jbk_photography

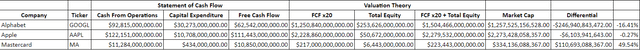

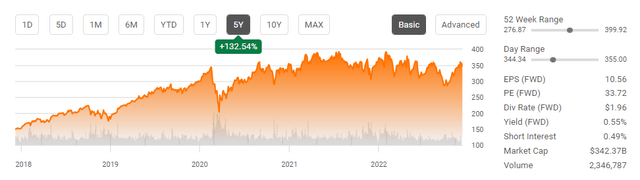

Mastercard (NYSE:MA) is a great company, but that doesn’t mean it’s a great stock to invest in today. MA’s track record is strong as it has generated 132.54% returns over the previous 5 years for shareholders while paying a small dividend. Backward-looking data sets a precedent and establishes a track record, but it doesn’t indicate what will occur in the future. When I look at the current valuations today, MA seems overvalued compared to other investments, such as Alphabet (GOOGL) or Apple (AAPL). I don’t believe that MA is a sell, but at its current valuation, I feel a lot of the upside is priced in already. Could MA rally if the market rallies into 2023, absolutely?

The big news that could push Mastercard higher

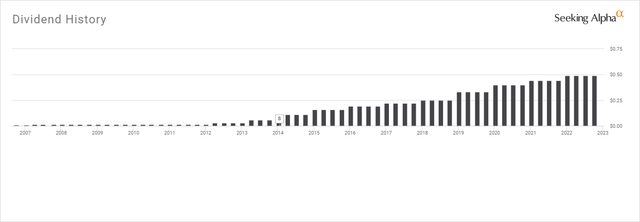

Market sentiment is a significant aspect of directional movements with stock prices. 2 things investors love are dividends and buybacks. MA just announced that it’s raising the quarterly dividend by 16.3% from $0.49 to $0.57 in addition to implementing a new buyback program of up to $9 billion of its class A shares. MA has $4.1 billion remaining in its current buyback program, and the $9 billion of additional capital allocated to buybacks will be utilized once the existing $8 billion buyback program has exhausted its capacity.

This is absolutely bullish for shares of MA. First, everyone loves a raise, and getting a 16.3% dividend increase is nothing to overlook. Second, MA’s buyback program projects confidence in its operations and provides value to shareholders. As MA repurchases shares on the open market, its outstanding shares will decline, increasing the ownership percentage all of its existing shares represent. This is bullish for investors because their shares now represent a larger portion of MA, in addition to its revenue and earnings. Buying back shares also helps manufacturer earnings and provides a boost to the bottom line. Hypothetically, if a company generated $1 billion in earnings and had 1 million shares, its EPS would be $1,000. If the company repurchased 100,000 shares and brought its share count to 900,000, and generated the same $1 billion in earnings, its EPS would increase to $1,111.11. By repurchasing shares, a company can manufacture increased earnings without generating an additional dollar of earnings. If MA can grow its earnings from continuing operations in addition to buying back shares, it could pave the way for larger-than-anticipated earnings beats, which could propel its stock higher.

This is bullish news, and I expect that the market will reward MA in some capacity. This will be the 12th consecutive annual dividend increase from MA, and MA has a 5-year dividend growth rate of 17.37%. MA’s dividend payout ratio based on its new dividend of $2.28 is 22.69% which is incredibly low. MA has more than enough room in its earnings to continue its annual dividend increases. The market usually looks favorable upon companies that reward shareholders through dividends and buybacks, and I would speculate that there is a stronger possibility of the market acting favorably on this news than negatively.

Mastercard is a great company, but I believe it’s overvalued, and shares are too rich for me

Nobody has ever been unhappy underpaying for something, especially a stock. The whole premise around investing is buying low and selling high. I think MA is a wonderful company and could be considered a duopoly with Visa (V) in the Credit card sector, with American Express (AXP) as a distant third. Just because MA is a great company, with a product that solves a problem and will theoretically always be needed, that doesn’t mean its stock represents value today. When I look at stocks that aren’t on the growth/speculative side of my portfolio, I am looking for a great deal, and I don’t want to overpay. A company such as MA already has so much of its growth factored into the stock price because it’s an established company embedded with society.

