Artur/iStock via Getty Images

Virtu Financial, Inc. (NASDAQ:VIRT), is one of the largest market making firms that are publicly traded. I believe VIRT could be an interesting counter-cyclical name for investors to consider as markets become more volatile. Market makers make money from trading, and profit opportunities can actually increase in volatile markets. It is currently trading at depressed valuations, with a good chance of beating analyst estimates. It is also paying a 4% dividend yield.

Company Overview

Virtu Financial is a leading market maker and broker to many global markets. It provides execution, market making, liquidity sourcing, and analytics to market participants.

Virtu Outperforms When Markets Are Volatile

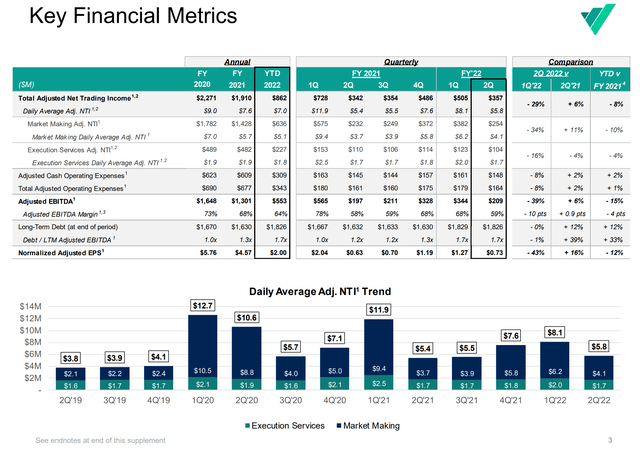

Looking at Virtu’s financial metrics, we see that the company typically does well when markets are volatile. For example, Q1 and Q2 2020 were at the depths of the COVID crash and recovery, and Virtu had extraordinarily good average daily net trading income (“NTI”) in those periods (Figure 1).

Figure 1 – Virtu Key Financial Metrics (VIRT Q2/2022 Presentation)

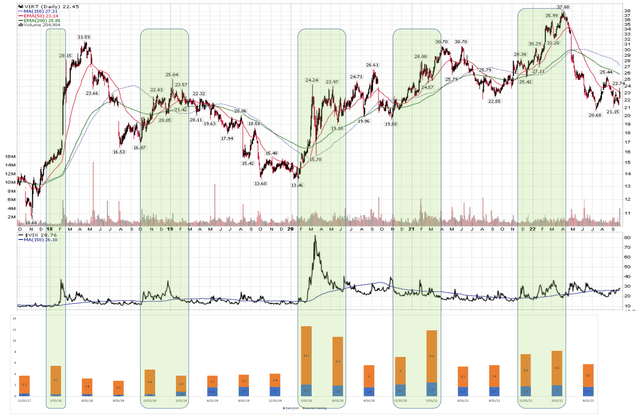

In fact, if we overlay Virtu’s Daily NTI trends with its stock price and the VIX Index (a measure of market volatility), we see that in general, Virtu’s financial performance and stock price outperform when there are periods of volatility (Figure 2).

Figure 2 – VIRT Outperforms in Volatile Markets (Author created with data from company reports and price charts from StockCharts.com)

We can also observe that most of the outperformance comes from market making trading income. This is because when markets are volatile, market makers have wider bid/ask spreads to profit from. As markets retest June lows and volatility starts to rise, we may see another period of strong financial performance from Virtu.

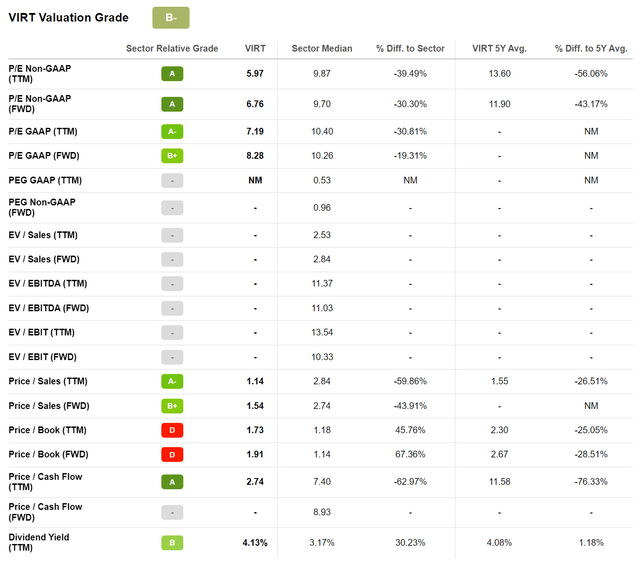

Valuation Attractive

Valuation-wise, Virtu is screening cheap, with the stock trading at 8.3x Forward P/E, a discount to the financial sector median 10.3x. It is also paying a 4.1% current dividend, which we believe to be quite safe given the low valuation multiple.

