kb79/iStock via Getty Images

Overview – Akero’s Data for FGF21 Mimic EFX Is Best In Class For NASH – 89bio’s Pegozafermin Has Same MoA

At the beginning of September, the share price of Akero Therapeutics (AKRO) – a small biotech ~7% owned by Pharma giant Pfizer (PFE) – rose from $12, to $27, and a few days later, from $27, to $40 – an overall gain of 233%.

The reason for the gains was the company’s publication of data from a Phase 2b trial – HARMONY – of its lead asset, Efruxifermin (“EFX’) in patients with pre-cirrhotic nonalcoholic steatohepatitis (“NASH”), fibrosis stage 2 or 3 (“F2-F3”).

In the study, at the 50mg and 28mg dose levels, 41% and 39% of EFX-treated patients respectively experienced at least a one-stage improvement in liver fibrosis with no worsening of NASH by Week 24, compared to 20% within the placebo group.

The secondary goal of the study – achieving NASH resolution without worsening of fibrosis – also was achieved, with 76% of the 50mg arm and 47% of the 28mg arm meeting this criteria, vs. 15% of patients in the placebo arm.

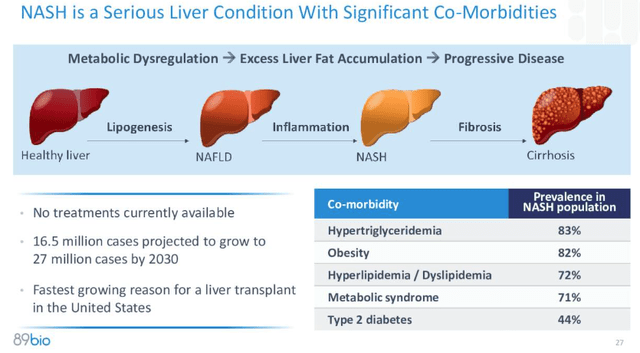

Given that the FDA’s approval criteria for a NASH drug is improvement of ≥1 stage in fibrosis with no worsening of NASH, or improvement in NASH resolution with no worsening of fibrosis, hopes are high that Akero could wind up winning the “NASH Dash,” the race to be the first drug approved to treat the disease, which has a prevalence of ~16.5m cases, expected to rise to 27m cases by 2030, and is the “fastest growing reason for a liver transplant in the United States,” according to the subject of this article – 89bio (NASDAQ:ETNB).

Akero’s drug EFX is engineered to mimic the biological activity profile of native FGF21. As I explained in my last note on 89bio:

FGF21 is an “endogenous metabolic hormone that regulates energy homeostasis, glucose-lipid-protein metabolism and insulin sensitivity”, which is secreted primarily by the liver, and has been clinically proven to reduce liver steatosis by increasing fatty acid oxidation, reducing free fatty acid deposits migrating from peripheral tissue to the liver, and reducing de-novo lipogenesis (“DNL”).

89bio has developed its own NASH candidate, now called Pegozafermin, which is a “a specifically engineered glycoPEGylated analog of fibroblast growth factor 21 (“FGF21”).” In other words, it had the same mechanism of action (“MoA”) as Akero’s EFX. A third company, pharma giant Novo Nordisk (NVO), also has a NASH candidate targeting FGF21.

89bio’s share price has also been rising in recent months – by >140% since early July, no doubt due to the progress being made by Akero, but while Akero’s market cap valuation currently stands at $1.83bn, 89bio’s is just $266m

89bio – Progress to Date

In an expansion cohort of a Phase 1b/2a study, in which 19 of 20 patients received end-of-treatment biopsies, Pegozafermin demonstrated clinically meaningful changes on endpoints including 26% of patients achieving a one-point or more improvement in fibrosis, and 47% achieving NASH resolution or improvement in fibrosis.

The data does not seem quite as strong as Akero’s, although there was only one patient withdrawal, out of 81 total patients, vs. five in the EFX study, out of 72 patients, suggesting Pegozafermin may have the superior safety profile.

