M. Suhail

Much Better Than Feared

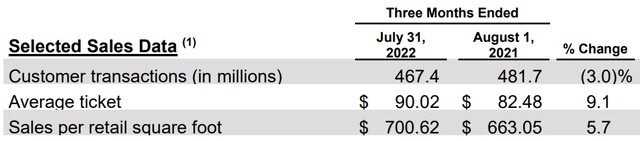

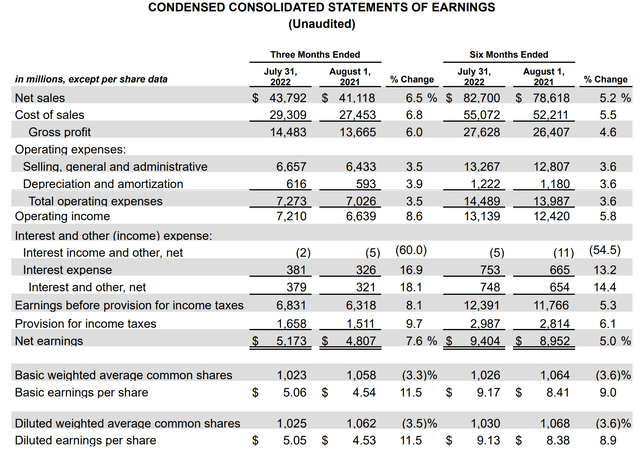

Home Depot (NYSE:HD) reported encouraging 2Q results showing that worries about a decline in home improvement spending are still unfounded. Sales grew 6.5% compared to last year. This was partially due to inflation as the number of transactions declined by 3% while average ticket increased by 9.1%. The transaction decline can also be attributed to consumers switching to professionals instead of DIY for their home improvement projects.

More impressively, the company held the line on operating costs, with only a 3.5% increase from last year despite the inflationary environment. This resulted in strong operating margins of 16.5% in 2Q and 15.9% for the first half.

With these strong results year-to-date, Home Depot seems to be conservative by leaving its guidance for the full year unchanged at sales growth of 3% and operating margin of 15.4%. That implies second half sales growth of only 0.8% and operating margins of 14.9%. The retailer does typically have some seasonality in its results, with stronger sales and margins in the first half because of the demand for gardening and outdoor projects. On the earnings call, however, analysts and the CEO speculated that demand could pick up this fall as consumers get back to home improvement after a strong travel season. This effect is not yet in the guidance, so it could provide upside if it occurs.

Chris Horvers

Got it. And then the follow-up on that sort of, Ted, your point on people came back from vacation and have reengaged in the category. Last year that seemed to happen more in the September time frame where DIY reengaged. How are you thinking about the DIY business into the fall versus maybe people come back and there are some things that need to get done and the kids are going back to school? But how do you think about the risk on DIY maybe fading as we get into September and the fall?

Ted Decker

Well, Chris, that’s a great question. And frankly, when we — given the strong first half and the strong second quarter, to reaffirm guidance, which implies a lower comp in the second half, that’s really the question for us. And frankly, we don’t know the answer. We’re super comfortable with Pro; that continues to motor on. But the question for the second half and the opportunity to do better than that implied comp is if the consumer hangs in there.

As Jeff said, of the various potential reasons for seasonal relatively underperforming in the first half, if it’s things more like weather, and having focus for so long in the backyard for two years if they went and did other things, go to the beach, et cetera. And then they get back in the fall and reengage, that will obviously be great news. But with these crosscurrents, we just haven’t called that. And that’s a little bit of conservatism in the second half.

On the bottom line, Home Depot is guiding for “mid-single digit” EPS growth, which reflects the impact of the operating income growth, offset by higher interest expense, but enhanced by a lower share count from buybacks. Assuming “mid-single digit” means around 5%, this would again imply little growth in the second half as EPS grew 9% in the first half.

Despite the record EPS, free cash flow is lower because of the need to build inventory. Inventory levels in dollars are 38% above a year ago even though sales are only up 6.5%. Half of this increase is due to inflation while the other half is due to efforts to keep more product in stock. The company is also improving its supply chain by opening distribution centers to enable same-day and next-day delivery of online orders. This investment reduces free cash flow in the short term through capex and working capital investment at the centers.

The market reaction was positive with the stock trading up around 4% after the earnings release. That brought the P/E back into its typical long-term range of 20-25 after trading below it for the past few months.

It has been difficult to evaluate Home Depot on short term performance over the last couple of years with the big negative of shutdowns in early 2020 followed by unprecedented demand from the stay-at-home trade in 2021 to slower growth this year due to reopening and inflation. Taking a longer perspective, the retailer looks like it was already shifting from a fast to a medium growth rate company before the pandemic. Looking forward, that means the former 20-25 P/E range may be above fair value. Home Depot remains an excellent company, and the market will continue to provide buying opportunities for the stock as it did in June 2022. After the recent rebound, however, the stock is now a Hold.