Figure 3 – VIRT Valuation (Seeking Alpha)

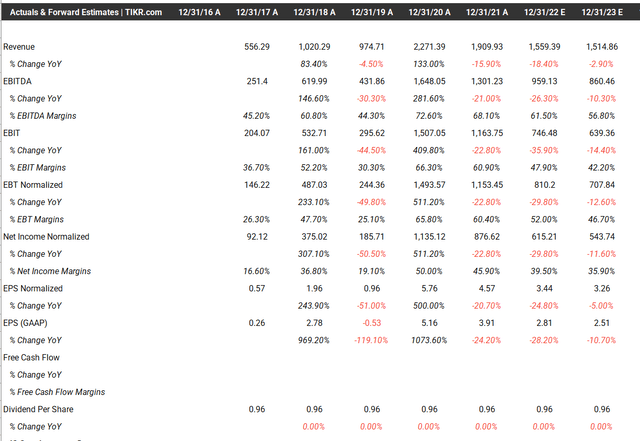

Estimates Are Too Low

If we look at analyst estimates, consensus has VIRT delivering $1.6 billion in revenues for 2022, and $2.81 in EPS. However, with 6 months already gone by, VIRT has reported H1/2022 revenues of $1.3 billion and $1.77 in diluted EPS. This implies Wall Street analysts are only expecting $300 million in revenues and $1.04 in EPS for the rest of the year. We think this is simply too low.

Figure 4 – VIRT Estimates (TIKR.com)

In Q2, daily NTI was $5.8 million, which translated into $605 million of total revenues and $0.78 in EPS. Given current heightened volatility, there is a very high likelihood September and Q4 2022 will see solid financial performance for Virtu.

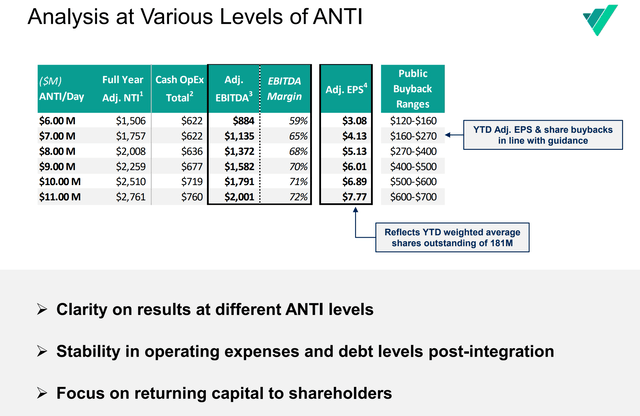

Looking at the company’s NTI sensitivity, Virtu is currently on pace to deliver $7 million in NTI and over $4 in EPS (Figure 5). If Q4 turns out to be volatile like other market drawdown periods, we could see significant upside to NTI and EPS.

Figure 5 – VIRT NTI Sensitivity (VIRT Q2/2022 Presentation)

Excess Cash Has Been Returned To Shareholders Via Buybacks

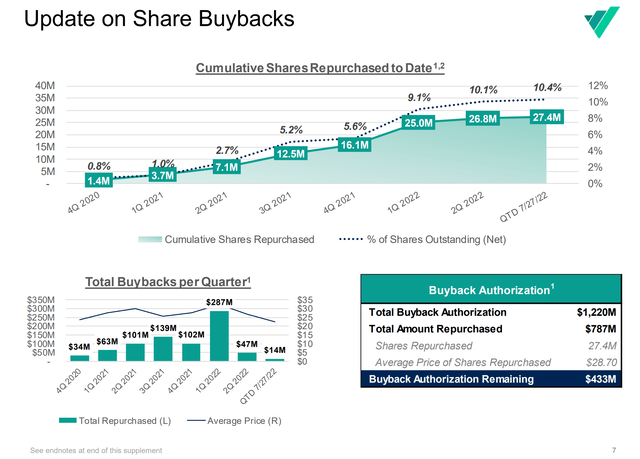

In addition to paying a sizeable quarterly dividend, Virtu has also been very active in share buybacks. In the past two years, the company has bought back more than 27 million shares, or 10.4% of shares outstanding (Figure 6). Given the expected strong levels of earnings power in the Virtu franchise, we don’t see this dynamic changing.

Figure 6 – VIRT Share Buybacks (VIRT Q2/2022 Presentation)

Risk

The biggest risk to Virtu is actually a calm market, where there is little opportunity for market makers like Virtu to make money. Fortunately, that does not seem to be the case, as the Federal Reserve appears intent on reducing the wealth effect in order to tame inflation.

Another risk is that Virtu’s traders take on undue risk and the firm ‘blows up’ as markets continue to grind lower. From historical performance, we see evidence Virtu has very strong risk management practices in place, as the company actually delivered the strongest NTI ever during Q1/2020, when the rest of the market was melting down.

Conclusion

Virtu Financial, by virtue of being one of the largest market making firms that are publicly traded, could be an interesting counter-cyclical name for investors to consider as markets become more volatile. Market makers make money from trading, and profit opportunities actually increase in volatile markets. It is currently trading at depressed valuations, with a good chance of beating analyst estimates. It is also paying a 4% dividend yield. I would recommend investors accumulate shares of Virtu as a hedge against market volatility.

Be the first to comment