Asia-Pacific Images Studio

Two months ago, shortly after the release of the new climate bill, I wrote about Maxeon Solar Technologies, Ltd. (NASDAQ:MAXN), a solar manufacturer, marketer, distributor and spinoff of SunPower (SPWR). Since then, although fluctuating, the stock price has trended upwards and increased by 3.87%. Year to date, investors have had returns of 43.76%.

Stock Price Trend Year To Date (SeekingAlpha.com)

Although MAXN is unlikely to become profitable before 2025, has delivered poor Q2 earnings results and is likely to do so in Q3, I still believe this is a solid opportunity for investors for a few reasons. Firstly MAXN owns its patented products, which have leading brand and quality reputations in the market. Secondly, its head office is based in Singapore, giving the company a global market reach compared to other peers such as SPWR. Thirdly, MAXN has a significantly lower market cap for the industry of $953.83 million, thus a greater possibility for an upside in the stock price. In November 2021, the stock price was briefly more than double its current value. Furthermore, MAXN is taking steps towards growth, with a more comprehensive end-to-end range of products, a change of CEO, a recently announced partnership deal with Aptera Motors and the ability to expand its US distribution from 2023 onwards outside of its current agreement limited to SPWR. Therefore I believe investors may want to consider a bullish stance on this company.

Analysts Reevaluate The Solar Industry

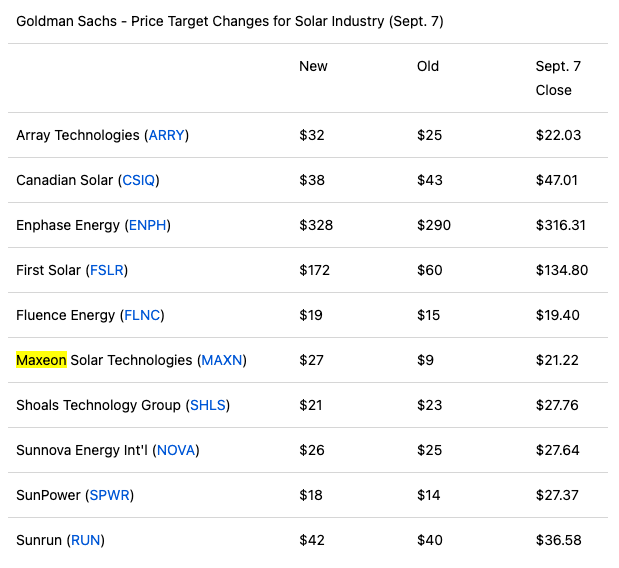

Over the last month, Goldman Sachs (GS) has upgraded MAXN from a Sell to a Buy rating. One of the key reasons is the passing of the climate bill in the US. Not only does it incentivize companies across industries to shift towards renewable energy sources, but there is $21 billion worth of leverage possibilities in the form of tax deductions and rebates. In the table below, we can see the adjustments made to price targets, and if we focus on MAXN, we see an impressive increase of 200%.

Goldman Sachs Price Target Changes (SeekingAlpha.com)

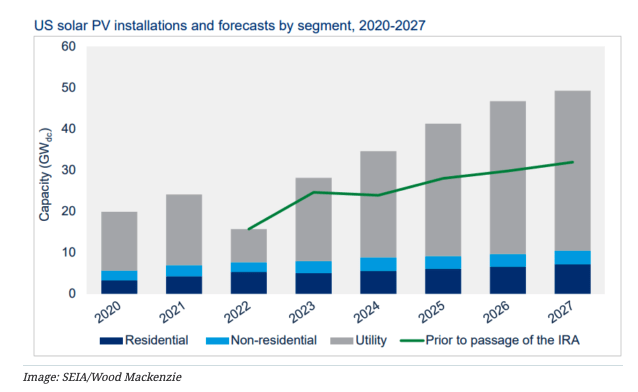

Solar energy could triple its capacity in the next five years, as seen in the graph below. The cost of solar energy is also continuing to decrease, and it is currently considered one of the cheapest renewable energy solutions. Furthermore, with the US climate bill, this is the first time that the industry has long-term investment certainty, which should bring confidence to the future success of leading brands such as MAXN that require considerable investments for continued innovations in the market.

US Solar Forecast (pv-magazine-usa.com)

The Power Of Patents, Changing Business Models And Distribution Agreements In The Solar Industry

MAXN has a long-standing 35-year history in the solar industry. It has over 1000 patents and has been recognized and rewarded for its technological innovations over the years. The company is looking to ramp up its manufacturing facilities across the globe. It aims to increase its capacity in the next few years significantly. MAXN manufactures SPWR panels and is currently the number one offering in the United States.