Becoming A Stalwart

In his 1989 book One Up On Wall Street, Peter Lynch classified stocks into six categories. His favorites were the “fast growers”:

… small, aggressive new enterprises that grow 20 to 25% a year. If you choose wisely, this is the land of the 10- to 40-baggers, and even the 200-baggers.

Home Depot managed to deliver this growth rate long after it was small and new. In fact, it was possible to get a 10-bagger in HD on a total return basis if you bought and held from 2009-2017.

Since then, Home Depot began transitioning into another one of Lynch’s categories called the “stalwarts”. Lynch defined these as large, established companies capable of delivering 10-12% earnings growth. Lynch says:

Stalwarts are stocks that I generally buy for a 30 to 50% gain, then sell and repeat the process with similar issues that haven’t yet appreciated. I always keep some stalwarts in my portfolio because they offer pretty good protection during recessions and hard times.

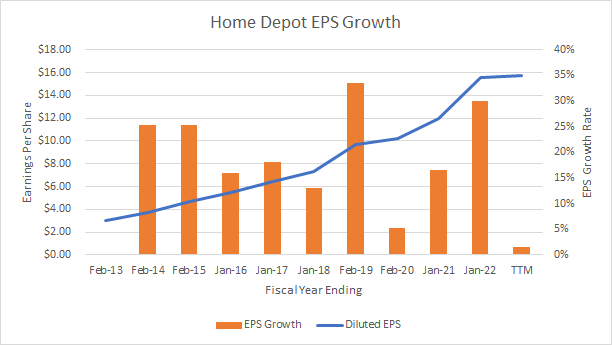

Looking at the last 10 years, Home Depot started out delivering Fast Grower EPS growth but then settled into Stalwart-like growth with a couple exceptional years. The bump in FYE 2/19 was from the Tax Cut and Jobs Act, while the bump in FYE 1/22 was from pandemic stay-at-home demand.

Author Spreadsheet (Data from Seeking Alpha company finanicals page)

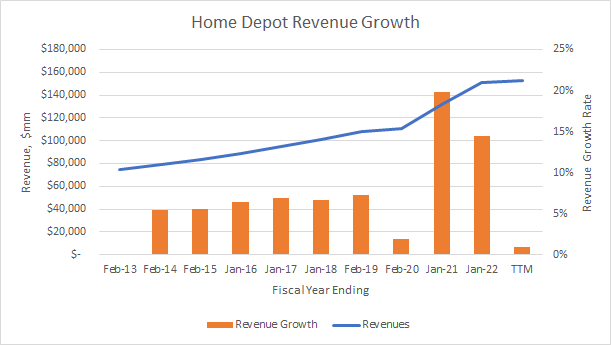

Let’s look at different components of the EPS growth to evaluate where it came from and if it can be delivered going forward. Starting with sales growth it looks like outside of the pandemic, Home Depot grew sales in the mid-single digits this past decade, slower in the years immediately before and after the height of the pandemic.

Author Spreadsheet (Data from Seeking Alpha company financials page)

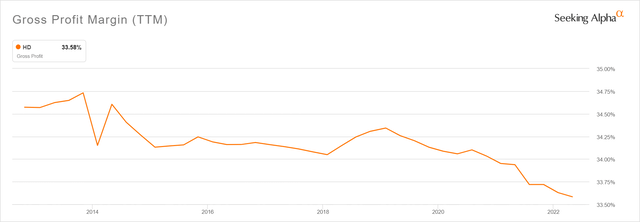

Gross margin has been declining, but very gradually, losing less than 100 basis points over the last 10 years.

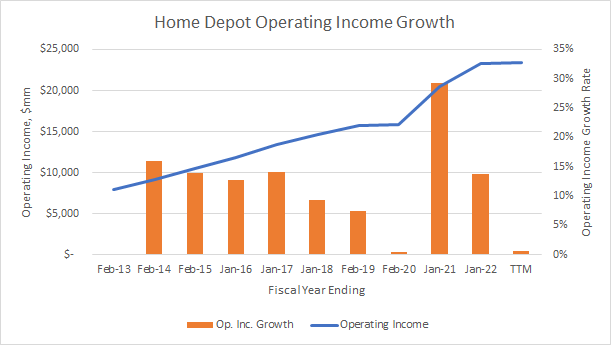

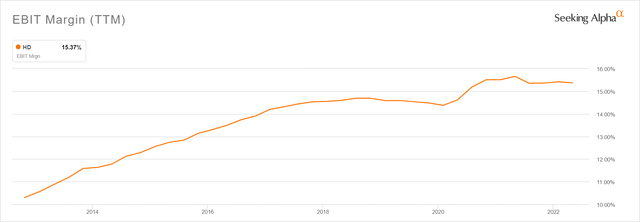

This is not a big concern, as the company strategy is to grow operating margins and income. On that front, Home Depot has been improving operating margins over the past decade.

