koto_feja/E+ via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on September 22nd, 2022.

In the technology sector, dividends aren’t always the main focus, but with larger tech names, it can be an added bonus. Traditionally, most tech stocks would want to keep reinvesting the cash into their businesses to provide share appreciation. Some of the largest names, such as Texas Instruments (TXN) and Microsoft (MSFT), however, are mature companies that can do a bit of both. The days of their growth aren’t exactly over, but their operations provide plenty of cash flow to fund both investments and return cash to shareholders.

Today, I wanted to give an updated look at TXN and MSFT as we haven’t since April of this year. Though I don’t feel I need to keep a very close eye on either company as they are some of the most sound companies around, it’s still good to check in every now and then. With the latest dividend boosts and a couple of quarters later, now seems an appropriate time to check on them again.

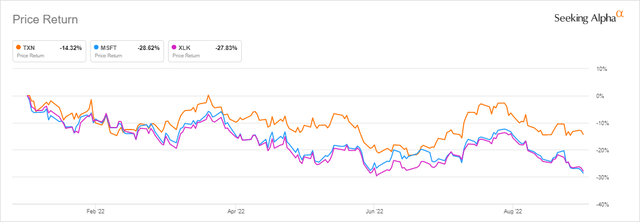

Both stock prices haven’t fared well on a YTD basis, but that’s to be expected with the current environment. Now might be an even more attractive time to consider adding either or both to one’s portfolio. Interestingly, TXN is holding up much better than MSFT. I’ve also included a look at the Technology SPDR (XLK). MSFT is ~22% of XLK, so the close correlation here isn’t too coincidental, in my opinion.

MSFT And TXN Price Return YTD (Seeking Alpha)

Microsoft

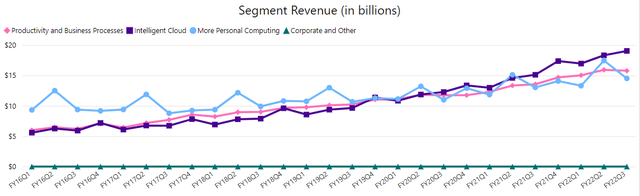

This old software behemoth has been pushing successfully into the cloud space. This has been a steadier segment for them that can counteract the more volatile PC space. We can see just how steady this growth has been by the segment revenue.

MSFT Segment Revenue History (Microsoft)

Also noteworthy is that productivity and business processes have also been a steady portion of their business. This includes commercial and consumer office 365 subscriptions. This shows the stability that a subscription service can provide when it is implemented successfully.

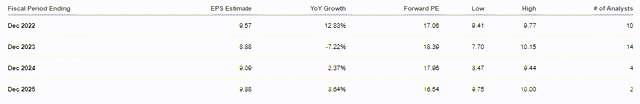

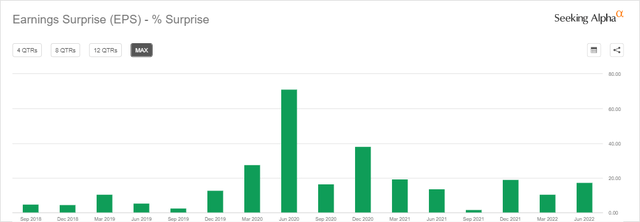

This sort of stability is reflected in the EPS the company can generate, which leads to dividends and buybacks for investors. Analysts expected EPS to grow 13.43% over the next five years. Fiscal 2023 expectations are $10.19, and fiscal 2027 shows an EPS target of $17.17.

The latest increase for MSFT was a 10% increase from $0.62 to $0.68 quarterly. According to analysts, that is lower than what EPS is expected to grow, but it means the forward payout ratio is roughly 27% at this time. If they continue to grow as expected but limit the dividend growth, this payout ratio will shrink.

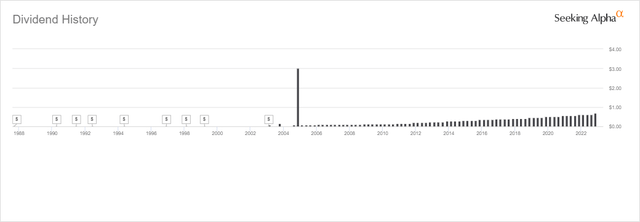

This latest raise also put MSFT in a position now where it has raised its dividend for 17 years.

MSFT Dividend History (Seeking Alpha)

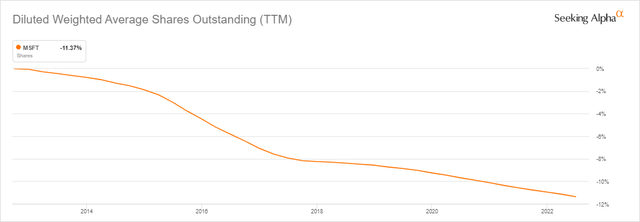

Not only are they rewarding shareholders through dividends, but buybacks have been a key focus for the company, too. The outstanding shares have declined by over 11% in the last decade. This is where some of that excess cash can go instead of growing the dividend more aggressively.