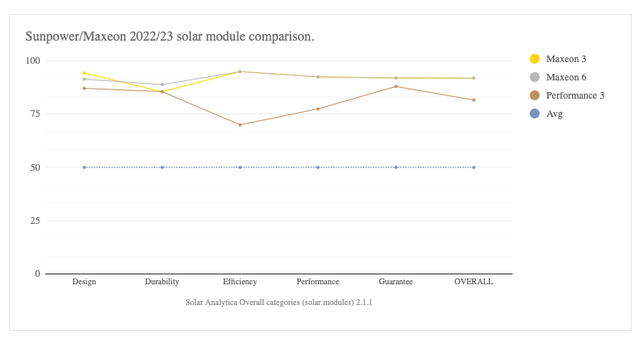

MAXN product versus peers (solaranalytica.com)

In the subsequent years, MAXN will be able to distribute independently from this agreement and significantly impact its potential growth in the US region. MAXN is shifting from a manufacturing business model to an end-to-end renewable energy provider. It has home energy solutions such as SunPower that give end customers intelligent advice on energy consumption. Furthermore, $200 million has recently been invested by TCL Zhonghuan, its second-largest shareholder at 28.85%, to develop these more holistic solutions further and focus on its international markets.

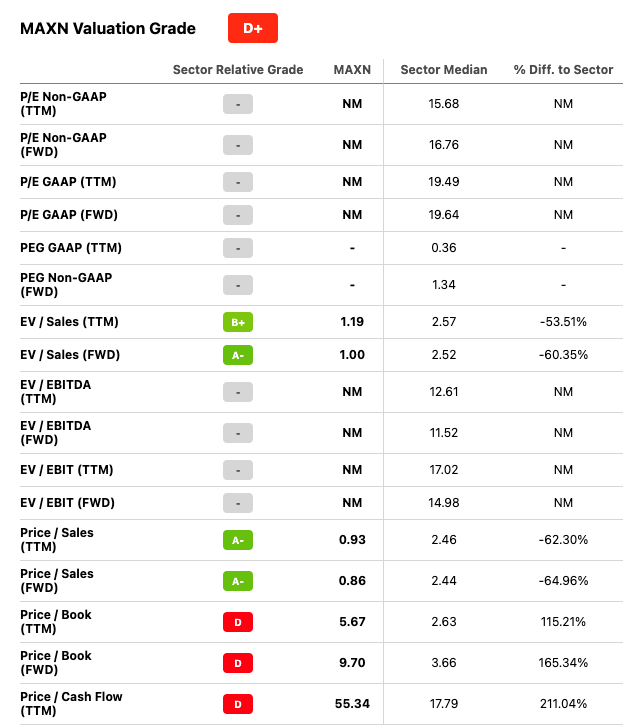

Valuation

If we look at Seeking Alpha’s Quant rating, we can see that MAXN has a grade value of D+. It is, of course, highly impacted by the unprofitable state of the company. However, the solar industry is still young and characterized by high initial costs in combination with long-term revenue contracts. It is positive to note that MAXN has an attractive enterprise-value-to-sales ratio of 1.19, which decreases if we take a forward-looking approach—indicating that the company may be undervalued. The company has a price-to-sales ratio of less than 1, meaning that investors invest less than what they earn in sales.

Quant Valuation (SeekingAlpha.com)

Risk

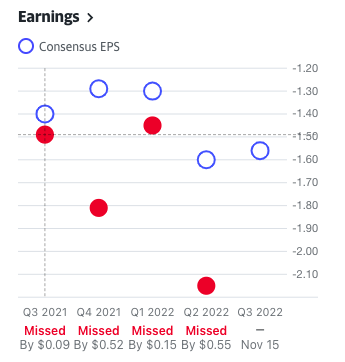

We are looking at a company that has yet to show profits. Although MAXN is a front-runner in the solar industry, it is a competitive market in which pricing and cost increases significantly impact the company’s performance. The company has missed EPS expectations for the last four quarters.

EPS Quarterly Misses for MAXN (YahooFinance.com)

MAXN’s Q2 results were heavily impacted by the ongoing increase in supply chain and operations costs. It will continue affecting the company in the following quarters. It has had an impact of $40 million year over year. There have also been significant increases in manufacturing costs, such as rising polysilicon prices. The company also experienced additional expenses connected to closing a manufacturing facility in France. There are repricing efforts taking place to improve the gross profit margin.

Although the company received an investment of $207 million in August, it saw a significant decrease in its cash levels in Q2 2022 to $180 million due to capital expenditures. Cashflow was negative at $11 million due to net loss and an increase in inventory. Leverage is critical for MAXN in this growth phase, where there are high costs connected to increasing the manufacturing capacity of solar energy.

Final Thoughts

Renewable energy firms are building up renewed shareholder interest this year due to today’s geopolitical environment. From your small town municipality to government-run initiatives, 2022 has seen laws and regulations discussed and implemented locally and internationally that incentivize crucial industries and end customers to switch to more sustainable energy options. The big question is which of these companies are worth investing in. If we look into solar energy companies, there is a wide range of publicly run firms with ambitious long-term plans. Although, on the fundamental business front, many companies are and will still be unprofitable in the next few years. I believe that although unprofitable, MAXN has significant upside potential due to its cheap price, its long-standing history in the market, its expanding business model and its US and international growth potential. Therefore I believe investors may want to take a bullish stance on this company.

Be the first to comment