PhonlamaiPhoto

As the world’s largest automotive safety supplier, with sales to all major car manufacturers, Autoliv’s (NYSE:ALV) business ebbs and flows with global car sales. Unfortunately for the company, car sales are currently quite weak, especially for the critical segment for the company of light vehicles. Complicating things further, the distressed global supply chain has been aggravated by lock-downs in China. The company has also been negatively impacted by raw material costs and currency fluctuations. In response the company is stepping up cost reduction actions, and implementing price increases.

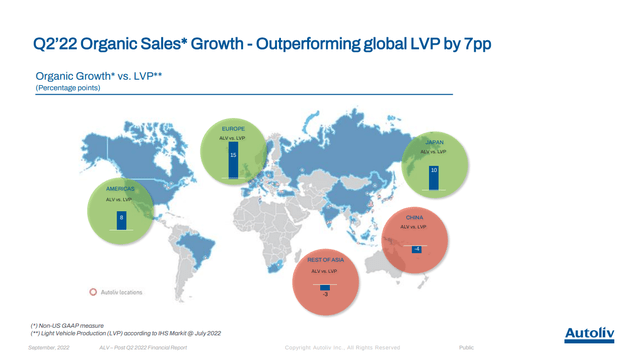

Despite all these challenges, the company has managed to deliver strong sales outperformance versus global light vehicle production (LVP), a sign that it is gaining market share and that safety content is increasing per vehicle. In addition to this outperformance vs. global LVP, another bit of good news is that the company continues innovating new products. For example, Autoliv recently announced that it is developing a helmet with integrated airbag for cyclists.

Financials

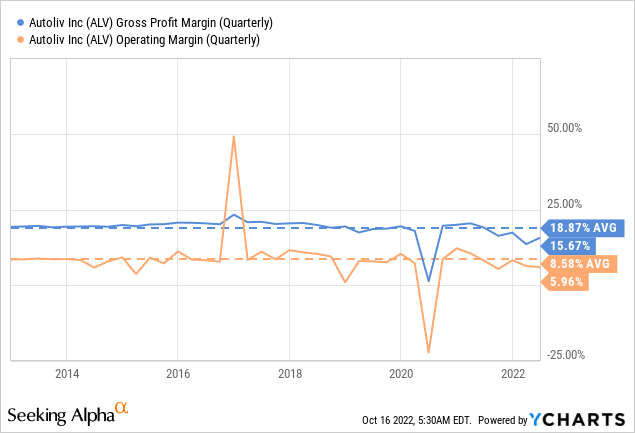

Given the tough operating environment, it is no surprise that operating margins are below the historical average and below the company’s target. The company’s adjusted operating margin target calls for ~12% no later than 2024, and in the most recent quarter (Q2’22) this was barely ~6%, while the company delivered an adjusted operating margin of ~8.2% one year earlier (Q2’21).

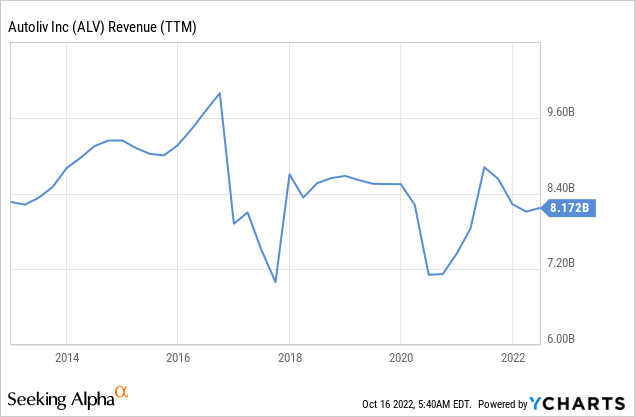

The recent down cycle can also be seen in the trailing twelve months revenue, which has been dropping since the second half of 2021, but now seems to have stabilized.