MSFT Shares Outstanding Change (Seeking Alpha)

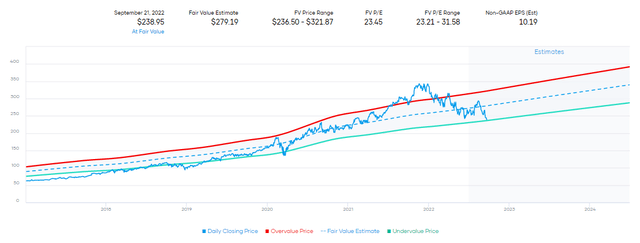

Based on the historical P/E ratio, MSFT has been looking exceedingly cheap lately as the stock price continues to decline with the overall bear market. Of course, the impact of higher interest rates and inflation are additional factors in what a stock’s valuation should be going forward. Growth isn’t being rewarded as richly as it was previously. Therefore, some could argue that this is exactly where MSFT should be trading.

That would also imply that shares won’t necessarily reverse course in the near term, but it does mean that investors are looking at a fairly attractively priced stock for the long term. Based on the fair value estimate of $279.19, that would suggest an upside appreciation of nearly 17%.

MSFT Fair Value Estimate (Portfolio Insight)

With MSFT, you also have a gaming division in the PC space. In that space, the acquisition of Activision Blizzard, Inc. (ATVI) is going through some intense regulatory hurdles. Perhaps rightfully so, as it is a significant acquisition in the gaming market.

Texas Instruments

TXN is another integral part of our everyday tech world, with its chips in the digital age. Though, as I have said, they don’t make the “sexy” chips that everyone clamors over. And that’s part of their strength, as they aren’t in an overhyped space. With nearly 100,000 customers worldwide, they are involved in just about everything, including “industrial, automotive, personal electronics, communications equipment and enterprise systems.”

It’s also a tech giant, but at around a $152 billion market cap is dwarfed by the much-larger MSFT at a $1.81 trillion market cap.

This being said, they are in more of a position where a global economic slowdown can impact them relatively more than something like MSFT. Pointing out above the stable and more predictable growth in cloud and subscriptions, TXN isn’t exactly in that position. Analysts expect TXN to take a bit of a hit in EPS in fiscal 2023.

TXN Earnings Estimates (Seeking Alpha)

On the other hand, they are 16 quarters out of 16 quarters for beating analyst EPS estimates, which means that some upside surprise isn’t necessarily a surprise, as more of a rather reliable coincidence.

TXN EPS Surprise (Seeking Alpha)

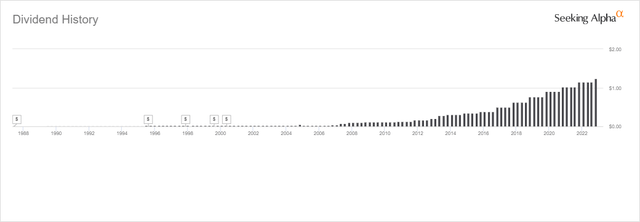

A slight dip also isn’t concerning to their dividend, which is easily covered. The latest increase was $1.15 to $1.24, working out to a 7.8% increase. This was slightly below inflation, and below the more historical average increase we have been seeing. The 10-year CAGR of the dividend was 21.07%, 18.13% over the last 5 years and 14.31% over the last 3. That has provided a significant growth ramp over the last decade. In fact, they’ve been raising now for 16 years.

TXN Dividend History (Seeking Alpha)

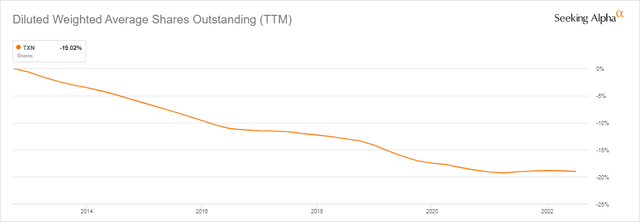

However, I’m certainly not disappointed in this raise at all. In fact, with the expectations of a softer economy and earnings dip, this is exactly what they should be doing to make sure their balance sheet remains robust. Included in the dividend boost was an authorization of another $15 billion added to the buyback program.

This is a more flexible way of returning capital to shareholders. TXN has also been more aggressive than MSFT in terms of percentage bought back over the last decade. Buybacks can help support a further boost to EPS.

TXN Shares Outstanding Change (Seeking Alpha)

In terms of valuation, it would appear that TXN has more upside potential than MSFT. Though both are relatively cheaper compared to their historical levels. The fair value estimate suggests that TXN could see an upside potential of around 26.7%.

TXN Fair Value Estimate (Portfolio Insight)

Conclusion

MSFT and TXN are two important tech companies in our digital world today. They play key roles in the past and future of our modern lives. However, the market has discarded them just the same in this 2022 bear market. Both are looking relatively more attractive lately. TXN is more susceptible to the business climate, but any downturn should be short-lived. A year or two is short-lived, in my opinion. I plan to hold TXN (and MSFT) for another 50 years or death, whichever comes first… It also shouldn’t threaten its dividend in any way, besides maybe a bit less growth than what we have been experiencing.

Be the first to comment