Pegozafermin also performed well across a host of other endpoints, including NAFLD Activity Score (NAFLD stands for Non-alcoholic Fatty Liver Disease which can lead to NASH) – 63% of patients had a 2-point or more improvement in NASH and no worsening of fibrosis – liver fat reduction – 50% of patients in Cohort 6 achieved a 50% of higher reduction in liver fat, and >70% in Cohort 4 and 7 – and reduction in alanine transaminase (“ALT”) levels, with the same cohorts all achieving >40% reduction, versus 4% of the placebo arm.

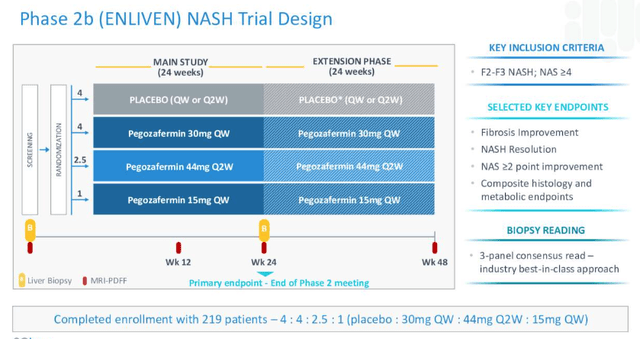

Based on the positive data, 89bio now has a fully enrolled Phase 2b study – ENLIVEN – ongoing, as shown in the diagram below:

89Bio Phase 2b study design (89Bio)

The study will read out data in Q123, management promises in its Q222 10Q submission, whilst also noting that it has:

completed a pharmacokinetic study of pegozafermin in NASH patients with compensated cirrhosis (fibrosis stage F4) demonstrating that pegozafermin 30 mg has similar single-dose pharmacokinetics and pharmacodynamics in F4 as it does in non-cirrhotic NASH.

In other words, if the drug works in F2 and F3 patients, it could potentially work in F4 stage patients also, who have a more debilitating form of the disease, as shown below.

NASH explained (89Bio)

In short, 89bio’s drug Pegozafermin appears to tick a lot of the boxes required to position itself as a genuine contender in the “NASH Dash,” an admittedly crowded field, encompassing many different approaches and drug classes.

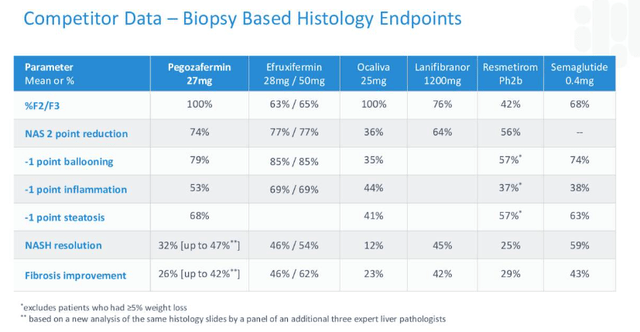

It’s interesting to note a comparison made by 89bio between leading contenders in the race to approval.

NASH contenders compared (89Bio)

Once again, EFX appears to have the slight edge over its competitors at this stage – and bear in mind this table was created by 89bio – but it doesn’t seem impossible that Pegozafermin could make up the small differences in a larger trial.

Akero is planning a second Phase B study in NASH patients whose condition is worse than in its HARMONY study, with results expected to be available next year, as well as a Phase 3 study. Meanwhile, Madrigal Pharmaceuticals has reported positive data from a Phase trial in NAFLD, and has a second Phase 3 ongoing that includes some patients with non-cirrhotic NASH.

Sizing Up The Market

NASH is a potentially massive (~$30bn+) market – as mentioned above, close to 30m people in the US may be diagnosed with the disease by 2030 – although it’s not necessarily a clearly defined market.

For example, many patients with NASH also have Type 2 diabetes, and two major drugs have recently hit the Type 2 diabetes market – Eli Lilly’s (LLY) Mounjaro, and Novo Nordisk’s Ozempic, that are also indicated to treat obesity under different brand names – Lilly’s Tirzepatide is not yet approved in obesity (it will be approved under a different name to Mounjaro), while Novo Nordisk’s once-weekly semaglutide subcutaneous injection is approved in obesity under the brand name Wegovy.

