Drew Angerer

Thesis

We follow up on our previous update on NIO Inc. (NYSE:NIO) in June, as we urged investors to be wary of buying into the rapid surge from its May long-term bottom.

We posited a pullback was imminent and suggested investors wait patiently for a deeper retracement first. Therefore, we aren’t surprised that NIO pulled back close to 24% from its June highs to its July lows as the market digested its buying upside. Furthermore, July’s delivery reports from NIO and its peers suggest that the recovery momentum from June has moderated markedly, given the rollover sales from May’s lockdowns.

However, we believe NIO has likely staged its near-term bottom in July, as buying sentiments have returned to support its stock. Therefore, while we had anticipated a deeper pullback previously, we no longer hold that view.

As a result, despite the worsening headlines from China given its recent slew of disappointing economic data releases, we are still ready to re-rate NIO.

Accordingly, we revise our rating on NIO from Hold to Speculative Buy, with a medium-term price target of $30.

The Market Is Not Concerned With NIO’s July’s Deliveries

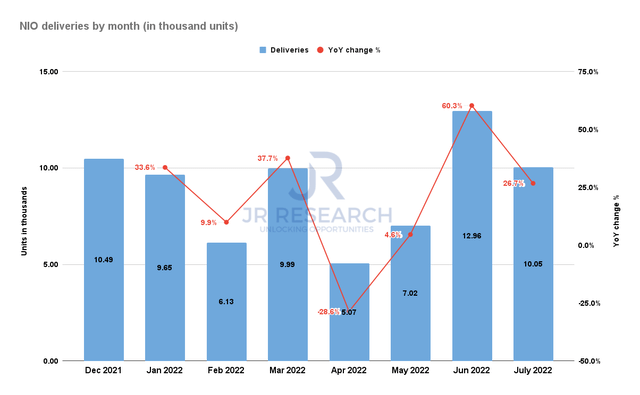

NIO deliveries by month (Company filings)

NIO updated that it delivered 10.05K of vehicles in July, up 26.7% YoY. However, the momentum has moderated from June’s deliveries of 12.96K (up 60.3%) of vehicles, following the reopening from April-May’s draconian COVID lockdowns.

Furthermore, the company is still seeing challenges from supply chain disruptions, which also impacted its ET7 deliveries in July. Notwithstanding, we are assured as July’s delivery cadence is still respectable, and we remain confident that NIO should continue to post robust momentum through H2’22.

However, the recent economic data on the Chinese economy has dampened buying sentiments in Chinese stocks. Economists are turning even more somber over China’s GDP growth for 2022, as a series of GDP forecasts cuts ensued. Bloomberg reported:

Economists are turning even more bearish, with Goldman Sachs Group Inc lowering its projection for gross domestic product growth to 3% from 3.3% while Nomura Holdings Inc slashed its forecast to 2.8% from 3.3%. That’s below the 3.8% consensus in a Bloomberg survey of economists and far away from the government’s original target of around 5.5% set for the year. – Bloomberg

Undoubtedly, the mayhem seen in the Chinese economy has continued to inflict pain on consumers and businesses, worsened by the property market downturn. However, we also urged investors to consider that the EV makers like NIO are still thriving, as EV sales in China continue to perform admirably.

The China Passenger Car Association (CPCA) also raised its EV outlook for 2022 to 6M recently (up from 5.5M). Therefore, we posit that China’s NEV market has maintained its resilience despite the weak performance in the broad economy. As a result, market sentiments over EV stocks could be lifted further as the economy improves subsequently (nothing collapses forever). Hence, we posit that the market has been buying the significant dips in Chinese EV stocks since their capitulation in March, as it accumulates over time.

NIO’s Price Action Is Constructive Of Accumulation

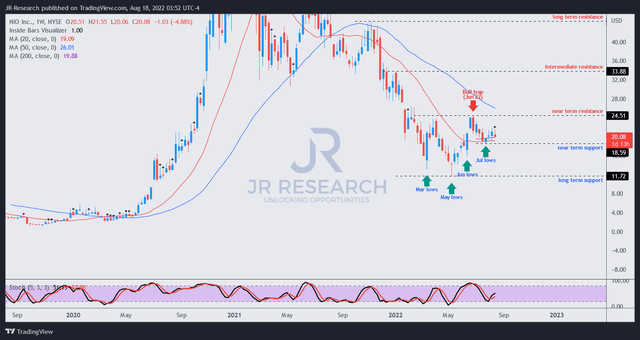

NIO price chart (weekly) (TradingView)

Note the double bottom bear trap (indicating the market denied further selling downside decisively) in May has held resiliently. As a result, we are increasingly confident that May should mark NIO’s long-term bottom after the capitulation seen in March.

NIO has also been forming higher lows over its pullbacks in June and July, suggesting accumulation. The robust buying support seen in its June and July lows also led to the recovery of NIO’s short-term bullish momentum, which augurs well for an eventual recovery of its medium-term bullish bias.

Notwithstanding, the near-term resistance that marked NIO’s June highs could continue to offer robust selling pressure in the near term. Therefore, investors should avoid adding close to that level.

Given the robust buying momentum we have observed in NIO over the past three months, we are confident that the market has been accumulating. Therefore, we urge investors to use the recent pullback from its June highs to add exposure.

Is NIO Stock A Buy, Sell, Or Hold?

We revise our rating on NIO from Hold to Speculative Buy.

We are confident that the market has re-rated NIO, as buying support has returned remarkably since its May lows.

NIO is also on track to recover its production growth cadence, which should see it continuing to launch a new semi-solid state battery pack in Q4. We are also awaiting the product refresh in its line-up in H2’22, as the company leverages China’s ongoing EV transition, despite the weak macro outlook.

Despite that, we posit that NIO could see further growth once the macro outlook improves moving forward, lifting buying sentiments further. Therefore, investors should capitalize on weaker sentiments in NIO to add exposure before the broad recovery in China’s economy.

Be the first to comment