Balance Sheet

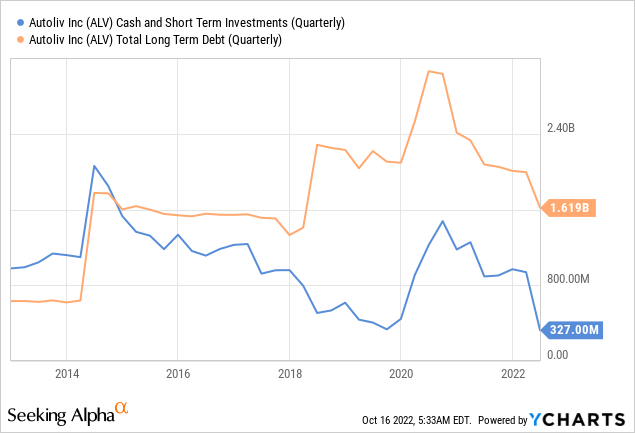

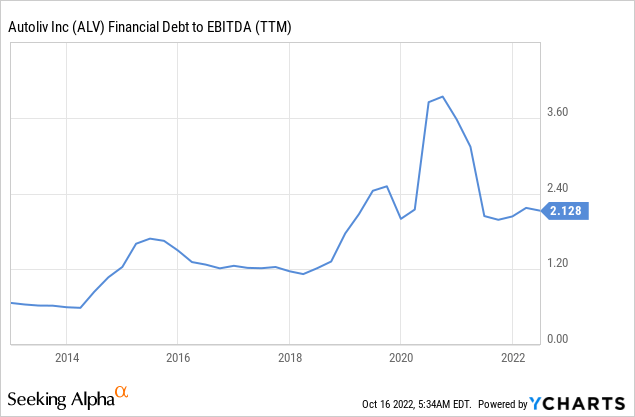

Autoliv should get some credit for significantly reducing its debt load, which now stands at ~ $1.6 billion, partially compensated with ~$327 million of cash and short-term investments.

Given the strained profitability, it is no surprise that, despite the debt reduction, leverage remains relatively high at ~2.1x debt to EBITDA, and above the company’s target as well.

Outperforming LVP

The main reason we remain optimistic about the company is the degree of outperformance it is delivering against light vehicle production, with a massive ~7% lead. One thing we do worry about is that the outperformance was universal, with China and the rest of Asia under-performing LVP. This makes us believe that in these regions the company is losing market share to rivals. Still, the company is doing really well on a relative basis in North America, Europe, and Japan.

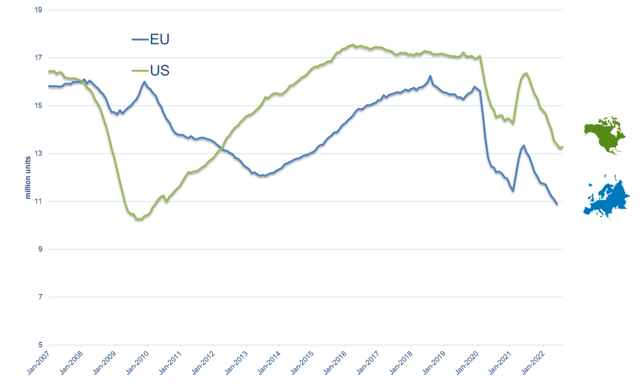

This might not give much comfort to investors at the moment, given how bad sales of new light vehicles are in the US and the European Union. European light vehicle sales are the lowest in 15 years, even lower than during the financial crisis.

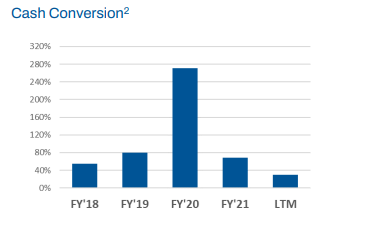

The tough operating conditions are having an effect on cash conversion too. With the company posting the lowest cash conversion the last twelve months in many years. The company attributes this to adverse working capital mainly due to volatile LVP and timing effects.

Autoliv Investor Presentation

Business Outlook H2’22

During the last quarter, the company provided guidance for the second half of 2022. It expects strong outperformance vs LVP to continue for the rest of the year. It also guided to a sequential margin improvement, with anticipated higher LVP volumes and price increases. It also expects improved supply chain stability going forward.

Valuation

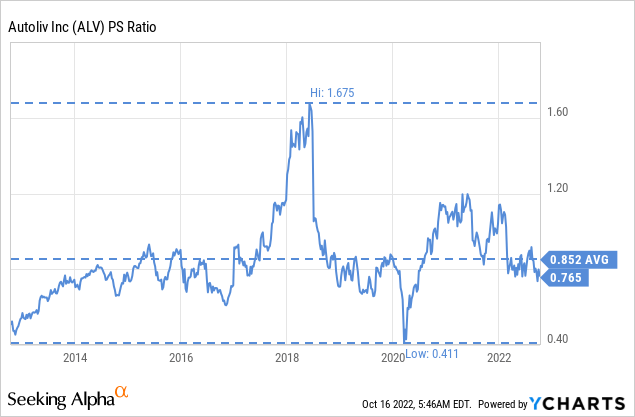

Based on valuation multiples alone, shares look fairly valued. It is important, however, to remember that the current multiples reflect earnings and margins of an extremely tough environment for the company, and that once this normalizes earnings and profit margins are expected to increase significantly. That is why we believe that shares present an attractive entry price for long-term investors willing to ride the short-term volatility. Starting with the price/sales multiple, it is currently below the ten-year average at ~0.76x.