These two drugs are forecast to potentially generate peak sales of >$20bn, and may be prescribed off-label to treat NASH, meaning that drugs approved specifically for NASH, such as Pegozafermin and EFX, could struggle to find a market. Additionally, many physicians have expressed unwillingness to prescribe drugs to treat NASH, preferring to encourage patients to embrace healthier lifestyle choices.

Nevertheless, the response to Akero’s data suggests that the market believes a drug approved for NASH could thrive, and in 89bio’s case, with its small market cap valuation, it’s not hard to see the share price rocketing if data from the Phase 2b is genuinely competitive.

The path to commercial success would be tricky – 89bio reported a cash position of just $139m as of Q222, and management does not have the necessary experience – although the company could raise huge sums if the share price spikes without upsetting its existing shareholders, and make some key hires – who wouldn’t want to work on the commercialization of one of the first ever approved NASH drugs?

An interesting question to ask however is why there is not more interest in 89bio from the big pharma community. As mentioned, Pfizer recently purchased ~$25m worth of Akero stock – why would another pharma not make a similar investment in 89bio, or simply buy it outright? Paying a 500% premium and acquiring 89bio for ~$1bn would hardly look like bad business if its Phase 2b data compares with Akero’s, given Akero’s market cap is close to $2bn.

Other Opportunities

89bio is not all about NASH either – the company is currently planning to put Pegozafermin through a Phase 3 study in Severe Hypertriglyceridemia (“SHTG”), scheduled to initiate in the first half of 2023. SHTG is a 4m patient market, management estimates, in which statins, fish oils and fibrates are usually prescribed, but are often ineffective.

Once again, as with the NASH data, Pegozafermin has demonstrated efficacy across a host of biomarkers for SHTG, including decreases in Triglycerides, non-HDL-C, and apolipoprotein-B – key biomarkers for cardiovascular risk. 89bio intends to seek approval in SHTG based on triglyceride lowering, management says.

Conclusion – Overlooked Or Overhyped? 89bio Remains A Contender In The NASH Dash Until Data Proves Otherwise

The investment thesis for 89bio is not difficult to summarize. You have a small biotech with a big ambition – to become the first company to secure FDA approval for a drug targeting NASH.

89bio’s candidate has a mechanism of action that has proven effective not only in the company’s own trials, but also in trials conducted by a rival with a much higher valuation, despite its lead candidate being at a similar stage of development.

Both drugs have delivered some strong data across a host of biomarkers – this is not a phony drug – an it could be 89bio that is the next company to read out key data. If that data is positive, then a share price spike is a near certainty.

Looking at the negatives, 89bio is a tiny company and should it fail to meet endpoints in either its NASH or SHTG trials, there are no other drugs in the company’s pipeline and as a result, anyone invested in the company may risk losing nearly their entire stake. It’s hard to make a case for 89bio being able to compete with the might of Lilly of Novo Nordisk either, should Pegozafermin become an unlikely commercialized drug.

The risk is high, but so is the reward, and the question investors need to answer is whether they are attracted to the company and its shares by the massive rewards on offer, or the genuinely compelling nature of its data.

A sensible investor probably wants to wait for more data – that may mean missing out on some sensational gains, but is the sensible play if you are investing money you can’t afford to lose.

Although 89bio’s data is generally impressive, it would be a stretch to argue that Pegozafermin could meet the FDA’s strict endpoints in a Phase 3 NASH trial, or that it can persuade the FDA to accept its proposed criteria for approval in SHTG. It’s not impossible, but it is, on balance, unlikely.

Nevertheless, it will be fascinating to see what data 89bio releases in Q123, and what position that data places it in the “NASH Dash.” At this stage you still can’t count 89bio out, although there may be too much left for the company to achieve, unless there is a big Pharma on hand to help this plucky biotech out.

Be the first to comment