Hispanolistic/E+ via Getty Images

Thesis

Match Group (NASDAQ:MTCH) is a stock that should warrant the attention of growth-oriented investors. The company’s financial performance continues to be robust, and we believe that APAC will fuel the company’s growth for the foreseeable future. We also analyzed the company’s valuation using a DCF, and we find that our model finds the stock to be undervalued by around ~30%. As a result, we are recommending a “BUY” on this stock.

Company Overview

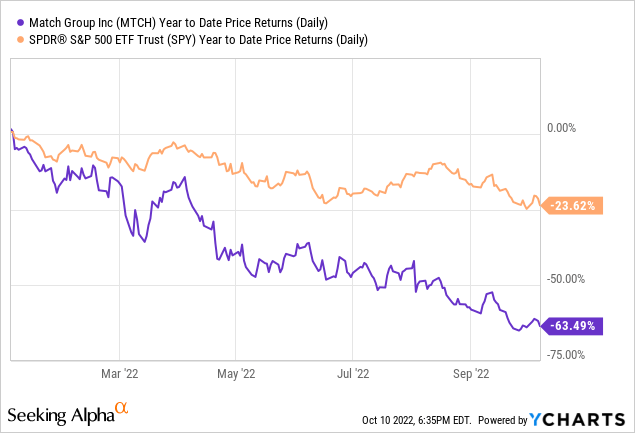

Match Group, Inc. is a leader in an American internet and technology company that provides dating products internationally. The company manages multiple dating apps, such as Tinder, Match, Meetic, OkCupid, Hinge, Pairs, OurTime, and more. In total, the company has more than 45 brands and serves more than 16 million paid users. Year-to-date, the company’s stock has significantly underperformed the S&P 500 with a YTD return of -63.49% in contrast to the index’s decline of -23.62%. Currently, the company’s market capitalization stands at $13.6 billion.

Recent Earnings

Robust Q2 Growth Metrics

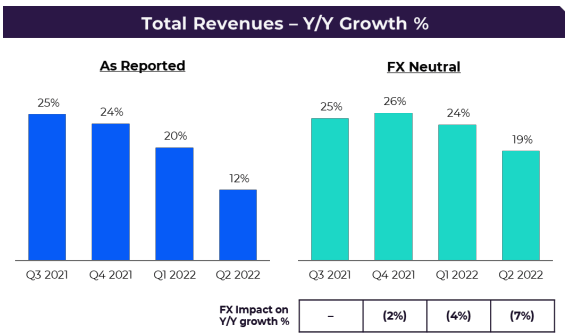

The company reported solid growth on a year-over-year metric, specifically for FX Neutral results. The year-over-year revenue growth on an FX neutral basis stood at 19% at a quarterly revenue of $842 million. APAC region saw immense growth as management reported a 49% YoY growth on an FX-neutral basis. We find growth in APAC to be quite attractive given the number of people in the area, in addition to the secular tailwinds on the region’s demographic and relatively low cultural adoption to digital mediums of finding romantic partners.

Q2 Letter to Shareholders

Muted Guidance

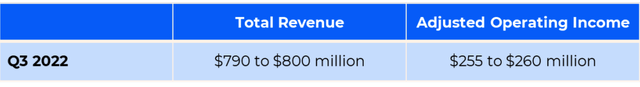

Management provided a guidance of $790 to $800 million which represents a flat year-over-year growth. We find that the subpar guidance can be explained by the economic backdrop where a slowdown in economic activity is bound to have a negative impact on the company’s revenue and bottom line. Nevertheless, we believe the ~32% operating margin to be a solid measurement of the company’s operational efficiency, and we find confidence in management’s emphasis that its top apps, such as Tinder and Hinge are performing strongly.

