Carl Court

Thesis

Airbnb, Inc. (NASDAQ:ABNB) stock has given up its initial post-earnings surge, even as CEO Brian Chesky & his team reported robust Q3 earnings. However, the market was right to focus on ABNB’s valuation relative to its peers. In addition, worsening macro headwinds could dampen Airbnb’s execution as consumers cut back on discretionary spending, including travel, as we move closer to a potential recession.

Management was sanguine at its Q3 call, highlighting that consumer demand was robust, and the company had not observed any material weakness in bookings. However, with the faster recovery in cross-border and urban travel, it’s expected to moderate its ADR growth further, which could impact margins in the near term.

Despite that, Airbnb remains in a much better position to navigate a recession than in its pre-pandemic days. It has significantly boosted its cash position with its strong free cash flow (FCF) profitability. Furthermore, the company has also retained its capital allocation discipline adopted during the pandemic, keeping its cost base “lean” and investing selectively to drive growth.

Hence, management highlighted that it remains confident in improving its already highly robust FCF bottom line moving forward, which should be constructive in sustaining buying sentiments at appropriate valuations.

We gleaned that ABNB’s price action has moved closer to re-test its July and November lows. Our valuation analysis also indicates that ABNB seems reasonably valued relative to its peers’ median with the recent selloff.

As such, we like the reward/risk for ABNB at the current levels. Revising from Hold to Buy with a price target (PT) of $120 (implying a potential upside of 30%).

China’s Cross-Border Tailwind Likely Not Baked In

China has further eased its COVID curbs today (November 7), as the government reminded state authorities that “any form of mobility control should not be implemented.”

Notably, the government released a ten-point measure that’s additional to its previous 20-point measure, including home quarantine and doing away with mass PCR tests. As such, we believe the return of long-awaited outbound cross-border travel from Chinese travelers could be pivotal to boosting Airbnb’s growth normalization, as the global economy moderates in 2023.

Emirates President Tim Clark highlighted recently that China’s reopening could spur “demand for travel the likes of which we will not have seen for a long, long time. The longer [the authorities] press the cork down in the water, the greater the velocity of return.”

Chesky also telegraphed his optimism in Airbnb’s Q3 commentary, as he accentuated:

The crown jewel of our China business was always going to be the China outbound business. [Our] take rate was higher for the outbound business than it was for the domestic business. [as] the inventory is more unique. There’s less competition and the average daily rate is a lot higher. So the outbound business was always the prized part of our business, and that’s what we’re focused on. Now, as you know, not a lot of people are leaving the country right now, but we want to be prepared for when they do. And they eventually will, of course. (Airbnb FQ3’22 earnings call)

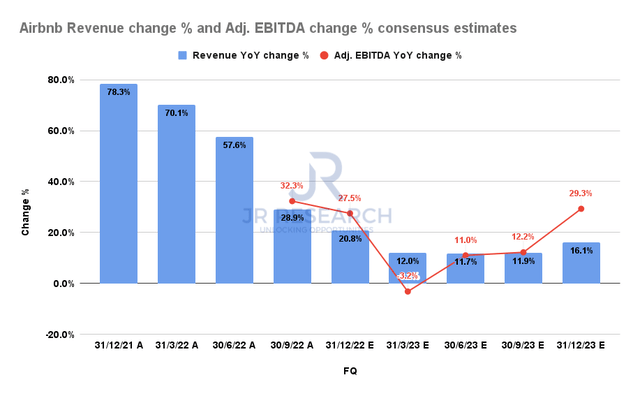

Airbnb Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As such, we parse there are likely upside surprises to Airbnb’s FY23 estimates as the Street adjusts to the tailwinds from China’s easing of COVID curbs. Therefore, we believe the revised consensus of a Q2’23 reopening in China is looking increasingly likely.

Hence, we assess it should be constructive in helping to mitigate some of the comp headwinds from Airbnb’s domestic reopening in 2021.

Is ABNB Stock A Buy, Sell, Or Hold?

ABNB stock last traded at an NTM EBITDA multiple of 16.8x, ahead of its peers’ median of 11.9x. However, its robust FCF profitability and strong net cash position imply an NTM FCF yield of 7.4%, above its peers’ median of 5.2% (according to S&P Cap IQ data).

Hence, we believe the market has likely priced in significant pessimism against Airbnb’s execution risks. Therefore, coupled with the meaningful tailwind from China’s additional easing measures, we favor ABNB’s reward/risk profile at the current levels.

Revising from Hold to Buy with a PT of $120.

Be the first to comment