As a result, operating income has been growing faster than sales.

Author Spreadsheet (Data from Seeking Alpha company financials page)

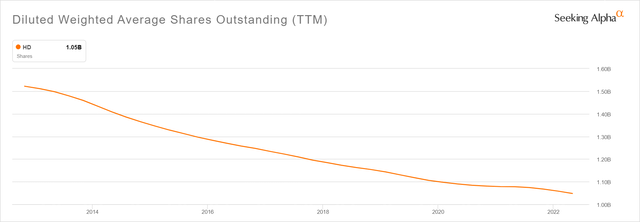

These operating income growth rates are still a bit less than Fast Grower status at the start of the period or Stalwart status in the back half. EPS growth reaching those levels depended on Home Depot buying back shares. The company has reduced share count by almost a third in the past 10 years.

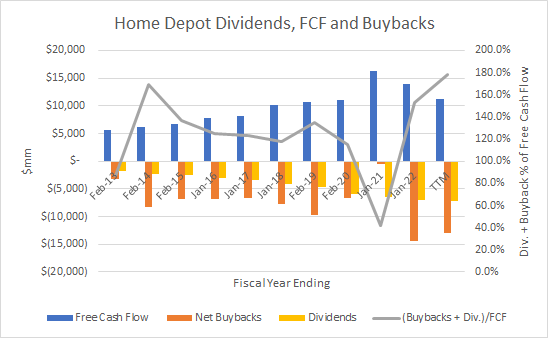

The company has also been a generous dividend grower. However, when we compare this capital return to shareholders with free cash flow, we see that the company routinely spends well over its FCF on dividends and buybacks.

Author Spreadsheet (Data from Seeking Alpha company financials page)

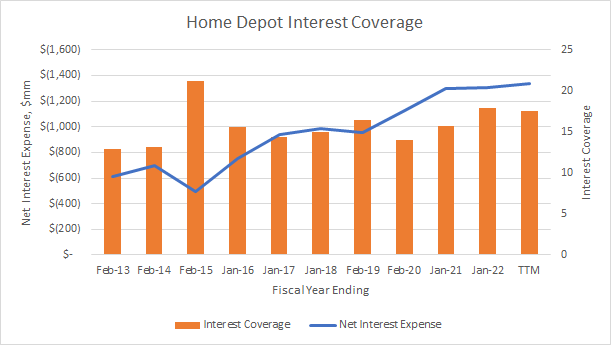

Maintaining this over time requires the company to issue debt regularly, which they have been doing. The good news is that debt levels have been manageable and net interest expense has increased slower than operating income, resulting in improving interest coverage.

Author Spreadsheet (Data from Seeking Alpha company financials page)

Still, this can’t continue forever, especially if capex and inventory build are impacting free cash flow growth.

Looking forward, it seems reasonable that Home Depot can get back to the 5-7% sales growth range it was in before the pandemic. This is faster than GDP growth. The company believes it is growing market share from smaller players with its focus on pro customers and its distribution center investments which allow it to fulfill orders more quickly. Home Depot is also growing sales in the MRO channel (maintenance, repair, and operations) through its repurchase of HD Supply.

Operating margins have stabilized since 2020 at around 15.5%. Home Depot has expanded operating margin over the years through operating leverage – delivering more sales while holding the line on labor and operating costs. The company’s investments in supply chain improvements and the online channel (especially with Pro customers) can deliver operating margin growth, although diminishing returns probably apply. The 1% per year operating margin improvement seen prior to 2018 is probably an upper limit going forward.

Finally, buybacks will probably need to be reined in looking forward. The 3-4% per year share count reduction we have seen over the past decade is probably too much, especially in an inflationary environment where working capital build cuts into free cash flow. The higher interest rate environment also makes it harder to add debt to buy back stock in excess of FCF. Based on the $6 billion per year buyback average seen pre-2020, Home Depot would be able to reduce share count by about 2% per year.

Adding it all together, 7% revenue growth plus 1% operating margin growth, plus 2% share count reduction would grow EPS by 10%, just in Lynch’s Stalwart territory.

Conclusion

Home Depot delivered average EPS growth of 19.5% in the 7 years ending in February 2020. Since then, the company enjoyed 2 years of strong growth from the pandemic stay-at-home trade. This growth has slowed considerably in the current fiscal year although current quarterly results show that the consumer is more resilient to macroeconomic concerns than expected. Still, Home Depot is maintaining its guidance of “mid-single digit” EPS growth this year. While this guidance may be conservative, future year growth looks more likely to be around 10%.

With this lower growth rate, the historical P/E range of 20 – 25 is probably too high going forward. Home Depot remains a great company but at $327 it is still worth about 20 times this year’s estimated earnings. The stock traded around $270 in June which is a more reasonable 16.5 times earnings for a stalwart 10% grower. I would not tell anyone to sell here, but those looking to start a new position should consider waiting for a pullback to that level.

Be the first to comment