I had discussed the importance of FCF and valuing companies on a price-to-FCF methodology way before the market shifted, and FCF became the new buzz phrase on financial news networks. Every investment is the present value of all future cash flow. Therefore, as an investor, I factor into my investment thesis a company’s FCF valuation. I have discussed FCF for years because I feel one of the most important valuation metrics is the FCF to Market Cap multiple a company trades at. Coincidently this hasn’t been a widely discussed valuation metric. FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This is also the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions.

I have consistently said that I want to pay between 18-22x a company’s FCF as I consider that level the barrier to value territory. I have tweaked my methodology a bit based on AAPL and have come up with a formula of 20x FCF plus a company’s total equity on the balance sheet to determine what I consider fair market value. AAPL is arguably the greatest company in the market as it’s the most profitable, generating $99.8 billion in net income and $111.44 billion in FCF in 2022.

Steven Fiorillo, Seeking Alpha

Today Apple has a $2.27 billion market cap, and is the largest publicly traded company in the world. It would be hard to agree that Apple isn’t the standard, considering it represents the largest position in the S&P 500 at 6.51% (SPDR S&P 500 Trust ETF Holdings) and is the most profitable company in the market. If Apple is the standard, then this would be a very accurate methodology for its market cap:

- Apple Market Cap $2,273,428,058,357

- Apple current total equity $50,672,000,000

- Apple 2022 FCF $111,443,000,000

- FCF multiple of 20 = $2,228,860,000,000

- (FCF $111,443,000,000 x 20) + $50,672,000,000 of total equity = $2,279,532,000,000

- Apple trades at a -0.27% discount to 20x its FCF plus total equity

- $2,273,428,058,357 – $2,279,532,000,000 = -$6,103,941,643, or -0.27%

Based on my methodology, MA trades at a 49.54% premium to its total equity plus 20x its FCF. MA has $6.44 billion in total equity on its balance sheet and generated $10.85 billion of FCF over the TTM. There is a $110.69 billion difference between MA’s market cap and my 20x FCF plus total equity methodology. If you were to strip out the total equity, MA is trading at 30.8x it’s FCF, and AAPL trades at 20.4x its FCF. I don’t believe MA should have a 50% higher valuation than AAPL when AAPL generated more than $100 billion of the FCF that MA generated over the TTM.

When I look at GOOGL based on the same metric, GOOGL looks undervalued. GOOGL has a market cap of $1.26 trillion and generated $62.54 billion in FCF over the TTM, with $253.63 billion of total equity on its balance sheet. The combination of 20x its FCF and total equity for GOOGL is $1.5 billion. This is $246.94 billion more than GOOGL’s current market cap and indicates that GOOGL is trading at a -16.41% discount. GOOGL also trades at 20.11x its FCF when total equity is stripped away.

It’s hard to justify MA’s market cap when looking at a valuation based on FCF. MA generated $10.85 billion in FCF over the TTM, which is remarkable, but there is no reason why MA is trading at 30.76x its FCF compared to under 21x for both AAPL and GOOGL. AAPL generates 10x the amount of FCF that MA produces, and GOOGL generates roughly 6x. MA is a company I want to own, but its current valuation is too rich for me, and I believe there is more upside to be generated in other names than MA.

Conclusion

The recent news is bullish for MA, and I wouldn’t be surprised if shares appreciated in value. MA gave its investors a double-digit dividend increase and added a new buyback program to the tune of $9 billion when the current one is finished. Throughout 2023, MA will be buying back shares and providing a helping hand to earnings while increasing the ownership level of existing shares. When I look at how MA is valued, I want to be a shareholder, but not at these levels. On a pure price-to-FCF methodology, MA trades at 30.8x its FCF, which is out of my 18-22x sweet spot, and it’s also roughly 50% larger than what GOOGL and AAPL trade at. I find it hard to justify MA trading at 30.8x its FCF when it produces 1/10th of the FCF that AAPL does or roughly 1/6th of the FCF that GOOGL produces. I love MA as a company, and it’s on my watchlist, but I don’t want to pay the current valuation and will wait until it comes down to a more attractive valuation.

Be the first to comment