the entrepreneur who controlled Badoo, which is the strongest player in Brazil and Europe. Andreev sold his stake in both companies to Blackstone, which is still backing its founder Whitney Wolf Heard, who owns 19% of the company.

Bumble has pedigree, scalability and cash and like Match, it’s consolidating by buying the Gen Z dating app Fruitz in Feb 2022.

Growth Catalysts

Under Penetrated Asia

In Q2-2022, the Asia-Pacific market (APAC) had only 18% dating product usage, as compared to 43% each for North America and Europe. This was the fastest growing geographic segment with 32% YoY growth, from $123Mn to $163Mn, grabbing 20% of Match’s $795Mn revenue in Q2-22.

I think for smarter growth in Asia, there will be a need to get local investment in those companies that provide that cultural fit. Match is already in several countries in Asia and has the scale to continue acquiring local home grown apps. Hyperconnect was its largest acquisition ever, in South Korea at $1.73Bn.

Product Differentiation

Bumble led the way by creating an entirely new product category – Feminist. Clearly, there was a need to counter the free for all, swinging culture of Tinder, and Bumble exploited it to the hilt, growing more than 20% each year in the last five to reach 22% of the market.

Hinge, with its voice prompts and focus on building relationships with the promise “Designed to be Deleted”, too ran up very impressive numbers, growing users by 20% over the last three years.

As Tinder, Bumble and Hinge has shown us – this is an ever changing landscape, with expanding boundaries. There are unexploited segments within social connections. What surprised a lot of people was the success of this industry to grow virtually during Covid – social connections became all the more important and I believe that both Match and Bumble, the industry stalwarts, will continue to find new categories, products and segments to grow.

Challenges

Monetizing User Growth

As much as Asia is under penetrated as compared to the U.S., and has the largest growth, monetizing that growth is a challenge. Match’s companywide revenue per payer (RPP) is $15.86 and skewed heavily to the US. While Asia will definitely grow faster with user additions, the estimated RPP in Asia is about a third of US rates.

Market Penetration

The U.S. with 43% of market penetration is likely to be fully penetrated, there is a ceiling on growth and expecting other countries to exceed that seems unlikely – we can well can understand why research firms are ascribing only 5-7% growth for the industry.

Europe

Europe grew only 6% in Q2-22. A vast majority of Europe is facing very high levels of inflation and a significant increase in energy bills due to the war in Ukraine. Given the macroeconomic conditions for the next year, Europe, which is Match’s second-largest market, faces a lot of headwinds and will continue to drag Match’s earnings lower in 2022 and the 1H of 2023.

High Debt Load

Match carries about $3.9Bn of long term debt on its balance sheet from its de merger from IAC (IAC). While it is not a cause for concern, Match haven’t increased it since, and it generates more than $800Mn in free cash each year, it’s still going to be an important aspect of decision-making and strategy.

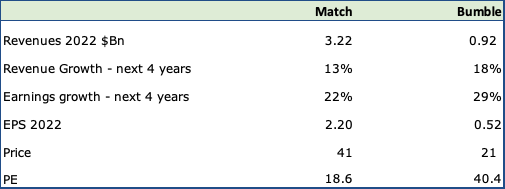

Match And Bumble

Bumble is a worthy competitor to Match, it has the scale and the smarts to continuously grow in the industry with enough cash to continuing plowing ahead. It’s growing much faster, expecting to grow revenues 18% each year and earnings at 29% compared to Match’s 13% and 22% respectively for the next four years.

What wins plaudits was the brilliant move in creating the “Feminist” segment – Women get to make the first move. And if imitation is the best form of flattery, it’s only now that Match has started to pay attention to that segment.

Bumble is an interesting investment to consider at a lower price.

Match and Bumble (Seeking Alpha, Fountainhead)

The Bull Case For Match

Size And Scale

Why buy Match after a slow Q2 (only 12% revenue growth) and weak guidance for 2022? Match guided to flat revenues or no growth for the 2H of 2022.

Because, it is the 800 pound gorilla. Because of its large portfolio and presence in every segment, it has the scale to grow and stay ahead and relevant. Even as industry wide growth slows to single digits, Match throws up a lot of cash – $912 Mn of operating cash and $833Mn of Free Cash Flow in 2021 – a whopping 28% of revenue, which gives it the capacity to buy growth by acquiring companies in niches and segments where it is cheaper to acquire than to grow organically.

New Segments And Acquisitions

As the spotlight shifts to APAC, which grew at 32%, North America still grew at a solid 9% in Q2-22. Match upped its game in its ethnic and niche segments with BLK, Chispa, Upward and Stir. These platforms are expected to contribute $75Mn in revenues in 2022, compared to 0, three years back.

It acquired Hyperconnect in Asia (South Korean market) in 2021 and plans to roll out Hinge widely in Asia. Hinge delivered on its promise of “Designed to be Deleted” – a focus on forming relationships, with massive growth in the US in the last three years; it’s expected to grow 50% in 2022 to about $300Mn in revenues.

Hinge should deliver well in Asia, a market where cultural mores place more emphasis on relationships instead of casual dating.

Furthermore, India, which has the potential to be the next huge growth market, has a much younger demographic and a deep internet penetration, which bodes well for Match. India has a median age of only 29, compared to 39 for the U.S. and 38 for China. India has an estimated 932 Mn internet users in 2022, according to Statista, more than 60% of the country’s population.

Make This Match!

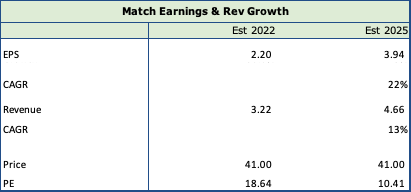

I believe Match has been punished enough for the terrible performance in 2022, having dropped a whopping 77% from its high of $182!

Consensus estimates still call for 22% earnings growth and 13% revenue growth for the next three years, which is much higher than the industry.

I also believe that a stronger dollar contributed to about 6% lower revenues in 2022 and once this stabilizes and reverses, this will be a tailwind for Match going forward.

Most importantly, I do not believe the market is valuing the consolidated nature of the industry and Match’s leadership in it, correctly. Nor is it fully pricing its market presence, its potential in Asia, gobs of cash flow generation and sheer scalability – which all deserve a premium. Its PE shrinks to 10 in 2025!, which is an unbelievable opportunity.

Seeking Alpha, Fountainhead

Be the first to comment