Potential in APAC

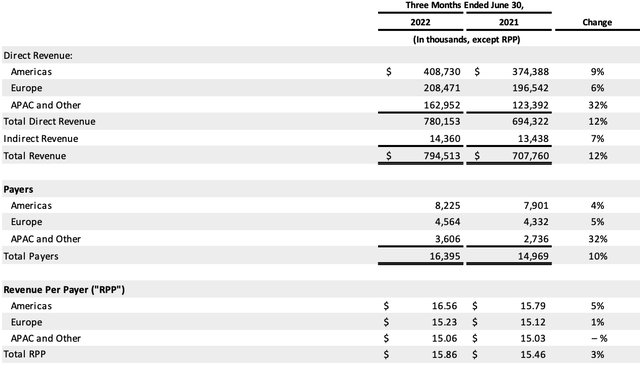

We believe APAC is going to drive the next level of growth for Match Group. Currently, as of Q2 2022, APAC (and Other) revenue made up only 21% of Match Group’s revenue. For paid users, APAC (and Other) segment had only 3.6 million paid users, compared to 8.2 million users in Americas and 4.6 million users in Europe. However, monetization potential of APAC (and Other) was in line with other regions, as APAC had an RPP (Revenue Per Payer) of $15.06 compared to Americas’ $16.56 and Europe’s $15.25. In sum, APAC is a region that has high revenue per user, but Match has significant under-penetration in the market compared to other segments. Management has recognized this and is investing heavily in APAC strategy, leveraging brands that meet Asian consumers’ preferences, such as Hyperconnect.

Valuation

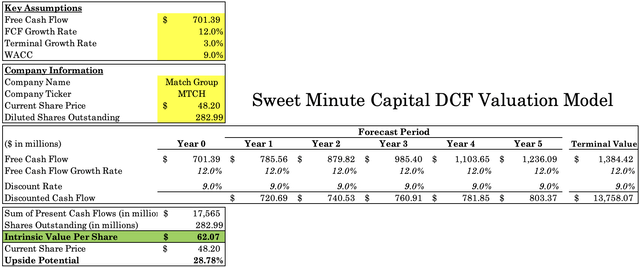

We derive an intrinsic valuation model using a DCF. The TTM Levered Free Cash Flow for Match Group is $701.39 million. With that cash flow number and a modest growth assumption of 12% (which is 33% below the recent YoY growth without FX impact) in addition to a terminal growth rate of 3.0% (which represents an above-average growth higher than the inflation rate), we derive an intrinsic value per share of $62.07 which represents a 28.8% upside from current levels.

Furthermore, PEG of 0.54 is far below the sector median of 1.22 and shows that the company may be undervalued compared to its growth potential. It is a common rule of thumb that a PEG below 1 represents that a stock may be undervalued. Given the intrinsic valuation model and the market valuation metric, we find that Match Group is undervalued at the current price.

Risks

Similar to other businesses in the current market, worsening macroeconomic conditions are likely to have a big impact of Match Group’s bottom line. As U.S. consumption deteriorates, people are likely to unsubscribe from their paid membership for Match Group’s dating apps and services. However, Match Group’s business model may be more resilient than people think. For one, Match Group has scores of different brands and services with different value proposition and user base. The mix of different brands (as well as the strength of those brands) will serve as substantial moats for the company’s financial performance. Furthermore, there is research that shows that online dating may be a recession-proof market. For example, Match’s subscriber growth actually accelerated in 2008 and there’s preliminary research that shows that the “continued need for human connection” resulted in “minimal business impact during the global financial crisis”. Also, given the low monthly cost, the demand for online dating services might be more price inelastic than previously thought.

Conclusion

Overall, Match Group is an online dating platform powerhouse that deserves investors’ attention. Match Group has strong brands that are integral now to modern dating, and the company’s financial performance has been solid, with markets such as APAC ready to fuel another round of financial growth for the firm. Using a DCF model, we see that the stock is significantly undervalued by the market based on conservative assumptions, and we believe the macroeconomic risks are minimal given the diverse assets and the potential recession-resiliency of the business model.

Be the first to comment