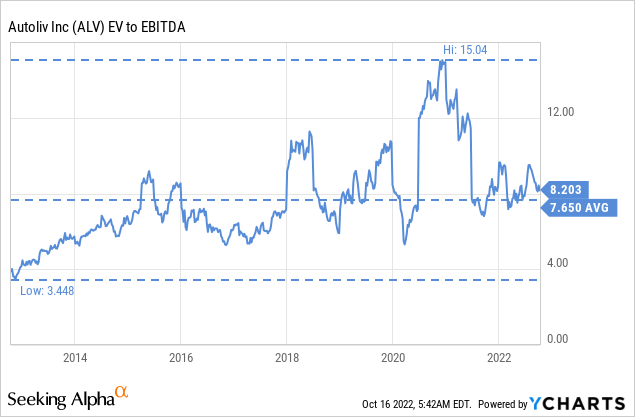

The EV/EBITDA multiple is also below the ten-year average, at only ~7.6x. This is about half the maximum it reached in the past decade.

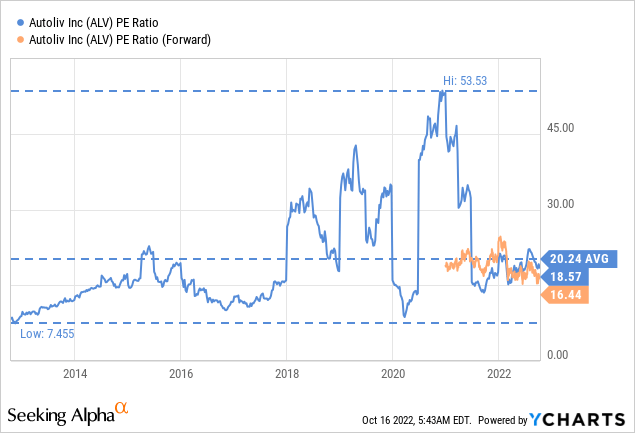

Shares also look attractively priced with a price/earnings ratio of ~18.5x, and a forward p/e of ~16.4x. This is not too high a multiple, especially considering that it is based on what we assume to be abnormally low earnings.

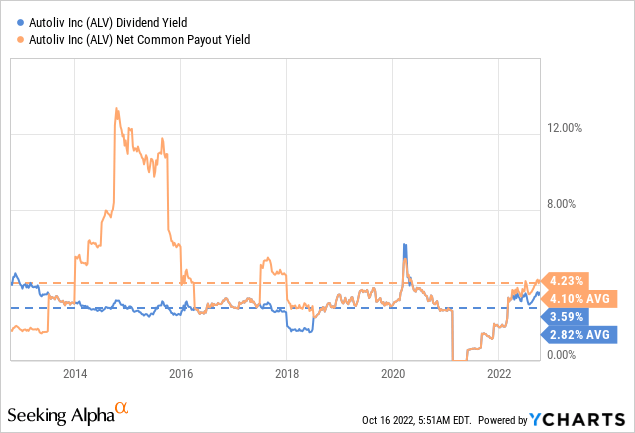

Both the dividend yield and net common payout yield (which also include share repurchases), are both slightly above their ten-year averages. It is encouraging to see that the company continues doing stock repurchases.

Risks

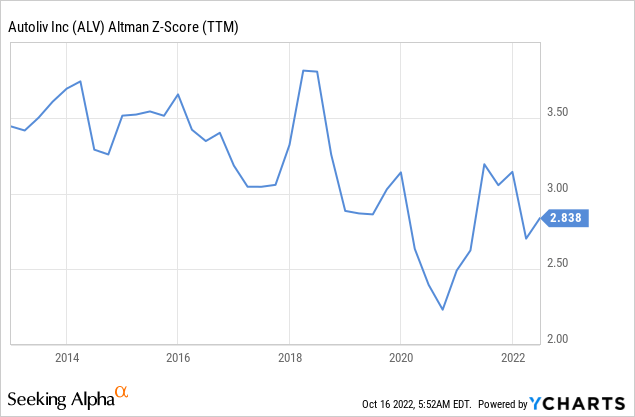

Our main concern is the company’s balance sheet, which is still relatively leveraged, and given the reduced profitability this has resulted in an Altman Z-score slightly below the critical threshold of 3.0.

Conclusion

We believe that shares already reflect to a significant degree the extremely tough environment for the company. Once things normalize, we would not be surprised to see shares go much higher. The company is already guiding for things to start getting better in the second half, with guidance for sequential margins improvement. This margin improvement should come from higher sales, price increases, and some level of market stabilization. In the meantime the company is continuing to provide shareholder returns through a decent dividend and some share repurchases.

Be the first to comment